When I try to explain how Plasma is different from other blockchains, I don’t start with buzzwords. I start with a simple question: what would a blockchain look like if it was designed first and foremost for money movement, not for trading, gaming, or meme coins? If you follow that question honestly, you end up with something that looks a lot like Plasma, a network where stablecoins aren’t just supported, they’re the main character.

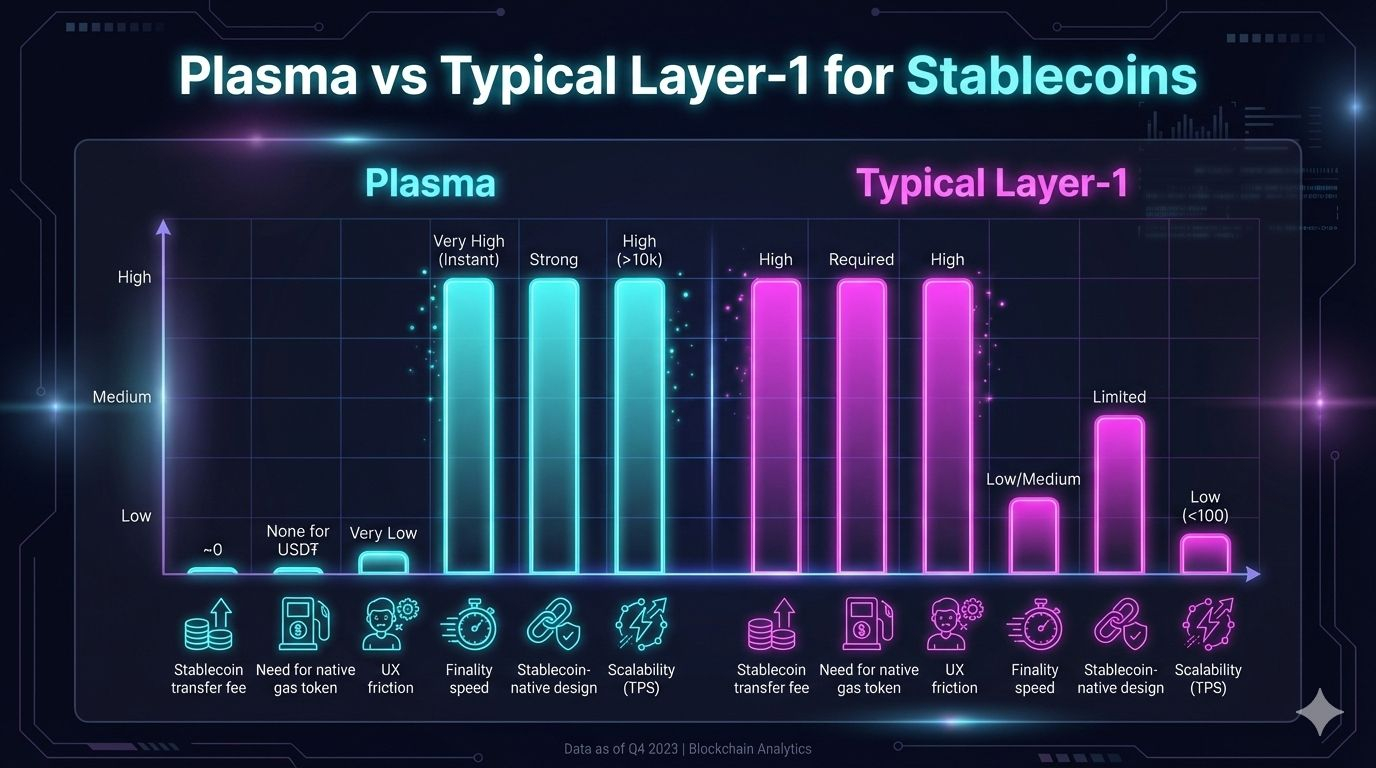

Most blockchains treat stablecoins as one more token in a long list. They support them, of course, but they don’t bend the protocol around them. You still have to hold the native token just to send your “dollars,” fees are denominated in something volatile, and the whole UX feels like it was built for DeFi traders rather than people sending money to family, paying salaries, or moving funds across borders. Plasma’s entire design is a reaction to that. It’s built at the network level to make stablecoins feel like real digital cash, and you can see that in a few key choices: zero-fee USDT transfers, custom gas tokens, and confidential yet compliant transactions, all sitting on top of a high-throughput, security-focused base layer.

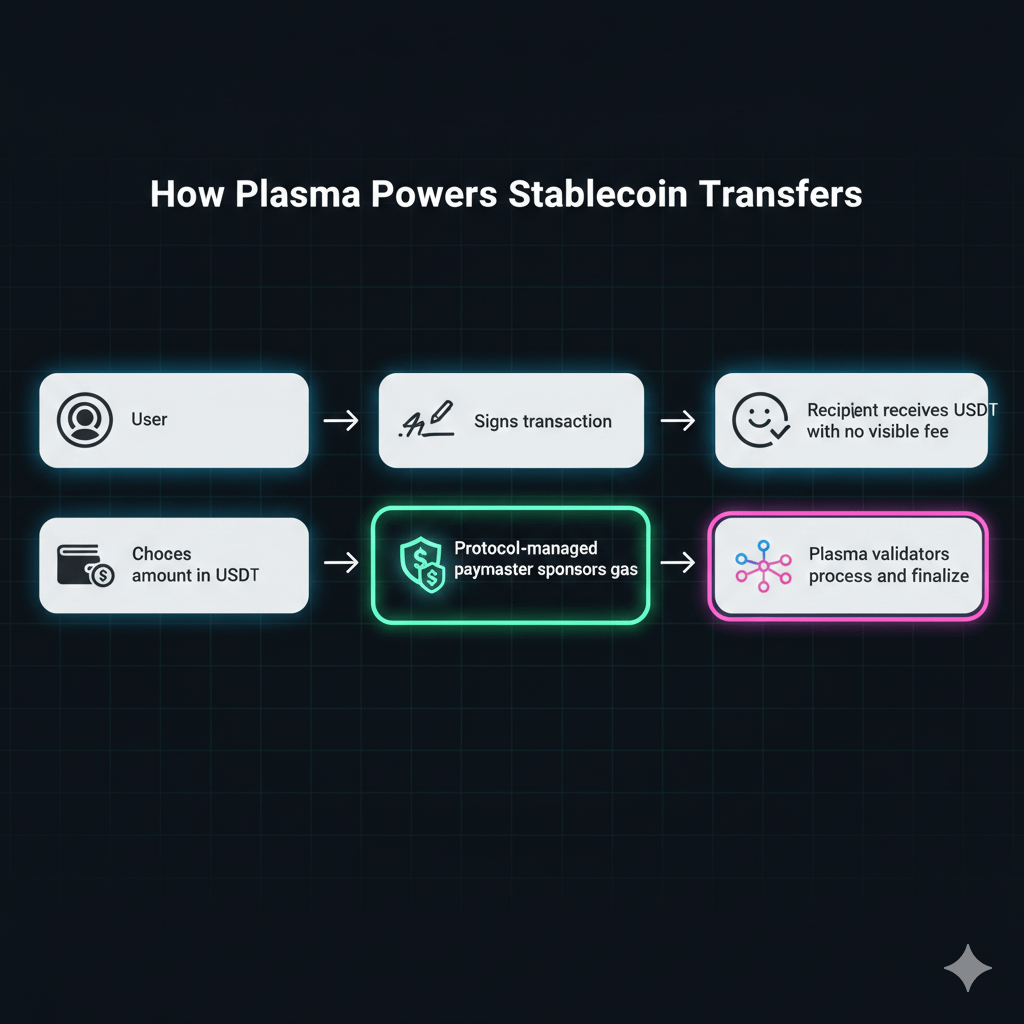

The first big shift is what happens when you actually try to send USDT. On a typical Layer 1, the flow is always the same: get some of the native token, hope gas fees aren’t spiking, pay that fee in a volatile asset, and only then does your stablecoin move. For a lot of people, that’s the exact moment they bounce. It’s confusing to explain why you need Token A just to move Token B, especially when Token B is supposed to represent something stable and familiar, like dollars. Plasma just cuts that knot. At a network level, it supports zero-fee USDT transfers by using a protocol-managed paymaster to sponsor gas. The transaction still consumes gas and validators still get paid, but the user doesn’t see the fee. From their point of view, they’re doing something much more intuitive: “I’m sending USDT,” full stop.

That one design choice changes the economics of everyday usage. Micropayments become realistic because they aren’t drowned by visible fees. Remittances become easier to explain to non-crypto users, because they aren’t forced to understand gas tokens and token juggling. Global money movement starts to feel less like a DeFi ritual and more like using a modern payment rail. Other chains can hack around this with relayers and app-level tricks, but with Plasma it’s part of the chain’s DNA, not a feature bolted on the side.

The second major difference is how Plasma thinks about gas itself. Traditional blockchains are very strict: gas is paid in the native token, end of story. That’s simple at the protocol level but painful at the user level, because it glues every experience, stablecoins included, to the economics of that one volatile asset. Plasma’s view is that this is a UX bug, not a law of nature. It supports custom gas tokens and stablecoin-first gas, which means that in many cases fees can be paid in assets that actually make sense for the user and the application. If a merchant runs on USD₮, if a dApp’s value is denominated in a particular asset, or if a business wants predictable fee accounting, Plasma doesn’t force them into a one-size-fits-all gas model. The network is flexible enough to treat stablecoins as first-class citizens in the fee layer too.

That might sound like a small detail, but it speaks to something deeper: Plasma is designed to align the unit of value, the unit of payment, and the unit of fees as much as possible. Instead of constantly converting between “my money” and “the chain’s money,” users and developers can think in one unit and stay there. In a world where most demand is for stablecoins, not native governance tokens, that feels like a more honest design.

Privacy is another area where Plasma takes a different road. A lot of blockchains sit at one of two extremes: everything is fully transparent forever, or a separate set of heavy privacy tools creates a universe that can be hard to reconcile with compliance. Plasma tries to occupy a more pragmatic middle ground, especially with payments in mind. It offers confidential transactions with the explicit intent of being “confidential, yet compliant.” In practice, that means you can get a degree of transactional privacy that makes sense for businesses and individuals who don’t want their entire financial history to be trivially scraped, but the system is still designed to work with audits, reporting, and regulatory requirements when necessary. For stablecoins that aim to power payroll, remittances, and B2B flows, that combination matters more than extreme anonymity on one side or hyper-transparency on the other.

All of this sits on top of a base layer that is built with stablecoin-scale demand in mind. It’s one thing to pitch yourself as a payments chain; it’s another to actually support the volume that comes with that. Plasma is designed to facilitate thousands of transactions per second, with finality that is fast enough to feel like a real payment system rather than a best-effort settlement layer. That kind of throughput isn’t just a performance flex; it’s a practical requirement if you expect to carry everything from cross-border remittances and real-time micropayments to merchant transactions and on-chain financial flows.

High throughput on its own wouldn’t mean much without strong security assumptions, and that’s another place where the network’s focus on money shows through. When a chain expects to secure serious value, especially a large amount of stablecoins; it has to think very carefully about validator incentives, consensus design, and how much room there is for censorship or rollback. Plasma’s emphasis on robust network-level security reflects that mindset. This isn’t just a playground to try weird ideas; it’s aiming to be infrastructure, something that people and institutions can lean on as part of their actual financial stack.

If you compare this to the usual “everything chain” model, the difference is mostly about priorities. A typical L1 tries to be reasonably good at everything: DeFi, NFTs, gaming, identity, whatever the next trend is. Stablecoins are welcome, but they have to share the stage. Plasma makes a very different bet. It says: stablecoins and global money movement are big enough to justify an entire network designed just for them. That’s why zero-fee USDT transfers aren’t a marketing gimmick, why custom gas tokens aren’t an afterthought, and why confidential-but-compliant transactions are a core design consideration rather than an add-on.

When I describe Plasma in simple terms, I usually put it like this: other chains support stablecoins; Plasma is designed around them. The features that make it stand out—zero-fee USD₮ transfers sponsored at the protocol level, flexible gas that understands stablecoin reality, privacy that fits with compliance, and capacity for thousands of transactions per second with serious security, are all different facets of that same core intention. It’s not trying to be everything to everyone. It’s trying to be the best possible blockchain for moving money, at scale, in a world that increasingly thinks in stablecoins.