Bitcoin is moving like a heavyweight in slow motion—every step shaking the market, every stumble echoing across the entire crypto arena. Over the past week, Bitcoin has experienced one of its sharpest weekly drawdowns in the current cycle, sliding from the $84,000 region to nearly $60,000. That’s not a casual pullback—that’s a statement.

At the time of writing, BTC has managed to claw its way back toward the $68,000–$70,000 zone, showing signs of resilience 🧗♂️. But beneath the surface, the on-chain data tells a colder, more cautious story—one that suggests the market has flipped into risk-off mode.

Institutional Money Is Stepping Back 🏦➡️🚪

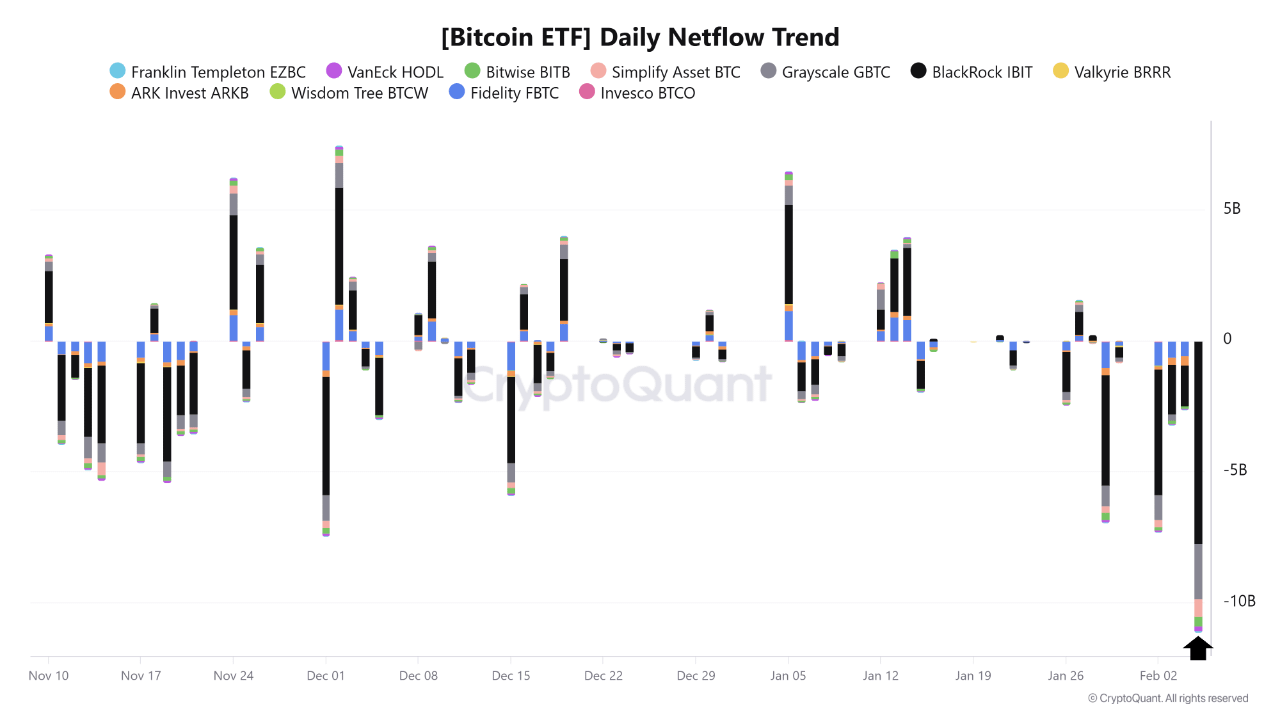

According to on-chain insights from CryptoQuant analyst Amr Taha, several key indicators are flashing warning signals. The most notable? Spot Bitcoin ETF flows—often seen as the heartbeat of institutional demand.

Under normal conditions, positive net inflows into US spot Bitcoin ETFs signal accumulation and confidence from large players. But this week, the tide has turned. Withdrawals have surged, led by BlackRock’s IBIT—the largest and most influential Bitcoin ETF in the market.

IBIT reportedly saw $4.7 billion in outflows on February 2, followed by another $7.7 billion on February 5, totaling a staggering $12.4 billion in redemptions 💸. That’s not portfolio rebalancing—that’s capital pulling back decisively.

Meanwhile, Grayscale’s GBTC also joined the exodus, registering approximately $2.1 billion in outflows over the same period. When both dominant ETF players bleed simultaneously, it’s hard to ignore the message.

Whales and Sharks Are Sending BTC to Exchanges 🦈📦

Institutional caution isn’t the only red flag. On-chain UTXO Exchange Inflow data paints a similar picture among large non-institutional holders. Using the 7-day simple moving average, Taha highlighted a sharp rise in Bitcoin being sent to exchanges—a classic precursor to selling pressure.

On February 4, exchange inflows from shark and dolphin wallets exceeded 14,900 BTC. Just one day later, that number jumped to 20,800 BTC, marking the first time since October that this metric approached the 22,800 BTC range. The last time inflows were this high, Bitcoin was trading above $122,000—right before a major shift in market structure ⚠️.

Translation? Big holders aren’t stacking sats right now. They’re preparing liquidity.

Binance Data Confirms the Risk-Off Narrative 🧪📊

Zooming into exchange-level behavior, data from Binance reinforces the same theme. On February 5, Bitcoin net inflows to Binance surged to $727 million, levels not seen since mid-November.

At the same time, stablecoins—particularly USDT—flowed out of the exchange, with negative netflows of around $450 million. This divergence matters. BTC moving into exchanges while stablecoins move out suggests traders are selling crypto exposure rather than rotating into fresh risk positions.

No fresh ammo. No dip-buying frenzy. Just caution. 🧊

So… Is This the End? Not Necessarily 🤔

All of this points to one dominant theme: capital preservation over risk appetite. Institutions are trimming exposure. Large holders are sending BTC to exchanges. Retail participation appears muted. The sentiment? Defensive.

That said, bearish data does not automatically mean an imminent collapse. Markets often stabilize—or even reverse—when fear becomes crowded. Bitcoin holding above key psychological levels despite this pressure hints that long-term conviction hasn’t fully cracked yet 🧠.

Still, one thing is clear: this is not a euphoric market. It’s a market that’s thinking, hesitating, and waiting.

At press time, Bitcoin trades around $69,500, down nearly 16% over the past seven days. The message from on-chain data is blunt but honest: respect the risk, watch the flows, and don’t confuse patience with weakness ⏳🔥.

The storm isn’t over—but neither is the story.

#MarketRally #WhenWillBTCRebound #BitcoinGoogleSearchesSurge $BTC