@Plasma I was standing by the office printer at 8:17 p.m., listening to the rollers squeal as a settlement report crawled out one page at a time. The totals were fine, but the footnotes were the usual fog: cutoffs, intermediaries, and “pending” statuses that never say who is actually holding risk. On my phone, a stablecoin transfer I’d sent earlier had already cleared, with a timestamp and a hash that didn’t care about banking hours. I care because I’m increasingly asked to explain what “final” really means. So where does the risk actually sit?

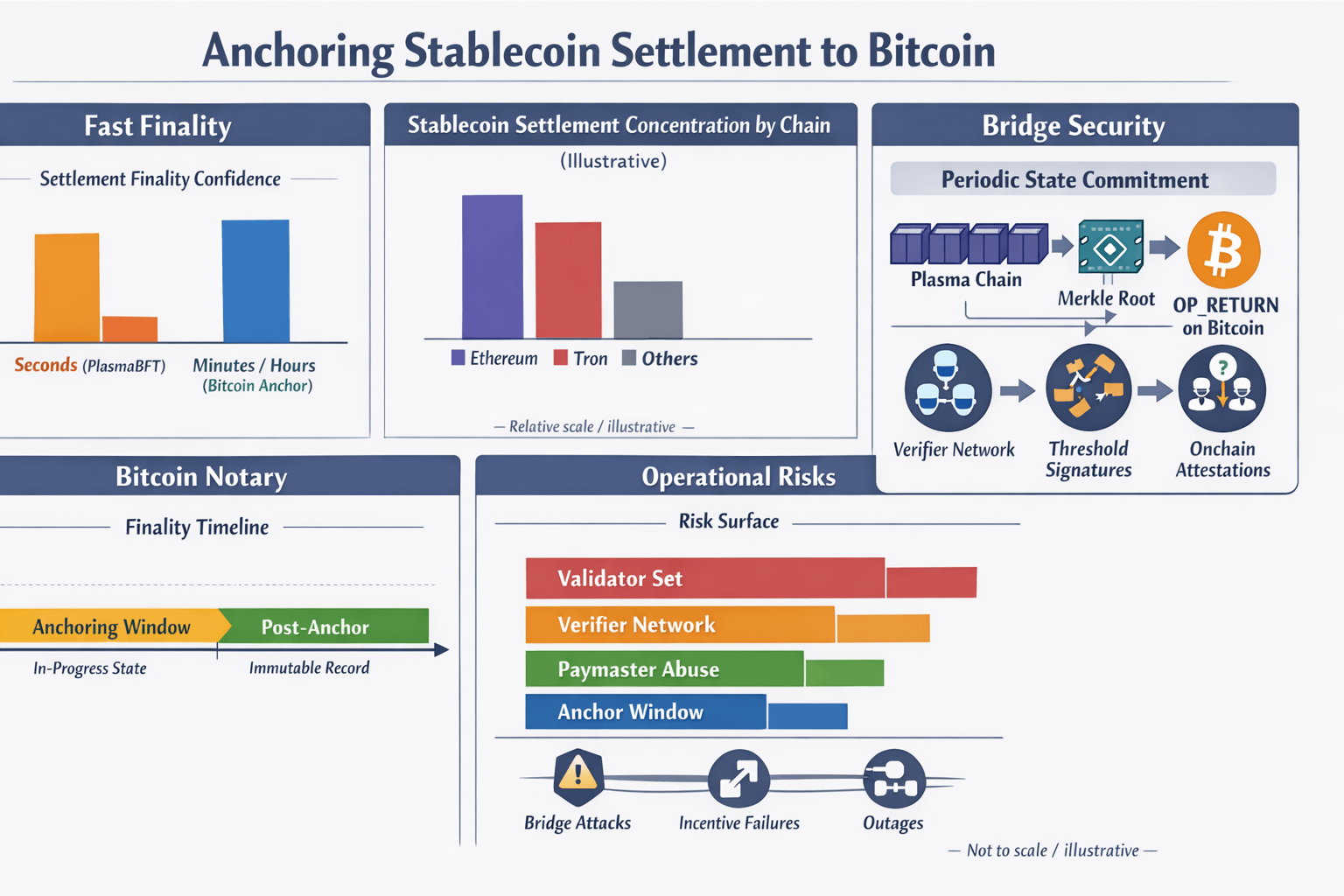

Stablecoins are trending again for boring reasons: the numbers are huge, and the use cases aren’t theoretical. 2025 research pointed to record onchain stablecoin volume, and separate tracking highlighted how much of that flow still settles on a narrow set of chains, especially Ethereum and Tron. Regulation is tightening the frame, too. The U.S. GENIUS Act set out a federal framework for payment stablecoins, Europe’s MiCA regime is now an operating reality, and euro-zone officials have publicly discussed euro-denominated digital assets as part of broader financial strategy.

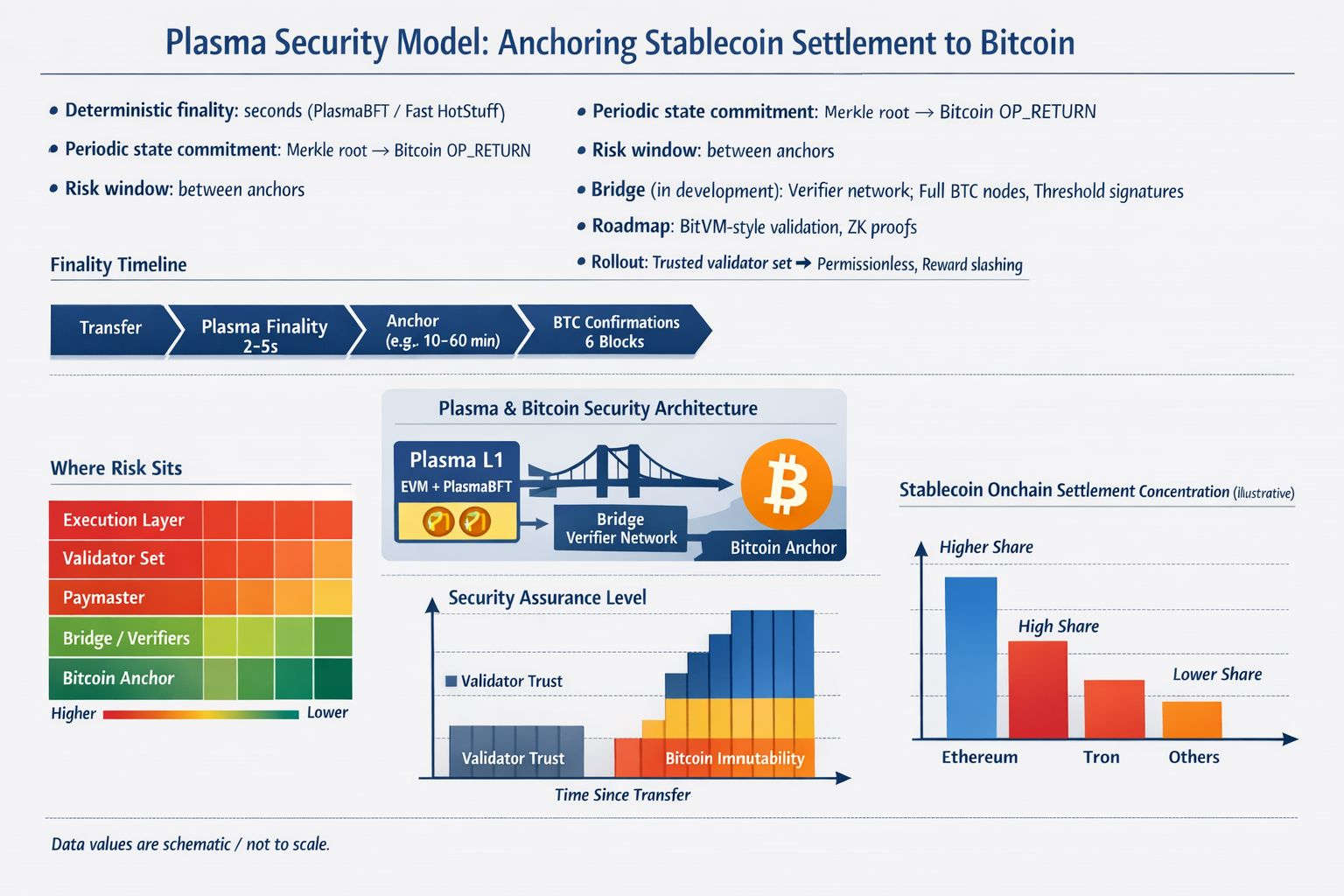

I pay attention to Plasma because it tries to treat stablecoin transfers like a primary workload, not an afterthought. In its docs, it presents itself as a stablecoin-focused Layer 1 with full EVM compatibility via a Reth-based execution layer, paired with a BFT consensus design called PlasmaBFT, based on Fast HotStuff, aiming for deterministic finality in seconds. What I find more revealing than the branding is the mechanics: a dedicated paymaster that sponsors “zero fee USD₮ transfers,” restricted to basic transfer calls, with lightweight identity checks and rate limits meant to control spam.

The part I keep circling back to is the security model: anchoring stablecoin settlement to Bitcoin’s hard-to-rewrite history. Plasma is described as periodically producing a compact commitment to its own state—often explained as a Merkle-root-style fingerprint—and recording that commitment on Bitcoin using a small data-bearing transaction format such as OP_RETURN. I like the clarity of the concept: fast execution can happen elsewhere, while Bitcoin acts as a slow notary. It also echoes the older Plasma idea of periodic commitments to a root chain, with the same tradeoff: stronger immutability after the anchor, but not instant certainty inside the anchoring window.

Anchoring is only half the story, because stablecoins live and die by bridges. Plasma’s bridge documentation describes a verifier network that runs full Bitcoin nodes, watches deposits, and signs withdrawals with threshold schemes so no single party ever holds the full key. It pairs that with onchain attestations for public auditability. I also notice the blunt disclaimer: the Bitcoin bridge and pBTC issuance system are still under active development and not live at mainnet beta. The same page points to possible future upgrades, like BitVM-style validation and zero-knowledge proofs, as those tools mature.

I keep a checklist in my head, because “periodic” is a real qualifier. Anchors create windows where I’m trusting the chain’s validator set and operational controls, and any verifier network is still an operational system with incentives, outages, and governance questions. Plasma’s consensus docs describe a phased rollout that starts with a trusted validator set and expands toward permissionless participation, and it favors reward slashing over stake slashing to avoid surprise capital loss. Meanwhile, bridge history is ugly: research has noted that cross-chain bridge attacks tend to be outsized, and recent Chainalysis reporting shows theft is still a live risk even as markets mature.

When I step back, I’m not chasing a new chain for its own sake. I’m chasing a settlement story I can explain without hand-waving. Bitcoin anchoring won’t make every stablecoin transfer instantly bulletproof, but it can tighten the finality story and make quiet rewrites harder to imagine. Plasma’s model looks like an attempt to turn “security” from a slogan into an architecture choice. I’m cautiously interested, and I’m waiting to see whether it stays boring when things get noisy.