I’ve been around long enough to recognize the rhythm of a new Layer 1. @Vanarchain

It starts the same way almost every time. Strong narrative. Confident roadmap. A promise to fix what the last generation got wrong. A token designed to power everything.

Then the market steps in. Reality stretches timelines. Users behave differently than expected. Liquidity moves faster than loyalty. And what looked inevitable starts looking fragile.

That’s the lens I use when I look at Vanar.

Not cynical. Not impressed. Just calibrated.

Because on paper, the direction makes sense. Instead of chasing DeFi mercenaries or governance maximalists, Vanar positions itself around entertainment, gaming, digital experiences — environments where normal people already spend time and money.

That instinct is correct. It probably always has been.

Most blockchains built infrastructure first and assumed users would magically follow. Vanar is attempting the reverse: start where attention already exists, then make blockchain invisible underneath it.

That’s smarter than it sounds.

Gaming, especially, is a natural bridge. Gamers already understand digital ownership. They buy skins. They trade items. They live in virtual economies that often rival small countries in size. The idea that blockchain could formalize and secure that ownership isn’t absurd — it’s intuitive.

But here’s where I get cautious.

Crypto gaming has scars.

We watched play-to-earn rise like a rocket and collapse just as quickly. The formula was simple: financial incentive first, gameplay second. It worked until it didn’t. Once token emissions outpaced demand, the illusion cracked. When prices fell, so did engagement. Turns out most “users” were really yield participants.

That lesson still matters.

So the real question for Vanar isn’t “Can gaming work on-chain?” It’s deeper than that.

Does the chain meaningfully improve the experience — or does it simply financialize it?

There’s a difference between enabling digital ownership and turning every interaction into a trade. One enhances immersion. The other replaces fun with spreadsheets.

If Vanar gets that balance right, it has a shot. If it leans too hard on token mechanics, history might repeat itself.

And that brings us to VANRY.

Like most Layer 1 tokens, VANRY carries a lot of responsibility. Security. Staking. Fees. Incentives. Governance. And, inevitably, speculation.

That’s a heavy load for a single asset.

Every L1 claims their token will be supported by organic demand from real usage. In practice, speculation often outruns utility. Early capital rotates. Emissions hit the market. Price volatility starts influencing behavior more than product design.

It doesn’t take a broken model to create pressure. Sometimes it’s just slightly misaligned incentives. Slightly too much inflation. Slightly too much reliance on market momentum.

And once speculation becomes the primary driver, ecosystems start building around price action instead of user experience.

That’s where chains quietly lose their long-term edge.

Vanar also casts a wide net: gaming, metaverse infrastructure, AI integrations, sustainability initiatives, brand partnerships. On one hand, that ambition signals long-term thinking. It suggests they’re not just building a niche chain for a single vertical.

On the other hand, execution bandwidth is finite.

Spreading across multiple narratives can either create synergy — or dilute focus. Building deep infrastructure for gaming alone is complex. Add AI, enterprise tooling, and consumer-facing integrations, and the surface area expands quickly.

The danger isn’t lack of vision. It’s diffusion of energy.

Meanwhile, the competitive landscape isn’t forgiving.

Ethereum still holds the deepest liquidity pools and developer gravity. Solana has leaned hard into performance and consumer applications. Modular chains and app-specific rollups are emerging constantly. Every month, a new ecosystem claims to be faster, cheaper, more scalable.

Network effects in crypto are brutal. Developers build where users are. Users go where utility exists. Liquidity follows attention. Once that loop forms, breaking into it is hard. Maintaining it is even harder.

So where could Vanar realistically carve space?

Its entertainment roots might actually matter more than people think.

Teams that have shipped consumer products tend to think differently from teams that have only shipped protocols. They obsess less over consensus purity and more over user flow. They understand that friction kills adoption faster than ideology.

Most users don’t care about TPS. They care if the app works.

They care if they feel anything while using it.

That’s where this whole thesis converges: invisibility.

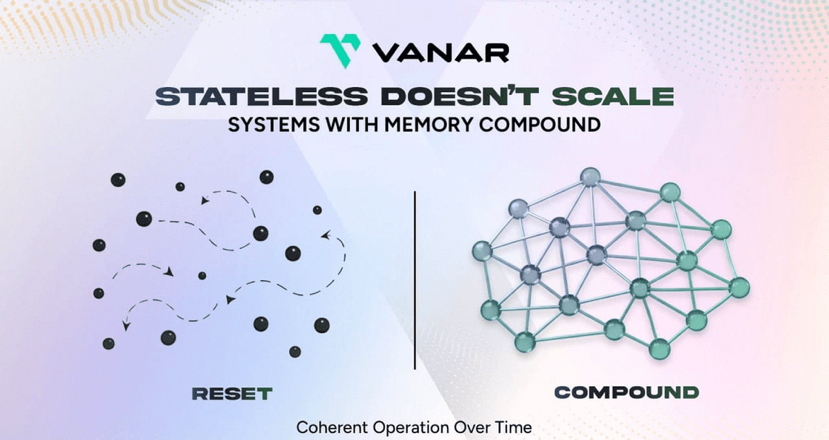

If Vanar succeeds in fading into the background — making blockchain a silent layer rather than a visible process — adoption becomes plausible. The more users feel wallets, gas, confirmations, and bridges, the more cognitive load builds. And cognitive load compounds.

But if the chain becomes something users don’t even think about, that’s powerful.

The irony is that the better infrastructure becomes, the less visible it is.

Another pressure point sits quietly in the background: regulation.

Once you start dealing with brands, entertainment companies, and mainstream consumers, the margin for ambiguity shrinks. Token classification, compliance frameworks, consumer protection — these aren’t optional debates anymore. They influence architectural decisions.

Chains that aim for mass consumer exposure don’t get to live in regulatory gray zones forever.

If Vanar wants to operate in that arena, operational readiness matters just as much as technical design.

Then there’s timing.

Bull markets can disguise weak retention. When prices rise, engagement looks organic. When momentum fades, the truth surfaces. We’ve seen entire ecosystems evaporate once incentives disappeared.

If Vanar can sustain engagement through different market cycles — not explosive growth, just steady usage — that’s meaningful. That would signal actual product-market fit rather than temporary enthusiasm.

The “next three billion users” phrase gets repeated so often it’s lost weight. But look at how other technologies achieved scale. Smartphones didn’t win because they were philosophically superior. They won because they made life easier immediately.

Crypto has to clear that same bar.

Not ideological improvement. Practical improvement.

Faster. Simpler. More seamless.

When I step back and strip away noise, what I see with Vanar is an attempt to root itself where attention already lives: gaming networks, digital experiences, virtual economies. That’s strategically sound. Starting with distribution beats starting with theory.

But I’ve learned not to confuse coherence with inevitability.

A clean architecture doesn’t guarantee retention. A native token doesn’t guarantee demand. An ecosystem doesn’t guarantee loyalty.

Layer 1 chains rarely collapse in dramatic fashion. More often, they drift. Builders slow down. Users rotate elsewhere. Liquidity finds a hotter narrative. And gradually, relevance fades.

The ones that survive usually do something subtle but important: they create reasons to stay that aren’t tied to token price.

If, two or three years from now, people are still playing games, buying digital assets, interacting with brands on Vanar without thinking about VANRY’s chart that’s when it becomes real.

If usage depends on incentives or momentum cycles, the road gets much harder.

None of this is a dismissal. It’s just pattern recognition.

The crowded Layer 1 market doesn’t reward potential. It rewards retention.

Vanar’s bet is that entertainment-driven distribution, combined with invisible infrastructure, can break through Layer 1 fatigue.

Maybe it can.

But the outcome won’t be decided by TPS metrics or roadmap threads.