As the crypto market matures in 2026, successful investing is now about understanding how a project’s economy is designed. This is where tokenomics comes in.

Tokenomics is the economic framework that governs how a token is created, distributed, used, and sustained over time. Strong tokenomics can support long-term growth and adoption. Weak tokenomics, even with good marketing, often lead to dilution, sell-offs, and collapse.

This guide explains tokenomics in a practical and accessible way helping you evaluate crypto projects more clearly, avoid common traps, and make more informed investment decisions.

𝟭. 𝗪𝗵𝗮𝘁 𝗶𝘀 𝘁𝗼𝗸𝗲𝗻𝗼𝗺𝗶𝗰𝘀?

Tokenomics combines token and economics. It describes how a crypto asset functions within its ecosystem and how value is created and maintained. At its core, tokenomics answers four essential questions:

• How many tokens exist?

• Who owns them?

• What are they used for?

• How are incentives aligned over time?

In 2026, tokenomics has become more important than ever. As narratives like real-world assets (RWA), AI-linked tokens, and DePIN evolve, investors increasingly focus on sustainability rather than speculation.

Projects with weak token design may perform well short term but they rarely survive full market cycles.

𝟮. 𝗖𝗼𝗿𝗲 𝗰𝗼𝗺𝗽𝗼𝗻𝗲𝗻𝘁𝘀 𝗼𝗳 𝘀𝘁𝗿𝗼𝗻𝗴 𝘁𝗼𝗸𝗲𝗻𝗼𝗺𝗶𝗰𝘀

A solid token model is built from several interconnected parts. Each one matters.

𝗮. 𝗧𝗼𝗸𝗲𝗻 𝘀𝘂𝗽𝗽𝗹𝘆

• Max supply: Is there a hard cap (like Bitcoin’s 21M)?

• Circulating supply: How much is already in the market?

• Inflation rate: Are new tokens constantly issued?

High inflation without strong demand usually leads to price pressure. Many strong projects counter inflation with burn mechanisms or capped emissions.

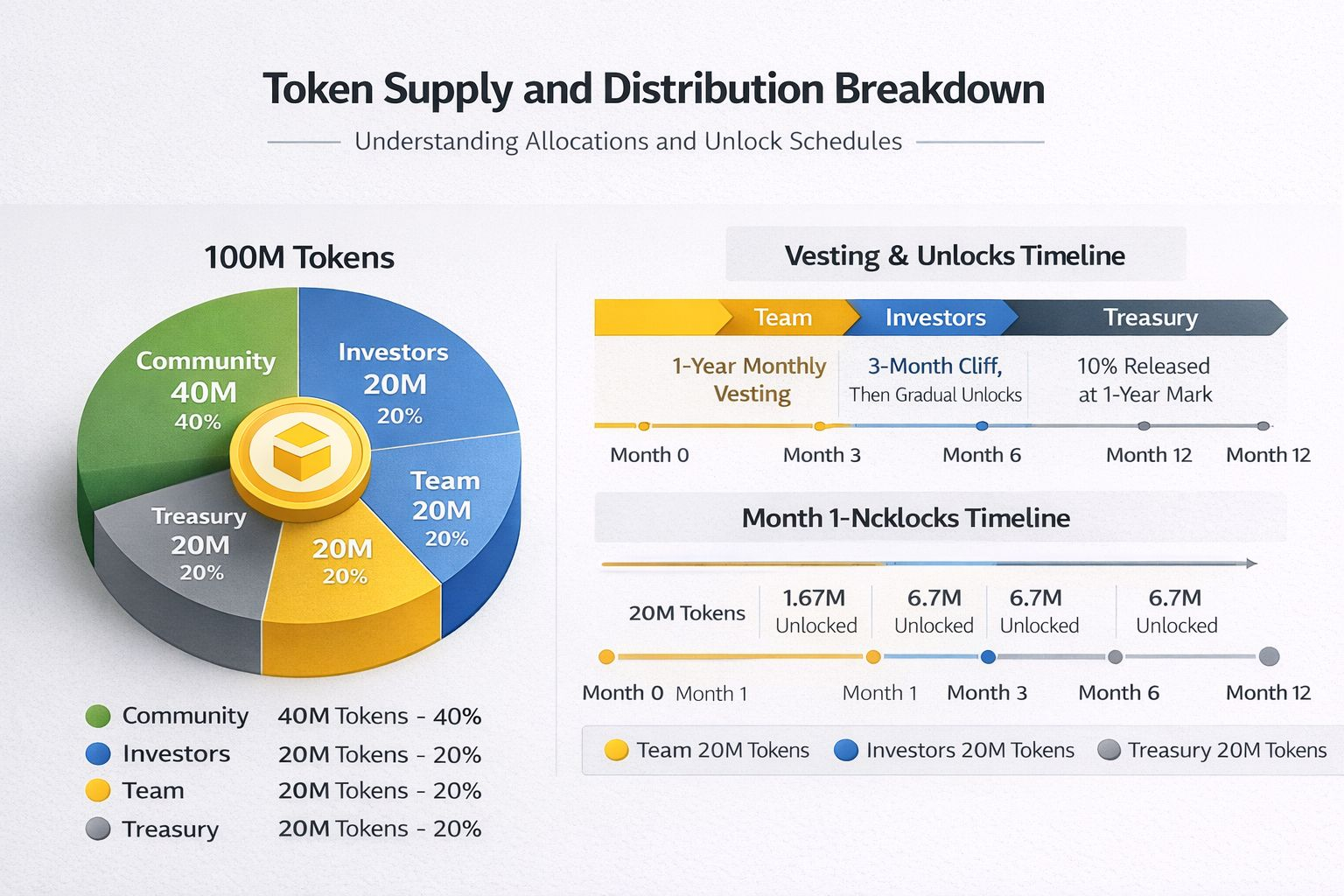

𝗯. 𝗗𝗶𝘀𝘁𝗿𝗶𝗯𝘂𝘁𝗶𝗼𝗻 𝗺𝗼𝗱𝗲𝗹

This shows who holds the tokens:

• Team & founders

• Early investors / VCs (Venture Capital (VC) refers to investment firms or funds that invest early in crypto projects or startups)

• Community & ecosystem

• Sometimes treasury

Red flags appear when:

• Teams control large percentages

• Tokens unlock quickly

• Community allocation is small

Balanced distribution builds trust and long-term stability.

𝗰. 𝗨𝘁𝗶𝗹𝗶𝘁𝘆 𝗮𝗻𝗱 𝗱𝗲𝗺𝗮𝗻𝗱 𝗱𝗿𝗶𝘃𝗲𝗿𝘀

Here ask a simple question:

What does the token actually do?

Common utilities include:

• Governance voting

• Staking and rewards

• Paying fees

• Access to services or products

Tokens without clear utility often lose value once hype fades.

𝗱. 𝗩𝗲𝘀𝘁𝗶𝗻𝗴 𝗮𝗻𝗱 𝘂𝗻𝗹𝗼𝗰𝗸 𝘀𝗰𝗵𝗲𝗱𝘂𝗹𝗲𝘀

Vesting controls when tokens enter circulation. Gradual unlocks protect the market. Sudden unlocks often trigger sell-offs.

𝗲. 𝗚𝗼𝘃𝗲𝗿𝗻𝗮𝗻𝗰𝗲 𝗮𝗻𝗱 𝗯𝘂𝗿𝗻𝘀

Governance aligns holders with the project’s future. Burns reduce supply, supporting scarcity.

In 2026, well-designed projects treat their token economy like a long-term financial system, not a quick fundraising tool.

𝟯. 𝗧𝗼𝗸𝗲𝗻𝗼𝗺𝗶𝗰𝘀 𝗶𝗻 𝗽𝗿𝗮𝗰𝘁𝗶𝗰𝗲: 𝗥𝗲𝗮𝗹 𝗲𝘅𝗮𝗺𝗽𝗹𝗲𝘀 𝗲𝘅𝗽𝗹𝗮𝗶𝗻𝗲𝗱

Understanding theory is useful but examples make it concrete.

📍Bitcoin (BTC)

• Fixed supply: 21 million

• No team allocation

• Halving every four years reduces inflation

Predictability and scarcity make BTC a strong long-term store of value.

📍Ethereum (ETH)

• No hard cap, but supply reduced via fee burns (EIP-1559)

• Strong utility: gas fees, staking, smart contracts

Demand grows with network usage, while burns offset issuance.

📍Weak tokenomics example

Many past memecoins shared the same issues:

• Infinite supply

• No utility

• Large team allocations

• Fast unlocks

Some modern projects lock tokens behind performance milestones (Adoption targets, revenue goals, network usage). Doing that, supply only expands when real growth happens, protecting holders from dilution.

𝟰. 𝗛𝗼𝘄 𝘁𝗼 𝗮𝗻𝗮𝗹𝘆𝘇𝗲 𝘁𝗼𝗸𝗲𝗻𝗼𝗺𝗶𝗰𝘀 𝘀𝘁𝗲𝗽 𝗯𝘆 𝘀𝘁𝗲𝗽

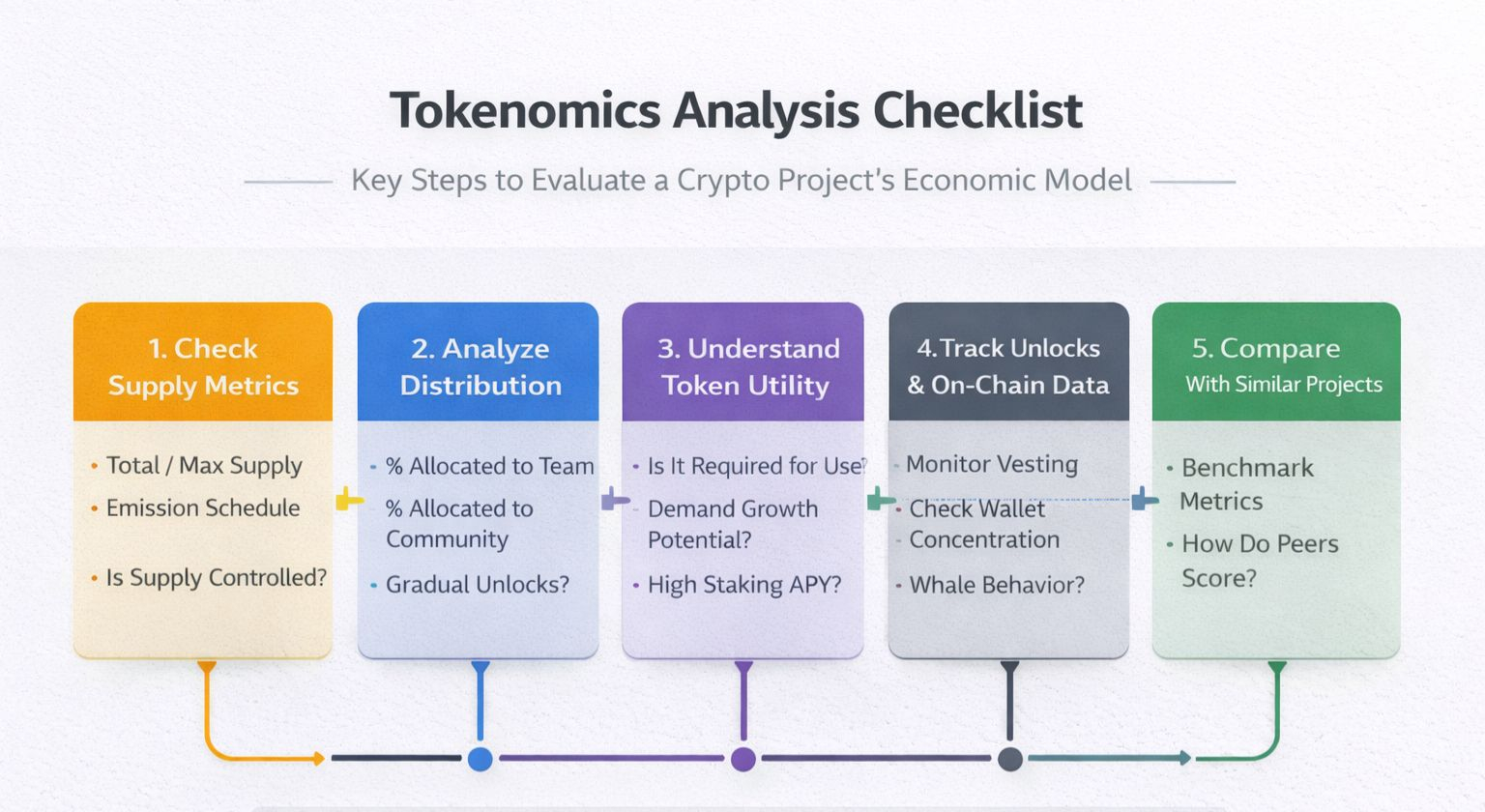

This is how to evaluate any token before investing.

Step 1: Check supply metrics

📍Total supply

📍Max supply

📍Emission schedule

Ask: Is supply controlled or expanding aggressively?

Step 2: Analyze Distribution

📍How much goes to the team?

📍How much to the community?

📍Are unlocks gradual?

A healthy project usually prioritizes long-term users, not insiders.

Step 3: Understand Token Utility

Read the documentation and ask:

📍Is the token required to use the platform?

📍Does demand grow with adoption?

📍Is staking meaningful or just inflation?

Step 4: Track unlocks and On-Chain Data

📍Monitor unlock schedules

📍Check wallet concentration

📍Watch whale behavior

High concentration increases volatility risk.

Step 5: Compare with similar projects

📍Benchmark tokenomics against competitors in the same sector.

If a token looks worse than peers on multiple metrics, be cautious.

𝟱. 𝗖𝗼𝗺𝗺𝗼𝗻 𝘁𝗼𝗸𝗲𝗻𝗼𝗺𝗶𝗰𝘀 𝗿𝗶𝘀𝗸𝘀 𝘁𝗼 𝗮𝘃𝗼𝗶𝗱

Even promising projects can fail due to poor design. So watch out for:

● Unlimited inflation with no burn

● Heavy VC or team control

● Fast unlock schedules

● No real token utility

● Centralized governance

In 2026, regulatory pressure also increases risks for non-compliant or poorly structured models.

Diversify, monitor unlocks, and prioritize transparency.

𝟲. 𝗣𝗿𝗮𝗰𝘁𝗶𝗰𝗮𝗹 𝗧𝗮𝗸𝗲𝗮𝘄𝗮𝘆𝘀 𝗳𝗼𝗿 𝗜𝗻𝘃𝗲𝘀𝘁𝗼𝗿𝘀

• Always analyze tokenomics before price

• Avoid projects where economics rely purely on hype

• Favor tokens tied to real usage and revenue

• Track supply changes over time, not just charts

Tokenomics doesn’t guarantee success, but it dramatically improves decision-making.

To summarize, Tokenomics is the foundation beneath every crypto project. Price may fluctuate in the short term, but over time, economic design determines survival. By understanding supply, distribution, utility, and incentives, investors move from speculation to informed strategy.

In a market that rewards patience and structure, tokenomics is one of the most powerful tools you can master.