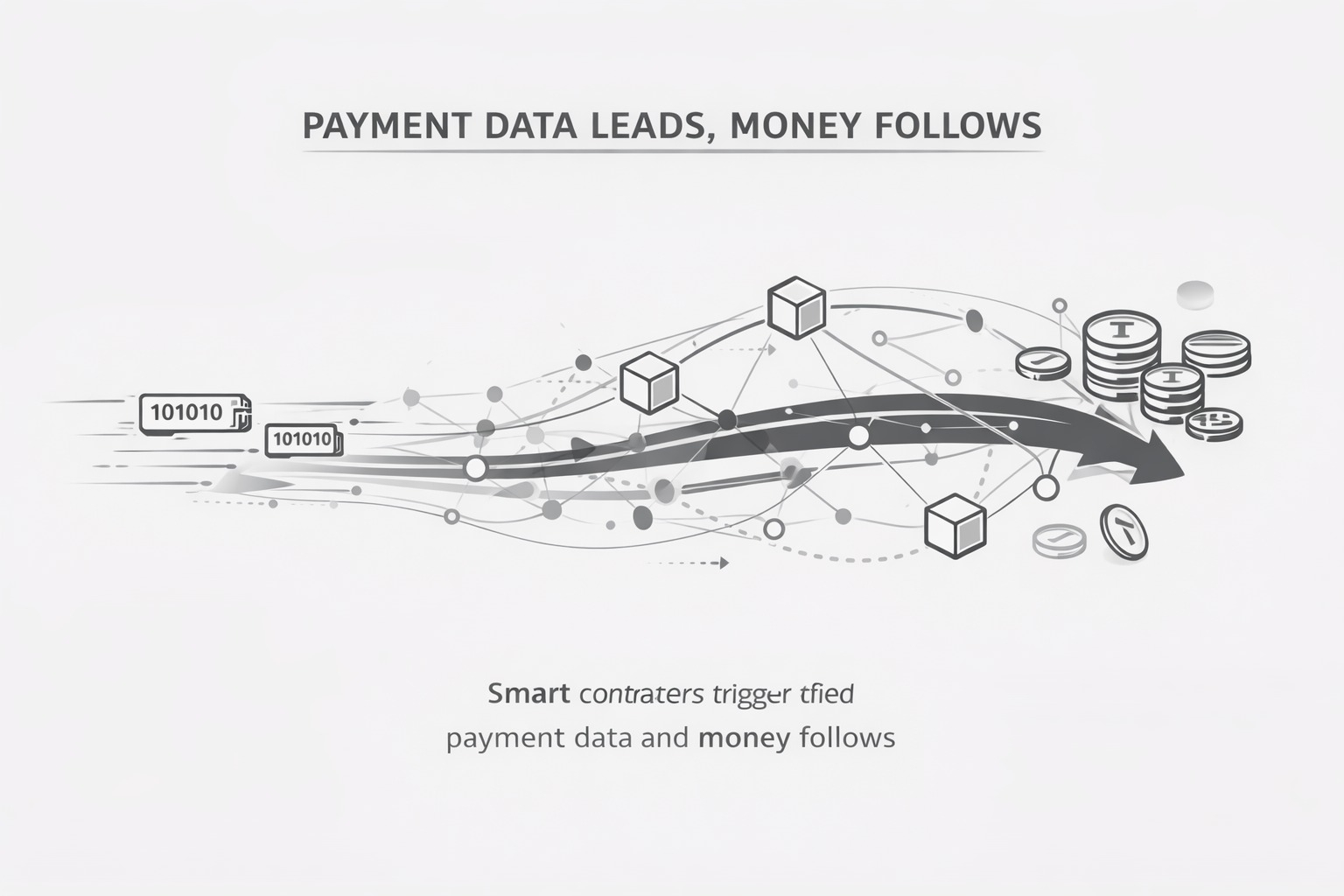

When people first hear about Plasma, their instinct is to think about money — fast payments, cheaper transactions, or cross-chain settlements. But that is only half the story. The true superpower of Plasma isn’t moving dollars or tokens from one wallet to another; it’s moving payment data with the precision, speed, and security that traditional systems can only dream of. Imagine a river not of cash, but of rich, structured information, flowing seamlessly across networks and chains, carrying the story of each transaction — who paid whom, when, why, and under what conditions. That is Plasma’s hidden engine.

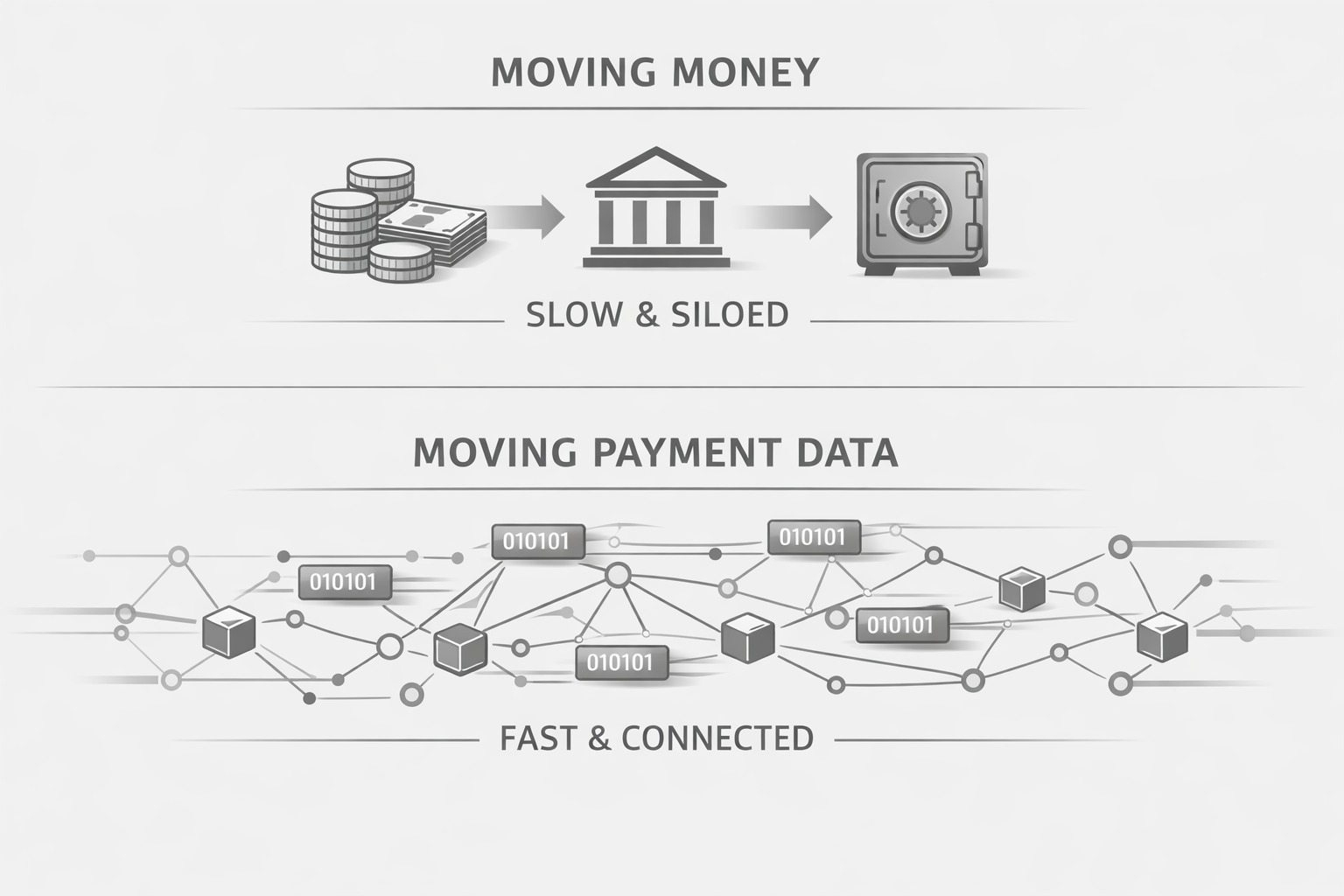

In conventional financial systems, the movement of money is often treated as the endpoint. Banks, payment processors, and credit networks focus on the transfer itself, but the trail of data — the context, the intent, the settlement metadata — is often slow, siloed, or incomplete. This is where inefficiency breeds friction, fraud, and delays. Plasma flips that model on its head. By treating payment data as first-class infrastructure, it allows the context of money to move as freely as the value itself. When a merchant receives a payment through Plasma, they receive not just a deposit, but a verified, structured story: the chain of intent, the origin of funds, and the cryptographic assurance that the transaction is valid.

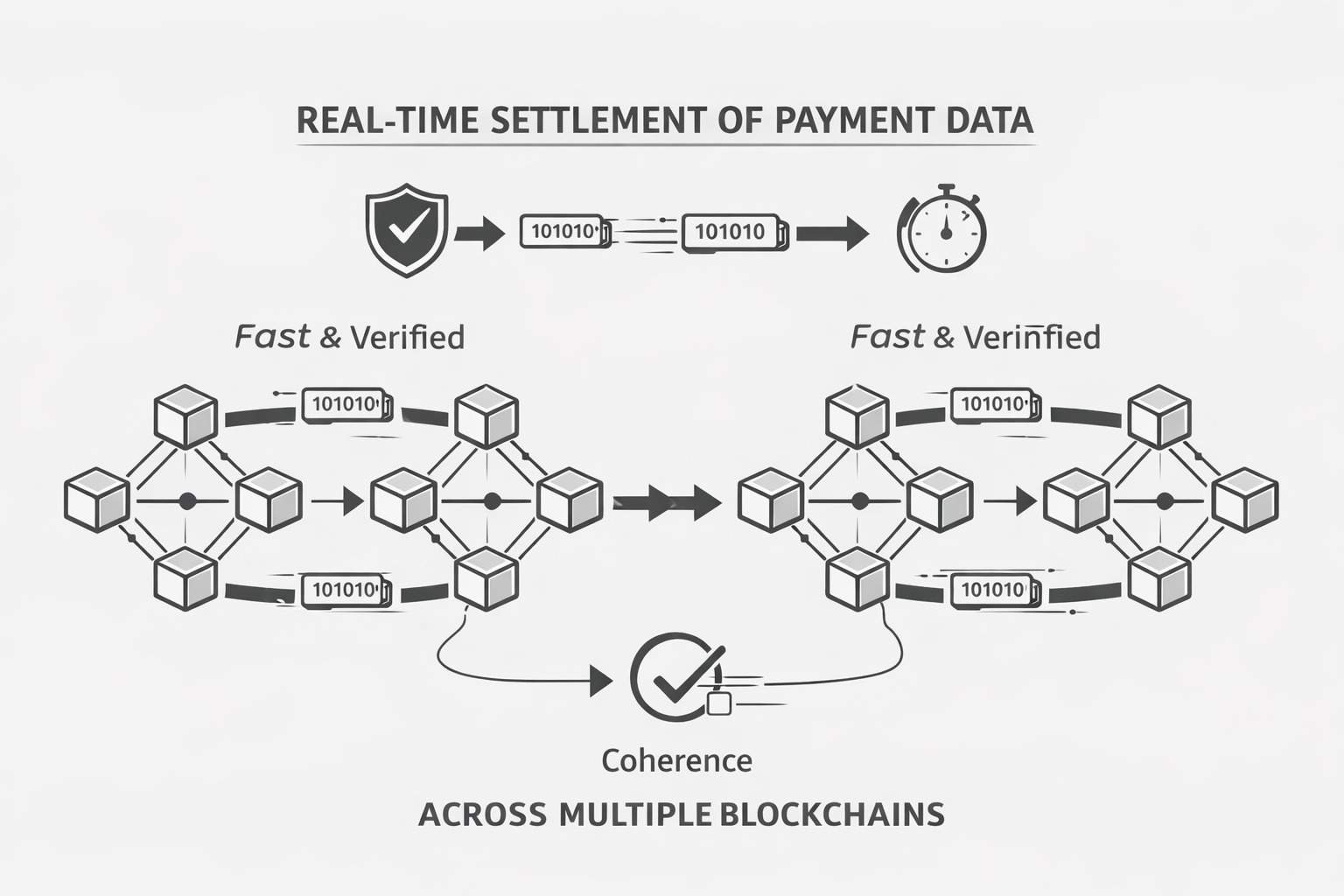

This shift transforms what it means to “settle” payments. Instead of simply confirming that money changed hands, Plasma enables ecosystems to settle information in real-time. This is the secret behind its cross-chain versatility. By anchoring transaction data to multiple networks, Plasma allows different blockchains and assets to communicate as if they were part of a single, unified ledger. The result is more than speed; it is coherence. Payment systems no longer need to reconcile after the fact, because the data has already traveled ahead, anticipating and pre-structuring every downstream calculation.

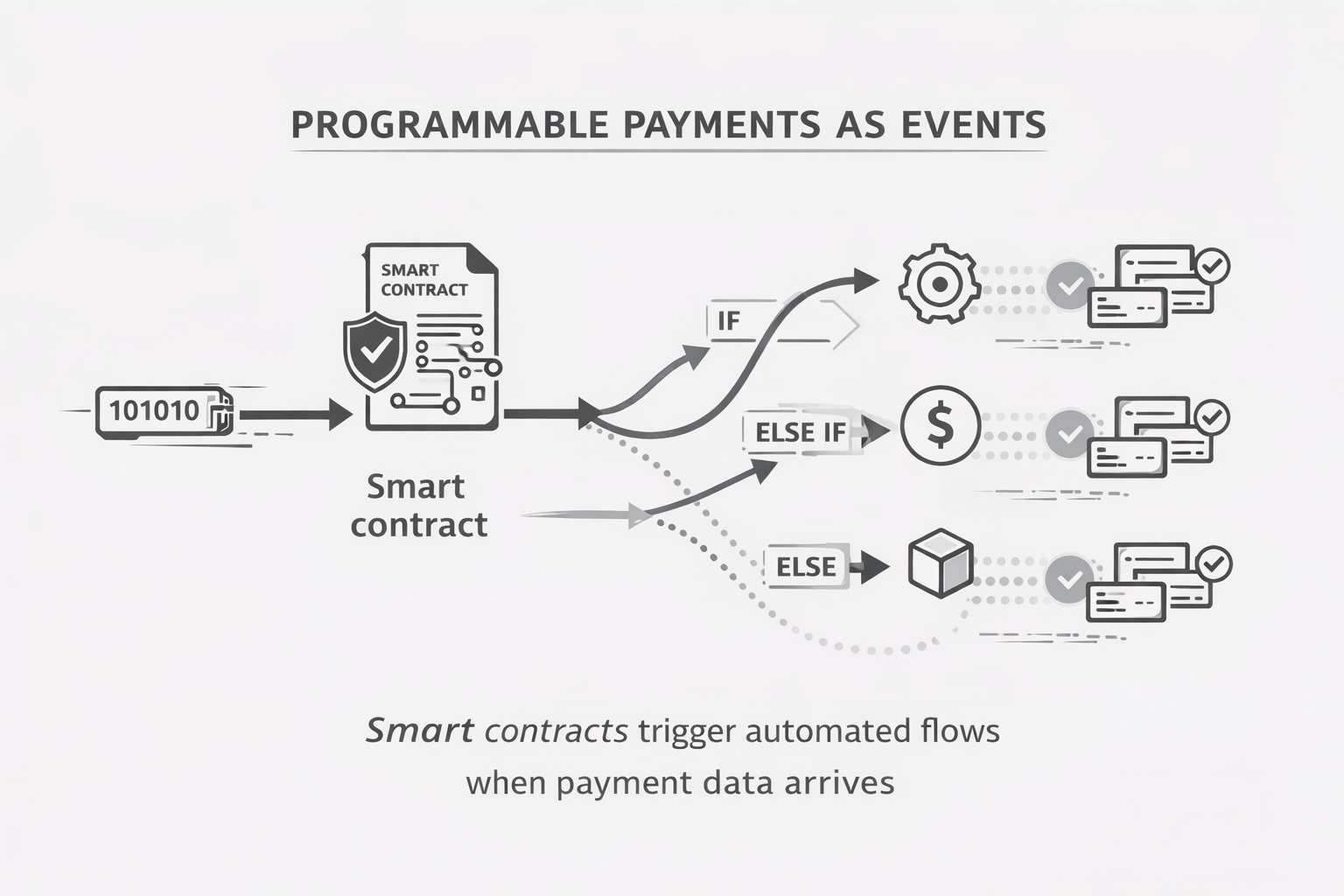

From a developer’s perspective, this is where the magic becomes tangible. APIs and smart contracts can act on payment data the instant it is generated, triggering automated flows, conditional disbursements, or analytics that were impossible under traditional frameworks. Plasma turns payments into programmable events, not just accounting entries. Businesses gain a clarity of insight that is both operational and strategic. They don’t just know that a transaction occurred; they know its full story, in real-time, with cryptographic guarantees that eliminate the gray areas where disputes and errors usually creep in.

Even philosophically, this approach rewrites the way we think about money in the digital age. Plasma positions value not as static currency but as dynamic information that can be routed, verified, and acted upon with unprecedented granularity. By prioritizing the flow of data over the flow of cash, it anticipates the future of financial systems — one in which intelligence, transparency, and coordination are inseparable from settlement. The money follows, but the data leads.

Ultimately, Plasma’s superpower is subtle yet profound. It doesn’t compete on transaction speed alone; it competes on contextual integrity, enabling payments to carry their own intelligence across chains, systems, and borders. The world has seen countless networks designed to move money faster or cheaper, but Plasma demonstrates that the real leap isn’t in the movement of value — it is in the movement of understanding, encoded into every transfer. This is what turns a payment into an event, a ledger entry into actionable insight, and a blockchain into a living, communicative network. In the end, Plasma teaches a simple but radical lesson: the future of finance isn’t about moving money — it’s about moving meaning.