📈 Why ALLO/ALLOUSDT Might Gain After an Unlock

✅ 1. The Unlock Size Is Relatively Small

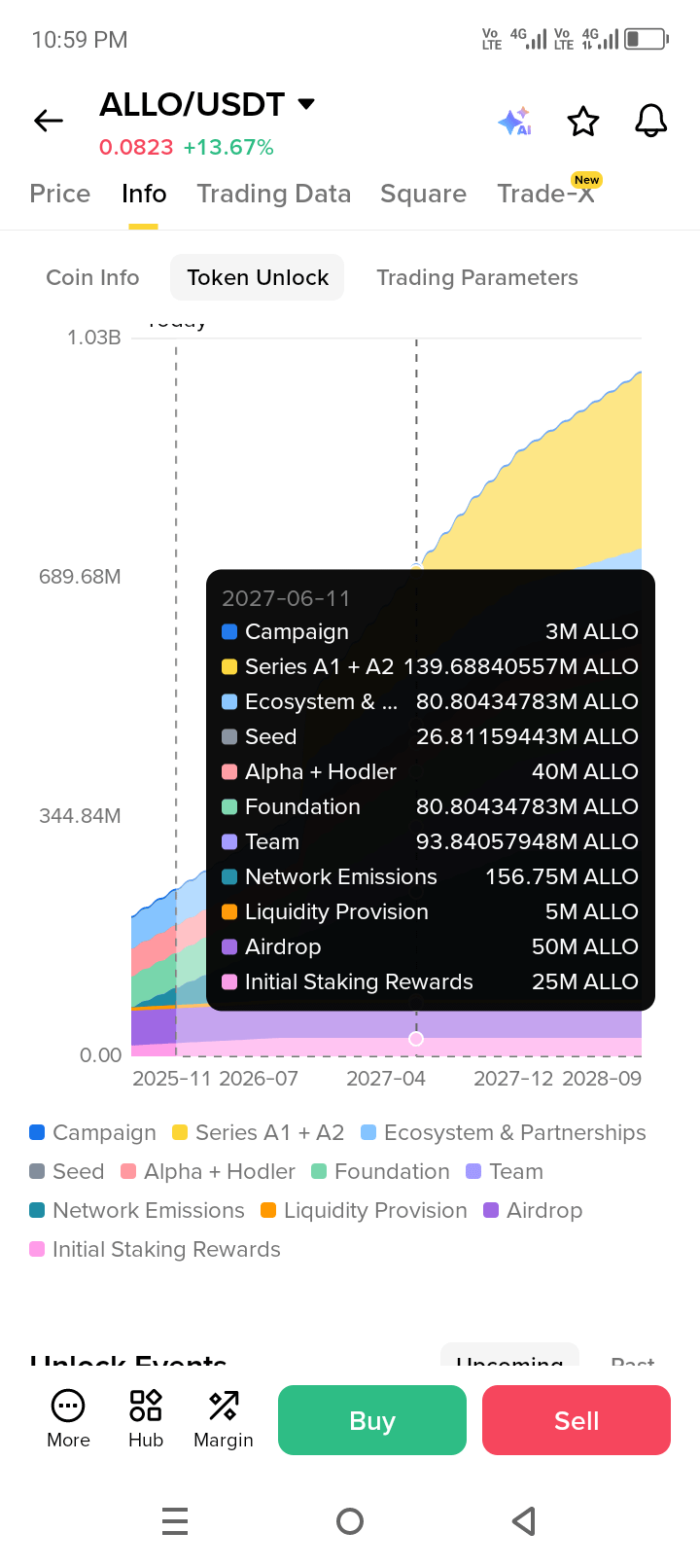

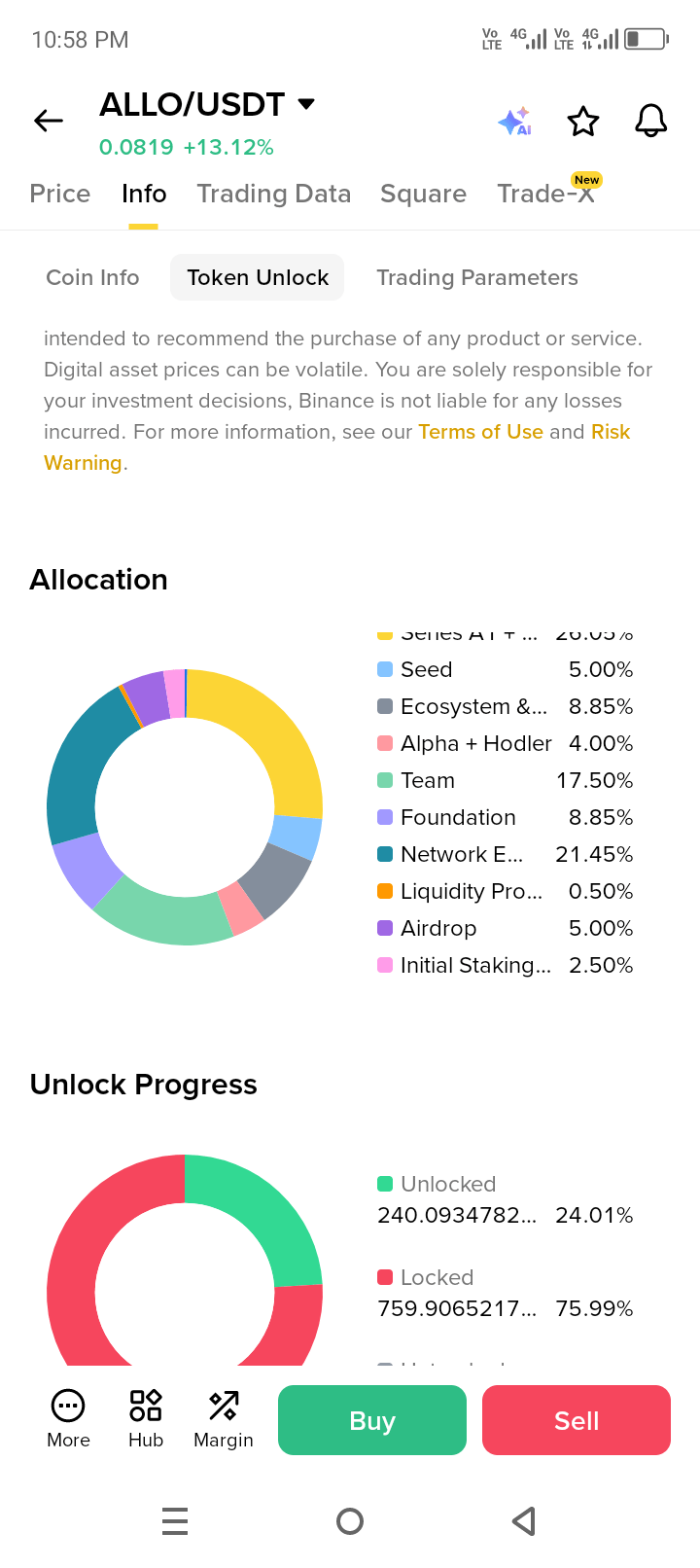

According to recent price trackers, the February 10 and March 11 unlocks for ALLO are about 3.69 million tokens each — roughly 0.37% of total supply (not huge relative to circulating supply). That means the immediate selling pressure may be limited, especially if holders don’t rush to sell after unlocking.

Smaller unlocks = less sudden supply shock → less price pressure.

✅ 2. Price Can Bounce Back After Initial Selling

Many tokens dip right around unlocks because:

early holders sell

traders anticipate dilution

…but after that volatility settles, buyers often step in if: ✔ investors think the token is undervalued

✔ there’s renewed interest or news

✔ other markets are rallying

This can create a post-unlock bounce or momentum growth, which is what you’re seeing.

✅ 3. Exchange Activity and Futures / Bots

ALLOUSDT is supported on multiple futures platforms and trading bots operate on this pair. When bots detect: 📌 price stabilization

📌 rising volume

→ they may push trend-following orders that make price climb short term.

So even around unlocks, bot-driven trading can add momentum in both directions.

📊 What It Means for Different Market Participants

👨💼 Traders (Spot & Futures)

👉 Price moves may not only reflect tokenomics but also short-term demand:

traders entrying lower after a potential dip

short-term momentum traders pushing price back up

This can create choppy but upward short-term moves even during unlock periods.

🤖 Bots (Arbitrage + Trend Bots)

Bots don’t care about emotions — they react to momentum, volume, and technical triggers.

When price stabilizes or starts rising after a brief dip, bots can:

enter long positions

chase breakouts

create cascading buys

This produces additional short-term momentum.

📈 Copy Traders

If many retail copy traders follow a strategy that: ✔ buys after dips or

✔ enters breakout signals

…then a shared entry point can amplify upward movement post-unlock.

🔗 On-Chain Traders

Unlocks increase supply, but if holders:

keep tokens instead of selling,

send tokens to liquidity/staking,

then on-chain circulation may not spike, and price pressure eases. Data for ALLO suggests unlock amounts are pretty limited compared to total supply, which supports this.

🪙 Staking / Earn

If ALLO holders stake or lock their tokens after unlocking (instead of selling), this keeps supply tight and supports upward price moves.

🧠 Key Takeaway

Despite token unlocks typically being bearish:

ALLO can still gain momentum after an unlock if: ✔ the unlock amount is small relative to the circulating supply

✔ selling pressure is limited

✔ buyers step in after initial volatility

✔ bots and traders drive short-term momentum

In other words, unlock events don’t always lead to straight downward prices — they can trigger volatility and then a rebound. #Write2Earn! $ALLO