Today, during our mid-morning coffee break at the office, a strange debate started.

Not about crypto.

Not about blockchains.

Not about technology at all.

It was about a payment that had “worked perfectly” yesterday… and the two hours we had just spent trying to understand it this morning.

The transfer had gone through without issues. Confirmation appeared. The supplier received the funds. Everything looked fine on screen.

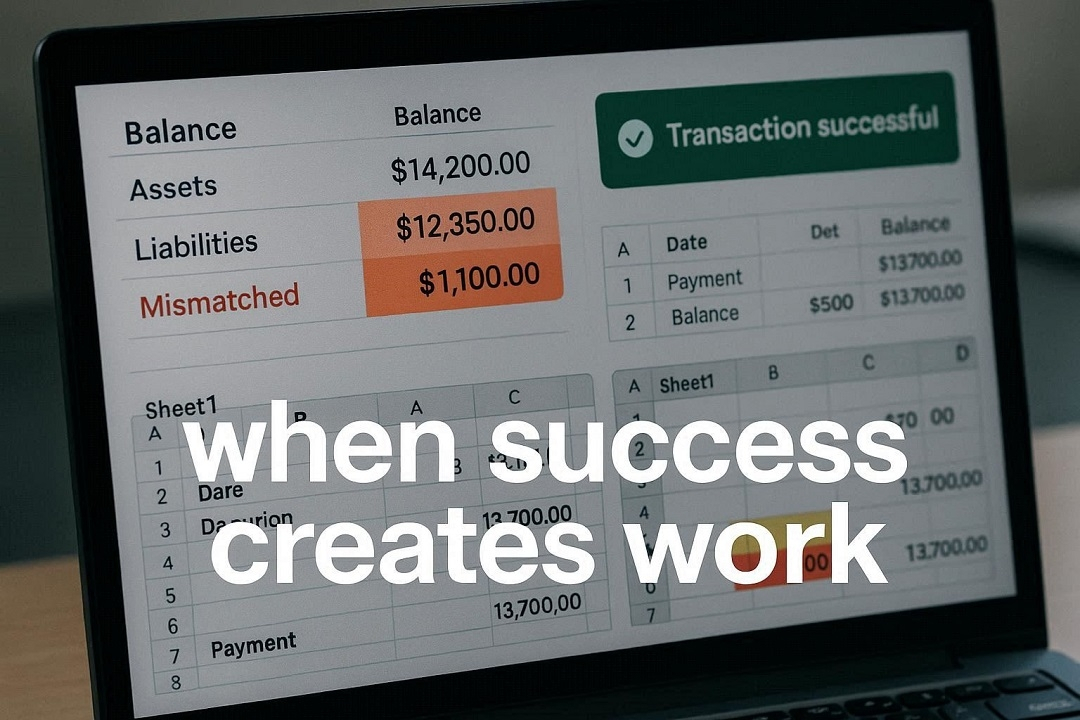

But today, when accounting opened the reports, something didn’t match.

An invoice was still marked as unpaid.

The balance didn’t reflect what the system showed yesterday.

References were missing.

Someone had to open spreadsheets.

Someone else had to send emails.

Someone had to manually verify what had already “worked”.

That’s when the realization hit the table:

The problem wasn’t the payment.

The problem was everything that happened after.

When payments leave the screen

In a demo, a payment ends when the confirmation appears.

In real businesses, that’s where the work begins.

Someone must match it to an invoice.

Someone must verify the amount.

Someone must ensure reports update correctly.

Someone must confirm that balances make sense without investigation.

If any of this requires manual work, the system is not usable at scale.

This is why finance teams don’t ask how fast a network is.

They ask how often payments create extra work the day after.

Reliability is not measured in seconds.

It is measured in how little operational noise yesterday’s payment creates today.

Where friction really appears

Payment issues rarely show up as failed transactions.

They appear as:

Mismatched balances.

Reports that don’t align.

Missing references.

Spreadsheets full of manual fixes.

The transaction succeeded.

Operations did not.

Why most payment systems are designed for demos

Most blockchain systems are optimized for what happens during the transfer.

Confirmations. Speed. Fees. Wallets.

But businesses are not organized around wallets.

They are organized around invoices, approvals, reports, payroll cycles, and reconciliation.

Payments must fit into those workflows without forcing people to think about how the blockchain works.

When a payment requires explanation the next day, trust disappears immediately.

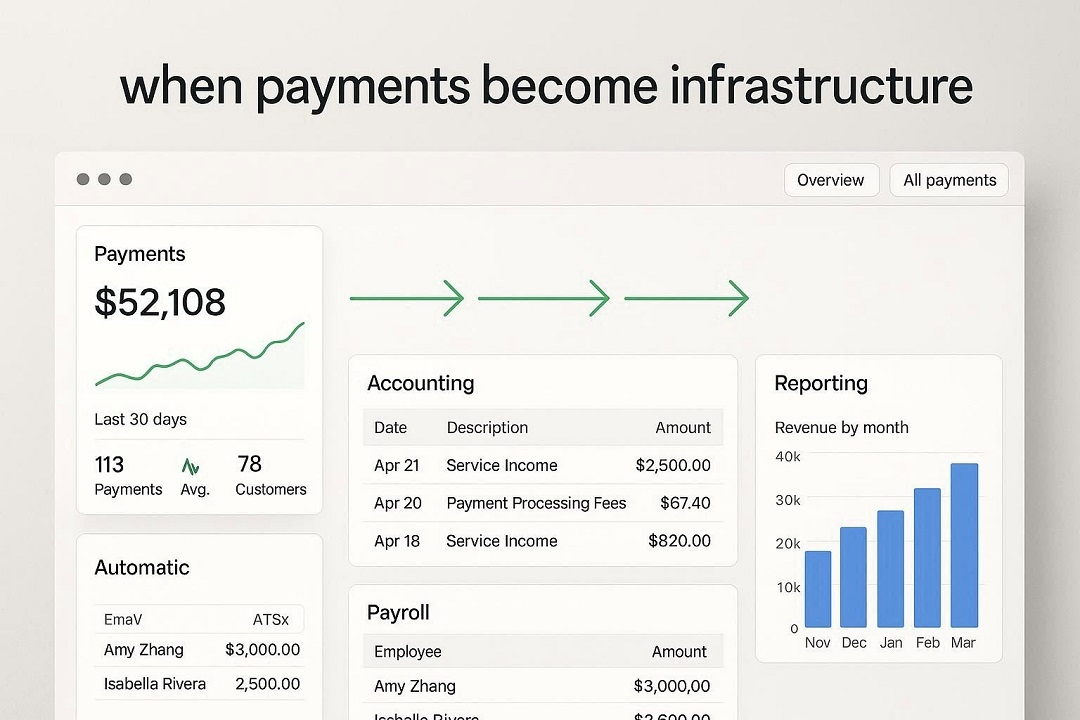

When payments start behaving like settlement

Trust appears when payments stop feeling like crypto transfers and start behaving like settlement actions inside existing tools.

This happens when:

Fees are predictable.

Finality removes doubt.

Transactions are easy to trace.

Financial data is not publicly exposed.

At that point, the question changes from:

“Did the transaction succeed?”

to

“Did this create any work for us today?”

Why this is exactly where Plasma fits

This is the type of problem Plasma is built to solve.

Not by making payments look impressive during the transfer, but by reducing the operational friction that appears after.

Stablecoin-native behavior, zero-fee USDT transfers, custom gas logic, account abstraction, fast finality, and confidential payments all serve one purpose:

Make the day after uneventful.

The conclusion we reached over coffee

The payment didn’t fail yesterday.

The system failed today.

And that is the moment when a payment rail proves whether it works for real businesses or only for demos.