The recent crypto market crash wiped out leverage, froth, and short-term speculation almost overnight. Prices fell, volumes cooled, and risk appetite vanished. Yet beneath the chaos, something quietly moved in the opposite direction: stablecoins kept growing.

While traders were liquidated, stablecoin supply expanded. USD₮ and USDC reversed their recent contraction, pushing total stablecoin supply to $306.78 billion, up 0.25% over the last 30 days. Today, stablecoins represent over 1.37% of the entire US M2 money supply — an extraordinary milestone for a technology that barely existed a decade ago.

Crashes expose what’s real. And what’s real is this: stablecoins are no longer a crypto tool. They are becoming money infrastructure.

Stablecoins Are Decoupling From Speculation

At first glance, the data seems contradictory. Transaction volume declined, reflecting reduced market activity. Adjusted stablecoin volume over the past 30 days sits at $2.9 trillion across 1.5 billion transactions, down from peak speculative periods.

But look closer.

The number of wallets holding stablecoins rose to 205.7 million, up 2.76% month-over-month. Tether alone is held by 120.8 million wallets. This divergence tells a powerful story: people are holding, not flipping. Stablecoins are being used as savings, settlement, payroll, remittance, and treasury assets, especially during volatility.

Think of it like a financial storm. When equity markets crash, capital doesn’t disappear — it moves into cash. In crypto, stablecoins are the cash.

1.37% of US M2: Why This Number Matters

US M2 includes physical cash, checking deposits, and easily convertible near-money. Stablecoins reaching 1.37% of US M2 means they are no longer a rounding error. They are competing with traditional money — without banks, borders, or banking hours.

And unlike bank deposits, stablecoins move 24/7, settle in minutes, and can be programmed. That’s why adoption keeps growing even when markets cool.

The implication is massive: if stablecoins continue this trajectory, the question is no longer if they become systemic — but what infrastructure they settle on.

Liquidity Is Growing — Infrastructure Is Lagging

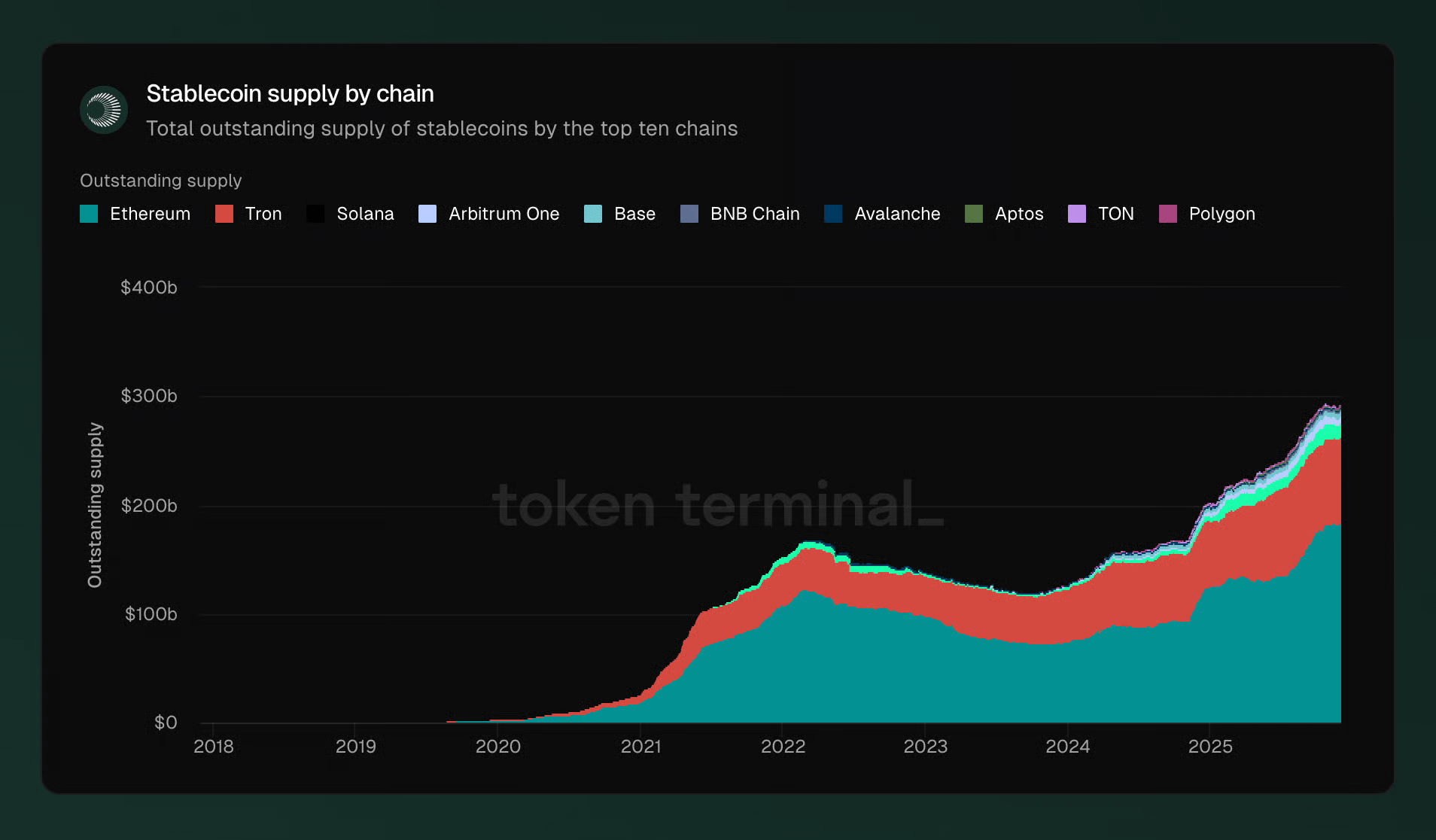

Stablecoin supply is expanding across chains:

Ethereum added $1.8B in stablecoins last week

Solana grew by $1.4B

Tron added $672.5M

Stablecoin supply by chain

Liquidity is everywhere. Settlement efficiency is not.

Today’s blockchains were largely optimized for apps, trading, or experimentation — not for global monetary flows at trillion-dollar scale. Fees spike under load. Finality varies. Reliability degrades exactly when it’s needed most.

This is where Plasma enters the picture.

Plasma: Built for the Stablecoin Era

Plasma is designed from the ground up for one purpose: moving stablecoins efficiently at scale.

Instead of optimizing for DeFi composability or speculative throughput, Plasma focuses on fast, low-cost, and predictable settlement — the same properties required by fintechs, neobanks, payment providers, and institutional treasuries.

Architecturally, Plasma prioritizes:

High-throughput stablecoin settlement

Minimal fee volatility

finality under stress

Programmable money flows for real-world finance

Think of @Plasma not as another app chain, but as financial plumbing — the pipes through which digital dollars flow when the system is under pressure.

If Ethereum is a global computer, Plasma is a global settlement engine.

Why This Matters Going Forward

As stablecoins expand beyond trading into salaries, cross-border payments, on-chain savings, and corporate treasury management, the cost of poor infrastructure rises dramatically. A delayed transaction isn’t just inconvenient — it can break payroll, settlement, or liquidity management.

The recent crash showed us something critical: speculation fades, but money usage persists. Stablecoins are quietly becoming the safest asset in crypto — not because they avoid volatility, but because they absorb it.

Conclusion: Money Is Moving — Rails Decide the Winners

Stablecoins at 1.37% of US M2 is not the end state. It’s the opening chapter. As adoption accelerates, the spotlight will shift from issuers to infrastructure.

The future won’t be decided by who prints the most stablecoins, but by who can move them faster, cheaper, and more reliably than legacy finance ever could

That’s the future #Plasma is building toward.

When money evolves, rails matter.And this time, they’re being built on-chain.