In the 2026 market, volatility is inevitable. The difference between a professional trader and a struggling amateur isn't in the indicators, but in Capital management.

If you want to trade for a living, treat your capital like a business, not a gamble.

The three commandments for survival:

1. The 1% Rule 📏

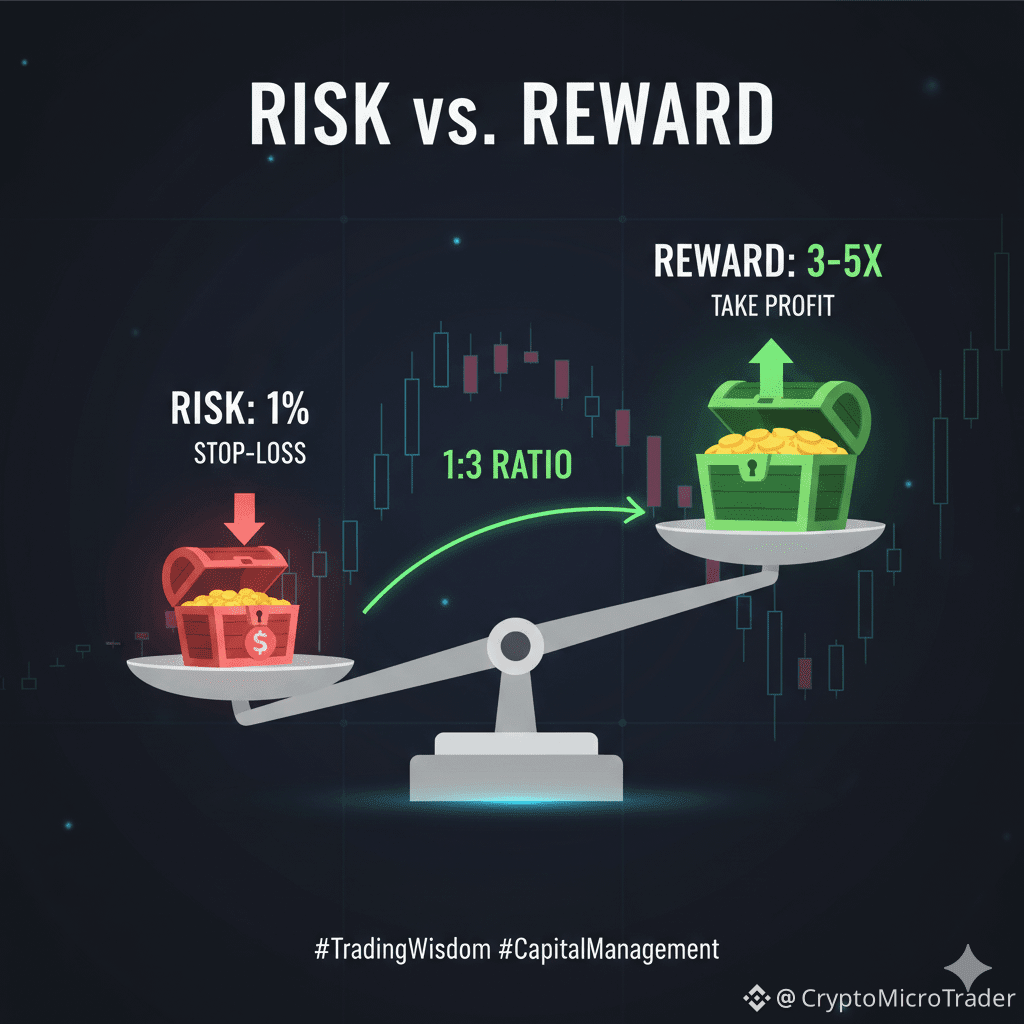

Never risk more than 1% of your total capital on a single trade. If you have $10,000, your limit for each trade is $100. This ensures that a series of losses doesn't wipe out your entire account.

2. Stop Loss is Essential 🛑

A mental stop loss is just wishful thinking. In a market that moves in fractions of a second, you need specific orders in your system. A stop loss is your insurance policy against total loss.

3. Leverage is a tool, not a lottery ticket ⚖️

High leverage (50x or more) doesn't make you rich overnight; it makes it easier to liquidate your position. Determine the size of your position based on your risk not your greed.

Professional mindset:

The goal isn't to make a million dollars today, but to ensure you can trade again tomorrow. In 2026, the market rewards patience and punishes recklessness.

"It’s not about how much you make when you’re right, but how little you lose when you’re wrong."

And you my friend, are you protecting your capital today? Drop a "YES" if your Stop-Loss is set! 👇