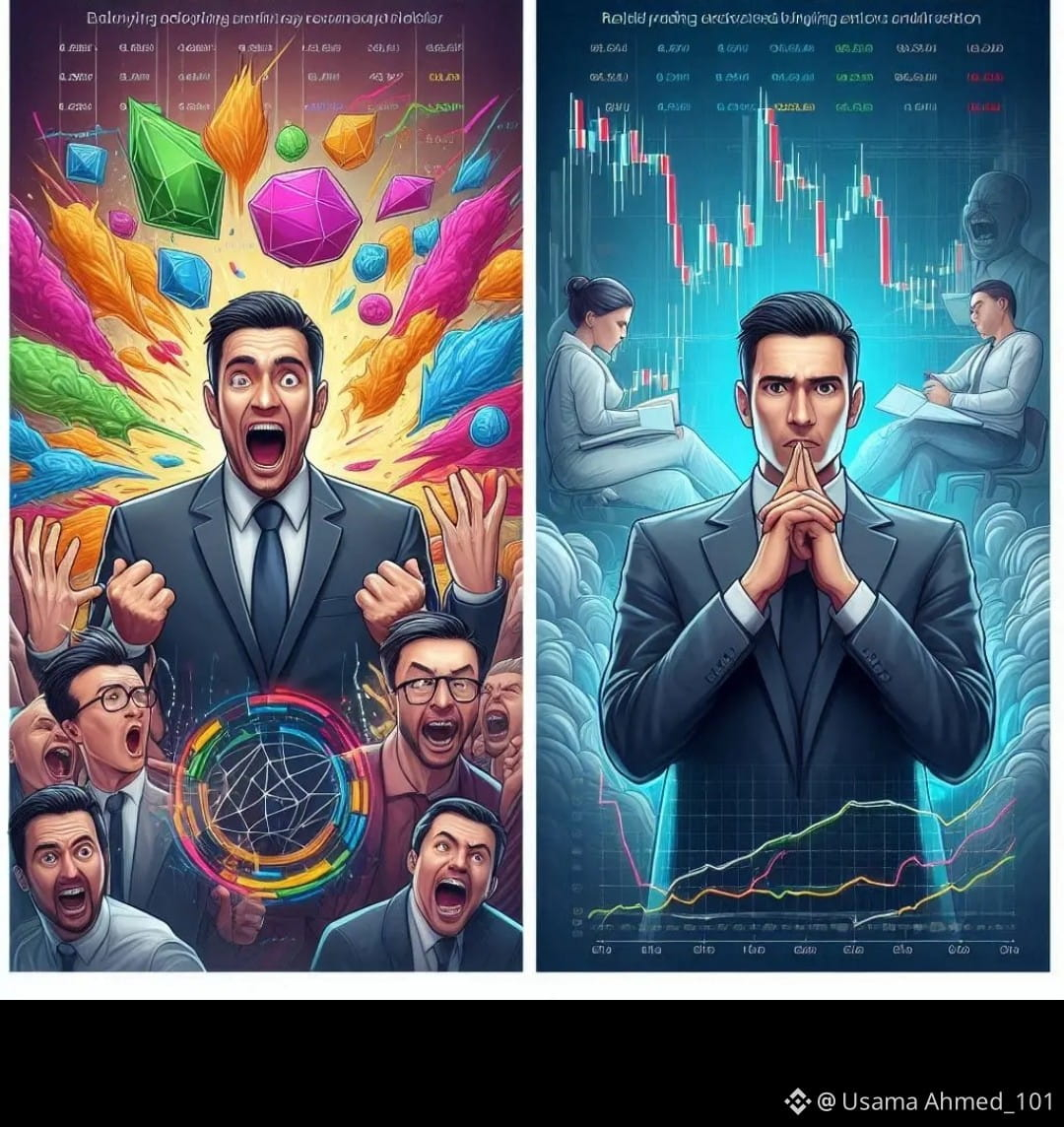

Most traders don’t lose money because the market is bad — they lose because they enter at the worst possible moment. 😨

When the chart is green, emotions take control. FOMO kicks in. You buy high, expecting more upside… and suddenly the market dumps. This silent trap wipes accounts every single day, yet most traders never realize what really happened.

Here’s the shocking truth most influencers won’t tell you:

Smart money buys when you’re scared, not when you’re excited.

Big players enter trades during boredom, low volume, and fear — while retail traders wait for confirmation that comes too late. By the time Twitter is bullish, smart money is already planning their exit.

Professional traders focus on price behavior, not hype:

They wait for liquidity zones

They respect support & resistance

They control risk before entering

They accept small losses to protect capital

Trading is not about being right every time — it’s about surviving long enough to win big. 💡

The market doesn’t reward emotions. It rewards discipline and patience.

If you’re tired of chasing pumps and watching your account bleed, maybe it’s time to change how you trade — not the coin.

👉 Be honest:

Do you usually buy out of FOMO or fear?

Comment below 👇 and let’s discuss like real traders.