When prices fall, many believe they are leaving the market. In reality, they are not. They are simply transferring ownership to someone else. Markets do not disappear during moments of panic. They change hands. And when fear dominates decision-making, the buyer is rarely a retail investor.

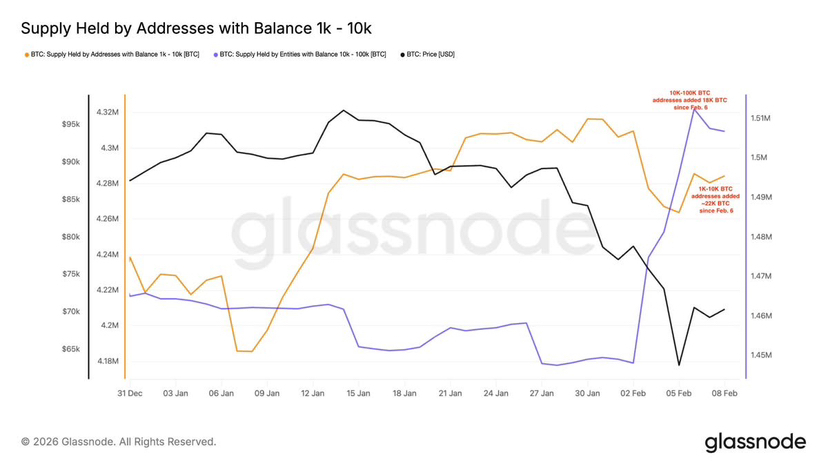

On-chain data makes this unmistakably clear. During the recent sharp pullback, as Bitcoin dropped below the $60K level, large whale cohorts quietly accumulated roughly 40,000 BTC. Wallets holding 1K-10K BTC and 10K-100K BTC both increased their positions - precisely while much of the market chose to sell in order to relieve psychological pressure.

Supply was not destroyed. It was absorbed.

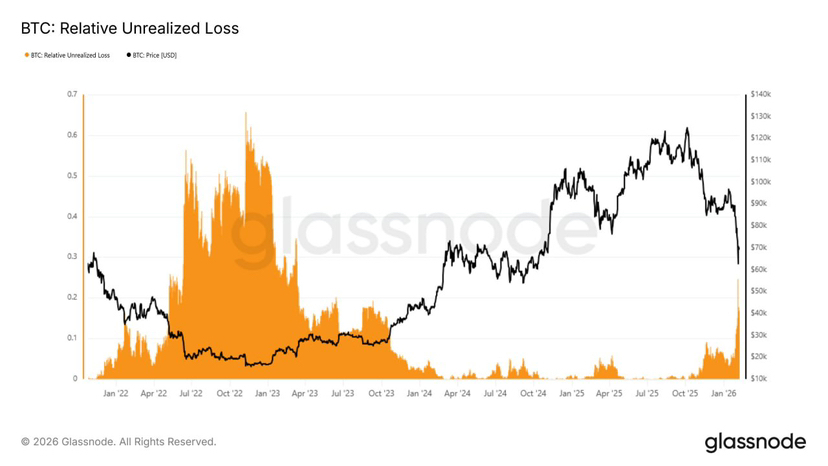

Around the $69K level, the market is currently carrying unrealized losses equal to roughly 17% of total market capitalization - more than $200 billion sitting in paper losses. This is not a minor shakeout. Historically, this zone marks a phase of confidence erosion, where holders begin questioning whether staying invested is still worth it.

Another critical signal: Bitcoin has traded below the realized price of whale cohorts holding 100 - 1K BTC. Historically, this condition has rarely coincided with whale capitulation. Instead, it tends to define periods where large holders accept drawdowns in order to accumulate, while the market takes time to flush out weak hands.

Another critical signal: Bitcoin has traded below the realized price of whale cohorts holding 100 - 1K BTC. Historically, this condition has rarely coincided with whale capitulation. Instead, it tends to define periods where large holders accept drawdowns in order to accumulate, while the market takes time to flush out weak hands.

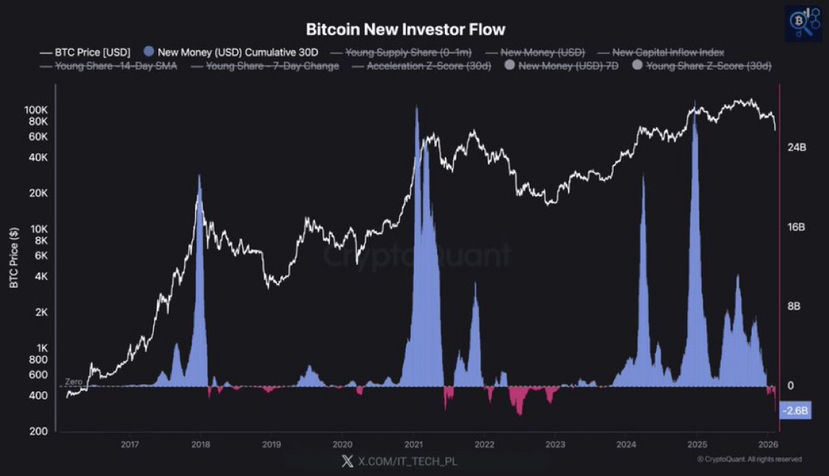

At the same time, new investor inflows are fading. Fresh capital is not entering the market with enough consistency to drive sustained upside. This explains why price struggles to break higher—not because belief has vanished, but because new money is standing aside. The market is currently functioning through internal redistribution, not external demand.

At the same time, new investor inflows are fading. Fresh capital is not entering the market with enough consistency to drive sustained upside. This explains why price struggles to break higher—not because belief has vanished, but because new money is standing aside. The market is currently functioning through internal redistribution, not external demand.

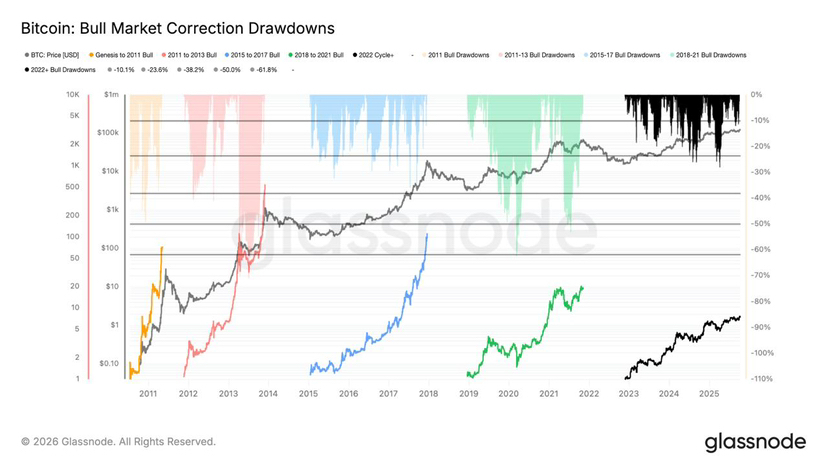

In the context of previous cycles, this correction is not the deepest, but it is prolonged. This is a correction of time, not price. It does not terrify participants instantly - it exhausts them slowly, until they willingly let go.

And that is when the transfer occurs. When you sell out of fear, you are not escaping risk. You are handing ownership to those with more capital, more patience, and no need for the market to rise tomorrow.

Markets always require sellers to form a bottom. The only real question is: who are you selling to -and why?