While Bitcoin $BTC struggles, Binance Coin — the native asset of the Binance ecosystem — is holding much stronger group.

According to recent price feeds, BNB $BNB has been trading near $900+, with occasional spikes above that level — a stark contrast to Bitcoin’s deep drawdowns.

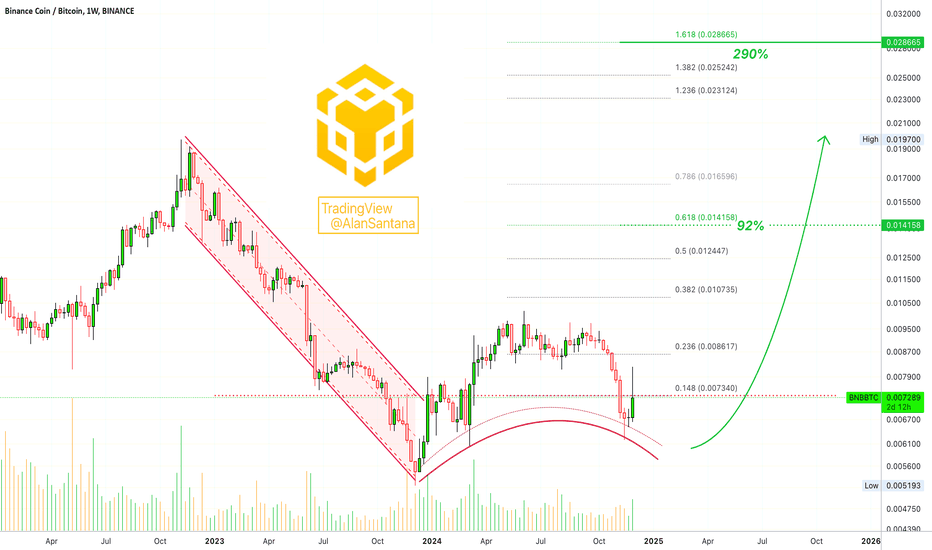

📌 BTC vs BNB Value Ratio

1 BTC ≈ 106.39 BNB, meaning a shift in dominance or volatility of one can have outsized effects on the others.

🌐 Fundamental Strength:

BNB has evolved far beyond a simple exchange token — it’s now a utility and infrastructure asset powering Binance Chain, wallets, payments, DeFi and smart contracts.

This broader role has helped BNB resist the worst of BTC’s sell‑off, keeping it in a relatively stable range compared to bearish markets for other assets.

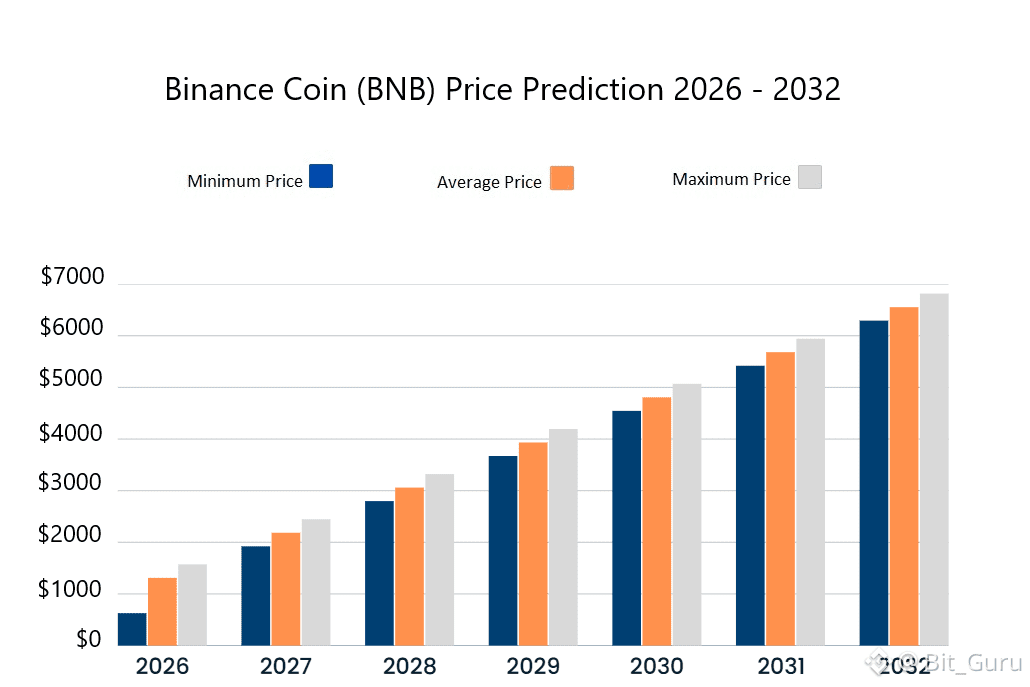

📈 BNB Price Predictions – Highlights

Analysts expect BNB’s price in 2026 to remain strong, often between $800 and $1,300+, depending on broader crypto conditions.

Forecast models predict possible upside above $1,400 in bullish scenarios.

💡 Why BNB can outperform in 2026

Strong utility demand from DeFi, smart contracts, and on‑chain activity.

Reduced token supply through burns creates scarcity dynamics.

📌 BTC vs BNB: What Traders Are Saying

🔥 Bitcoin HODLers:

“BTC is the digital gold of the 21st century — corrections are temporary.” Long‑term holders are staying put despite volatility.

🚀 BNB Bullish Traders:

“$BNB is cheaper, utility‑driven, and poised to rally once market sentiment improves.”

⚠️ Risk‑On Traders:

Expect volatility spikes across both assets — but see BNB as a leading meme‑season and utility play if altcoins resume major rallies.

#BinanceBitcoinSAFUFund #USRetailSalesMissForecast #BTCMiningDifficultyDrop #BNB_Market_Update