Bitcoin has experienced a relief bounce up to $68,394 from its capitulation at the $60,000 levels. However, the present levels are precarious. Let me elaborate on the "Perfect Storm" facing the crypto space in Q1 of 2026.

The 3 Bearish Catalyst

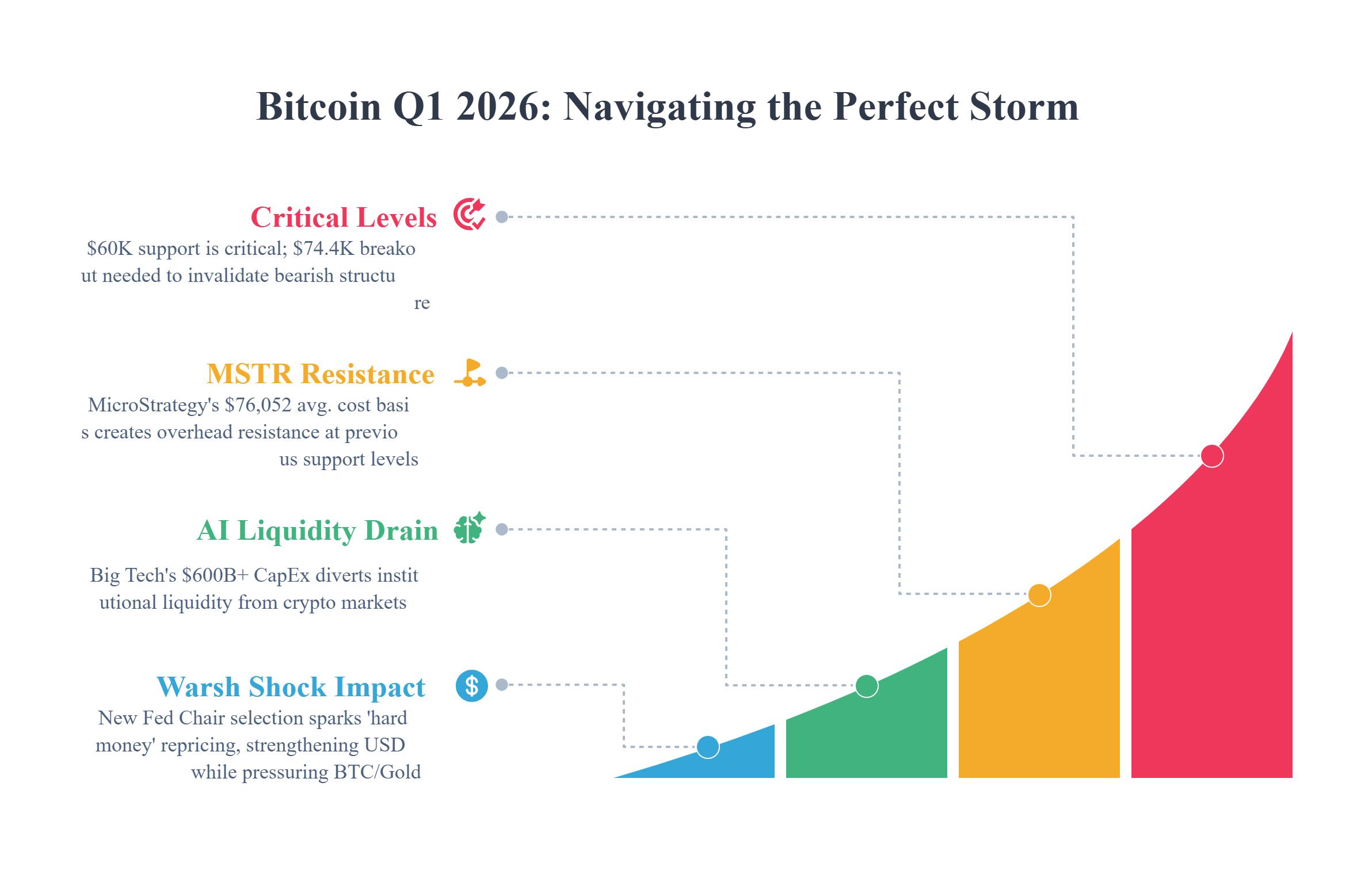

1. The Warsh Shock: The selection of Kevin Warsh as Fed Chair has sparked a "hard money" repricing event, causing the value of the Dollar to rise while Gold and BTC plummet.

2. AI Liquidity Drain: Big Tech firms like Amazon and Google are investing more than $600B in Capex for 2026. This investement is draining liquidity out of the cryptocurrency space.

3. Strategy (MSTR) Underwater: With an average cost basis of ~$76,052, the largest corporate holder is underwater, making past support levels now major overhead resistance.

Chart Analysis (4H Time)

UT Bot Signal:The "UT Bot Alerts" signal on the chart is currently in a SELL stance. The current run-up is technically a reversion to the mean on the Linear Regression Line.

The Floor: The long lower wick reinforces that $60,000 is the key "line in the sand." If the level fails to hold, the door to $49k flings open.

The Ceiling: Bulls need to make up the deficit of $74,400 to break the bearish pattern.

Verdict:

Caution is advised. The ‘up-only’ days are paused. We're currently in a defensive range between the $60k low of capitulation and our current $76k supply wall.

Disclaimer⚠️⚠️⚠️: This podcast expresses the opinions of a third party and is not financial or investment advice. It may contain sponsored content. Please refer to full T&Cs. Any opinions, news, research, analyses, prices, or other information contained herein is intended as general information about the subject matter covered and does not constitute investment, financial, or trading advice. Prices of digital assets can be highly volatile. The value of your investment may go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions, and Binance is not liable for any losses you may incur. DYOR (do your own research) before relying on any financial information.

#BitcoinGoogleSearchesSurge #WhenWillBTCRebound #RiskAssetsMarketShock #WarshFedPolicyOutlook