$POP prediction

Market Context:

Before diving into POP price forecasts, it’s important to note broader market conditions — because POP pricing often follows Bitcoin’s movements.

Bitcoin recently showed sharp volatility with deep sell-offs and partial rebounds, reflecting a crypto market in flux. BTC fell to lows below $65,000 after a significant correction from its record highs, and despite some bounce back above $65,000, bearish pressure remains in the market. �

The Guardian +1

That environment influences smaller assets like POP, which tend to amplify Bitcoin’s trend due to lower liquidity.

Short-Term POP Prediction: Next Few Days

📉 Recent Forecasts

According to CoinCodex forecasts for Proof of Presence (POP), the token is expected to trade with minimal movement in the short term but with possible range fluctuations this week:

🔹 Today / Tomorrow: POP could stabilize around its current price (~$0.00266).

🔹 This Week: The weekly range projected is between $0.00194 (bearish) and $0.00266 (neutral).

🔹 Next 7 Days: A modest upward scenario could see POP reach around $0.00210 by next week’s optimistic target. �

CoinCodex

Key takeaway: $POP POP may see modest volatility this week but is unlikely to spike sharply unless Bitcoin gains strong momentum.

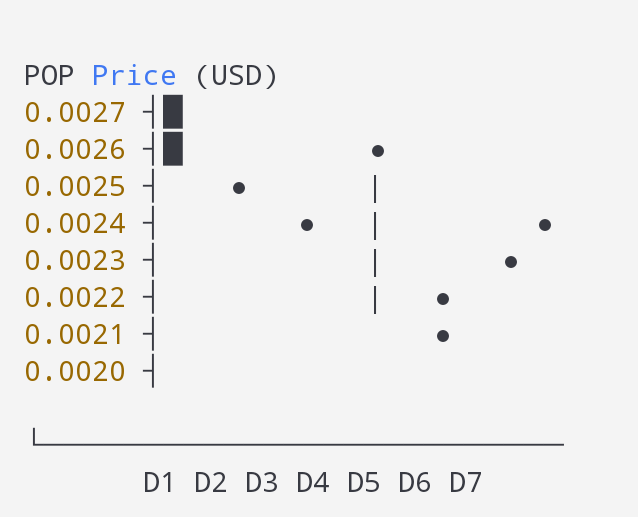

Weekly POP Price Range Projection

Here’s a simple 7-day forecast table based on the prediction ranges:

Date

Price Forecast (POP)

Day 1

~$0.00266 (current)

Day 2

~$0.00260

Day 3

~$0.00255

Day 4

~$0.00250

Day 5

~$0.00245

Day 6

~$0.00240

Day 7

~$0.00210 (upside)

This reflects a mix of neutral to slightly bearish scenarios and assumes the wider crypto market remains under pressure.

Factors Likely to Affect POP This Week

✔️ Bitcoin’s Price Action

If Bitcoin stabilizes or rebounds above key levels (e.g., mid-$60,000 range), altcoins like POP could follow with small gains.

✔️ Market Sentiment & Liquidity

Lower market confidence and reduced trading volume can lead to sideways or slight downward moves.

✔️ News & Events

Any macroeconomic changes, regulatory updates, or exchange listings can sharply move low-cap assets.