You know why you are always losing in their playground?

It's simple you are always following their flow not understanding it.

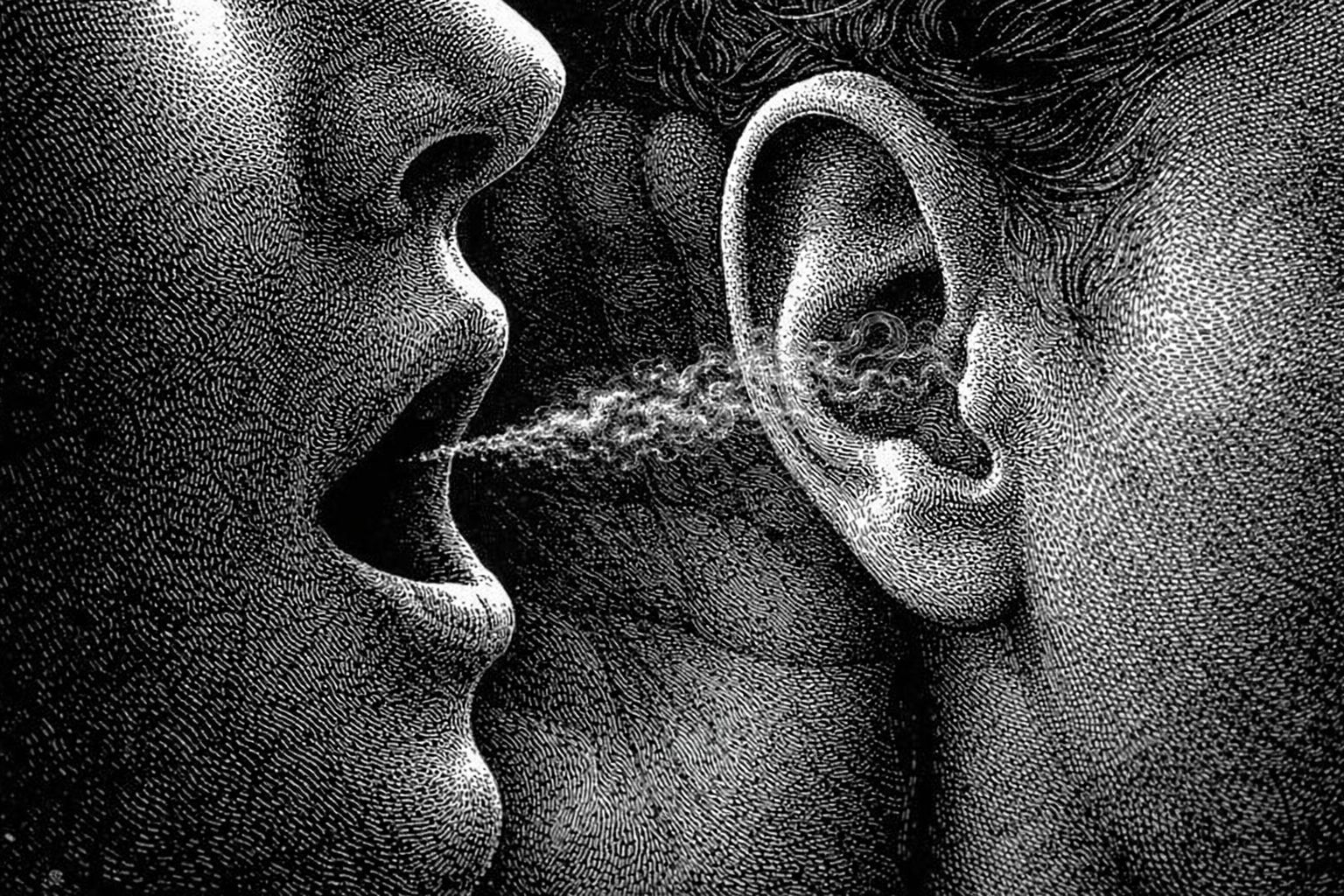

In today hyperconnected world markets move at the speed of information. News spreads in seconds. Trends go viral in minutes. Prices spike before most people even understand what’s happening. And in the middle of that chaos, one powerful emotion drives decision-making more than logic ever does:

FOMO — Fear of Missing Out.

I. WHAT IS FOMO?

FOMO stands for “Fear of Missing Out.”

It is the anxiety that others are gaining opportunities, profits, status, or advantages while you are being left behind.

In investing and financial markets, FOMO appears when:

A price suddenly surges.

Social media is flooded with success stories.

Influencers call something “the next big thing.”

Friends show screenshots of profits.

FOMO convinces you that if you don’t act immediately, you will miss a life-changing opportunity.

And the moment that fear hits you. Congratulations! you've officially become their exit liquidity. "Thanks for playing!"

II. The Psychology Behind FOMO

A ridiculous thing is humans are wired for social comparison.

Historically, being excluded from the group meant reduced chances of survival. Today, that instinct still exists but it manifests financially.

When you see others “winning,” your brain interprets it as:

A threat (I am falling behind).

A loss (I missed something important).

An urgent call to action (I need to enter now).

Under emotional pressure, rational analysis weakens. You stop asking critical questions:

What is the intrinsic value?

Who entered earlier?

Who benefits if I buy now?

What is my exit plan?

Instead, you chase momentum.

And when you chase momentum late you often become liquidity for those who entered early.

"This game is always changing. If you don’t change, you’ll always lose."

III. The Playground Is Designed by the Prepared

Markets are not random playgrounds.

They are structured environments where:

Early participants accumulate quietly.

Information advantages matter.

Narrative timing is strategic.

Liquidity cycles are predictable.

By the time something “feels obvious” it is usually no longer early.

The breakout you see is often the distribution phase for someone else.

This does not mean the system is unfair but it does mean it rewards preparation over reaction.

IV. Why You Keep Losing

"Relying on empty words for safety is the most expensive mistake."

You lose not because you lack intelligence.

You lose because you enter emotionally and You treat their words like "insurance".

FOMO creates three dangerous behaviors:

Late entry – Buying after significant price appreciation.

Overexposure – Allocating more capital than your risk tolerance allows.

Panic exit – Selling during corrections due to emotional exhaustion.

The cycle repeats:

Hype -> Entry -> Volatility -> Fear -> Loss -> Regret -> Repeat.

Until discipline replaces emotion.