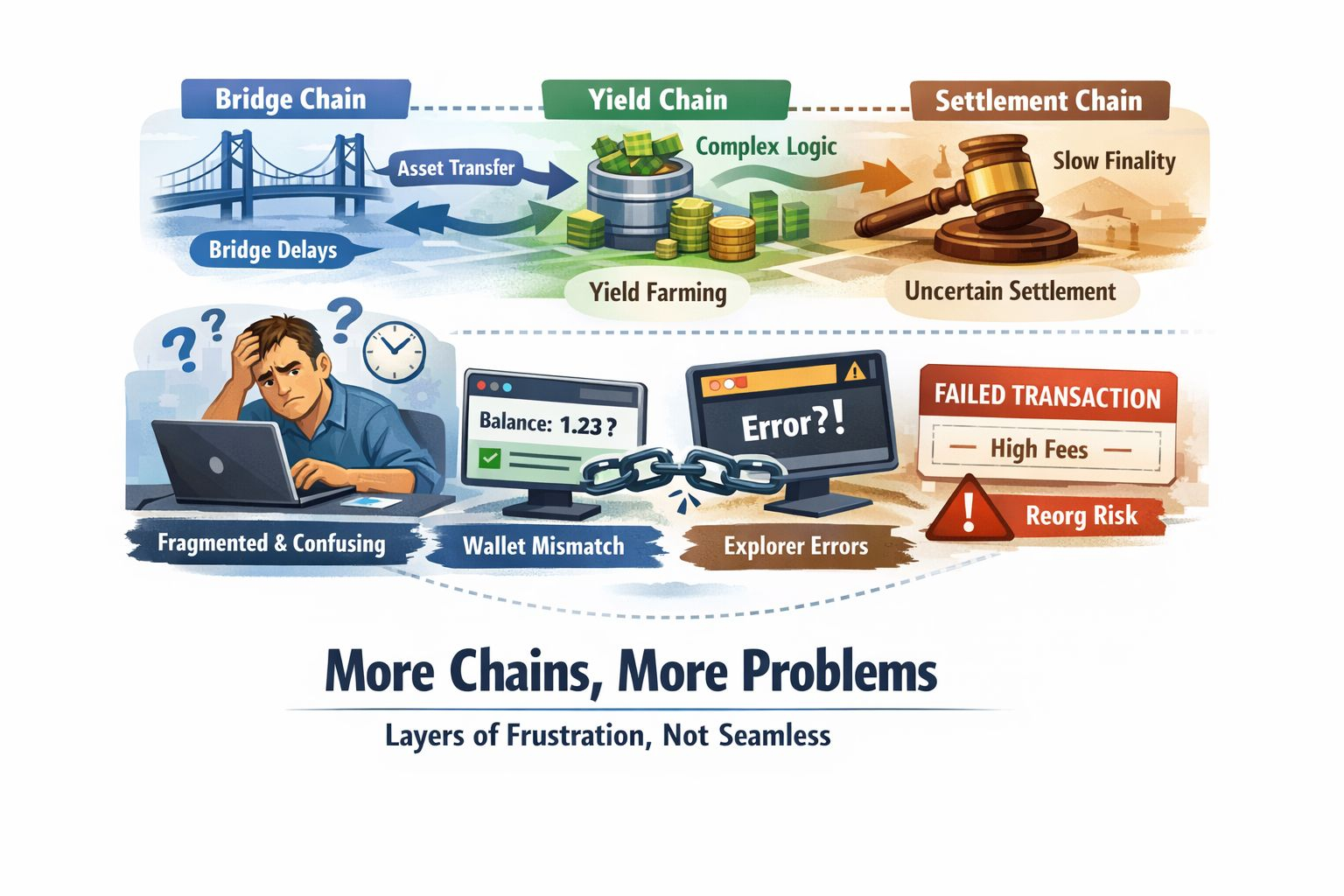

The moment that pushed me to Plasma wasn’t ideological, it was operational. I was moving value across what was supposed to be a seamless multi chain setup, assets bridged on one chain, yield logic on another, settlement on a third. Nothing was technically broken. But nothing felt coherent either. Finality was conditional. Balances existed in limbo. Wallets disagreed with explorers. I waited for confirmations that meant different things depending on which layer I trusted that day.

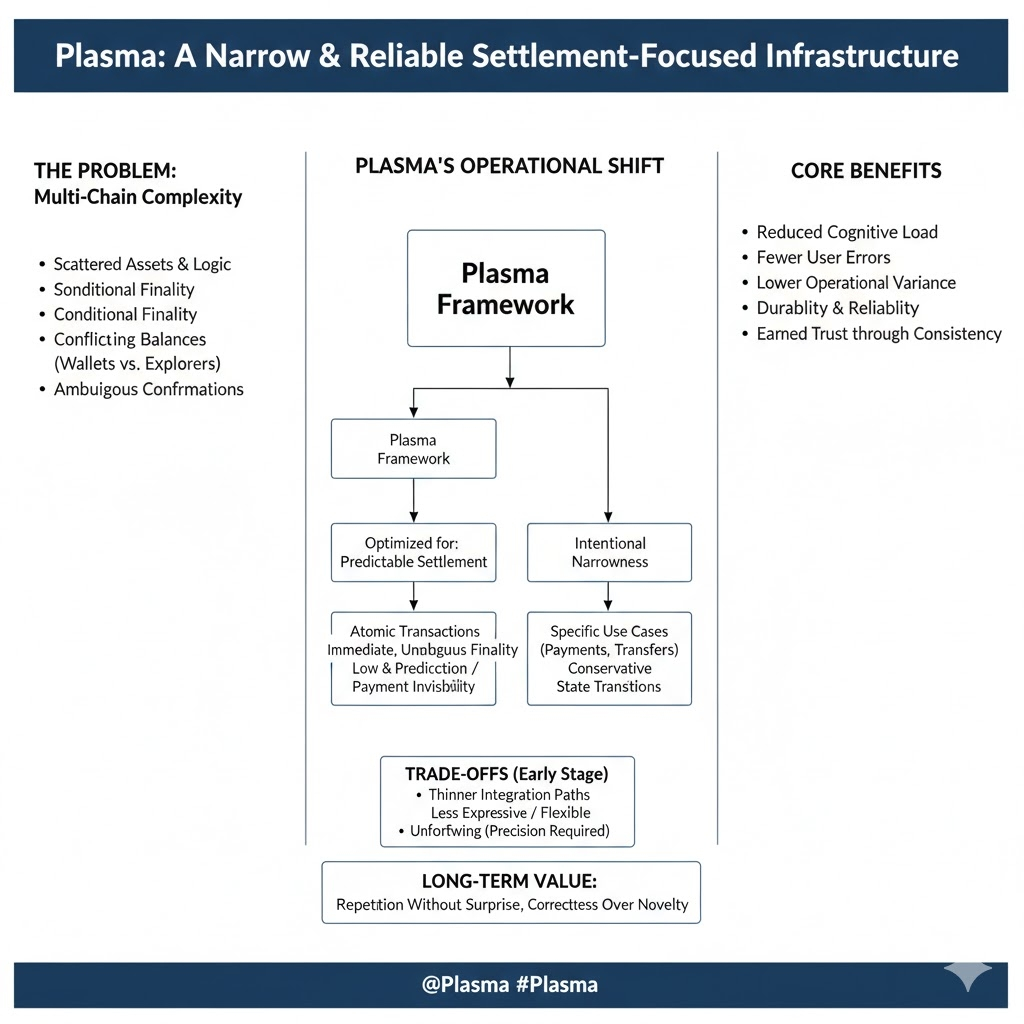

That experience cracked a narrative I had absorbed without questioning: that more layers, more bridges, and more modularity automatically produce better systems. In practice, they produce more handoffs and fewer owners of correctness. Each component works as designed, yet no single part is accountable for the end state. When something goes wrong, the system shrugs and the user pays the cognitive and operational cost. Plasma forced me to step back and ask a less fashionable question: what does real financial demand actually require from infrastructure?

Working hands on with Plasma reframed the problem as a settlement problem, not an application one. The system is intentionally narrow. It optimizes for predictable settlement behavior rather than expressive execution. That choice shows up immediately in how it handles finality. When a transaction settles, it settles. There is no mental math around probabilistic confirmations or reorg risk. That sounds trivial until you’ve tried reconciling balances across systems where confirmed means probably fine unless something happens.

Plasma’s approach reframes those costs as design constraints. Fees are predictable and low enough that users don’t need to think about optimization. More importantly, they’re structured so that the act of paying doesn’t dominate the interaction. Gas abstraction and payment invisibility aren’t flashy features, but they change the workflow entirely. When users aren’t forced to reason about gas tokens, balances across chains, or timing their actions, they behave differently. They complete flows. They make fewer mistakes. They don’t stall at the last step.

Atomicity is treated as a first order concern, not a convenience. State transitions are conservative by design. You don’t get the illusion of infinite composability, but you also don’t get partial failures disguised as flexibility. From an operator’s perspective, this reduces variance, the hidden cost that rarely appears in benchmarks. Lower variance means fewer edge cases, fewer emergency fixes, and fewer moments where humans have to step in to reconcile what the system couldn’t.

This matters more than headline TPS figures because most real systems aren’t bottlenecked by raw throughput. They’re bottlenecked by human hesitation. A system that can process thousands of transactions per second but loses users at the confirmation screen is optimizing the wrong layer. Plasma’s insight is that reducing cognitive load is a form of scaling.

Running a node made these trade offs tangible. Consensus behavior is steady rather than aggressive. Under load, the system doesn’t oscillate or degrade unpredictably. Resource usage stays within expected bounds. State growth is controlled and explicit, not deferred to future upgrades. This kind of discipline only emerges in systems that assume they will be blamed when something breaks.

Comparing this to incumbents is instructive when you focus on lived experience rather than ideology. On many general purpose chains, the workflow is powerful but brittle. You can do almost anything, but only if you understand what you’re doing. Errors are easy to make and hard to recover from. In Plasma, the workflow is narrower, but it’s harder to misuse. That trade off won’t appeal to everyone, but for payments and everyday transfers, it aligns better with how people actually behave.

That discipline comes with friction. Plasma is not forgiving. Inputs must be precise. Tooling doesn’t hide complexity just to feel smooth. This is a real barrier to adoption, especially for developers accustomed to layers that tolerate ambiguity and rely on retries or rollbacks. And there’s no guarantee that users will notice the difference immediately. Good infrastructure often goes unnoticed precisely because it removes friction rather than adding features. That makes it harder to market and slower to gain attention.

But that’s also why it’s worth watching. Not because it promises explosive growth or viral adoption, but because it addresses inefficiencies that compound quietly. Every unnecessary fee calculation avoided. Every transaction completed without confusion. Every new user who doesn’t need to learn how the system works before it works for them.

But there is a corresponding benefit. When I measured execution behavior and reconciliation across stress scenarios, Plasma behaved like infrastructure designed to be relied upon rather than experimented with. Systems built for financial settlement assume adversarial conditions, operator mistakes, and long time horizons. Systems built primarily for innovation often assume patience, retries, and user forgiveness. Those assumptions shape everything from consensus design to fee mechanics.

The economics only make sense when viewed as mechanics, not incentives. Fees regulate load and discourage ambiguous state rather than extracting value. Token usage is tied directly to settlement activity, not speculative narratives. Demand emerges from usage because usage is constrained by correctness. This limits explosive growth stories, but it also limits failure modes.

Plasma doesn’t pretend to be a universal execution layer. It doesn’t try to host everything. It does one thing narrowly and expects other systems to adapt to its constraints rather than the other way around. That makes it less exciting, but more legible.

There are still gaps. Integration paths are narrower than the broader ecosystem expects. The system demands more intentionality from users and developers than most are used to. In a market that equates optionality with progress, Plasma’s focus can look like inflexibility. Yet those are surface problems. They can be improved without changing the system’s core assumptions. Structural incoherence is harder to fix.

What Plasma ultimately reframed for me is where value actually comes from. Not from throughput metrics or composability diagrams, but from repetition without surprise. The same transaction behaving the same way under different conditions. The same assumptions holding during stress as they do during calm periods.

Durability is unglamorous. Reliability doesn’t trend. But financial infrastructure doesn’t need to be interesting. It needs to be correct. Long term trust isn’t granted by narrative dominance or technical ambition. It’s earned, slowly, by systems that are boring enough to disappear, until the moment you need them not to fail. That’s not a reason to evangelize. It’s a reason to observe. Over time, systems that respect how people actually behave tend to earn trust, not loudly, but steadily.