The pitch is by now likely well-known: a ground-up Layer 1 blockchain focused on stablecoins, transferring USDT freely, and sub-second finality, and with Tether itself support. By paper it is the type of infrastructure the stable coin economy has been looking to. However, seeing that since September, $XPL has lost over 95 per cent of the value since it was at its all-time high, the right question is not, will Plasma moon? but is it the underlying thesis that is no longer water, and what tangible fact would it prove to be right or wrong.

It is neither a sell signal nor a buy signal. It is a model to think very clearly about @plasma just as the hype is defrosting its cooling effect and the actual work is meant to commence.

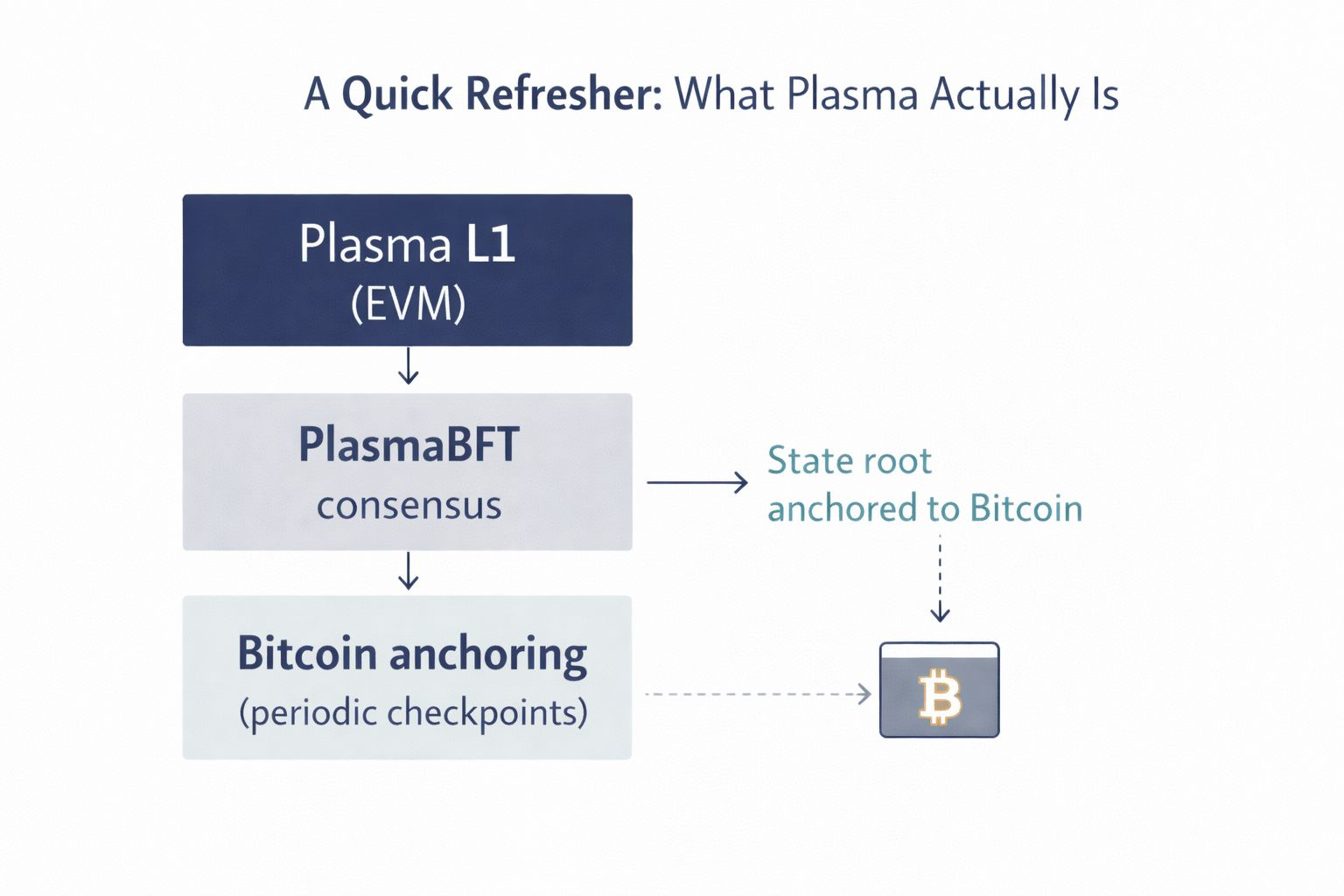

Quick Refresher: What Plasma really is.

Plasma is not a rollup, and is a Layer 1 blockchain, not a sidechain in the traditional meaning of the term, which operates on a bespoke consensus mechanism called PlasmaBFT, based on Fast HotStuff. It is Ethereum-compatible, i.e. Ethereum developers can happily use the existing smart contracts with little friction. The network has a schedule of pegging the state to Bitcoin which inherits part of the finality guarantees offered by Bitcoin but operates a separate set of validators to handle everyday transactions.

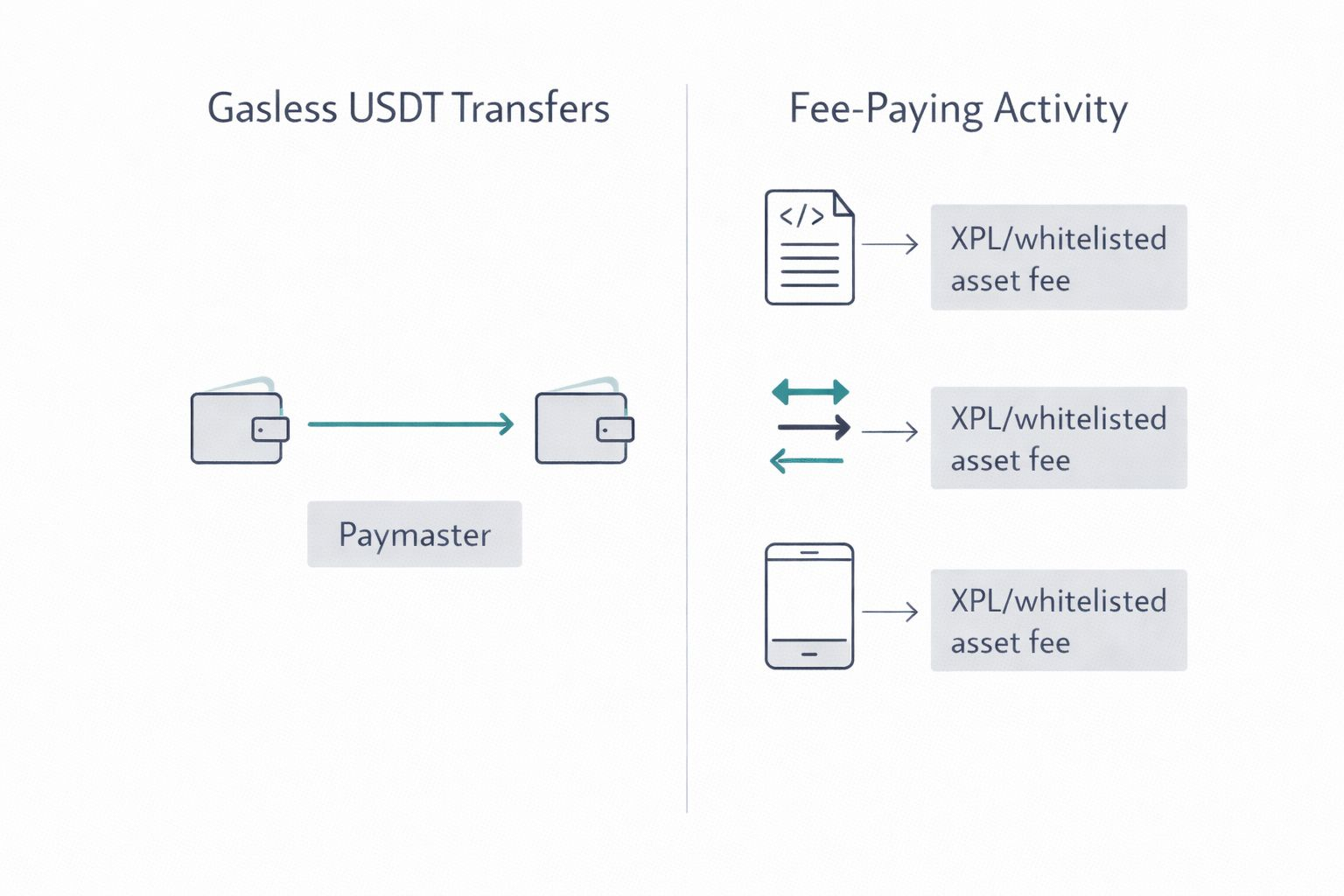

Its architecture of stablecoins-first is the most important distinguishing characteristic. Every transfer of USDT is sponsored by a protocol-level paymaster, meaning that end users do not have to have any native token to transfer dollars. Other operations, deployments of contract, communicating with DeFi, also require the payment of fees in XPL or whitelisted assets. Imagine it is a blockchain where the default mode is optimized on dollar-denominated payments, and all other things are considered secondary.

Checklist Falsifiable: 5 Conditions to Keep Track of.

Instead of discussing price charts, it is important to determine what would actually prove the thesis of the Plasma. Here are five conditions. In case the majority of them are on the positive trend in the next 6-12 months, the project may be developing something that will last. In the event that a majority of them stall, the skeptics would likely have a case to pay.

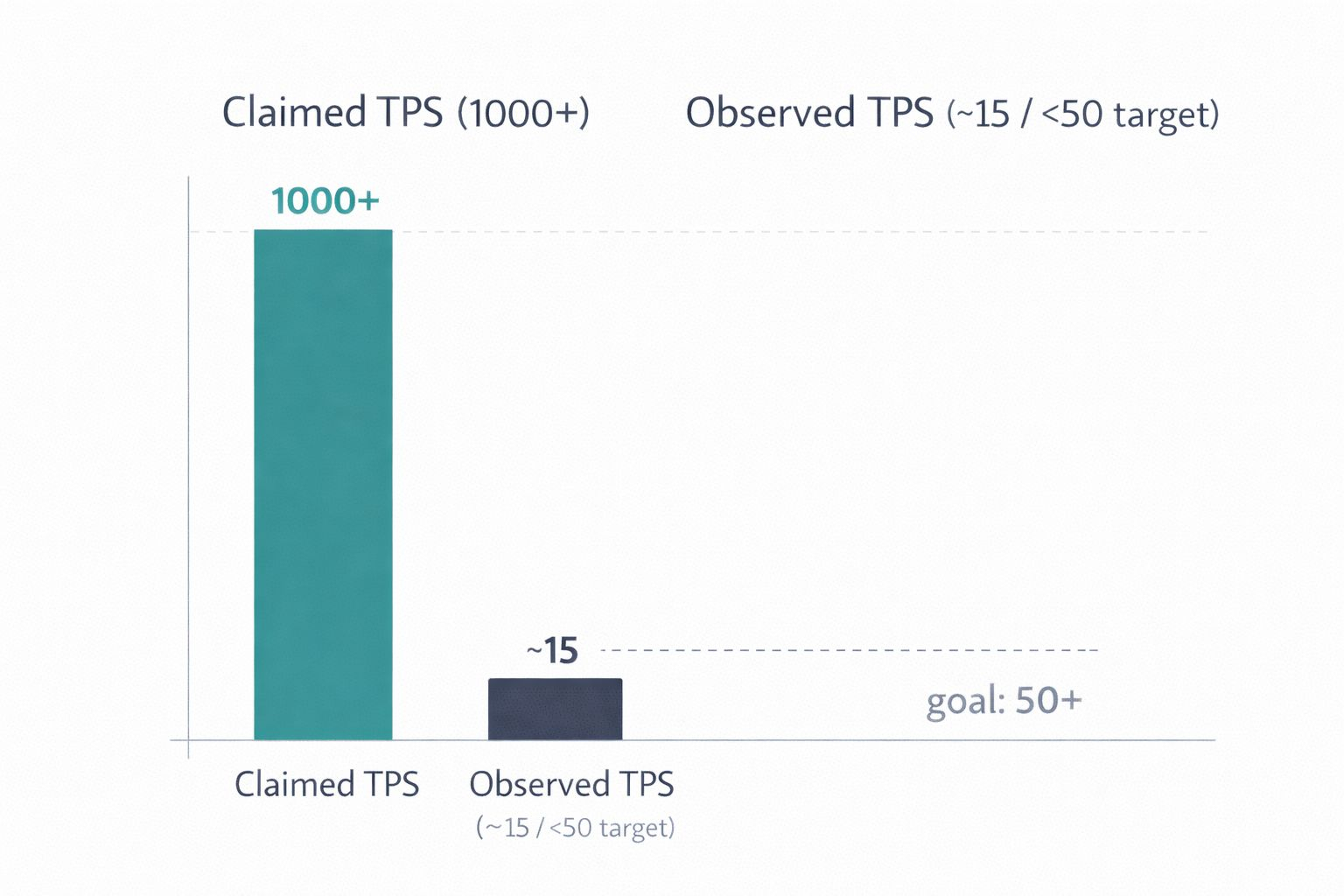

Actual Transaction Throughput Must Bridging claims gap.

The marketing literature of Plasma mentions that its throughput is more than 1,000 transactions each second. Nevertheless, as indicated by block explorer statistics at the end of October 2025, the real throughput was very nearer to 15 TPS. That gap matters. Each new Layer 1 promises hypothetical throughput which is high than the actual usage, which is normal in the initial months. However, it is the direction that matters. Assuming that six months after the mainnet is launched the network is still serving less than 50 TPS, the narrative of being built to be scaled is no longer credible despite what any benchmarks claim.

What to follow: Weekly average TPS on the block explorer of Plasma. People should seek organic growth as opposed to airdrop spikes or incentive programs.

Stablecoin TVL Must stop being a One-Lending-Vault-only Trading.

Plasma received more than $2 billion in stablecoin deposits on its first day, an impressive number of deposits by any metric. Yet much of the business was concentrated into one lending vault with about 8 per cent returns in a year. It would ultimately become a healthy stablecoin ecosystem comprising a number of use cases, such as payments, remittances, payroll, merchant settlement, and a selection of DeFi protocols. The chain can functionally be a payments network should the full value proposition thereof be distilled to one yield product, which in effect is a yield aggregator with a token of its own.

What to be observed: The count of different protocols with significant TVL (say, over $10 million each), and whether there are any non-DeFi payment integrations that do come into existence.

The Problem with Zero-Fee Transfers Requires Physical End Users, not Crypto Natives.

The 0-charge USDT transfer option is truly impressive to the individuals in the emerging market who now pay 1-3 percent on remittances. But persuasive features do not necessarily result in adoption. Plasma must show that non- crypto-native users, small business people, freelancers, migrant workers are indeed utilizing the network to make payments. This is, perhaps, the most difficult to satisfy condition since it involves the distribution partnerships which are not confined to the crypto echo chamber.

What to monitor: Collaboration with fintech applications, neobanks, or the payment processors that include retail consumers. The new Plasma One card due out could be a sign of things to come, but it has to go out and hit the market.

The Decentralization of Voters Requires Plausible Schedule.

As the mainnet beta launched, all the validator nodes were managed by the Plasma team. The roadmap also states that external validators and stake delegation will come in later, and staking will be reached at the beginning of 2026. Progressive decentralization is a widespread practice, and it is not necessarily bad. In the case of a network with billions of dollars in stablecoins, however, block production centralizing is an important trust choice. The later this continues the more difficult it becomes to differentiate Plasma and a permissioned database with a token attached.

What to monitor: How many validators are independent and how diverse the set of validators is geographically and structurally and whether there is stake delegation as planned.

Token Utility Must get circular, not circular.

It is the conflict in the core of the token design of #Plasma that making the chain efficient in terms of zero-fee transfers of stablecoins, which implies that the main use case does not involve the need to hold with XPL at all. The utility of the token is based on staking, non-stabilitycoin transaction gas, and the reward of the validators. Hypothetically, that is a consistent model, but it suffers a bootstrapping problem. Unless the majority of users utilize XPL in a way that involves converting USDT into XPL and leaving it there, as opposed to buying and offloading the token, the token strictly relies on staking yield and speculative interest to drive demand. To become organic and demand creation To generate organic demand, there must exist some kind of meaningful on-chain activity beyond mere transfers, smart contract interaction, DeFi composability, and application-layer fees, which constitute actual buy pressure.

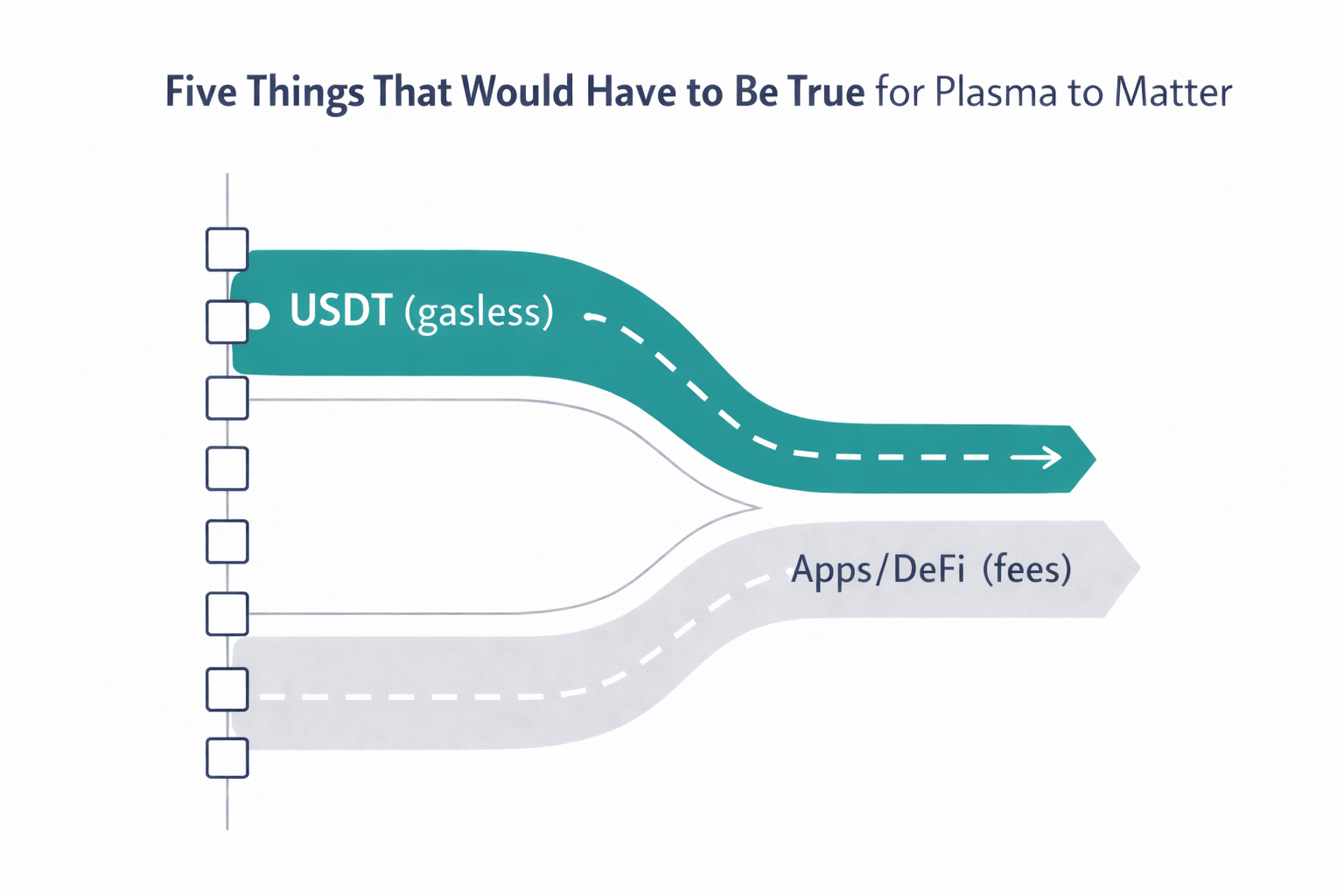

Watch: The percentage of gasless transfers to fee-paying transactions. A healthy ratio would reflect an increasing free transfer activity as well as the fee-paying one.

Three of the Risks that are Not Given Adequate Attention.

On top of the checklist, there are structural risks to be named in a straightforward manner.

Supply overhang is real. As 25 percent of the team and 25 percent of the investors will have a 3-year unlock schedule, with a 1-year cliff, there will be a significant selling pressure when the tokens are unlocked. This is increased by the inflationary model (5% per year as rewards of validator) model. Any person making such an evaluation of the token must model the appearance of circulating supply at the 18-month mark or the 36-month mark, not only at the current time.

The level of competition is not diminishing. Tron already accepts most transfers of the USDT in the world. Base and Solana are growing tooling of stablecoins. The landscape can be redefined by the own infrastructure moves of Circle. Plasma. purposely designed to support stablecoins, is differentiated nowadays, but the moat is based on the speed of execution. When the specialization argument is undermined by the addition of similar paymaster features by established chains.

The policy uncertainty regarding stablecoins may go in both directions. Tighter regulation of stablecoins can make the compliant infrastructure (a potential positive) or limit the permissionless transfer model that is popular with Plasma (a potential negative). Any stablecoin-native chain will have its ceiling determined by the direction of regulation in the US, the EU, and the major emerging markets.

One of the Visual You can suggest to your own research.

To monitor Plasma over time, one of the dashboard metrics to create would be the weekly average TPS, the total number of unique protocols that have TVL of more than 10M, the circulating supply as a percentage of the total supply, and the ratio of gasless-to-fee-paying transactions. It would be much easier to see these monthly curves and have a better understanding of trajectory than at price alone. (Note: This is not fake data on my part, these are the figures that you can get on the block explorer of Plasma and DeFi trackers websites)

Where Does This Leave Us?

The market of the stablecoins is vast and expanding. The infrastructure supporting it, in most aspects, is a system of workarounds attached to blockchains that do not support it. This is a plausible hypothesis that can be made by Plasma in his bet, that a purposely designed chain can do it better. However, a hypothesis is not a conclusion.

The five conditions mentioned above are not accidental. They are correlated to the particular assertions Plasma makes about itself: throughput, stablecoin utility, mainstream adoption, decentralization and token relevance. Tracking such conditions will do you better than sentiment in the event that you are going to put time and attention to this project: which will give you a framework that can literally change your mind in one or another direction.

Which is the single most likely condition on this list, in your opinion, that Plasma will satisfy first, and which do you consider the most worrying to you?