The blockchain ecosystem has been rapidly evolving, and Ethereum has long been the backbone for decentralized applications (dApps). However, as user adoption grows, Ethereum’s network congestion, high gas fees, and slower finality have posed challenges for developers aiming for scalable, cost-effective solutions.

Enter Plasma Blockchain, a Layer 1 platform tailored for stablecoin settlement that is fully EVM-compatible via Reth and offers sub-second finality through PlasmaBFT. For developers familiar with Ethereum, migrating to Plasma provides a smoother experience, enhanced transaction speed, and innovative features like gasless USDT transfers and stablecoin-first gas.

1. Understanding Plasma’s Architecture

Before migrating, it’s crucial to understand Plasma’s architecture:

Reth (Ethereum-compatible runtime): Plasma provides full EVM compatibility, meaning developers can deploy Ethereum smart contracts with minimal code changes.

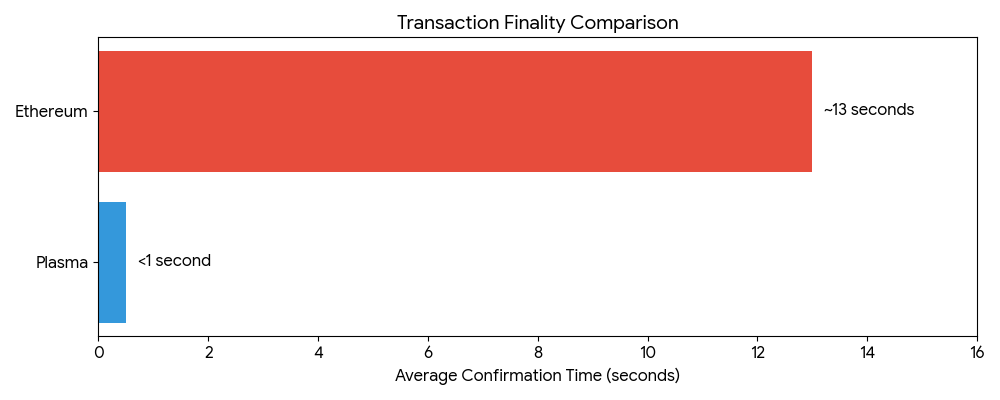

PlasmaBFT (Consensus Mechanism): Provides sub-second finality and high throughput, enabling applications to scale without bottlenecks.

Stablecoin-centric Features: Gasless transfers for popular stablecoins (like USDT) and a stablecoin-first gas system improve user experience.

Bitcoin-anchored security: Plasma leverages Bitcoin as a security anchor, enhancing neutrality and censorship resistance.

2. Preparing Your Smart Contracts

When migrating, consider these steps:

Audit Solidity Code:

Most Ethereum contracts run on Plasma with minimal modification. However, check for block-specific assumptions like gas limits or transaction ordering.

Integrate Stablecoin Gas System:

Plasma’s unique stablecoin-first gas model allows paying fees with stablecoins instead of native tokens. Modify your contract’s fee handling logic to leverage this.

Test for Sub-Second Finality:

PlasmaBFT confirms transactions almost instantly. Ensure your contract logic, especially state-dependent operations, works under rapid confirmations.

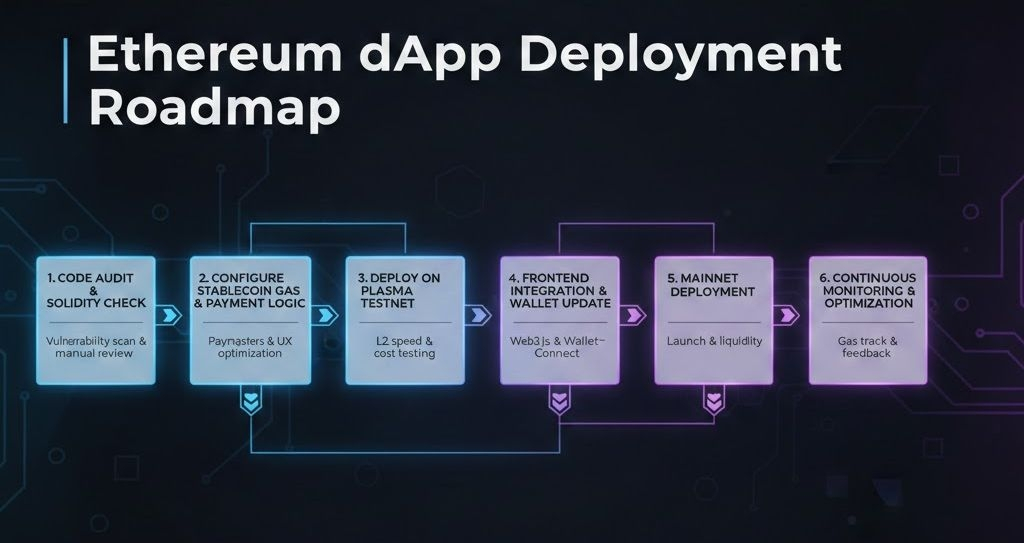

3. Migrating dApps: Step-by-Step

Step 1: Setup Plasma Development Environment

Install Reth-compatible toolchains (Truffle, Hardhat).

Connect to Plasma testnet to simulate migration.

Step 2: Port Smart Contracts

Copy Solidity contracts from Ethereum.

Adjust gas logic for Plasma’s stablecoin-first system.

Test contracts using Plasma-specific RPC endpoints.

Step 3: Update Frontend Integration

Replace Ethereum RPC URLs with Plasma RPC endpoints.

Ensure wallets (like MetaMask) recognize Plasma’s stablecoin gas options.

Test all transaction flows for speed and gas optimization.

Step 4: Deployment and Monitoring

Deploy contracts to Plasma mainnet.

Monitor transactions via Plasma explorer.

Adjust contract gas handling if users report delays in edge cases.

4. Leveraging Stablecoin Features

Plasma’s stablecoin-centric design gives developers unique advantages:

Gasless Transfers: End-users can send USDT without holding native Plasma tokens.

Stablecoin-first Gas: Reduces friction in dApp adoption, especially in retail markets.

Cross-Border Payments: Sub-second finality combined with stablecoins ensures real-time settlement for global users.

Use Case Example: A retail payment dApp on Ethereum may face $5 transaction fees, causing user drop-off. Migrating to Plasma allows instant transactions with minimal or zero gas, increasing adoption.

5. Security and Neutrality Considerations

Plasma anchors its security to Bitcoin, enhancing trust and censorship resistance. For developers:

Smart contracts inherit high-security guarantees.

Critical applications like payment processing or stablecoin lending benefit from reduced risk of network attacks.

Neutral, censorship-resistant design supports global operations without reliance on a single chain’s politics.

6. Best Practices for Migration

Start with Testnet: Test every function before mainnet deployment.

Leverage Existing Ethereum Tools: Most developer tools (Truffle, Hardhat, Ethers.js) are compatible.

Audit Gas Usage: Even with stablecoin-first gas, optimize contract functions for efficiency.

Educate Users: Communicate to end-users that gas can be paid in stablecoins or is sometimes free.

Monitor Network Updates: Plasma is evolving; stay updated with PlasmaBFT upgrades and Reth improvements.

Conclusion

Migrating from Ethereum to Plasma is a smooth and strategic decision for developers seeking:

Faster transaction finality

Lower transaction costs

Stablecoin-centric features

High security via Bitcoin-anchored mechanisms

By leveraging Reth compatibility and PlasmaBFT consensus, developers can migrate their existing Ethereum smart contracts with minimal friction, opening the door to real-time, user-friendly dApps in retail and financial markets.

Plasma’s combination of speed, stability, and developer-friendly architecture positions it as a strong Layer 1 alternative for Ethereum-native projects looking to scale and optimize for stablecoin payments.