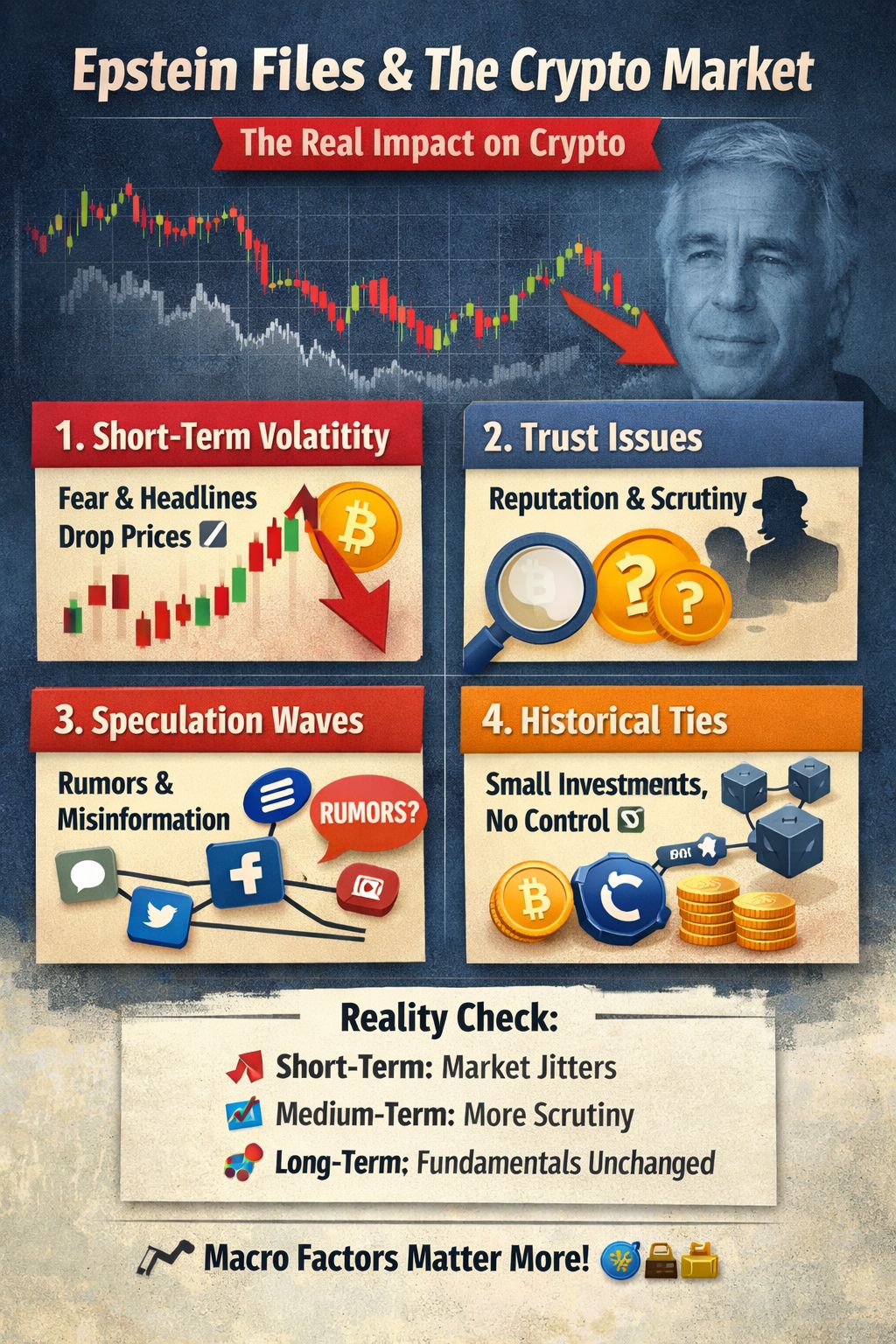

$BTC When new files dropped, crypto markets became nervous and prices dipped for a while.

Example: BTC saw quick drops during news cycles — but analysts say macro factors (interest rates, Fed news, global risk) were actually the main drivers, not the files alone.

Basically: news fear = temporary selling pressure.

👉 Traders react emotionally to controversy headlines.

🧠 2. Reputation & trust issues in crypto

Some documents showed historical connections between Epstein and early crypto circles or funding environments.

This caused:

more institutional scrutiny

investor caution

discussions about governance & ethics in crypto projects

AInvest

👉 Not a technical problem — more of a PR / trust issue.

🔍 3. Speculation & misinformation waves

Social media started linking random coins or founders without proof.

Major crypto companies already denied many rumored links.

Experts warn: most claims are speculation, not evidence.

👉 Rumors create noise → markets overreact.

💰 4. Historical connections (but limited real influence)

Files showed Epstein invested in early crypto startups like Coinbase — but with small stakes and no governance role.

Meaning:

he wasn’t controlling crypto

blockchain tech itself is unaffected

⚖️ Final reality check

✔ Short-term: volatility + fear

✔ Medium-term: more scrutiny & regulation discussions

✔ Long-term: crypto fundamentals mostly unchanged

Crypto usually moves more due to:

interest rates

liquidity

global markets

regulation

—not scandals alone.