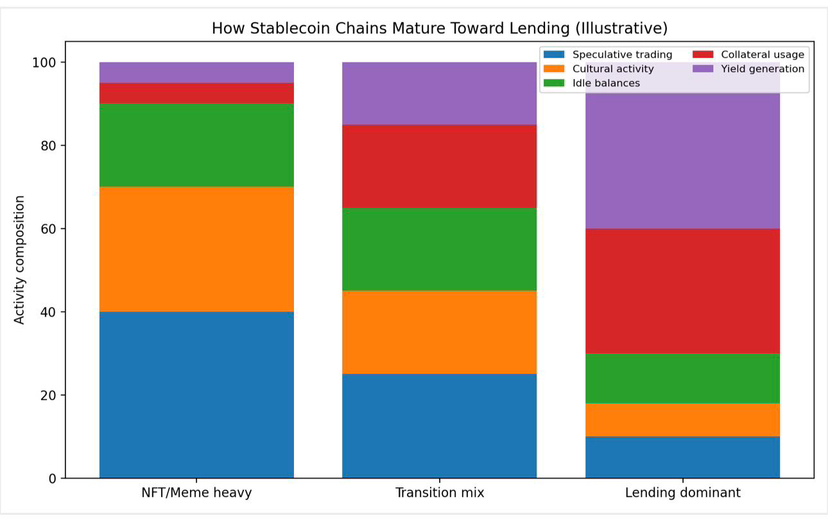

I’ve watched multiple blockchain categories search for the application that would finally justify their existence. NFTs promised culture. Memecoins promised attention. Gaming promised engagement. Each wave delivered moments of intensity, yet most of them struggled to sustain everyday economic necessity.

Stablecoins changed the equation.

They introduced assets people already understood. Units tied to familiar value, used not to speculate on identity but to move capital, manage exposure, and maintain liquidity. The shift sounds simple, yet it altered the gravitational center of onchain behavior.

The question then becomes: once a chain attracts stablecoin liquidity, what is the first activity that naturally emerges?

After observing flows around Plasma, the answer increasingly appears to be lending.

Not collectibles.

Not social tokens.

Borrowing and supplying.

This outcome should not be surprising. Stablecoins are financial instruments before they are cultural objects. Holders tend to think in terms of opportunity cost. Idle balance represents foregone yield. Movement implies intent to optimize.

Where optimization exists, lending markets form.

They form because they translate passivity into productivity. Suppliers earn. Borrowers unlock leverage or liquidity. The system produces mutual benefit without requiring participants to adopt unfamiliar mental models.

In other words, the activity feels normal.

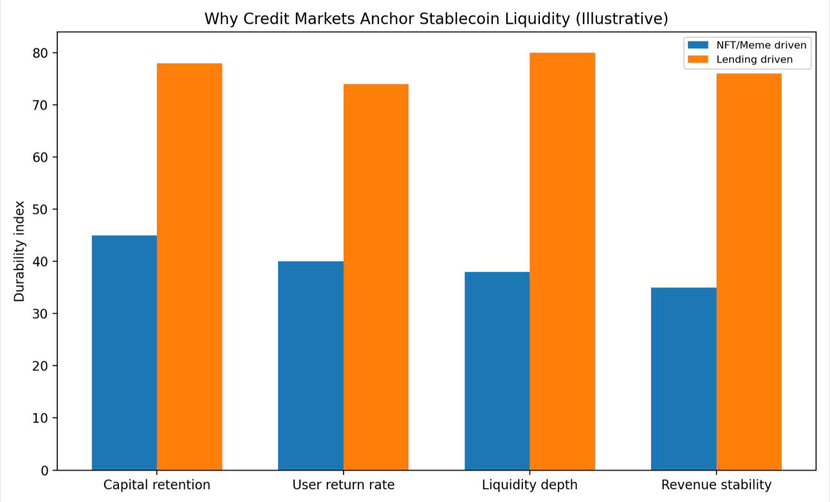

Product-market fit is often misunderstood as popularity. In practice, it is closer to inevitability. When a tool solves a recurring problem with minimal explanation, usage compounds naturally. Participants return not because incentives shout, but because absence would feel inconvenient.

Lending fits that definition for stablecoin environments.

Once capital sits onchain, the next rational step is to make it work.

NFTs, by contrast, depend heavily on narrative energy. They require attention cycles. Valuations fluctuate with culture. This can generate bursts of excitement, but it rarely produces routine financial behavior. Participants drift in and out.

Memecoins operate similarly. They thrive on virality. Their strength is speed, not persistence.

Lending markets operate differently. They reward patience, discipline, and repeat interaction. Positions remain open. Strategies evolve gradually. Risk management becomes central.

Time horizons extend.

This matters for infrastructure.

Systems built around longer horizons tend to stabilize. Liquidity deepens. Interfaces mature. Participants invest in tooling because they expect to remain. Ecosystems begin to resemble financial networks rather than entertainment venues.

That transition is significant.

What is noticeable in Plasma’s case is that lending activity does not feel artificially imposed. It feels adjacent to why the assets arrived in the first place. Stablecoins are already units of settlement. Turning them into units of credit is a short conceptual leap.

Minimal translation is required.

Developers benefit from this alignment. They can predict user motivation more reliably. They understand why deposits appear. They can design around known behaviors such as collateral management, yield comparison, and capital efficiency.

Predictability accelerates iteration.

Another advantage is composability. Lending markets create reference rates, liquidity anchors, and risk signals that other applications can observe. Entire layers of financial logic can develop on top.

This is harder to achieve with categories that revolve around sentiment rather than necessity.

Of course, lending is not without challenges. Liquidations, oracle design, governance disputes. These are serious issues and should not be minimized. But importantly, they are familiar issues. Traditional finance has confronted versions of them for decades.

Familiar problems are often easier to solve than novel ones.

Users, too, approach lending with clearer expectations. They recognize interest. They understand collateral. They can evaluate risk in intuitive terms. Participation becomes less about discovery and more about execution.

Comfort grows.

From this perspective, Plasma’s trajectory looks less like experimentation and more like convergence. The network is aligning with behaviors that stablecoin holders already practice elsewhere. Instead of trying to invent new demand, it is facilitating existing demand in a new venue.

That usually travels further.

What you begin to see is density. Capital stays. Strategies layer. Relationships between borrowers and suppliers stabilize. Volatility remains, but it operates within structure.

Structure is a precursor to maturity.

There is also an institutional dimension. Professional participants tend to prioritize environments where financial primitives are clear and repeatable. Lending markets provide exactly that. They allow modeling, hedging, forecasting.

Serious money prefers calculable terrain.

After spending time watching how these dynamics unfold, the impression is not explosive growth but steady consolidation. Plasma is not chasing spectacle. It is hosting a function that stablecoin liquidity inevitably seeks.

And inevitability is powerful.

None of this means other categories will disappear. Culture and speculation will continue to cycle. But if we are searching for the first durable anchor, lending remains a strong candidate.

It converts presence into productivity.

Whether Plasma can maintain resilience through market stress will determine long-term success. Product-market fit reveals itself most clearly when conditions deteriorate. If participants remain because alternatives are less convenient, the thesis strengthens.

Time will tell.

For now, the signs suggest that stablecoin chains find their footing when they enable capital to earn. Lending is not glamorous, but it is persistent.

And persistence is usually what builds ecosystems.