Let me get straight to the point:Plasma isn’t just some relic from the early days of scaling research.The more time I spend digging into Layer 1 congestion,bridge hacks,and this tidal wave of rollups,the more I see Plasma as a foundational idea that got to modularity before it was cool.It drew a hard line between execution and enforcement run your computations anywhere,sure,but when it comes to settling up,everything comes back to the base chain.That split completely changed how I look at scalability.Now,I care less about raw throughput numbers and more about where the system’s actual security lives.

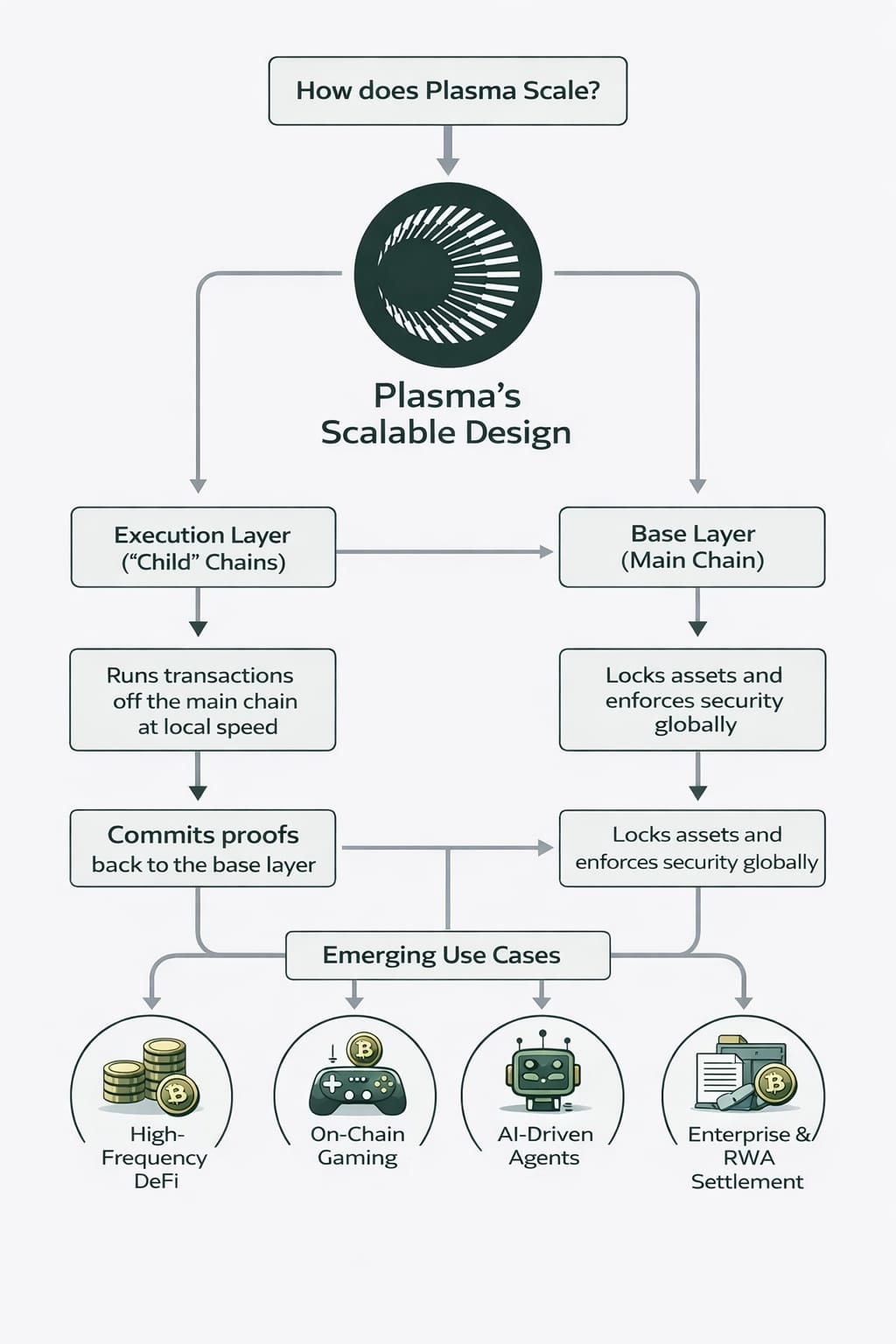

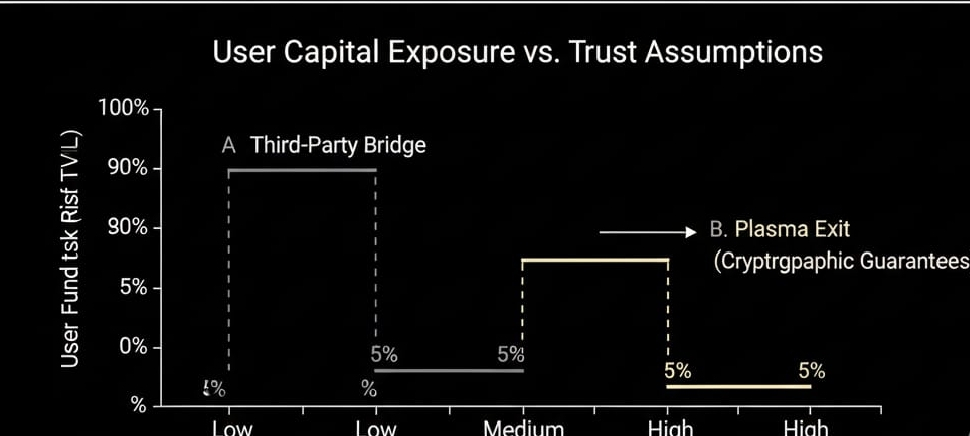

Here’s the core idea:Plasma locks assets on a robust base layer while letting activity flourish on “child” chains.These chains regularly send proofs back home,and the main chain acts as judge and jury.That’s not just theory.In a world where bridges keep collapsing and trust assumptions go up in smoke,Plasma lets users exit to Layer 1 using cryptographic guarantees no need to trust the bridge.That design choice has real teeth when it comes to protecting capital.

To me,Plasma’s real innovation is its approach to enforcement.Instead of shoving every transaction into one global soup,it lets smaller execution environments run independently.This is hitting home right now as the industry moves toward modular architectures,new data availability layers,and restaking.Plasma saw early that blockchains are better off specializing than chasing every goal at once.

The practical benefits jump out in DeFi.Take perpetuals or structured products stuff that needs fast, reliable fees and low latency.If you try to run those directly on a packed Layer 1,you get more risk of liquidation and more slippage.Plasma style child chains can process all that rapid fire order flow,while still settling securely on the main chain.That’s how you actually build scalable,trustworthy financial rails.

Gaming is another area where Plasma shines.On chain games rack up thousands of tiny interactions every session.Doing that on the base chain just burns money.But with a Plasma chain built for games,you keep player assets safe on Layer 1,while letting all the action happen at speed and scale.Honestly, this is one of the best real world cases for why execution should specialize.

The story doesn’t end there.With AI agents interacting with smart contracts rebalancing, arbitraging,doing their thing they need quick execution loops.Plasma’s setup is perfect for high frequency action,without jamming up the base layer or risking main chain security.

Of course,Plasma has its issues.Early versions made users wait out exit periods and depend on fraud proofs,which isn’t exactly smooth UX.Data availability’s another sticking point if users can’t get at transaction data,they can’t prove anything on exit.Fixing this means better data availability tech and smarter user interfaces.Scaling isn’t just about cryptography;it’s about incentives and coordination too.

Looking at the market,Plasma fits the broader move toward risk adjusted scaling.When capital is tight,nobody cares about wild TPS claims.What matters is system durability and minimizing systemic risk.Plasma’s layered enforcement gives you that by cutting down on external trust.

After analyzing all these scaling models,I’m convinced:you can’t trade away enforceability for headline numbers.Plasma is a reminder that scaling by adding specialized execution environments is more sustainable than just cranking up the base layer until it breaks.

Even as implementations change,I think Plasma’s core philosophy execution anywhere,enforcement anchored will stick around.The real question isn’t how many TPS you can post on a dashboard.It’s whether users can always claw back their assets, even in the worst case scenario.

Plasma’s approach forces a disciplined mindset about infrastructure.Run your logic wherever it doesn’t matter.But security needs one,clear,unbreakable anchor.If you want to build resilient systems or make smart crypto investments,that’s the lesson to take away as we head deeper into the modular era.