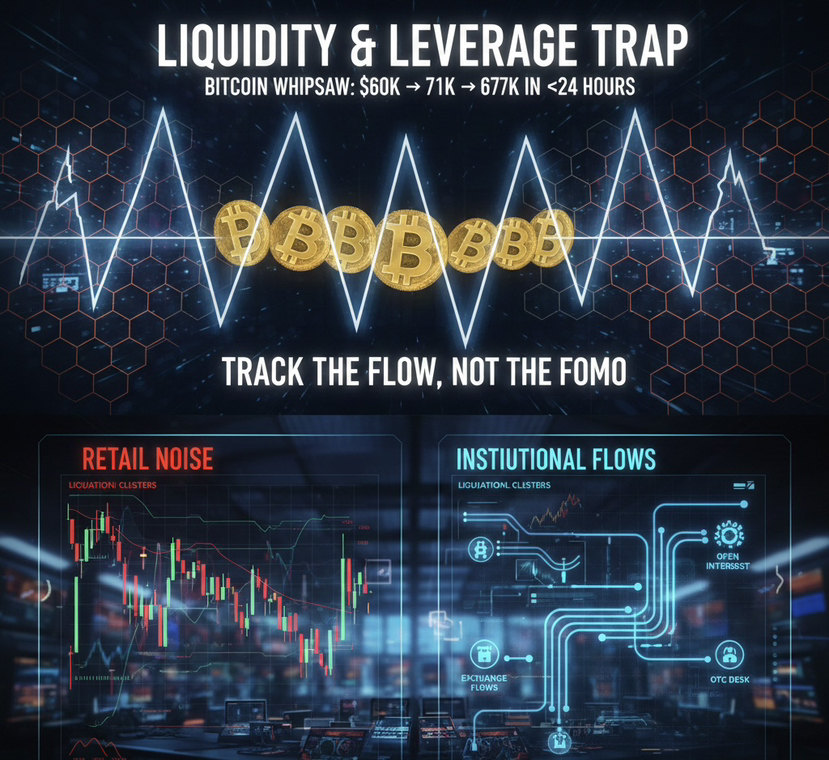

Bitcoin experienced an extreme move within a single day:

• Dropped toward $60,000

• Rallied back near $71,000

• Then sold off again toward $67,000

All within less than 24 hours.

Many traders call this “normal volatility.

But this type of sequence is usually not organic.

It is often the result of thin liquidity + high leverage + aggressive flow control.

📌 The Most Important Thing Most Traders Ignore: FLOWS

Retail traders focus heavily on candlesticks, patterns, and headlines.

However, in modern crypto markets, flows matter more than narratives:

• Exchange inflows/outflows

• OTC execution

• Treasury accumulation/distribution

• Perpetual futures positioning

• Liquidation clusters

When liquidity is thin, price can be pushed significantly without requiring “hundreds of billions.”

The key is timing and structure, not just capital size.

🔥 Why Violent Swings Are So Profitable

Entities with access to deep liquidity (exchanges, market makers, large funds, and treasury-style buyers) often profit most from rapid two-way volatility.

In recent sessions, the market saw activity equivalent to roughly:

230,000 BTC ($18B) moving back and forth.

That type of turnover is not “investor conviction.”

It is usually positioning and execution.

🧠 The Classic Setup: Farm Both Sides

This sequence is extremely common in leveraged markets:

1. Hard dump → fear spreads + weak hands exit

2. Fast pump → FOMO returns

3. Leverage increases → traders chase longs

4. Dump again → long liquidations trigger

5. Then pump → short liquidations trigger

Result:

Both long and short traders get liquidated, while the market extracts liquidity from both sides.

⚠️ This Was Not About Headlines

There was no major fundamental shift that explains an $11K move in one day.

What we saw was primarily driven by:

• Leverage

• Liquidity conditions

• Forced liquidations

• Aggressive flow execution

This is why price can look irrational — because it is not moving based on “belief.”

It is moving based on positioning.

✅ What Smart Bitcoin Holders Should Do

Instead of reacting emotionally to candles:

• Track exchange flows

• Watch funding and open interest

• Monitor liquidation heatmaps

• Avoid over-leveraging in thin liquidity conditions

• Understand that whipsaws are often designed to reset positioning

Final Thought

Bitcoin is not “broken.”

But the short-term market is heavily influenced by leverage mechanics.

And when liquidity is thin, the market becomes a machine:

Dump → liquidate → pump → liquidate → repeat.

Stay calm. Stay data-driven.

And don’t let the market farm you. #MarketRally #BitcoinGoogleSearchesSurge #USIranStandoff #Write2Earn $BTC