There is a moment in the life of every financial technology when the debate about possibility ends and the debate about reliability begins. Early on, participants argue about whether the system works at all. Later, they assume it works and start asking whether it can support routine life.

Stablecoins appear to be crossing that boundary.

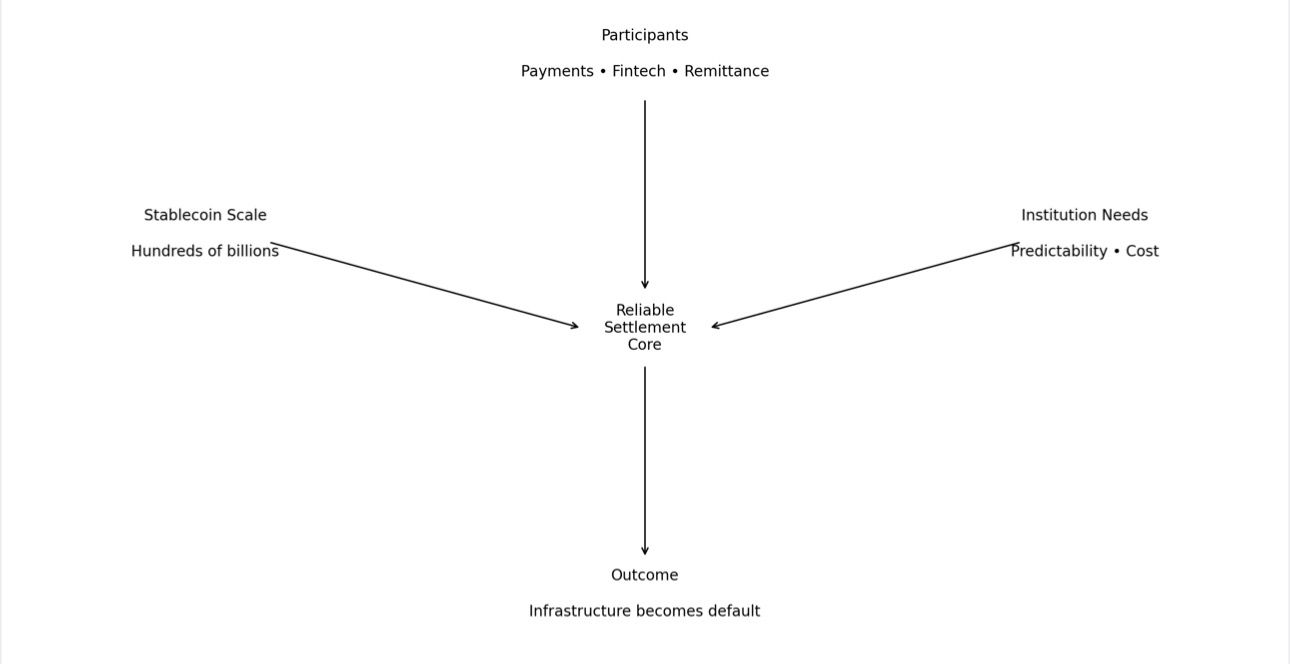

When outstanding supply measures in the hundreds of billions and monthly transfer value prints in the trillions, describing the phenomenon as experimental becomes difficult. The instruments are already embedded in payroll cycles, trading infrastructure, remittance corridors, treasury operations and informal savings behavior. They are not future products. They are current utilities.

At that point, attention shifts.

The industry stops asking who can create digital dollars.

It starts asking where those dollars can live safely.

Issuance is visible. Settlement is decisive.

Anyone can mint representations of value, but clearing them in ways that institutions trust is far harder. Payments businesses, fintech platforms, and cross-border operators do not measure success in viral adoption curves. They measure it in failure rates, reconciliation time, legal clarity and cost stability.

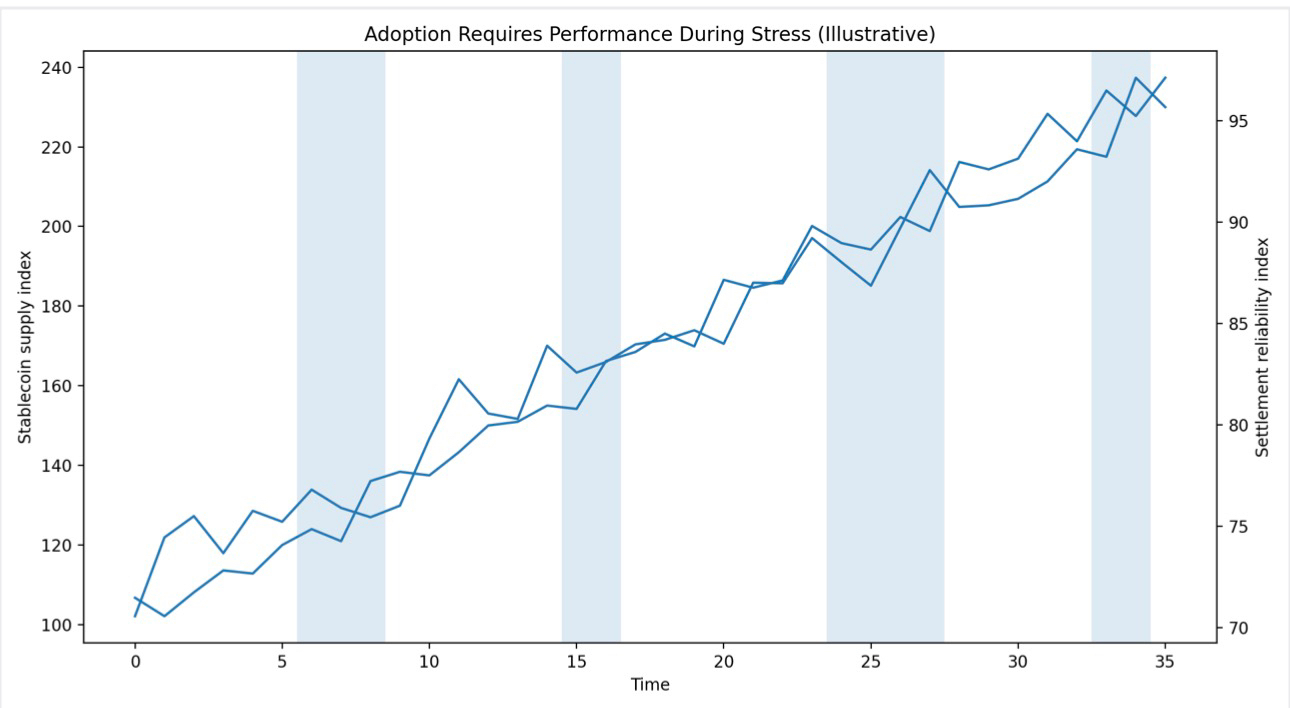

If infrastructure behaves unpredictably during volatility, integration becomes too risky. Technical merit is irrelevant if operations teams cannot depend on outcomes.

Reliability is not glamorous, but it is mandatory.

This is why the conversation around @Plasma deserves attention. The emphasis appears less focused on spectacle and more on normalization. The ambition is not to dazzle observers with innovation, but to make movement feel routine.

Routine is powerful.

When transactions clear without surprise, participants begin building assumptions around that behavior. Treasury departments model liquidity differently. Payment providers widen usage. Developers reduce protective buffers. Over time, confidence compounds.

Infrastructure graduates from curiosity to expectation.

At scale, predictability outweighs novelty. Businesses prefer environments that behave tomorrow the way they behaved yesterday. Sudden shifts in cost or confirmation logic introduce operational stress that most companies are unwilling to absorb.

In traditional finance, entire industries exist to reduce these uncertainties. Blockchain systems aspiring to host serious flows must achieve similar discipline.

Plasma seems oriented toward that requirement.

Another dimension is fragmentation. Stablecoin liquidity spread across incompatible routes creates inefficiency. Transfers slow. Arbitrage widens. Accounting becomes messy. Enterprises hesitate to rely on systems that complicate internal processes.

What institutions want instead is cohesion. They want assets that maintain identity while settlement inherits strong guarantees. They want rails that support scale without requiring constant supervision.

They want boring.

Boring infrastructure is underrated because it rarely trends on social media. Yet it is precisely what large operators prefer. Drama may entertain markets, but it terrifies compliance departments.

If digital dollars are going to integrate into real economies, their home environments must respect that preference.

Plasma’s trajectory suggests an understanding that the next wave of adoption may not arrive from enthusiasts but from organisations that demand invisibility. The blockchain should work, but it should not intrude. Complexity should exist, but it should not surface unnecessarily.

Users should feel outcomes, not mechanics.

This mindset changes how success is measured. Instead of celebrating peak throughput, attention moves to sustained performance. Instead of maximizing feature announcements, teams refine guarantees. Instead of chasing expansion for optics, they reinforce stability.

Progress becomes quieter.

Quiet progress is often mistaken for stagnation. In reality, it can indicate maturation. Systems that intend to host financial infrastructure must evolve cautiously. They cannot rewrite assumptions every quarter. Trust would evaporate.

Durability requires patience.

If stablecoins are settling into everyday use, then platforms capable of supporting that normality will gradually become default choices. Businesses gravitate toward what works repeatedly. Over time, habit replaces evaluation.

Once habit forms, switching costs rise.

This is the long game. Not explosive conquest, but incremental embedding. Each successful settlement reinforces the next. Each uneventful day strengthens credibility.

Momentum builds without announcement.

Of course, competition remains intense. Multiple networks are pursuing similar ambitions. Regulatory landscapes will shape outcomes. Skepticism toward new rails is understandable and healthy.

But readiness still matters.

When demand appears, it will not wait for infrastructure to catch up.

What makes @Plasma notable is its apparent willingness to prepare before applause arrives. It is focusing on making digital money movement predictable enough that organizations can treat it as normal business activity.

If that goal is achieved, recognition will follow naturally.

In the end, the winners of the next decade may not be the loudest innovators. They may be the systems that become so dependable that nobody thinks about alternatives.

Reliability becomes invisible.

Invisible becomes default.

And default becomes power.