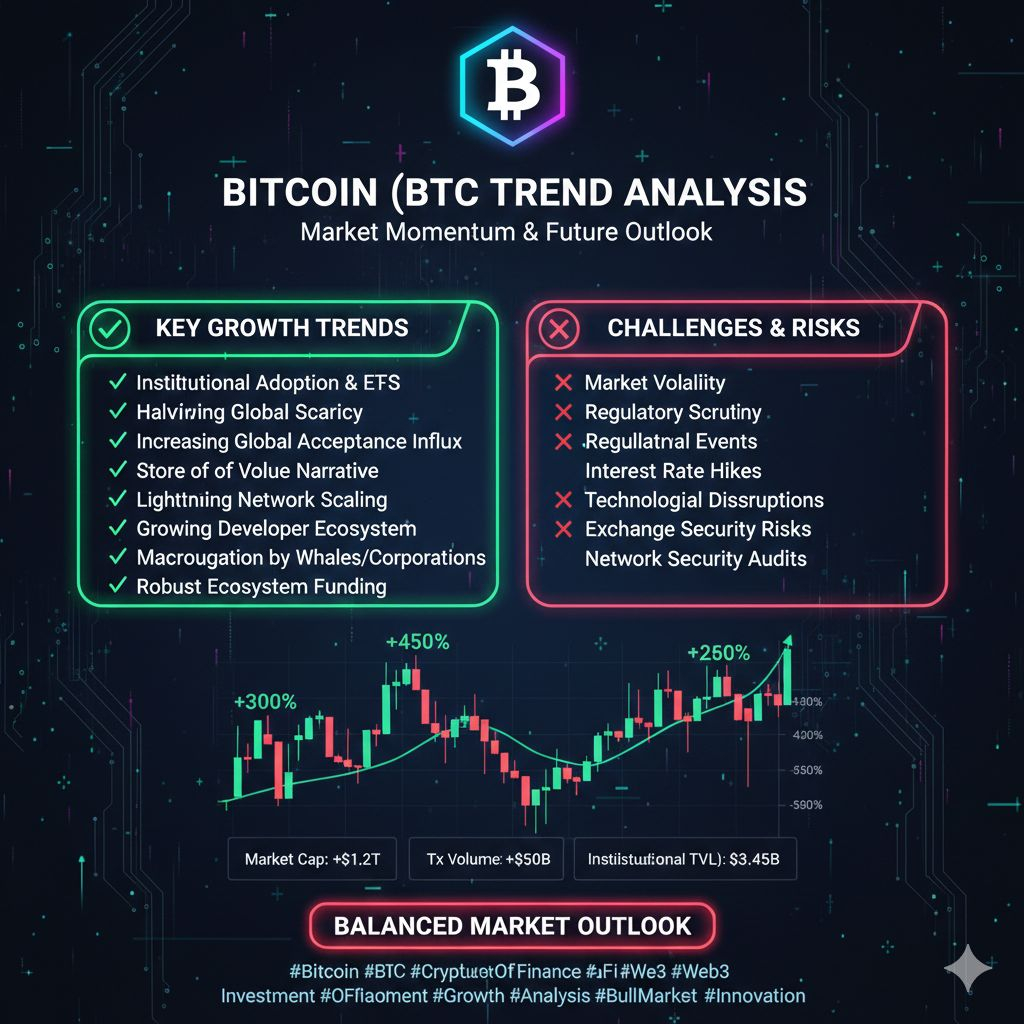

$BTC remains the original and most dominant cryptocurrency, often seen as digital gold. Its scarcity, with a capped supply of 21 million coins, gives it a strong store-of-value narrative that attracts both retail and institutional investors. As regulations mature and more funds, corporations, and even countries consider Bitcoin exposure, its long-term demand could stay strong.

Looking ahead, Bitcoin is likely to benefit from continued adoption as a hedge against inflation and financial uncertainty. As traditional finance integrates with digital assets, Bitcoin’s role as a reserve asset in crypto portfolios may increase. Halving events, which cut miner rewards and slow supply growth, have historically supported price appreciation in past cycles.

In the short term, Bitcoin can be volatile and influenced by macroeconomic trends, interest rate shifts, and global risk sentiment. But over the long run, its network security, growing institutional interest, and strong brand make it an attractive asset for long-term investors. Always do your own research and think long term when evaluating Bitcoin.