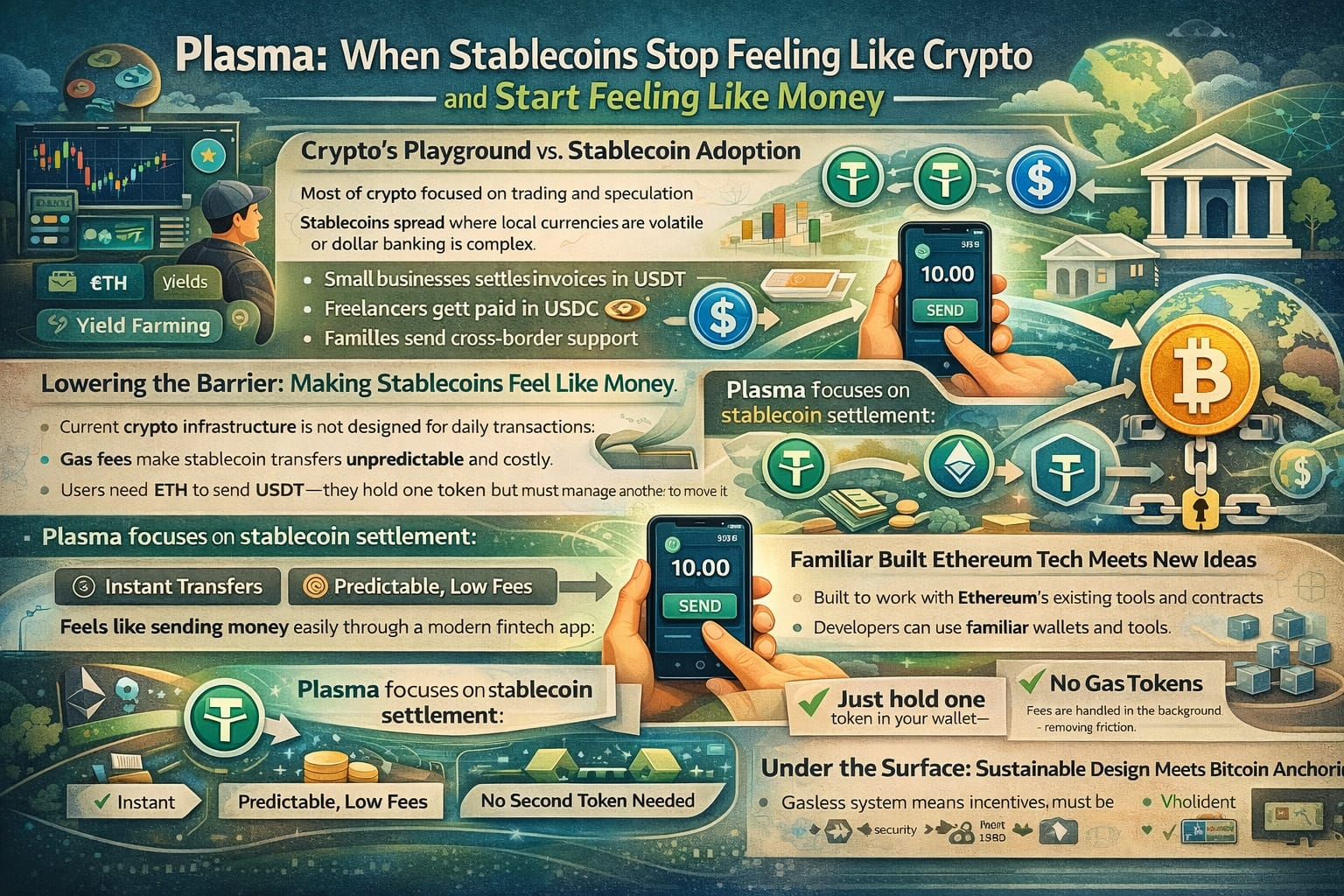

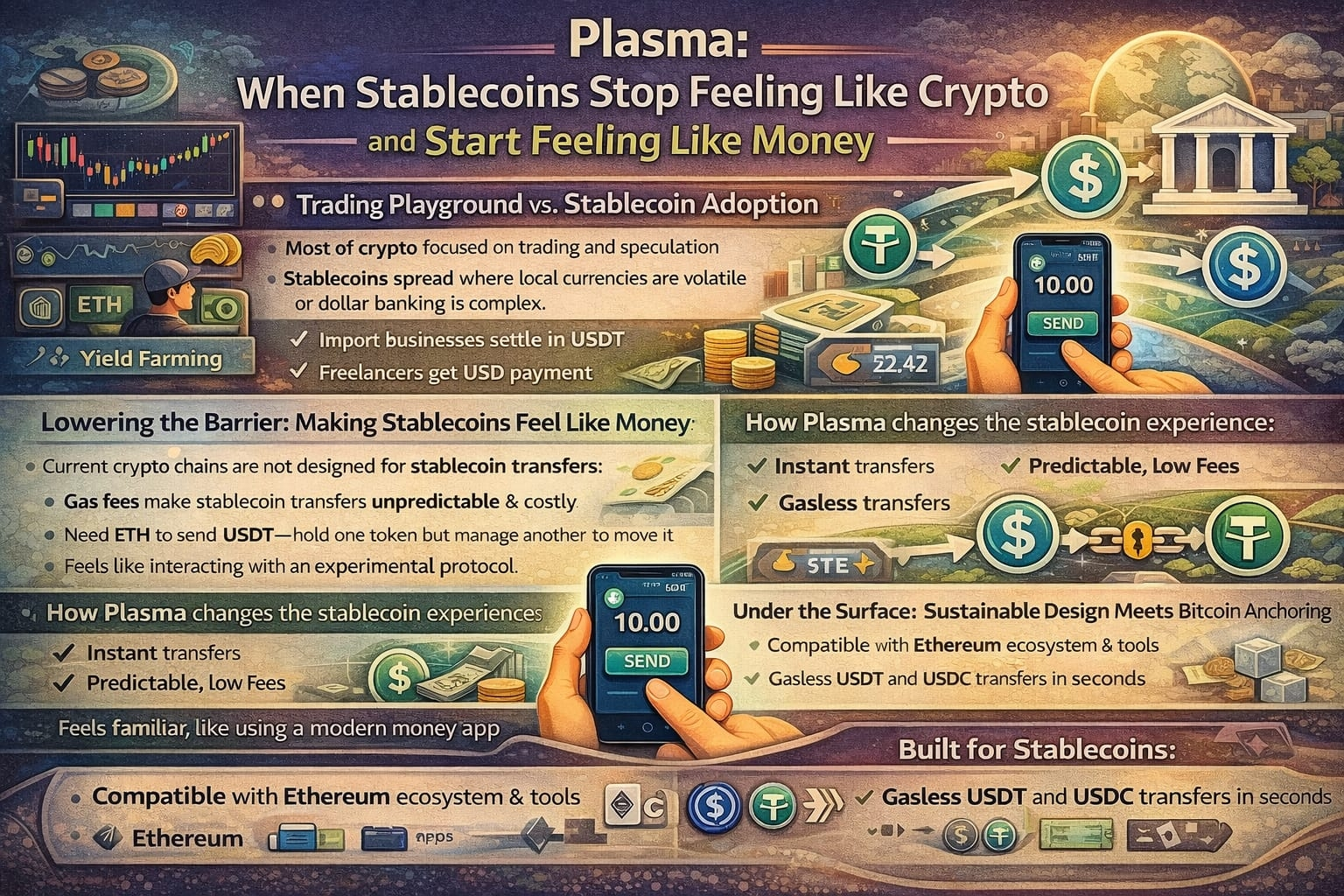

For years, crypto has talked about reinventing money. In reality, most of it reinvented trading. Charts, tokens, yields, narratives — the industry became very good at building financial playgrounds for people who were already inside the system. Meanwhile, something quieter was happening. Stablecoins were spreading, not because of ideology, but because people needed them.

In parts of the world where local currencies lose value quickly or access to dollar banking is complicated, stablecoins became practical tools. Freelancers started asking to be paid in USDT. Small import businesses began settling invoices in digital dollars. Families sent support across borders using stablecoins because it was faster and sometimes cheaper than traditional remittance channels. None of this felt revolutionary. It felt practical.

But the infrastructure underneath was never really designed for this kind of everyday use. Sending stablecoins still meant worrying about gas fees. It meant holding a different token just to move the one you actually cared about. It meant explaining to new users why they needed ETH to send USDT. For people deep in crypto, that friction is normal. For everyone else, it’s strange.

Plasma begins with a simple shift in perspective. Instead of treating stablecoins as just another asset on a general-purpose chain, it treats them as the main character. That change sounds small, but it reshapes everything.

The idea is straightforward: if most real activity on-chain is stablecoin transfers, then the chain itself should feel like it was built for that purpose. Transfers should be instant. Fees should be predictable. Users shouldn’t have to manage a second token just to send digital dollars. The experience should resemble sending money through a modern fintech app, not interacting with an experimental protocol.

Under the surface, the architecture reflects that intent. Plasma keeps compatibility with Ethereum’s ecosystem so developers don’t have to start from zero. That’s not a glamorous decision, but it’s practical. The crypto world already has a massive base of tools, wallets, and smart contracts built around the EVM. Reusing that environment lowers the barrier to adoption. It says, “You don’t need to learn a new language. Just build.”

At the same time, Plasma pushes hard on speed. Sub-second finality is not just a technical metric. It changes how a transfer feels. When money is involved, waiting introduces doubt. Is it confirmed? Is it reversible? Should I wait longer? Payments demand clarity. A system that can say, almost instantly, “This is final,” reduces anxiety in a way that no marketing slogan can.

Then there’s the gasless design. For years, the need to hold a native token to pay fees has been one of crypto’s quiet barriers. It makes sense from a protocol perspective, but from a human perspective it’s awkward. If someone only wants to hold digital dollars, why should they need anything else?

Gasless stablecoin transfers flip that expectation. The complexity doesn’t disappear; it just moves behind the curtain. Through account abstraction and fee sponsorship mechanisms, the system can handle fees without forcing the user to think about them. To the person sending money, it feels like one asset, one action. That simplicity is powerful. It removes the small confusions that often prevent new users from ever starting.

Of course, simplicity on the surface often means complexity underneath. Validators still need incentives. Transactions still need to be processed and secured. If fees are paid in stablecoins or sponsored by intermediaries, the economics must be carefully designed so the network remains sustainable and resistant to abuse. These are not trivial engineering challenges. They require careful modeling and constant adjustment.

Another layer of the story is Bitcoin anchoring. On the surface, this sounds symbolic — borrowing Bitcoin’s reputation for neutrality and security. But there’s more going on. By anchoring to Bitcoin, Plasma attempts to tie its fast-moving environment to a slower, widely trusted base layer. It’s a bit like building a high-speed train system that ultimately settles onto a deeply established rail network. The fast layer handles everyday movement. The anchor layer provides final assurance.

This design choice also reflects a broader reality. Trust in digital systems often rests not just on code, but on social perception. Bitcoin has earned a reputation for being difficult to manipulate and politically neutral. Aligning with that perception may make institutions more comfortable experimenting with Plasma for settlement and treasury flows.

Retail users, meanwhile, may never think about any of this. They will care about whether the transfer arrives instantly. Whether the fee is negligible. Whether the system works consistently. In countries where inflation erodes savings or capital controls limit access to global finance, reliability is not a luxury — it is survival. If Plasma can provide stablecoin transfers that feel as smooth as sending a message, it could quietly embed itself into daily economic life.

Institutions see a different angle. For them, speed reduces counterparty risk. Deterministic finality simplifies reconciliation. Predictable fee structures make accounting cleaner. If stablecoins are already part of their treasury strategy, a chain optimized for moving them efficiently becomes attractive infrastructure rather than experimental tech.

Still, there are open questions. When a system centers itself around stablecoins, it inevitably becomes linked to the issuers behind those coins. Regulatory pressure on a major issuer could ripple through the network. Validator composition and governance decisions will determine how decentralized the system truly is. And any payments-focused infrastructure must prove itself over time, because outages or inconsistencies erode trust quickly.

What makes Plasma interesting is not that it promises to be faster or cheaper. Many chains make those claims. What stands out is its refusal to chase every possible use case. It narrows its focus to something concrete: stablecoin settlement. It accepts that most people using crypto today are not looking for abstract decentralization experiments. They are looking for functional money rails.

If it succeeds, the impact may not be loud. There may be no dramatic headlines. Instead, freelancers will get paid faster. Merchants will settle invoices without worrying about gas tokens. Cross-border transfers will feel less like hacks and more like normal financial activity. The technology will fade into the background, which is often the real sign of maturity.

Money infrastructure is rarely glamorous. It is judged by its reliability, not its novelty. Plasma is betting that by designing around how stablecoins are actually used — rather than how blockchains are theoretically supposed to work — it can build something durable.

In the end, the question is simple. Can a blockchain feel less like a blockchain and more like money? Plasma is one of the clearest attempts yet to answer that question, not with ideology, but with design choices aimed directly at everyday use.