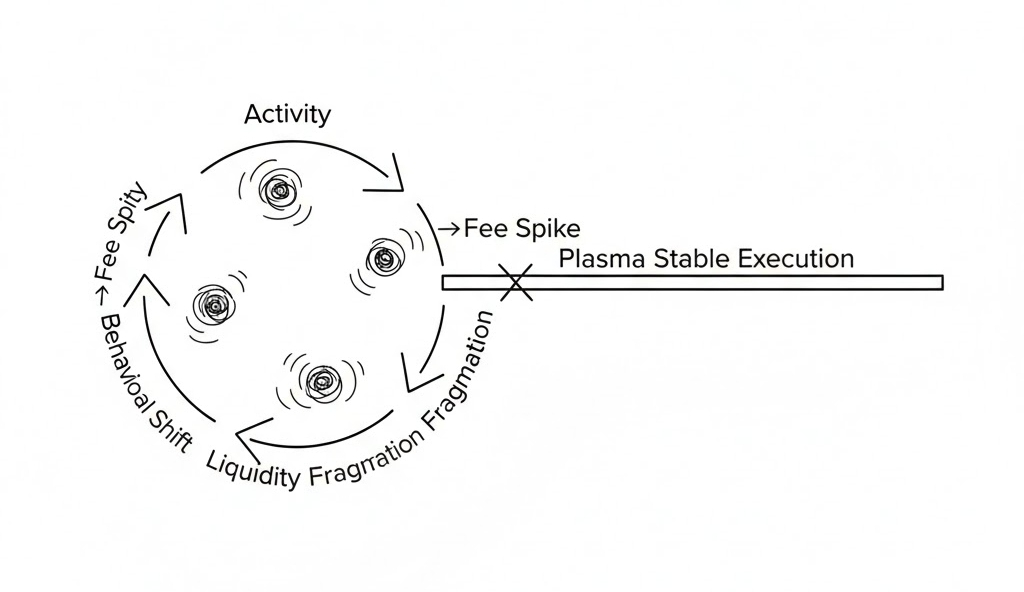

Most blockchains unintentionally amplify reflexivity. When activity increases, fees rise. When fees rise, behavior changes. When behavior changes, liquidity fragments. The system feeds back into itself. Settlement becomes sensitive to its own momentum.

@Plasma interrupts that loop.

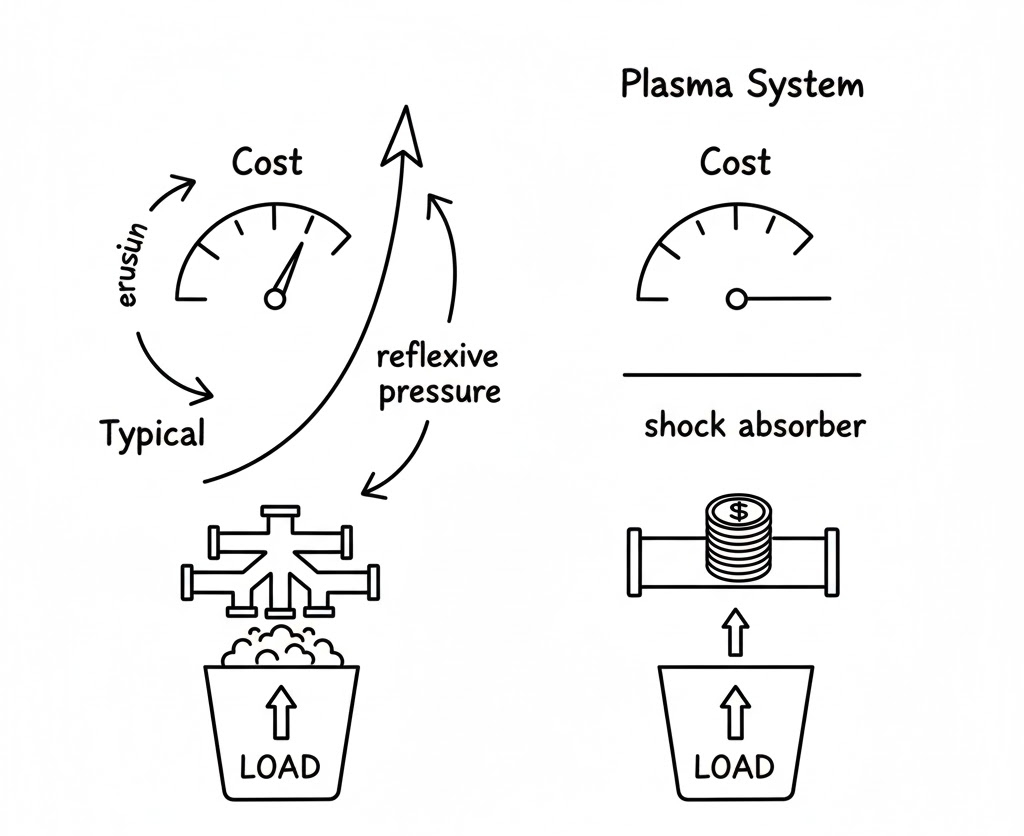

By stabilizing execution around predictable, stablecoin-native flows, it removes one of the primary reflexive triggers: variable cost under load. That matters more than throughput benchmarks. In volatile systems, infrastructure responds to emotion. In constrained systems, infrastructure resists it.

Reflexivity is powerful because it compounds. A surge in demand becomes a pricing spike. A pricing spike becomes strategic delay. Strategic delay becomes liquidity inefficiency. Over time, the network behaves less like a rail and more like a market reacting to itself.

Plasma’s design dampens that internal feedback. Stable execution cost acts like a shock absorber inside the protocol. Activity can increase without immediately converting into economic turbulence at the base layer. This is not about eliminating volatility in assets; it is about preventing volatility from infecting the settlement fabric itself.

Plasma's Security reinforces the suppression. Anchoring to an external neutrality layer limits endogenous manipulation. The chain’s internal state is less susceptible to self-reinforcing pressure cycles.

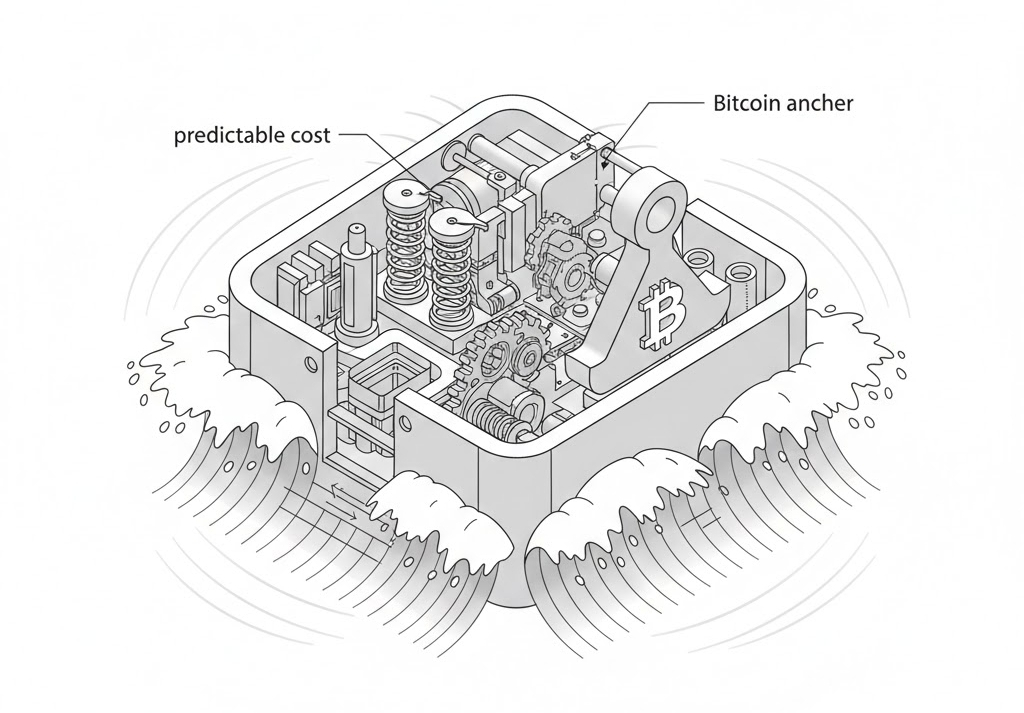

What emerges is a different kind of infrastructure psychology. Participants do not need to anticipate spikes. Applications do not need to hedge against congestion. Settlement stops reacting to itself.

If crypto is to mature into financial infrastructure rather than perpetual reflexive machinery, some chains will need to absorb volatility instead of transmitting it. @Plasma appears architected to do exactly that.