In the evolving landscape of crypto payments, stablecoins have emerged as the bridge between the efficiency of digital assets and the stability required for real-world financial transactions. Yet, despite their promise, moving stablecoins across existing blockchain networks remains surprisingly cumbersome. High volatility in gas tokens, delayed finality, and convoluted bridging mechanisms often introduce friction, making what should feel like “digital cash” experience closer to traditional banking delays. Plasma, a Layer 1 blockchain engineered specifically for stablecoin settlement, is positioning itself as a solution to these frictions, offering a developer- and user-centric approach to digital payments.

A Stablecoin-First Approach to Payments

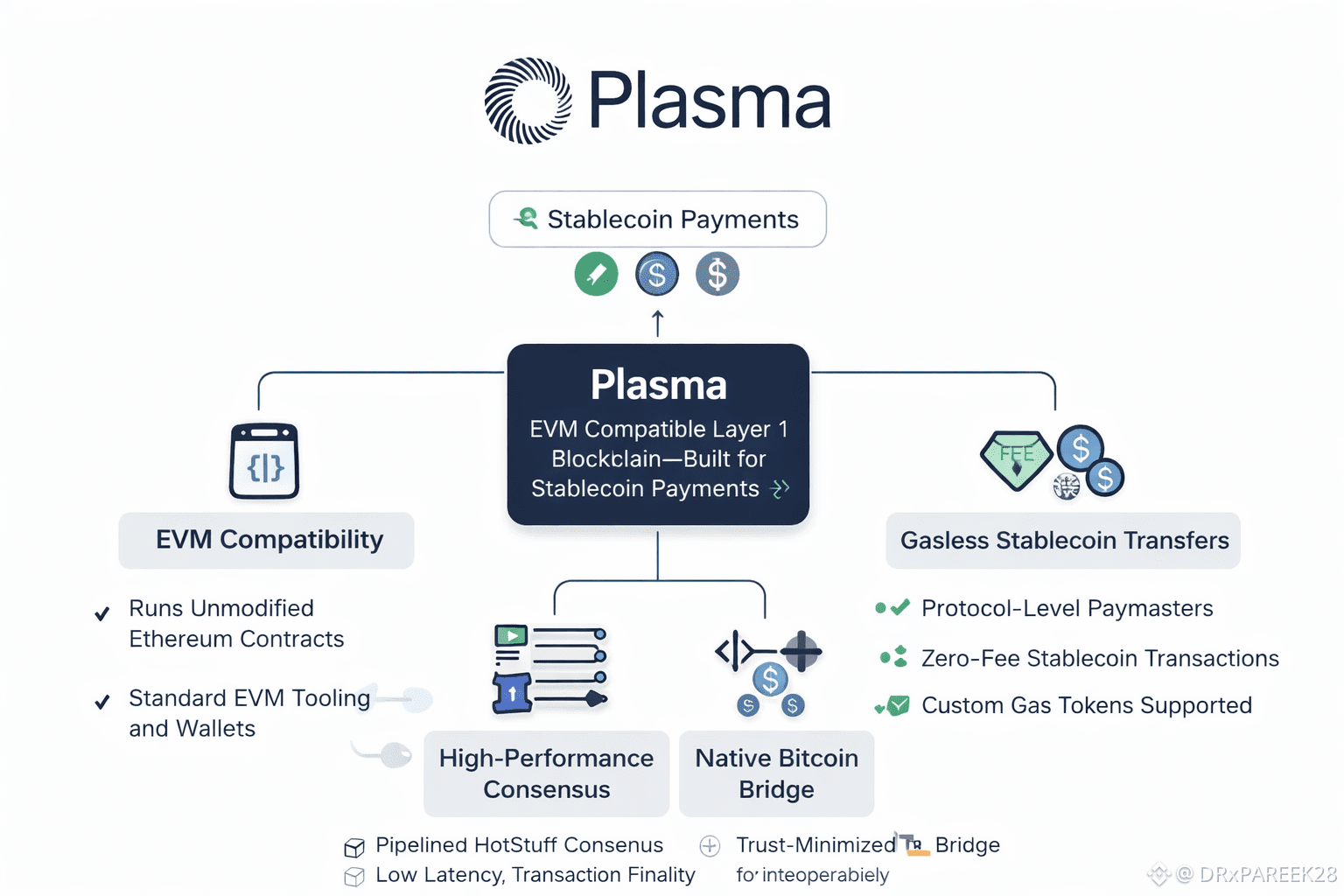

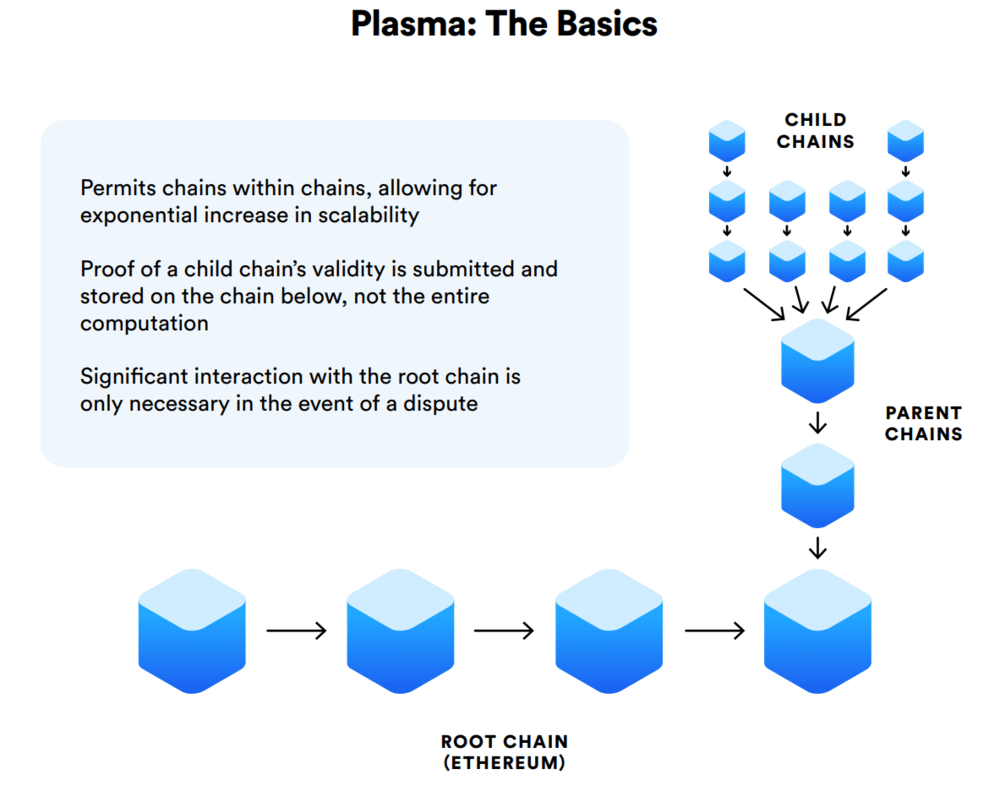

At its core, Plasma reimagines what a blockchain can be when stablecoins are treated as first-class citizens. Unlike general-purpose blockchains where native tokens dictate transaction mechanics, Plasma flips the model: stablecoins are the centerpiece, and all network logic is optimized around their use. This approach directly addresses one of the most persistent pain points in crypto adoption—the need to hold, acquire, or convert volatile network tokens simply to move value. For everyday payments, payroll processing, or business settlements, this friction can make blockchain impractical. Plasma eliminates it by allowing users to send USDT or other stablecoins without worrying about gas payments in a separate volatile token.

EVM Compatibility: Building on Familiar Ground

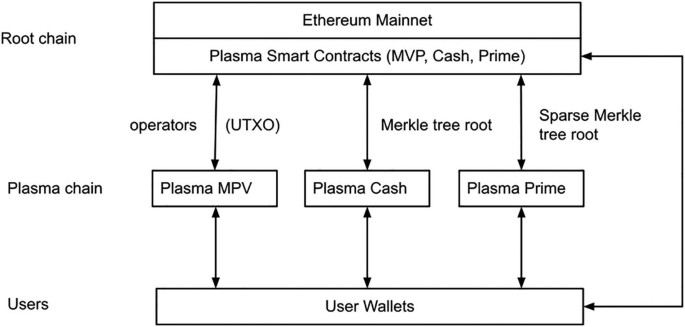

For developers, Plasma offers full Ethereum Virtual Machine (EVM) compatibility via its Reth implementation. This is significant because it allows existing Solidity-based applications to migrate or deploy natively on Plasma without rewriting their smart contracts. DeFi platforms, payment dApps, and financial infrastructure tools can leverage Plasma’s ecosystem immediately, benefiting from its stability-focused architecture while maintaining interoperability with Ethereum tooling and developer standards. In effect, Plasma marries the familiarity of Ethereum’s development environment with the specialized performance optimizations needed for real-world payment use cases.

PlasmaBFT and Sub-Second Finality

High transaction throughput is critical for any payment-focused blockchain. Plasma employs the PlasmaBFT consensus protocol, designed to deliver sub-second finality even under heavy payment loads. Unlike traditional proof-of-stake or proof-of-work mechanisms, PlasmaBFT allows the network to confirm transactions almost instantly, reducing settlement risk and providing the responsiveness that users expect in everyday payment scenarios. For merchants, payroll processors, and other financial operators, this speed is more than a convenience—it’s essential for maintaining operational fluidity.

Native Stablecoin Features

Beyond speed, Plasma introduces stablecoin-native primitives that redefine usability. Gasless transfers allow users to send USDT without ever holding the chain’s native token, streamlining onboarding and lowering barriers to adoption. Additionally, the network supports stablecoin-first fee payments, meaning users can pay transaction costs in the same stablecoin they are transacting. These features collectively reduce cognitive overhead, enabling a payment experience that mirrors traditional digital banking more closely than typical crypto interactions.

Confidential Payments for Enterprise Use

In the realm of business finance, transparency is often a double-edged sword. Payroll, vendor payments, and intercompany settlements require confidentiality without compromising verifiability. Plasma integrates confidential payment capabilities that allow financial actors to move value discreetly, addressing privacy concerns while maintaining the auditability necessary for compliance. By supporting confidential transactions, Plasma opens the door for stablecoins to be used in scenarios previously reserved for private banking rails or centralized payment networks.

Bitcoin-Anchored Security and Trust-Minimized Bridging

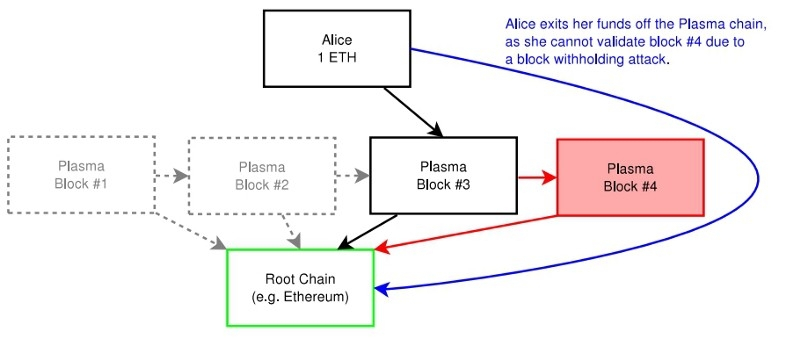

Security is paramount in payments infrastructure, and Plasma leverages Bitcoin-anchored security as part of its trust-minimized design. By anchoring checkpoints to the Bitcoin blockchain, Plasma enhances censorship resistance and provides an immutable reference point for transaction finality. This approach complements its internal consensus guarantees and adds a layer of reassurance for institutional participants who require strong assurances against network compromise. Trust-minimized bridging further enables assets to move between chains with reduced reliance on centralized intermediaries, creating a more open and secure stablecoin ecosystem.

Validator Decentralization and the XPL Token

Plasma’s roadmap emphasizes decentralization, with validators playing a central role in securing the network through the XPL token. The token functions both as a staking asset and as an incentive mechanism, aligning network security with economic participation. Over time, the protocol aims to broaden its validator base, ensuring resilience against collusion and concentration while preserving high throughput and low-latency settlement.

Why Plasma Deserves Attention

As stablecoins increasingly underpin global payments, a blockchain optimized specifically for their movement is a logical evolution. Plasma addresses the frictions that have hindered crypto’s real-world usability—volatile gas fees, slow finality, complex bridging, and privacy concerns—while retaining developer familiarity through EVM compatibility. Its combination of speed, usability, confidentiality, and security positions it as a compelling infrastructure layer for both retail and institutional adoption.

Conclusion

Plasma represents a shift in blockchain design philosophy: rather than forcing stablecoins to conform to general-purpose networks, it molds the network around stablecoins themselves. By delivering fast, predictable, and private settlement capabilities, Plasma could become a cornerstone of the next generation of digital payment rails. As adoption grows and validator decentralization strengthens, the network is poised to offer a compelling alternative to traditional payment networks, making it a project to watch closely in the evolution of stablecoin infrastructure.