lands because it speaks to something everyone in crypto has felt in their bones: stablecoins are the most used product in the market, yet moving them can still feel weirdly 2017. You can trade perps at millisecond speed, but then you send USDT and you’re back to worrying about fees, confirmation times, and whether your app integration is going to break the moment the network gets busy. Plasma is trending because it’s built around that exact contradiction optimize the chain for stablecoins first, and let everything else be secondary.

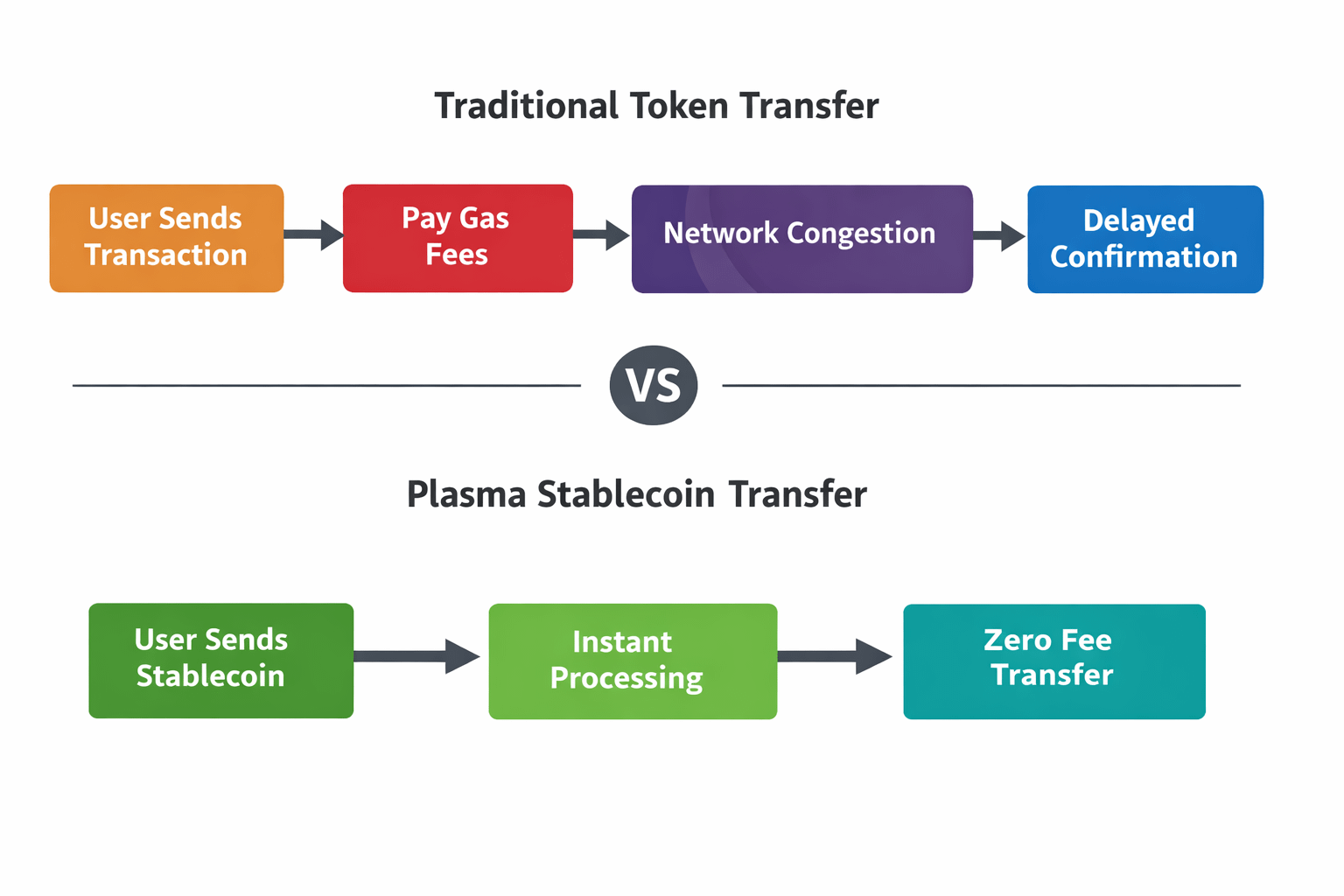

A quick translation for anyone who doesn’t live in protocol docs: Plasma positions itself as a purpose built Layer 1 for stablecoin payments, with the headline promise of near instant transfers and effectively “zero fee” USDT movement during its initial rollout. A Layer 1 just means it’s its own base blockchain (not a dapp, not an add on), and the reason that matters is control. When a chain is designed for general computation, stablecoin transfers compete with everything else for blockspace. When it’s designed around payments, the defaults fee mechanics, throughput targets, wallet UX assumptions can be tuned for “send dollars, fast.” Plasma also leans into EVM compatibility, which is developer speak for “if you already build on Ethereum style tooling, you won’t feel like you’re learning a completely alien stack.”

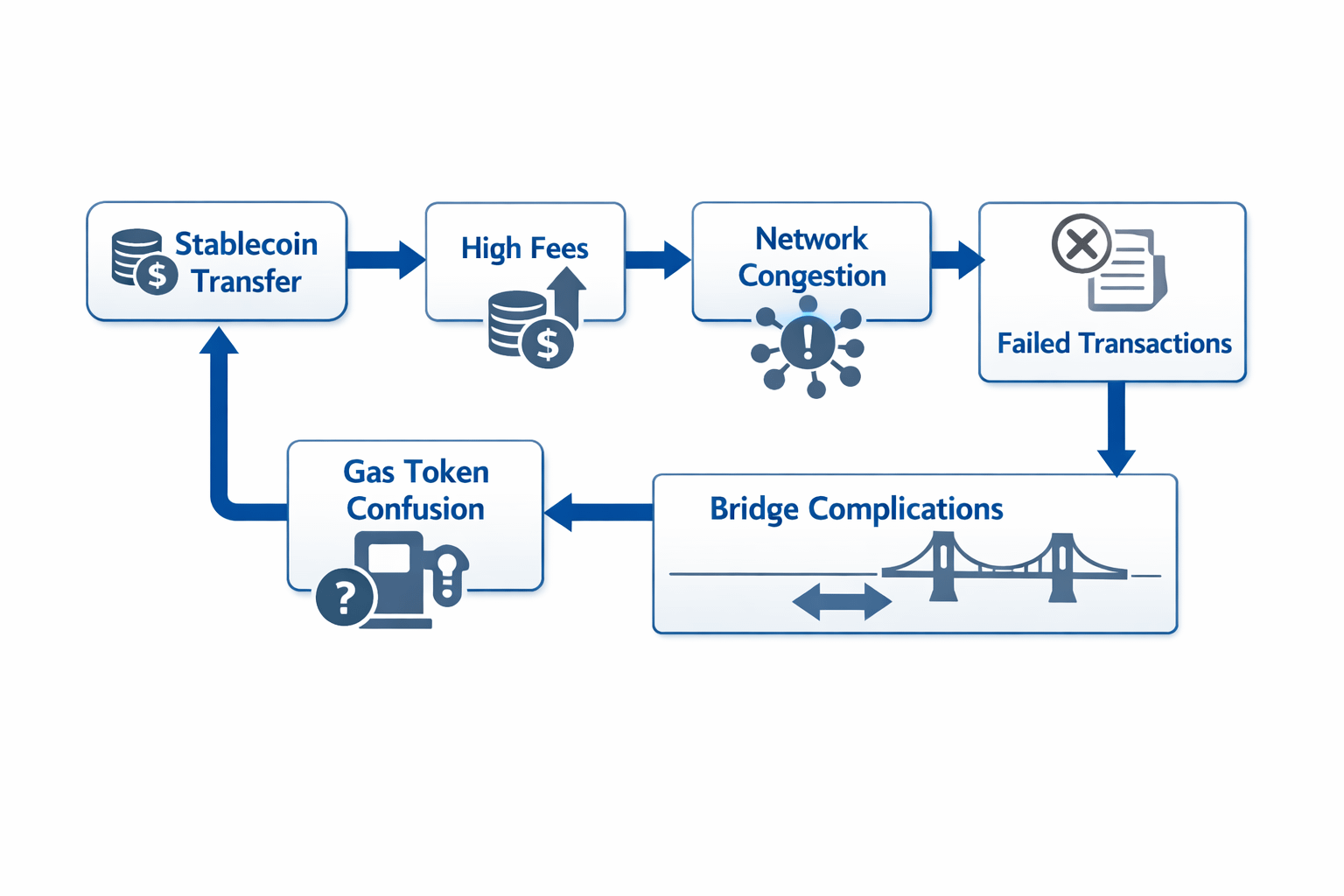

The developer pain point here is real and surprisingly under-discussed outside of builder circles. If you’ve ever shipped a stablecoin-heavy product payouts, remittances, merchant settlement, game economies you know the friction rarely comes from writing the smart contract. It’s everything around it: fee sponsorship, failed transactions during congestion, users confused by gas tokens, and the endless edge cases when you’re bridging assets across networks. Plasma’s narrative is that you reduce that surface area by making stablecoin transfer the “happy path.” Even if you don’t buy every claim, the direction is clear: strip complexity away until sending a dollar on-chain feels like sending a message.

The timeline matters because “fast and cheap” is promised by everyone. Plasma has put concrete milestones on the board. Its public testnet went live on July 15, 2025, framed as the first public release of the core protocol and a step toward mainnet beta, with developers invited to deploy and run infra. Then the project drew broader market attention in late July 2025 after a public token sale reportedly closed with $373 million in commitments against a $50 million target numbers that, love them or hate them, signal real demand for stablecoin rails as a category. And by September 2025, multiple outlets were reporting a mainnet beta launch date of September 25, with claims that the network would debut with more than $2 billion in stablecoin liquidity and enable zero-fee USDT transfers in the initial rollout.

As a trader, I look at this less like “new chain, new token” and more like a bet on flow. Stablecoins are the plumbing of crypto. They’re how traders rotate risk, how funds rebalance, how market makers settle, how people in high-inflation economies hold purchasing power, and how OTC desks move size without spooking the order book. If you reduce transfer friction, you don’t just make payments nicer you potentially change behavior. People rebalance more often. Arbitrage tightens faster. Smaller transfers become viable. The market becomes, in a subtle way, more liquid because the cost of moving value drops.

But it’s also fair to ask the skeptical questions. “Zero fees” rarely means “zero cost.” It usually means the cost is paid somewhere else: subsidized by the protocol early on, offset by another revenue line, or shifted to validators in a different incentive design. Plasma’s reported approach includes a consensus layer optimized for stablecoin transactions (often described as PlasmaBFT), plus a broader plan to monetize higher value services once the base transfer rail attracts volume. That’s not automatically good or badbit’s just the economic reality of running a chain. Traders should care because sustainability determines whether today’s cheap rail becomes tomorrow’s congested toll road.

So why is it catching attention now? Because stablecoin adoption keeps marching forward regardless of market cycles, and the industry is finally treating stablecoin movement as its own product category rather than a side effect of DeFi. Plasma’s progress from testnet in mid-2025 to mainnet beta in late 2025, plus the scale of fundraising and liquidity claims gives the “stablecoin native chain” idea enough substance that builders can actually test it instead of arguing on timelines. If you’re a developer, the question is simple: does it reduce the number of moving parts you have to duct tape together to ship a stablecoin app? If you’re a trader or investor, the question is just as clean: does faster, cheaper stablecoin settlement meaningfully increase flow and retention, or does it end up as another fragmented venue? Either way, this is one of the few narratives that’s anchored in a real daily annoyance—and that’s usually where the lasting infrastructure plays come from.