Plasma is quietly shaping up to be one of the most interesting Layer-1 blockchains in crypto right now, especially if you care about stablecoins actually being used in real life. Built from the ground up for stablecoin settlement, Plasma mixes fast performance, simple user experience, and Bitcoin-anchored security into a single network that feels more like payment infrastructure than a typical crypto chain.

The journey moved into high gear in mid-2025 when Plasma launched its public testnet. This gave developers their first real chance to deploy smart contracts, test payments, and explore how Plasma’s custom consensus and Ethereum-compatible execution actually behave in practice. Just a few months later, on September 25, 2025, Plasma crossed a major line with the launch of its Mainnet Beta. This wasn’t a quiet release either. At launch, the network went live with more than two billion dollars in stablecoin liquidity committed by over a hundred partners, instantly placing Plasma among the largest stablecoin-focused ecosystems from day one.

At the heart of the network is PlasmaBFT, a custom consensus system inspired by modern fast-finality designs. In simple terms, transactions confirm almost instantly, often in under a second, and the network can handle thousands of transactions per second. This is especially important for payments, where waiting even a few seconds can feel slow. Plasma pairs this with full Ethereum compatibility using Reth, a high-performance Rust-based Ethereum client. For developers, this means familiar tools like Solidity, MetaMask, and Hardhat work out of the box, without needing to learn a new programming model.

What really makes Plasma stand out, though, is its focus on stablecoins as first-class citizens. Users can send USDT without holding the native token at all, thanks to gasless transfers sponsored at the protocol level. Fees can also be paid directly in stablecoins or even Bitcoin, removing one of the biggest friction points for everyday users. The goal is simple: sending stablecoins should feel as easy as sending a message, not like managing a complex crypto wallet. Looking ahead, Plasma also plans to introduce privacy features for payments, something institutions and large financial players often require.

Security is another major pillar of the design. Plasma periodically anchors its state to Bitcoin, using Bitcoin as a neutral and highly secure settlement layer. This approach aims to combine Bitcoin’s censorship resistance with the flexibility of an EVM chain. Over time, Plasma plans to roll out a more trust-minimized Bitcoin bridge, allowing native BTC to move onto the network and be used for lending, collateral, and decentralized finance applications.

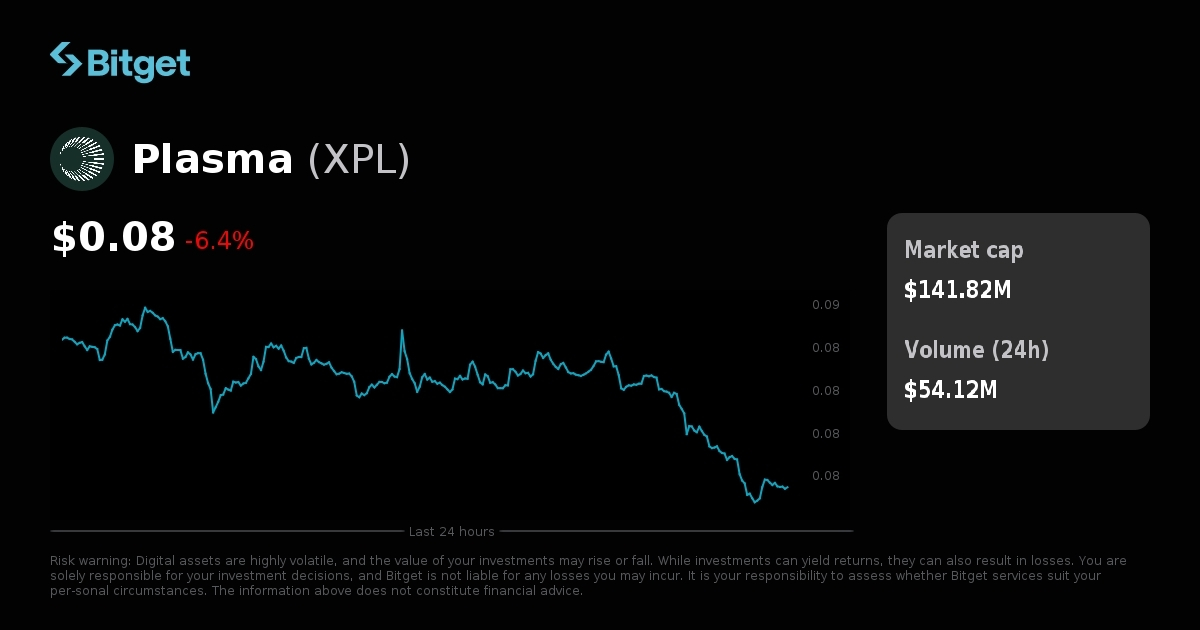

On the economic side, Plasma’s native token, XPL, was generated at launch. Roughly ten percent of the supply was sold publicly, with the rest allocated to community distribution, ecosystem incentives, and long-term development. The project raised an eye-catching 373 million dollars in an oversubscribed token sale, far exceeding its original target and signaling strong interest from both retail and institutional participants. The total supply is reported to be around ten billion tokens, with future unlocks expected over time, including notable releases planned for mid-2026.

Behind the scenes, the team has been scaling fast. Plasma has brought in senior hires across product, payments, and protocol security, suggesting a clear focus on moving from launch into real-world adoption. Some early ecosystem products are already being discussed, including payment and neobank-style services designed to let users spend stablecoins seamlessly, earn rewards, and move money globally with minimal friction.

In the wider market, Plasma is positioning itself against heavyweights like Ethereum and Tron, as well as newer chains built for payments. Its core idea is straightforward but ambitious: stablecoins deserve infrastructure that is fast, cheap, neutral, and built specifically for moving value, not just experimenting with finance. If Plasma can keep attracting developers, integrate smoothly with wallets and payment apps, and deliver on its Bitcoin-anchored vision, it could become a serious backbone for global stablecoin settlement.

Plasma is still early, and execution will matter more than promises. Adoption, real transaction volume, and ecosystem growth will ultimately decide its place in the market. But as of now, it stands out as one of the clearest attempts to make stablecoins work like everyday money, backed by serious capital, serious engineering, and a clear long-term vision.