$VANRY in 2026: From Narrative to Infrastructure

The biggest shift around Vanar isn’t noise it’s clarity. What once sounded like another Layer-1 narrative is now structured like a real stack with defined roles, economic logic, and a visible path from vision to product.

That difference matters in a market that has become far more selective.

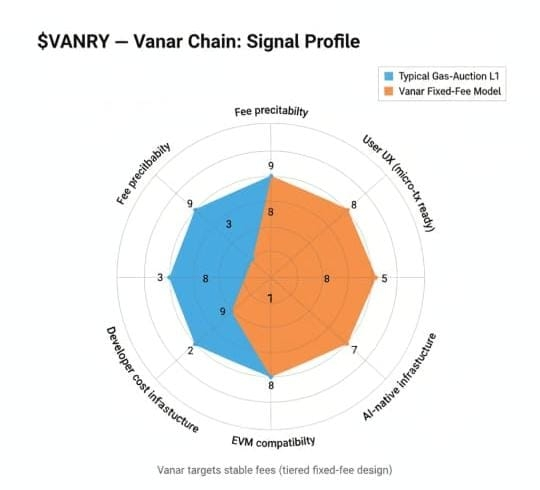

Predictable, Not Just Cheap

Most chains advertise low fees. Very few focus on cost predictability.

Vanar is engineering toward fiat-denominated gas stabilization through a calibrated control mechanism designed to reduce volatility at the execution layer. Instead of letting congestion or token swings dictate operational costs, the network aims to maintain economic consistency.

Why that matters:

AI agents can’t operate efficiently with unstable execution costs

Enterprises require budgeting certainty

Long-term applications depend on reliability, not temporary cheap fees

Cheap is temporary.

Predictable is sustainable.

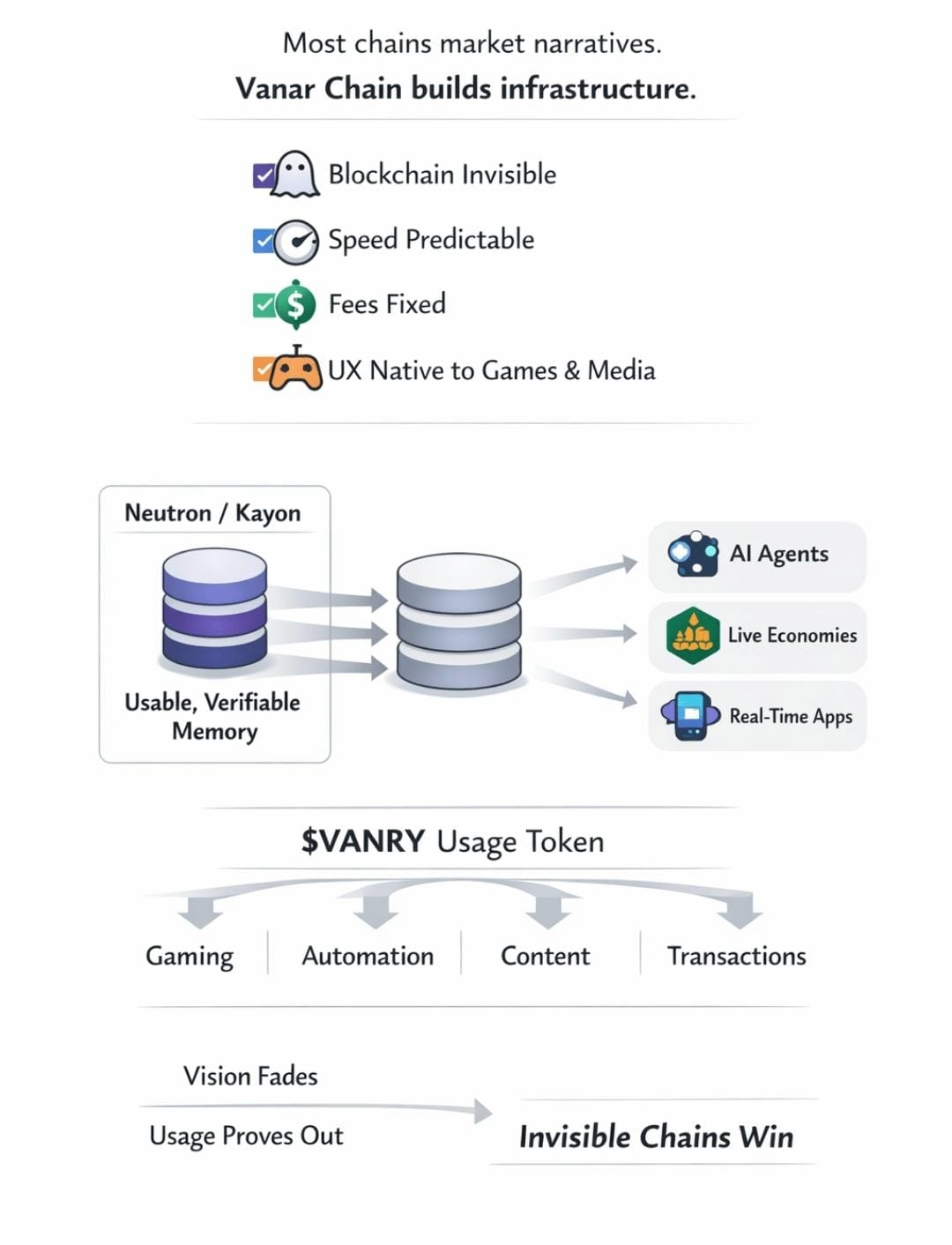

A Stack, Not a Buzzword

Vanar’s messaging now feels structured:

Base Layer: Fast, low-cost activity execution

Neutron: Semantic compression layer making heavy data usable on-chain

Kayon: Reasoning layer validating and acting on structured information

EVM Compatibility: Builder accessibility

When a blockchain explains itself like a stack, you can trace the line from architecture to product without guessing. That’s when it starts to feel like infrastructure instead of speculation.

Real-World Alignment

The 2026 market isn’t chasing hype cycles. It’s watching for networks that can support:

Payments

Tokenized real-world assets

Compliance-aware automation

AI agents executing reliable workflows

Vanar’s positioning suddenly aligns with that shift.

Add to that its consumer footprint through Virtua Metaverse and the VGN games network, and the “next 3 billion users” narrative carries more weight. It’s not starting from zero — it’s building on existing verticals.

The Role of $VANRY

This is where many L1s fail. Tokens often become little more than gas.

Vanar positions $VANRY as:

Execution fuel

Staking and validator coordination

Governance participation

Economic balancing layer of the ecosystem

As adoption scales, VANRY becomes a coordination asset — not just a transaction medium.

Why Now?

Nothing dramatic changed overnight. The difference is timing.

The market matured.

The messaging sharpened.

The stack became clearer.

If Vanar continues delivering integrations, live AI workflows, and seamless onboarding where the chain becomes invisible behind the product, the narrative shift could turn into durable momentum.

2026 rewards infrastructure that behaves predictably.

Vanar is positioning itself accordingly.