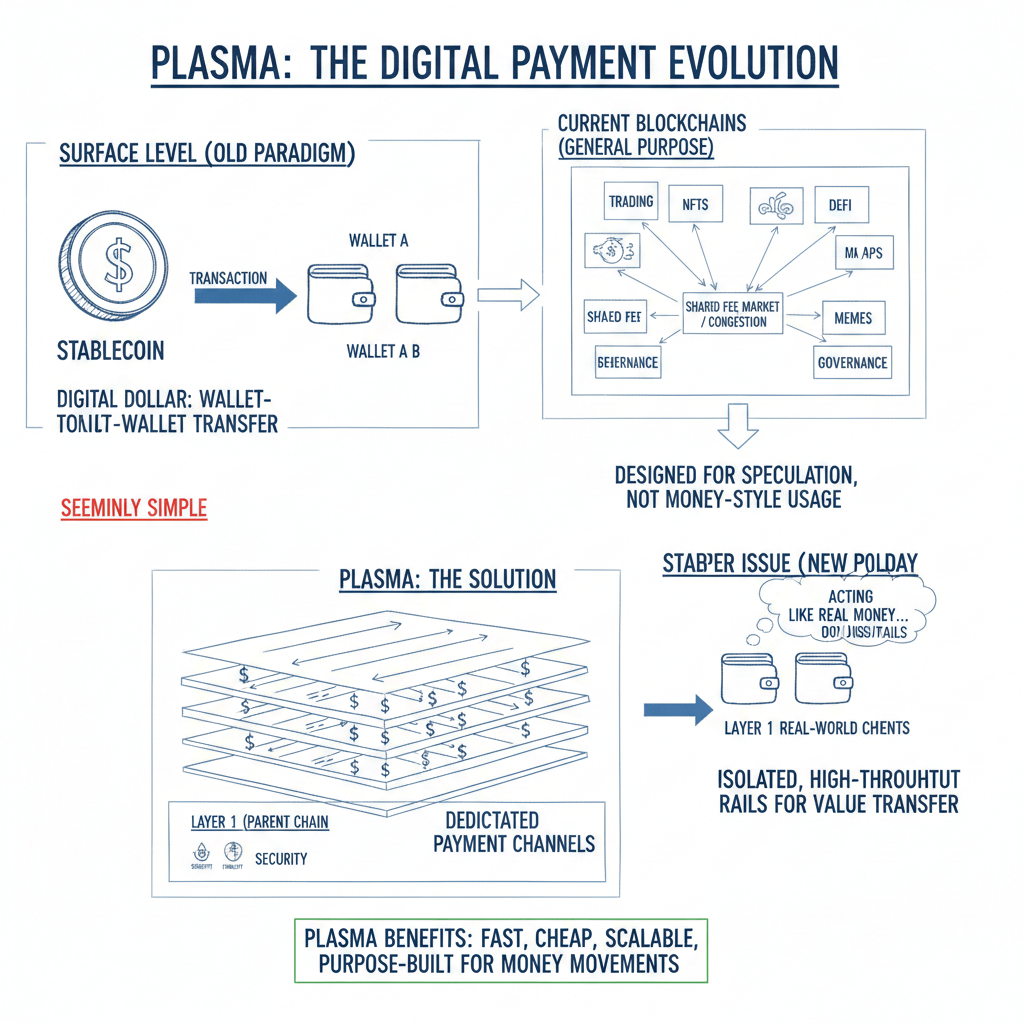

Plasma look like the simplest thing in crypto. A digital dollar moves from one wallet to another, and it feels like we already have the answer to payments. That surface level view is exactly why most investors miss the deeper issue. Stablecoins are acting more and more like real money, but they are still forced to run on rails that were not designed for money style usage. Most chains were built to serve everything at once trading, tokens, apps, memes, NFTs, governance, all competing for the same space and the same fee market. That design works when the main activity is speculation. It becomes inefficient when the main activity becomes stable value moving constantly, at high volume, with real world expectations.

The structural pain point is not just fees being high sometimes. The real pain point is that stablecoin settlement is not treated as a primary workload. When stablecoins become a daily tool for remittances, merchant payments, payroll, and treasury flows, the system needs to behave like a utility. Predictable cost, predictable finality, and a predictable experience for people who do not want extra steps. Right now, stablecoins are still living in an environment where everything around them pushes in the opposite direction.

One of the most overlooked frictions is the native token requirement. On many networks, you can hold USDT and still be unable to send it because you do not have the networks gas token. That sounds small until you imagine it at scale. A merchant accepts stablecoins but now must hold a volatile asset only to move their stable balance. A retail user receives USDT but gets stuck because they cannot pay gas. A payment app tries to hide it with a relayer or paymaster, but then the app is quietly subsidizing users, managing inventory, monitoring abuse, and dealing with unpredictable conditions. What looks like a simple transfer becomes a full operational system behind the scenes.

Then there is fee unpredictability. Even if the network is cheap, fees priced in a volatile token create a constant pricing problem. A stablecoin is meant to be stable, but the cost to move it fluctuates with the token market. That forces wallets and payment services into constant recalculation, and it forces businesses into hedging behavior they never wanted. In payments, this is not just annoying, it becomes a planning issue. If you cannot forecast the cost of settlement, you cannot comfortably build products around it.

Another layer most people do not see is fragmentation. Stablecoins exist on many chains, and that sounds like expansion, but it also splits liquidity and splits settlement routes. To move stable value across the ecosystem, you often need extra hops bridges, wrappers, swaps, relayers, routing decisions. Every hop adds cost, time, and risk. Over time, the industry ends up rebuilding the same plumbing again and again, because each wallet or payment provider has to create custom logic for routing, sponsorship, monitoring, and settlement assurance. This is the hidden tax that slows the adoption curve. It is not exciting, but it is the reason why stablecoin payments still feel inconsistent depending on where and how you use them.

Over the next three to five years, this mismatch is going to matter more than any marketing story. Stablecoins are already used heavily inside crypto, but the next wave is stablecoins being used as everyday money tools in high adoption markets and as settlement tools for businesses and institutions. When usage gets heavier and more mainstream, the market stops caring about chains that can do everything and starts caring about rails that behave the same way every day. Payments always compress toward reliability. The rails that win are the ones that reduce failure points, reduce hidden dependencies, and reduce integration cost.

This is where Plasma is trying to solve something quietly. The angle is not just that it is fast or cheap. The angle is that it is being built around stablecoin settlement as the main job. It is EVM compatible so builders do not need to relearn everything, but the bigger point is that it introduces stablecoin first behavior at the base layer. That means designing the chain so stable value movement does not require users to manage a separate volatile token in the normal flow, and so the fee model can be expressed in stable terms instead of volatility terms.

If stablecoin transfers can be gasless for certain direct flows, that changes onboarding completely. The user only needs the stablecoin they already have. The merchant only deals with stable value. The wallet does not have to constantly rescue users from gas problems. This is not a small improvement, it removes a recurring friction that kills payment funnels.

If fees can be paid in stablecoin terms, that changes product design. Payment apps can show costs clearly. Businesses can forecast settlement costs. Providers can price services without constantly reacting to token volatility. That kind of predictability is what lets payments infrastructure scale.

Fast finality matters too, but not as a hype stat. It matters because payments need a clean moment when funds are final. When settlement is consistent and quick, you can build user experiences that feel normal and business processes that feel safe. Without that, you end up with delays, retries, support tickets, and risk buffers. Those are the boring problems that decide whether a rail becomes a utility.

If Plasma succeeds, it will not be because it shouts the loudest. It will be because it makes stablecoin movement feel boring and dependable. That is what payment rails always become when they win. People stop thinking about the chain and just trust the transfer.

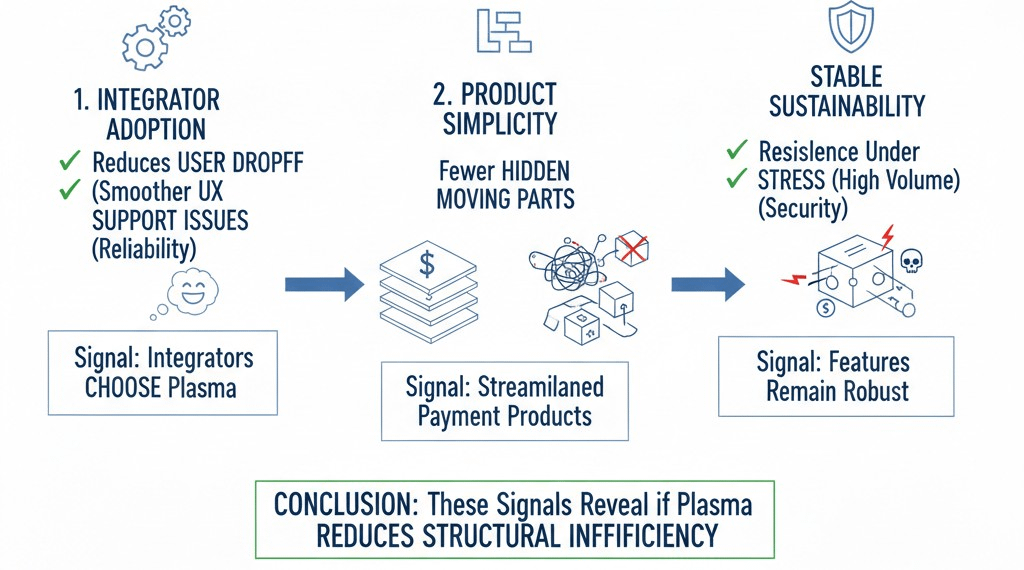

The best way to evaluate this is not by narratives. It is by watching whether integrators choose it because it reduces user drop off and support issues, whether payment products can operate with fewer hidden moving parts, and whether stablecoin native features remain sustainable under stress and abuse attempts. Those signals reveal whether the chain is actually reducing the structural inefficiency that most investors do not see yet.

Plasma The quiet takeaway is simple. Stablecoins are growing into a real money layer, but the current infrastructure forces them to behave like a token inside a speculative environment. That creates hidden costs in onboarding, fee predictability, settlement certainty, and routing complexity. Those costs will matter more as stablecoins expand into daily payments and institutional settlement. Plasma is trying to remove that compounding friction by treating stablecoin settlement as the main workload and building stablecoin native behavior into the base layer.