The popular claim that human attention spans are shrinking to less than that of a goldfish is a convenient narrative, yet it does not withstand scrutiny, because the evidence suggests not that our capacity for focus has diminished, but that we have become increasingly selective about what deserves our time and focus.

This adaptability creates attention capital markets, where human focus becomes the new form of value instead of money.

It has been unfolding for years as the internet learned how to price human focus. Social platforms like TikTok make this visible, turning captured attention into revenue with industrial efficiency. Yet the window for engagement has compressed to mere seconds. As AI lowers content production costs, attention paradoxically becomes scarcer, driving its value higher.

From Cash Flow to Attention

Traditional finance recognises two core asset types:

Cash Flow Assets — equities and bonds generating investor returns through earnings

Supply & Demand Assets — commodities and currencies whose prices respond to market dynamics.

Crypto has added a third category of assets to markets: one valued on attention. These attention assets such as NFTs, creator coins, and memecoins act as cultural focal points, with prices rising and falling alongside public interest and narrative momentum.

The value of any such asset is determined by two forces: fundamentals and attention. In the case of memecoins, almost all of the value comes from attention, with little or no underlying fundamentals. They matter culturally but lack financial depth or structure.

A more mature form of Attention Asset would provide direct exposure to measurable human focus and reward traders for identifying when that focus is mispriced.

If markets could trade attention itself, they would begin to aggregate collective beliefs about what will capture human interest next.

Over time, this would turn fragmented opinions into shared forecasts about attention flows. Properly designed, Attention Assets could grow beyond memes and speculation and emerge as a credible new asset class built around one of the scarcest resources of the digital age.

Memecoins already offer a primitive version of this idea by enabling speculation on attention. Market capitalisation tends to follow engagement: when a token trends socially, its price usually follows. While insiders and market structure create distortions, the relationship between visibility and valuation generally holds.

As attention spans shrink, speculation accelerates. Early memecoin cycles lasted months or even years; Dog Wif Hat sustained relevance for six months. Other tokens, like Libra, reached billion-dollar valuations and collapsed within hours. This mirrors broader internet dynamics, where engagement windows continue to compress and capital rotates faster.

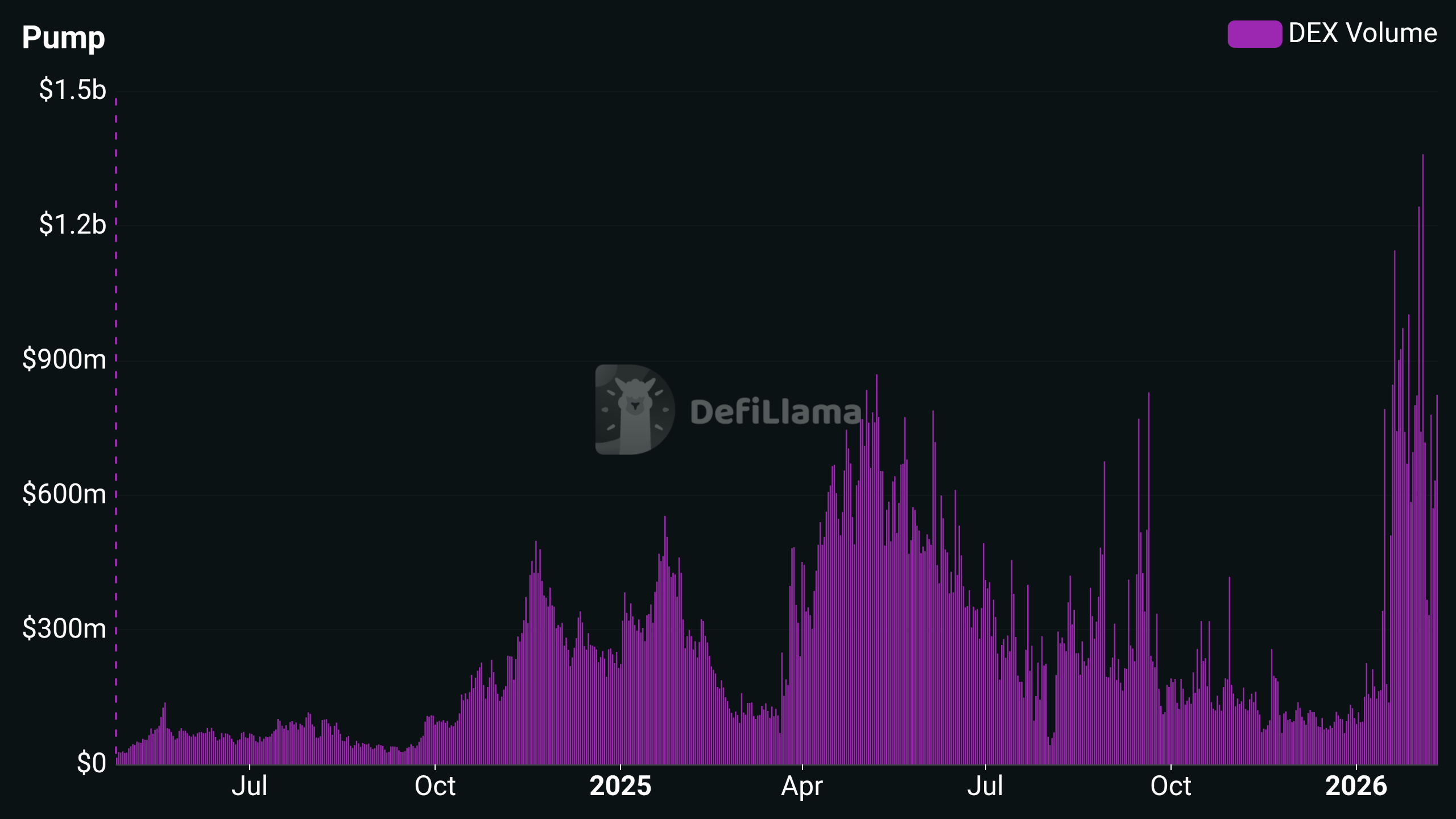

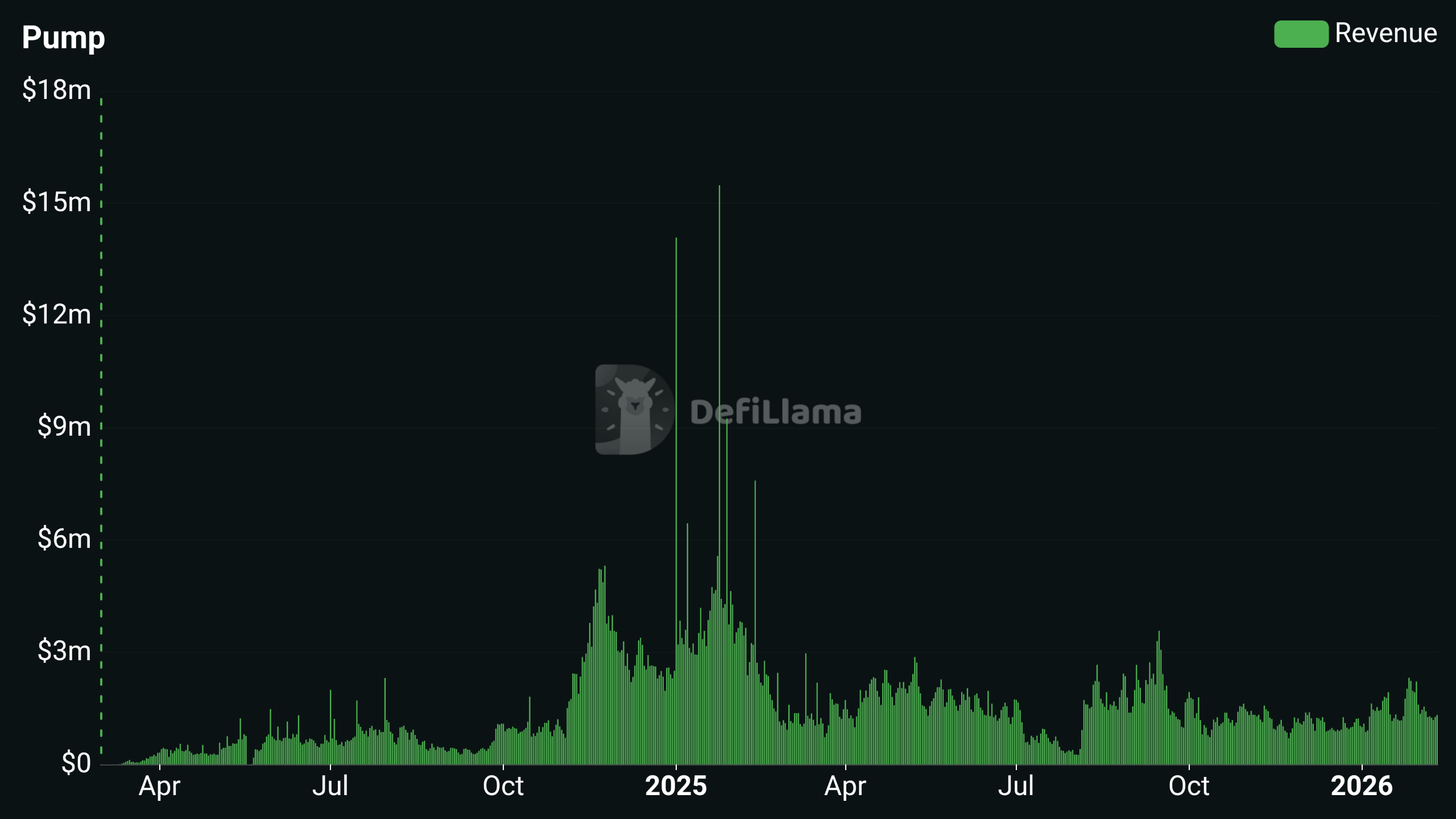

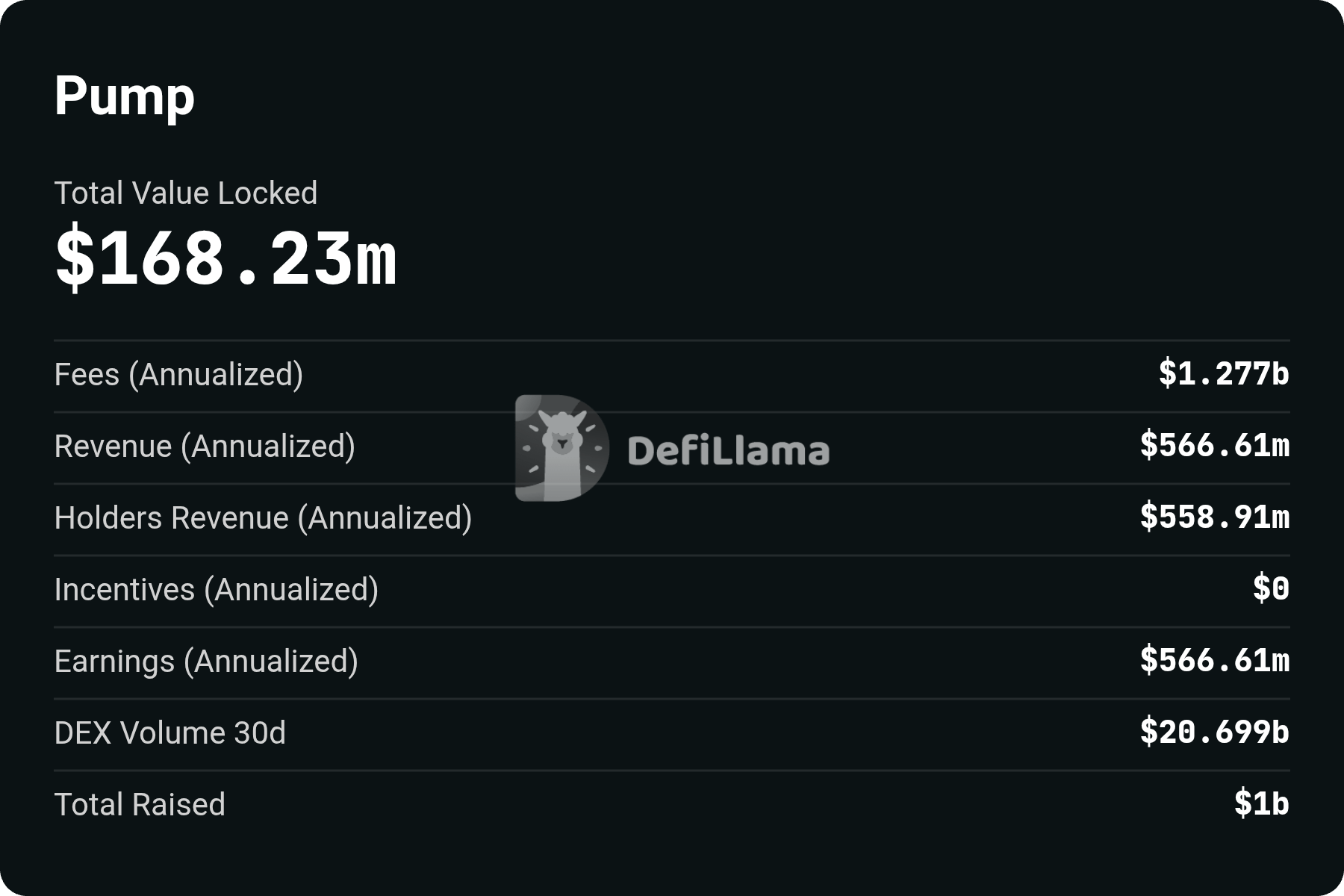

Token creation is approaching an inflection point.

Launch volumes rise steadily, resembling the early trajectory of platforms like YouTube as they moved from gradual to exponential content production.

These conditions favour speculative consumer applications built on attention assets. Platforms illustrate this convergence by linking token performance directly to viewer engagement, turning any stream into a tradable signal of interest and blending entertainment, speculation, and product design.

Because of this, competition between platforms increasingly revolves around capturing and sustaining attention. Growth becomes a contest for mental real estate rather than physical resources. Platforms no longer monetise only transactions; they monetise participation, time, and focus, treating attention with the seriousness once reserved for commodities.

________________

Capturing Attention is Not the Same as Keeping It

Sustained engagement depends on balancing activation, retention, and reactivation. Capturing attention is not the same as keeping it.

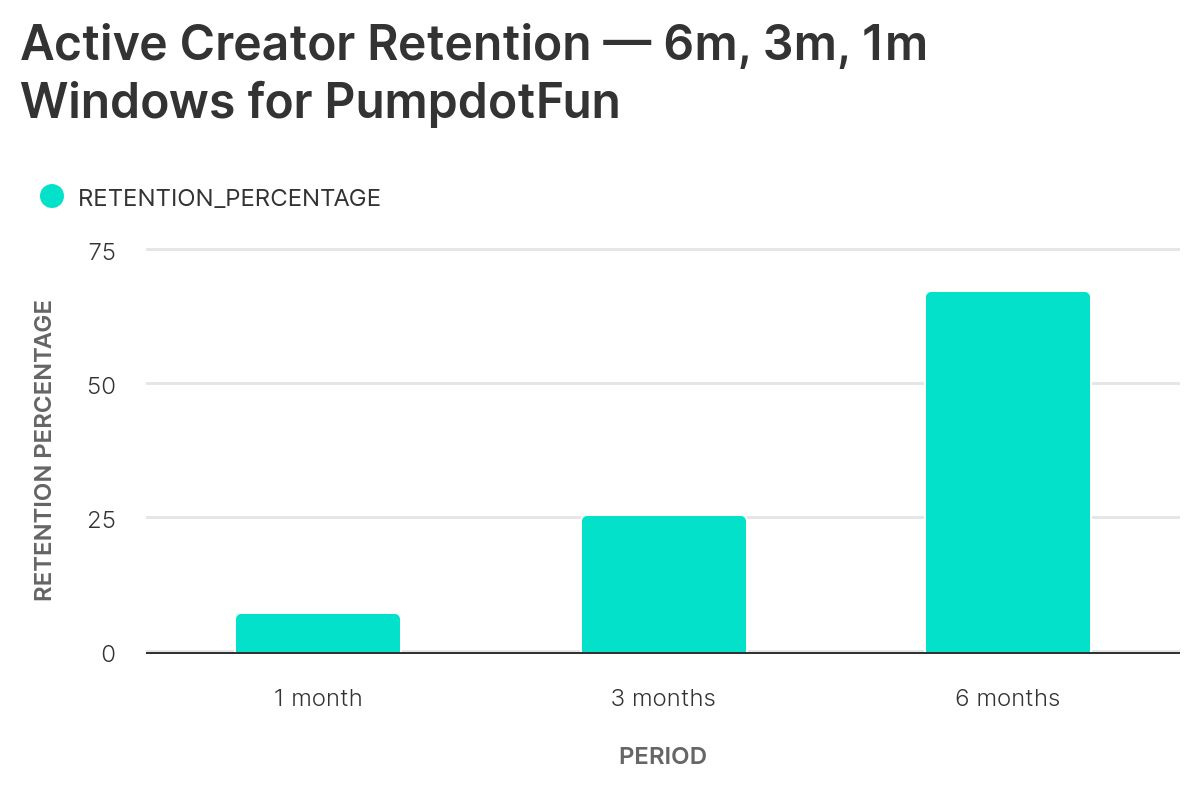

Retention data reveals this. A six-month creator retention rate of 67% appears healthy at first glance, yet closer inspection shows that many creators remain active only out of necessity and not conviction.

These creators repeatedly launch new tokens in search of a breakthrough. This behaviour becomes visible in graduation data, which has been declining over time.

At the same time, the number of tokens launched per creator reached record levels, peaking at 3.25. Token graduation marks the moment a token attracts community and liquidity. When graduation rates decline while creation accelerates, it suggests that buyers are becoming cautious as creators grow more aggressive.

Market contraction produces high-churn behaviour that resembles gambling more than sustainable product building.

Market sentiment ultimately governs these cycles. Periods of rising SOL prices and abundant liquidity align with spikes in token creation and speculation.

________________

Creator Capital Markets

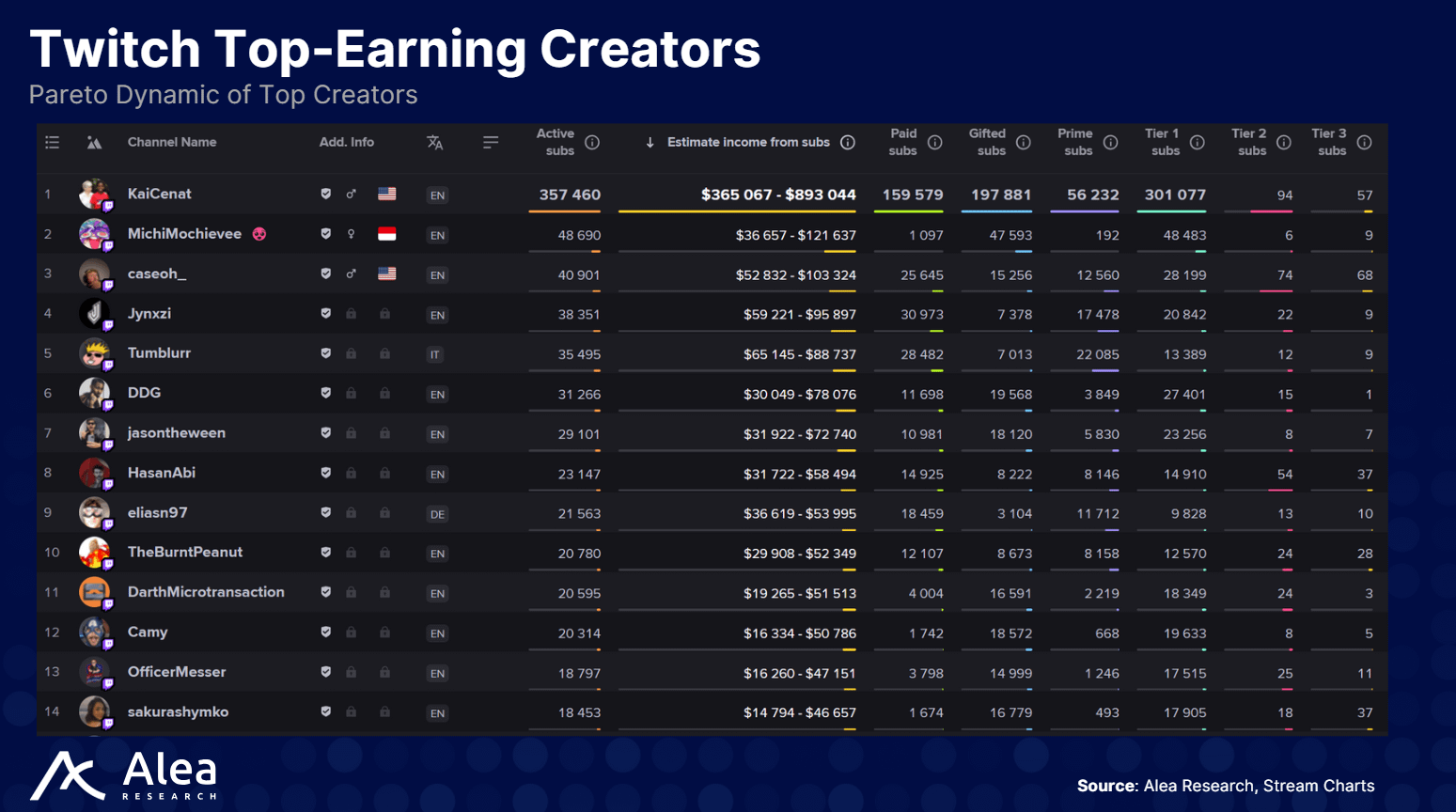

Creator Capital Markets turn influence into an asset. They give streamers and influencers tools to tokenize their audiences so engagement can be owned and traded.

Streamer tokens tie value to fan interaction, allowing supporters to buy into a creator’s growth rather than merely watch it.

Early results show strong demand. Some streamer tokens reached market caps in the tens of millions, while creator activity increased after launch. Daily earnings from these tokens now compete with platforms like Twitch and Kick, and the payout structure favours creators instead of middlemen.

For fans, this changes what participation means. Instead of being passive viewers, they become stakeholders who benefit when a creator grows. As popularity rises, token demand increases, rewarding people who supported the creator early.

Loyalty, attention, and financial incentives become part of the same loop, making it possible to invest in emerging creators before they become mainstream.

______________

Building Attention Oracles

Attention, as valuable as it is, is also difficult to measure accurately. To trade it as an asset, markets need attention oracles—tools that convert engagement data into tradable values for long and short positions.

Without reliable measurement, attention-based markets cannot function, and prices can be vulnerable to manipulation.

Social media metrics alone are insufficient.

They can be easily gamed, and raw follower counts, likes, or mentions do not scale linearly with actual engagement. Global fanbases are spread across multiple platforms, making it hard to capture attention comprehensively.

Goodhart’s Law highlights the risk: once attention becomes a target for trading, the very metrics designed to track it can be distorted.

______________

Prediction Markets as a Solution

One effective approach is to use binary prediction markets to build attention oracles.

Markets can be created around specific events or milestones, such as follower counts, awards, or other high-profile achievements, and then aggregated into an attention index.

Each market is weighted by liquidity, significance, and time to resolution to approximate the overall attention level.

Prediction markets also allow hedging. Traders can balance short positions on an attention index with long positions in its constituent markets, creating more stability and reducing arbitrage opportunities.

Design Considerations

Constructing a robust attention oracle requires balancing four factors:

Input relevance – Does the data accurately reflect attention?

Acquisition practicality – Can it be collected efficiently?

Manipulation resistance – Can the metric be gamed?

Aggregation methodology – How should diverse inputs be combined?

Prediction market approaches work best for high-profile subjects with active and liquid markets, such as celebrities or public figures.

However, attention often flows unpredictably: LeBron losing a championship might spike discussions about age or performance, increasing attention even as the index falls. Real-world attention is dynamic, and markets must account for these discrepancies.

Hybrid Approaches

Optimal attention oracles likely combine multiple sources. Social metrics, Google Trends search volumes, and LLM analysis of news and trending content can all feed into the index. Machine learning can filter spam or irrelevant signals, producing a cleaner measure of actual focus.

____________________

Real-World Platforms and Attention Capital Markets

Platforms like KaitoAI quantified quality CT attention, which led to the rise of InfoFi, where market forces determine where attention should flow instead of traditional social media algorithms.

Similarly, Wallchain is building for AttentionFi, and Noise.xyz will leverage Kaito’s mindshare data, allowing anyone to long or short attention trends.

_____________

The Everything Social App

This right here is why I am particularly have my eyes on @Binance Square Official

The next generation of social applications is converging streaming, feeds, tipping, and interactivity into a single onchain ecosystem.

Every interaction can connect to token flows and digital wallets, linking social identity with economic participation. In this landscape, attention is the ultimate scarce resource, creating defensible advantages for platforms that can capture and sustain it.

Mechanisms that once fuelled speculation now support circular creator economies, turning engagement into measurable value.

Attention capital markets are driving verticalisation, similar to how fintech unbundled banks. Consumer applications will fragment into specialised verticals—idea-focused launches, music platforms, and creator-specific systems.

While memecoins and attention assets persist, integration of focus into consumer products is deepening. AI and low-code development reduce production costs, making token-coupled app launches viable.

Attention → Emotion → Action → Retention

Applications can achieve viral growth, generate attention and revenue, and then gracefully exit, which is a repeatable and economically sustainable cycle.

__________

Investment and Market Implications

For investors, the rise of creator capital markets marks the next frontier after DeFi and tokenisation: the tokenisation of human capital. These markets allow both retail and institutional participants to gain exposure to cultural production, turning creators into investable assets.

If this model scales, it could expand across music, gaming, sports, and other creative industries, with tokens representing fractional ownership of influence, intellectual property, or digital revenue streams. Essentially, it is a high-beta bet on the financialization of creativity itself.

Risks remain, from regulatory scrutiny to speculative saturation, but the trajectory is clear: attention has emerged as an asset class, and infrastructure is developing to support its trading and monetisation.