Crypto is not just about buying and selling coins. For many, staking has become one of the most effective ways to earn passive income. Binance, being one of the largest exchanges in the world, offers users multiple staking options that can help grow their crypto holdings safely and efficiently. In this article, we’ll explore how Binance staking works, its benefits, and tips to maximize your earnings.

*What is Staking and Why It Matters?*

Staking is the process of locking your crypto in a network to support blockchain operations like validating transactions. In return, you earn rewards, usually in the same crypto you stake.

*Why it’s important:*

*Passive income:* Your crypto works for you while you hold it

*Supports blockchain networks:* Helps secure transactions and maintain decentralization

*Better than idle holding:* Instead of leaving crypto in your wallet, staking earns you extra returns

*Binance Staking Options :*

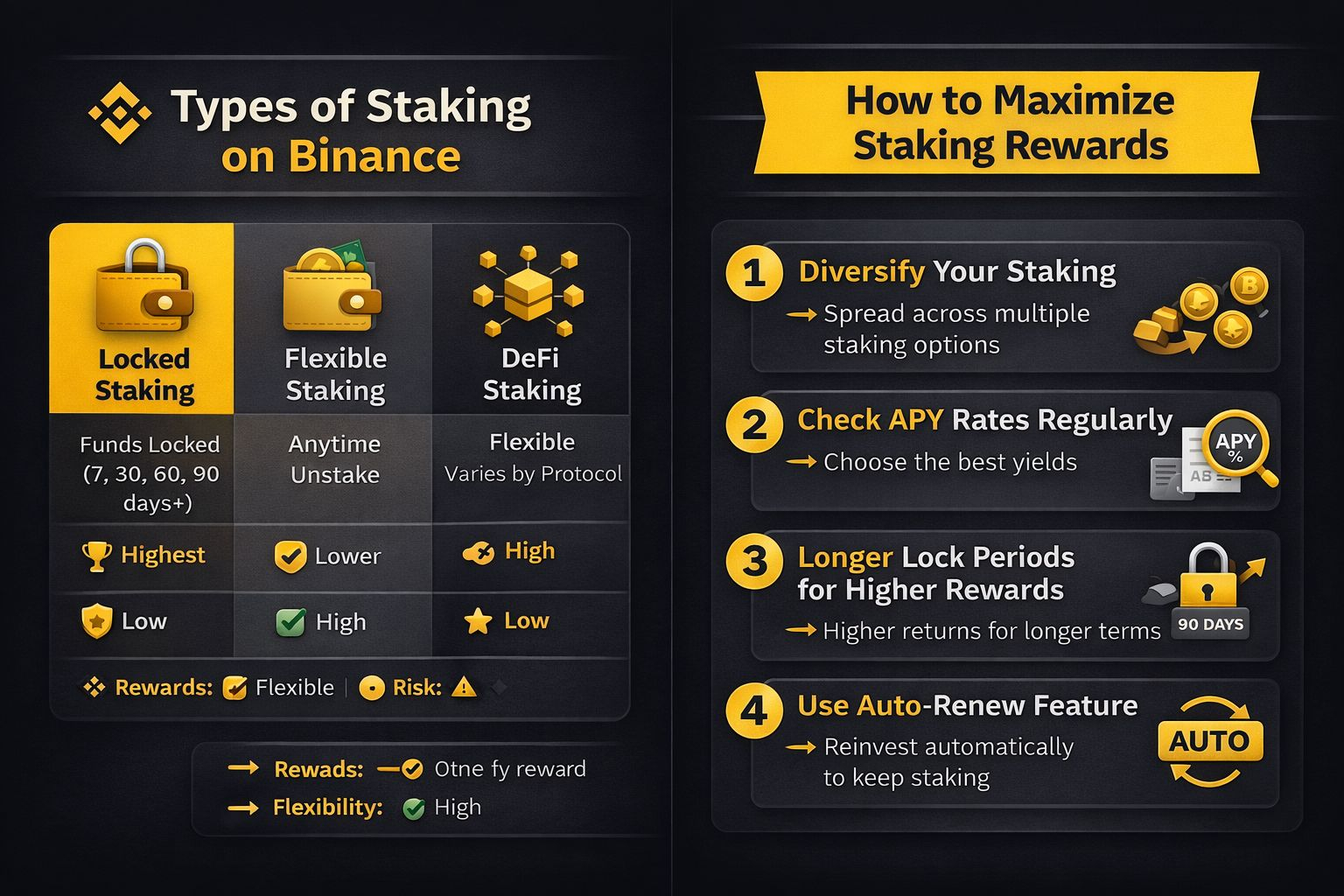

Binance offers multiple staking options for different types of users:

*1. Locked Staking*

Lock your crypto for a fixed period

Higher rewards than flexible staking

Ideal if you don’t need immediate access to funds

*2. Flexible Staking*

Stake and unstake anytime

Lower rewards, but perfect for beginners or those who want liquidity

*3. DeFi Staking*

Invest in decentralized finance protocols through Binance

Higher potential returns, but comes with slightly higher risk

*Visual Idea:*

Infographic comparing Locked, Flexible, and DeFi staking side by side with reward rates

*How to Maximize Your Staking Rewards on Binance*

*Diversify Your Staking* – Don’t put all your crypto into a single coin. Spread across multiple staking options.

*Check APY Rates Regularly* – Binance updates Annual Percentage Yield (APY) rates frequently; pick the best ones.

*Longer Lock Periods for Higher Rewards* – Locked staking usually offers better returns.

*Use Auto-Renew Feature* – Let your staking automatically renew to keep compounding your rewards.

💡 Tip: Even beginners can start with low-risk flexible staking, then move to locked staking once comfortable.

Risks You Should Know

Market price fluctuations can affect your total gains

Early withdrawal from locked staking may not be allowed or may incur penalties

DeFi staking has smart contract risks

*Pro Tip:* Only stake crypto you don’t need immediately and do your research on the coins you choose.

*Conclusion*

Staking on Binance is a powerful way to earn passive income while participating in the crypto ecosystem. By choosing the right staking type, monitoring APY rates, and diversifying your holdings, anyone can start earning safely.

Start staking today and make your crypto work for you:

https://www.generallink.top/referral/earn-together/refer2earn-usdc/claim?hl=en&ref=GRO_28502_PAOKH&utm_source=default

#cryptoguide #Binance #defi #Beginnersguide #TradingCommunity