I wasn’t thinking about decentralization maximalism. I was thinking about observability. When does a payment actually exist? When is it settled? When can I act on it?

That was the moment I began reassessing the modular narrative we’ve been sold, and why Plasma’s independent L1 architecture, counterintuitive as it seems, started to feel less like stubbornness and more like engineering discipline.

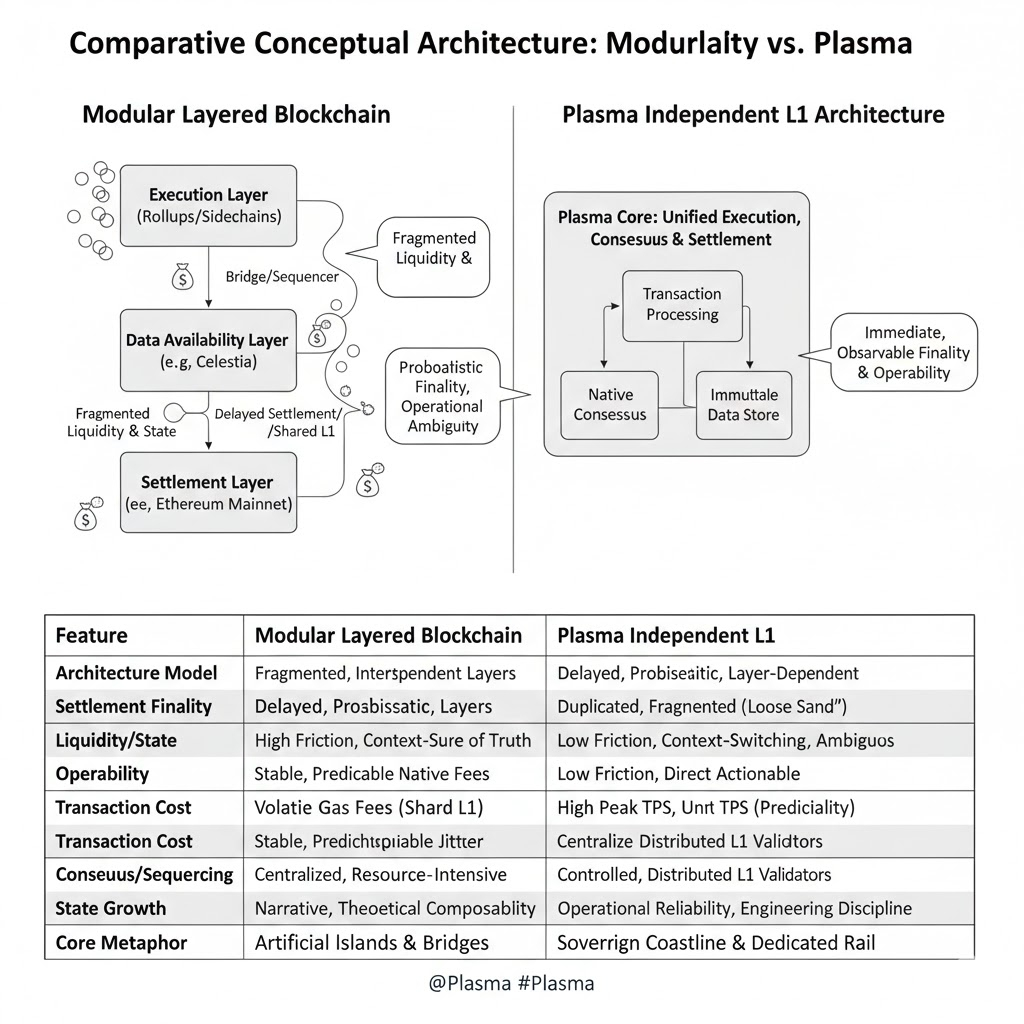

The modular thesis is elegant on slides: execution here, data availability there, settlement somewhere else. Rollups multiply. Liquidity fragments. Bridges promise seamless composability.

In practice, it feels like moving capital between artificial islands.

In reality, shifting assets between them is an exercise in managing delay, slippage, fee volatility, and interface risk. Liquidity isn’t unified; it’s duplicated. TVL numbers look impressive, but they often represent parallel pools rather than a coherent economic surface.

This fragmentation creates what I call loose sand liquidity. It looks abundant until pressure hits. Under stress, market volatility, NFT mints, memecoin frenzies, gas spikes, bridges slow down, sequencers prioritize, and your supposedly cheap transaction becomes a small negotiation with congestion.

Modular architecture promises scalability by specialization. But specialization introduces boundaries. And boundaries introduce friction.

When a payment must traverse three layers before reaching finality, settlement becomes probabilistic. Observable state diverges across wallets, explorers, and dashboards. From an operator’s standpoint, that is dangerous.

Because payments are not just about settlement.

They are about operability.

The more I built on L2s, the more I realized how dependent we are on sequencers behaving well.

Most rollups today rely on centralized sequencers. They batch transactions, order them, and post data to Ethereum. If the sequencer stalls, the chain stalls. If it censors, you wait. If it reorders, you absorb the MEV consequences.

Yes, the ultimate settlement anchor is Ethereum. But that’s part of the problem.

You’re not really final until Ethereum says you are. And Ethereum’s block space is not yours. It’s shared across hundreds of rollups and the base layer itself.

In practical terms, that means finality is delayed and indirect. You operate in a shadow state until the base layer confirms.

From a developer’s perspective, this creates ambiguity. When can I trigger downstream logic? When can I release goods? When can I consider a payment irreversible?

I don’t want layered assurances. I want a single, observable event.

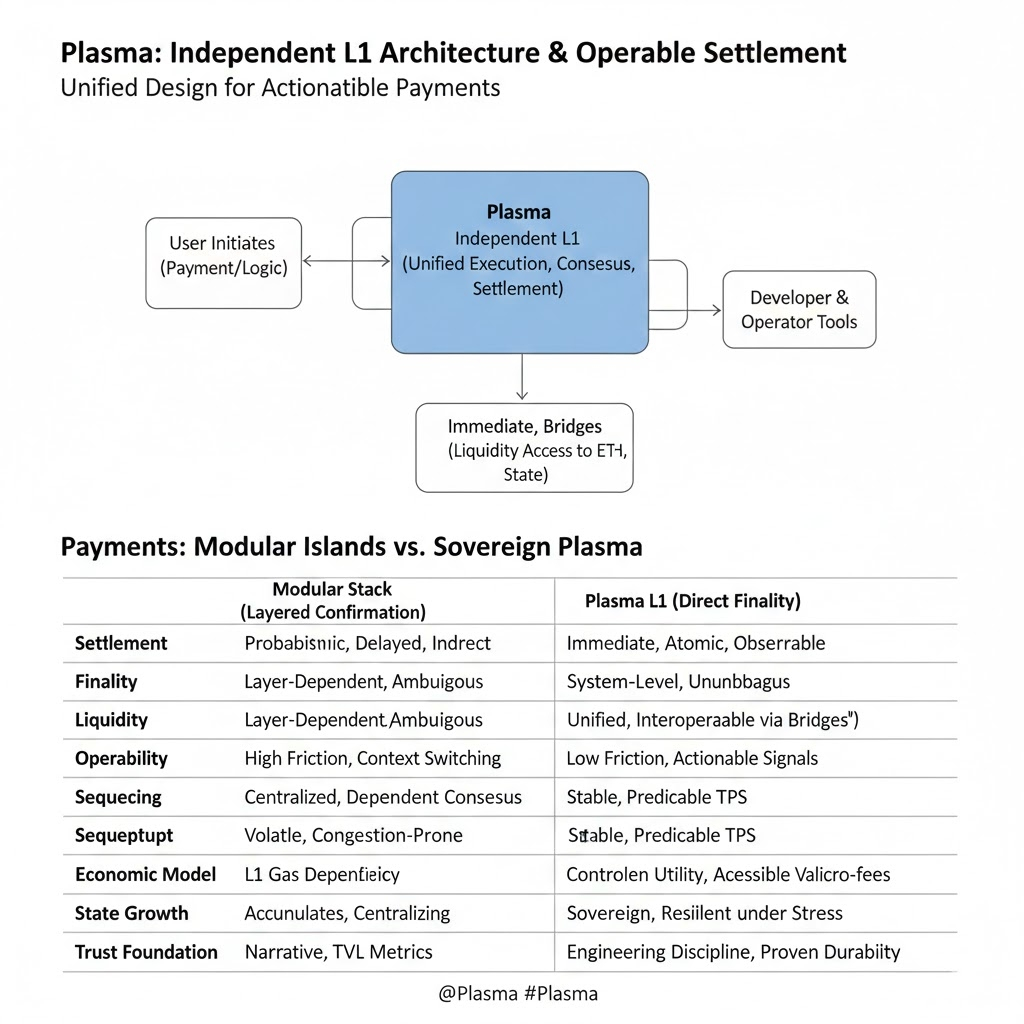

That’s where Plasma’s independent L1 architecture starts to look less naive and more intentional.

I spun up a Plasma testnet node partly out of skepticism.

Independent L1s feel politically incorrect in today’s Ethereum centric narrative. If you’re not an L2, you’re dismissed as irrelevant. If you’re not EVM-compatible, you’re considered friction.

But running the node changed something.

There was no sequencer above me. No external settlement dependency. No waiting for Ethereum to confirm what had already been confirmed locally.

When a transaction was included in a Plasma block and finalized, that was it.

No secondary layer of reassurance.

The most immediate sensation was something I hadn’t felt in a while: wholeness.

The chain’s execution, consensus, and settlement were unified. State updates were atomic within a single system boundary. When I observed a payment on-chain, it wasn’t waiting to be revalidated elsewhere.

For payments, that matters.

Because payments are binary events. They either happened or they didn’t.

Atomicity is often discussed in the context of smart contract composability. But in payment systems, atomicity is existential.

Plasma’s architecture restores something fundamental: transaction confirmation equals system-level finality.

There is no external settlement layer that might retroactively alter state.

That simplification reduces cognitive overhead. From an operator’s perspective, it eliminates cross-layer race conditions. It means downstream systems can react immediately to confirmed events.

Settlement becomes observable and actionable.

That shiftfrom layered confirmation to direct finalityis what makes payments operable again.

Let’s talk throughput.

Chains love marketing extreme TPS numbers. Hundreds of thousands. Millions.

I’ve worked through enough network stress tests to know that headline TPS is often achieved under unrealistic conditions. Sustained throughput under adversarial or high concurrency scenarios is a different story.

Looking at Plasma’s on-chain metrics during stress phases, what stood out wasn’t explosive TPS. It was block time stability.

Block time variance remained tight. Jitter was minimal. The consensus layer seemed tuned not for spectacle but for predictability.

Predictability is underrated.

In financial infrastructure, consistent latency beats peak throughput. You don’t need 200,000 TPS for retail payments. You need thousands of stable TPS with low variance and reliable confirmation windows.

That’s the difference between a racetrack and a commuter rail system.

Solana, for example, demonstrates incredible performance under ideal conditions, but downtime incidents have exposed the fragility of pushing throughput to the edge of stability. Plasma’s approach feels more conservative.

And in infrastructure, conservative is often synonymous with survivable.

The economic model is where the contrast with L2s becomes sharp.

On Ethereum aligned L2s, gas is paid in ETH. L2 tokens often serve governance roles. The more successful the rollup, the more it indirectly strengthens ETH rather than its own token economy.

That means network usage directly translates into token demand. Even simple transfers consume the native asset. Economic activity reinforces the security model.

I executed a moderately complex contract call on testnet. The fee was negligible, not because it was subsidized, but because the network design made it efficient.

For micro payments, this matters.

You cannot build a viable $5 transaction system where users routinely pay $1 - $2 in gas. That model only works for high-value DeFi.

Plasma’s fee model makes small transactions economically viable. It’s not about beating Ethereum at DeFi. It’s about enabling use cases Ethereum structurally struggles with.

One of the less glamorous but critical issues in blockchain infrastructure is state growth.

Older chains accumulate data relentlessly. Running a full node becomes expensive. Hardware requirements creep upward. Decentralization quietly erodes.

This is not just a storage optimization.

It’s a decentralization safeguard.

If retail participants can run nodes without enterprise hardware, censorship resistance becomes real. Compare that to many L2s, where centralized sequencers remain single points of operational control.

Sovereignty is not a slogan. It’s a function of who can participate in validation.

Being an independent L1 does not mean isolation.

Plasma’s cross chain bridges to ecosystems like Ethereum and BSC provide liquidity access without architectural dependency.

This distinction is subtle but important.

An L2 inherits security,and congestion, from its base layer. An independent L1 can interface externally while retaining internal autonomy.

It’s like building a dedicated rail line that connects to a city hub but does not depend on the city’s track availability to function.

When Ethereum congests, Plasma does not stall. When gas spikes on mainnet, Plasma continues operating within its own economic domain.

That separation enhances survivability.

Plasma’s wallet UX needs work. Coming from If Plasma fails to expand its tooling ecosystem, it risks becoming a technically elegant but economically irrelevant chain.

Engineering discipline alone does not guarantee adoption.

What ultimately convinced me to keep watching Plasma wasn’t marketing. It was GitHub.

The commit frequency on core protocol components is high. P2P layer optimizations are incremental and obsessive. Latency improvements are measured in milliseconds, not headlines.

In a market obsessed with narratives, AI tokens, memecoins, modular hype, this kind of quiet protocol engineering feels almost anachronistic.

It reminds me of early Bitcoin core development: slow, careful, focused on robustness.

Most chains today compete at the application layer. Plasma competes at the network layer.

That’s not glamorous.

But when extreme market conditions hit, when gas explodes, when sequencers stall, when bridges clog, the chain that survives is the one that optimized the boring parts.

The deeper realization for me was this:

Settlement is not enough.

A system can technically settle transactions and still be operationally unusable for payments.

Operability requires immediate and observable finality, predictable latency, stable fees, independent consensus, and accessible validation.

Plasma’s architecture restores alignment between settlement and operability.

When a payment confirms, it exists. It can trigger downstream logic immediately. It does not wait for upstream validation elsewhere.

That observability transforms payments from probabilistic events into actionable signals.

I am not blind to risk.

Ecosystem growth is uncertain. Developer migration is hard. Network effects are brutal.

But infrastructure durability is underpriced in hype cycles.

When markets chase narratives, they ignore survivability. When congestion returns, and it always does, the value of independent, stable, low-cost infrastructure becomes obvious.

Plasma is not competing for memecoin volume.

It is positioning itself as a settlement layer that remains operable under stress.

If it fixes wallet UX, strengthens developer tooling, and attracts a few meaningful DeFi primitives, it could transition from a technically interesting chain to a structurally important one.

In the meantime, I see it as infrastructure optionality.

In a world of modular islands built on shared block space, Plasma feels like a sovereign coastline, less crowded, less fashionable, but structurally intact.

And after too many late nights watching pending spin across fragmented layers, that kind of integrity feels less like ideology and more like necessity. polish, the native tooling feels dated. Developer tooling is thinner. The DApp ecosystem is sparse.

Migration cost is non trivial. Architectural divergence means developers cannot simply copy paste Solidity contracts.

That friction slows adoption.

If Plasma fails to expand its tooling ecosystem, it risks becoming a technically elegant but economically irrelevant chain.

Engineering discipline alone does not guarantee adoption.

What ultimately convinced me to keep watching Plasma wasn’t marketing. It was GitHub.

The commit frequency on core protocol components is high. P2P layer optimizations are incremental and obsessive. Latency improvements are measured in milliseconds, not headlines.

In a market obsessed with narratives, AI tokens, memecoins, modular hype, this kind of quiet protocol engineering feels almost anachronistic.

It reminds me of early Bitcoin core development: slow, careful, focused on robustness.

Most chains today compete at the application layer. Plasma competes at the network layer.

That’s not glamorous.

But when extreme market conditions hit, when gas explodes, when sequencers stall, when bridges clog, the chain that survives is the one that optimized the boring parts.

The deeper realization for me was this:

Settlement is not enough.

A system can technically settle transactions and still be operationally unusable for payments.

Operability requires immediate and observable finality, predictable latency, stable fees, independent consensus, and accessible validation.

Plasma’s architecture restores alignment between settlement and operability.

When a payment confirms, it exists. It can trigger downstream logic immediately. It does not wait for upstream validation elsewhere.

That observability transforms payments from probabilistic events into actionable signals.

I am not blind to risk.

Ecosystem growth is uncertain. Developer migration is hard. Network effects are brutal.

But infrastructure durability is underpriced in hype cycles.

When markets chase narratives, they ignore survivability. When congestion returns, and it always does, the value of independent, stable, low-cost infrastructure becomes obvious.

Plasma is not competing for memecoin volume.

It is positioning itself as a settlement layer that remains operable under stress.

If it fixes wallet UX, strengthens developer tooling, and attracts a few meaningful DeFi primitives, it could transition from a technically interesting chain to a structurally important one.

In the meantime, I see it as infrastructure optionality.

In a world of modular islands built on shared block space, Plasma feels like a sovereign coastline, less crowded, less fashionable, but structurally intact.

And after too many late nights watching pending spin across fragmented layers, that kind of integrity feels less like ideology and more like necessity.