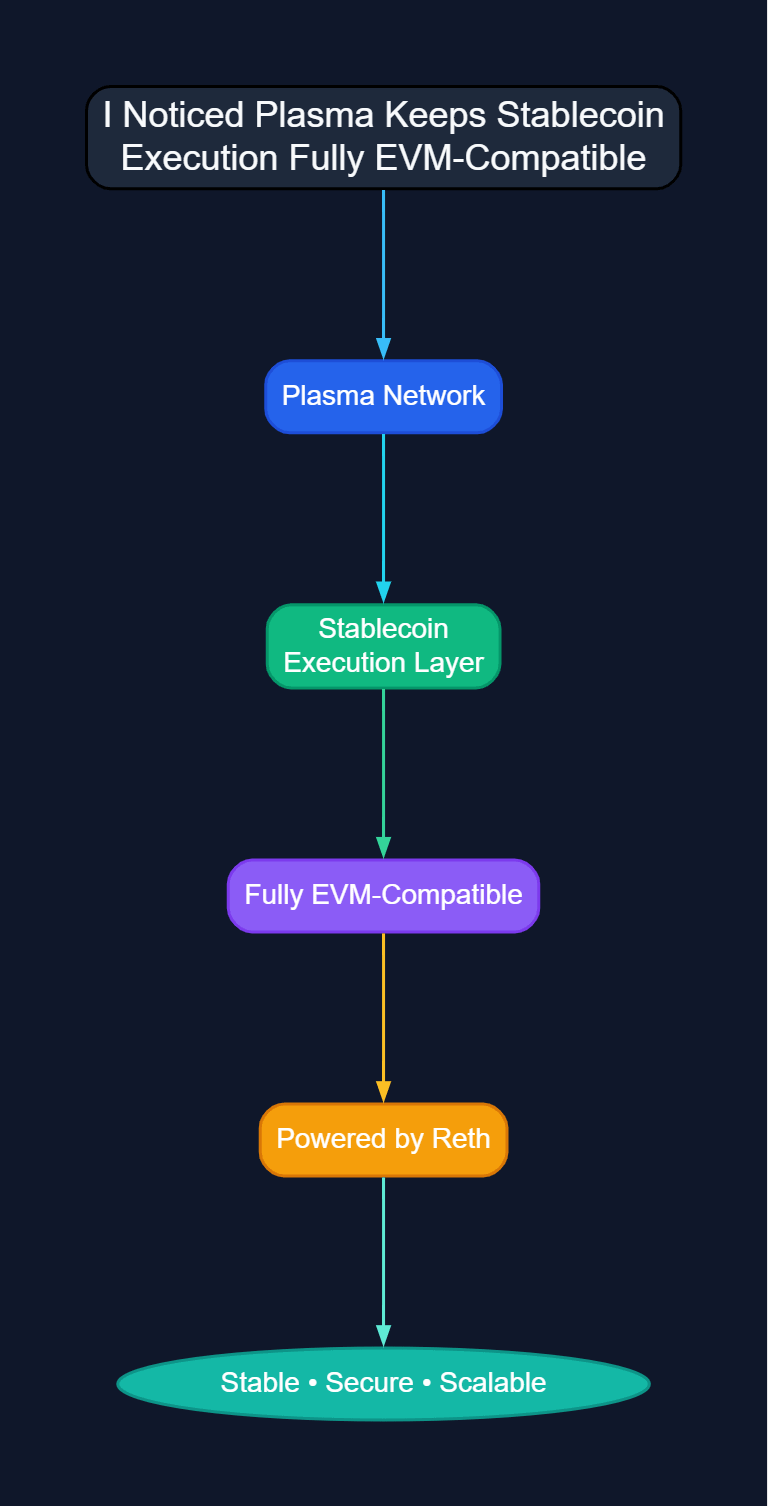

I noticed Plasma does not introduce a modified execution environment for its stablecoin-focused design, but instead maintains full EVM compatibility through Reth. Rather than separating itself from established Ethereum tooling, Plasma preserves contract behavior while optimizing around stablecoin settlement as its primary use case.

Plasma operates as a Layer 1 blockchain tailored specifically for stablecoin settlement. By integrating Reth as its execution client, the network ensures that existing Ethereum smart contracts, including widely used stablecoin contracts, can execute without alteration. This continuity eliminates the need for rewritten logic or specialized contract versions when deploying or interacting within the Plasma environment.

Reth provides deterministic execution consistent with Ethereum's Virtual Machine standards. On Plasma, this compatibility means stablecoin transfers, approval mechanisms, and contract interactions follow familiar bytecode rules while benefiting from Plasma’s own consensus and finality structure. Execution logic remains predictable and standardized, reducing complexity for developers and payment integrators.

Sub-second finality through PlasmaBFT complements this compatibility. While Reth governs execution behavior, PlasmaBFT governs confirmation. The separation between execution and consensus allows Plasma to maintain Ethereum-aligned smart contract processing while delivering fast and deterministic transaction confirmation. Contracts execute in a familiar environment, but transactions finalize within Plasma’s optimized consensus framework.

For stablecoin settlement, this combination is structurally significant. Stablecoin contracts often form the basis of payment flows, treasury operations, and cross, border transfers. Making sure that such contracts continue to operate without changes helps to maintain the smooth running of operations.

This design reduces friction for both retail users and institutions. Retail participants interact with stablecoin contracts that behave exactly as expected within the EVM standard. Institutional actors integrating payment logic or treasury automation can rely on execution consistency without maintaining separate codebases. The execution layer remains stable even as usage patterns scale.

I also noticed that Plasma’s choice to remain fully EVM-compatible signals discipline rather than expansion. Instead of introducing proprietary virtual machines or experimental execution rules, Plasma anchors its smart contract environment to a well-established standard. This allows the network to focus its innovation on settlement performance, stablecoin-first gas mechanics, and security reinforcement rather than altering contract semantics.

Because execution behavior mirrors Ethereum standards, developer tooling, auditing practices, and monitoring infrastructure remain directly applicable. Contract interactions, event logs, and state transitions align with known EVM patterns, simplifying integration for payment providers and infrastructure participants operating in high-adoption markets.

Plasma's architecture therefore balances familiarity and specialization. Reth ensures standardized contract execution, while PlasmaBFT ensures rapid confirmation. Stablecoin-first transaction design operates alongside this compatibility rather than replacing it. The result is a Layer 1 environment where stablecoin settlement is optimized without fragmenting the execution standard.

Importantly, this compatibility does not dilute Plasma’s positioning. The network remains tailored for stablecoin settlement, but it achieves this by refining performance and fee mechanics rather than redefining smart contract behavior. Execution integrity and settlement optimization coexist within a single, coherent framework.

Conclusion

Plasma maintains full EVM compatibility through Reth while tailoring its Layer 1 infrastructure for stablecoin settlement. Smart contracts execute under familiar Ethereum standards, while PlasmaBFT provides sub-second finality to support efficient confirmation. By preserving execution consistency and optimizing settlement performance, Plasma aligns developer familiarity with stablecoin-focused infrastructure, reinforcing its role as a specialized yet standards-compatible network.

@Plasma $XPL #Plasma