Most traders are watching charts.

Some are watching whales.

Almost no one is watching the real thing that moves markets:

Liquidity.

And between Feb 10 – Feb 12, the U.S. system faces a silent stress test most retail won’t even notice — until it’s too late.

The $125B Shockwave Nobody Is Pricing In

The U.S. Treasury is issuing:

$58B in 3-Year Notes → Feb 10

$42B in 10-Year Notes → Feb 11

$25B in 30-Year Bonds → Feb 12

Total: $125,000,000,000

Settlement date: Feb 17

This isn’t just “routine debt.”

It’s a liquidity vacuum.

What Actually Happens During These Auctions

Let’s simplify it.

When the Treasury sells bonds:

Banks, funds, institutions buy them

They pay in cash

That cash leaves the financial system

Liquidity tightens

Less liquidity = less oxygen for risk assets.

And when oxygen gets thin, risk chokes first.

Why This Isn’t Just Another Auction

Auctions are stress tests.

They reveal the real appetite for U.S. debt.

Two outcomes exist:

Scenario 1: Strong Demand

Auctions clear smoothly

Yields stay stable

Liquidity impact is absorbed

Risk assets breathe

Scenario 2: Weak Demand

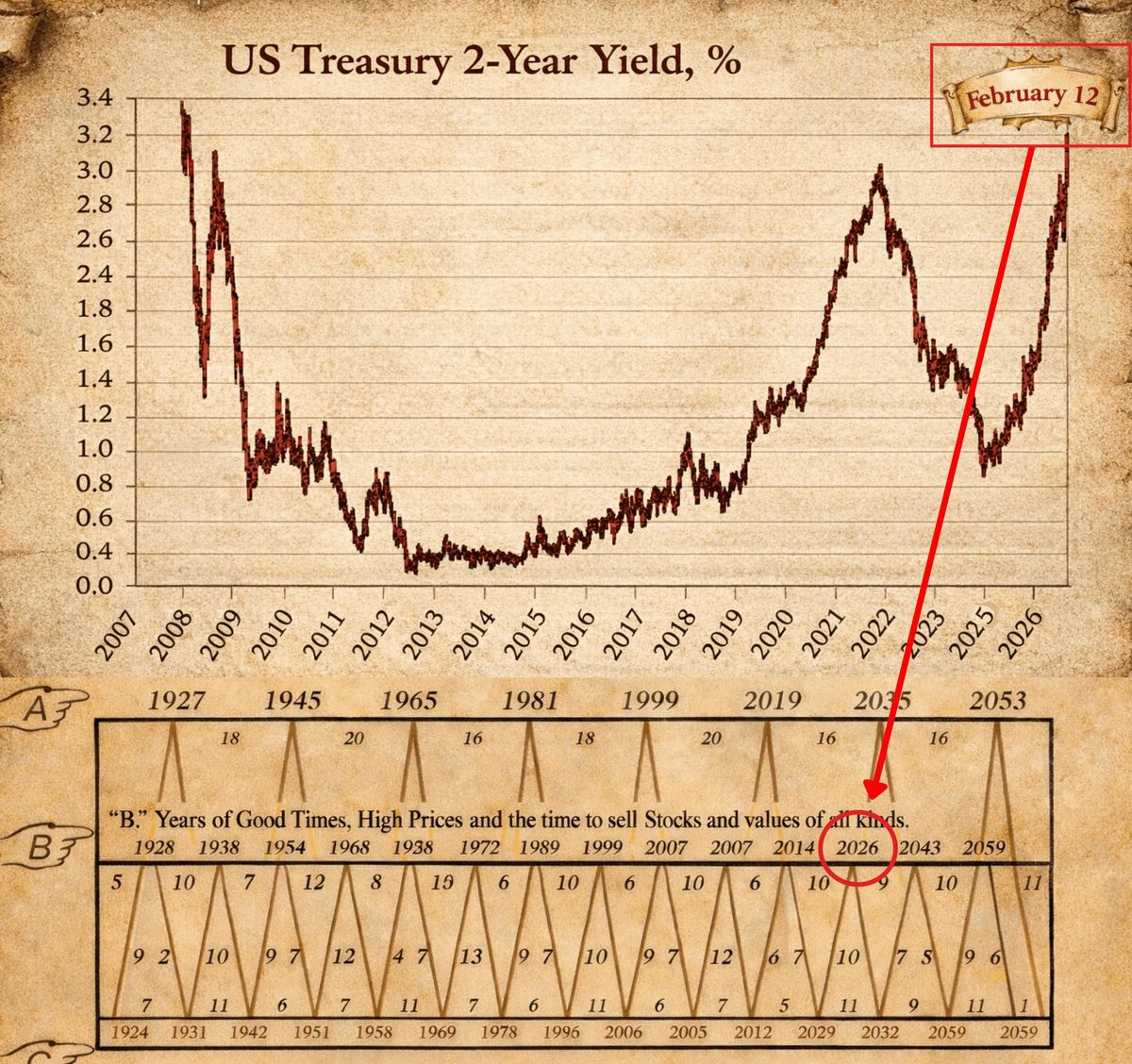

Yields spike

Liquidity tightens aggressively

Financial conditions harden instantly

Selling feeds on itself

And here’s the key:

Bonds move first. Then equities react. Then crypto gets hit hardest — and fastest.

Why This Is Giga Bearish If It Goes Wrong

This isn’t about “new debt.”

The U.S. always issues debt.

This is about timing.

Markets are stretched. Positioning is crowded. Volatility is suppressed. Sentiment is complacent.

Now drop a $125B liquidity drain into that environment.

That’s not neutral. That’s combustible.

Feb 10–12: The Test

Feb 17: The Impact

The auctions happen Feb 10–12.

But the cash leaves the system Feb 17.

That’s when the real tightening hits.

If something breaks, it won’t break during a quiet afternoon.

It’ll break when positioning is heavy and liquidity is thin.

And crypto — being the most reflexive asset class — reacts violently.

Why Crypto Traders Should Care

Crypto doesn’t trade in isolation anymore.

It trades with:

Treasury yields

Dollar strength

Liquidity flows

Risk appetite

When liquidity expands, crypto flies.

When liquidity contracts suddenly, crypto gets nuked.

If auctions are weak and yields spike:

Equities wobble

Leverage unwinds

Crypto sees forced liquidations

It’s not theory.

It’s how modern markets are wired.

The Trap

The real trap?

Charts look fine.

BTC structure looks constructive.

Alts are stabilizing.

Volatility is low.

That’s exactly when macro shock hurts the most.

Because no one is positioned for it.

What Smart Traders Watch

Instead of guessing tops and bottoms, watch:

Auction bid-to-cover ratios

Indirect bidder participation

Yield tail vs when-issued levels

Dollar index reaction

10Y yield behavior

If yields jump and the dollar rips, liquidity just tightened.

And risk assets won’t ignore that.

This Is Not Fear — It’s Awareness

Maybe auctions clear cleanly. Maybe demand is strong. Maybe yields stay calm.

If so, risk assets likely continue higher.

But if they don’t?

The move won’t be gentle.

And crypto won’t get a warning candle.

It’ll get a cascade.