1. VanarChain Kya Hai aur Kyu Bana Hai

Aaj kal crypto space me har project apne aap ko next big thing bolta hai, lekin VanarChain ko samajhne ke liye hype side me rakhna zaroori hai. Main yaha simple words me explain kar raha hu ki VanarChain ka whitepaper kya bolta hai, iska VANRY token kaise kaam karta hai, AI ka role kya hai, aur scalability, governance, staking rewards aur risks ka real scene kya hai. VanarChain basically ek Layer 1 blockchain hai jo focus karta hai real-world utility, entertainment ecosystem, gaming aur digital asset economy par. Ye EVM compatible hai, matlab Ethereum wale smart contracts yaha easily deploy ho sakte hain without major changes. Iska main goal hai fast transactions, low fees aur developers ke liye practical environment create karna.

2. Technology, Scalability aur Eco-Friendly Model

Whitepaper ke according, VanarChain Proof-of-Stake (PoS) mechanism use karta hai. PoS ka matlab hota hai mining nahi, balki validators apne tokens stake karke network secure karte hain. Isse energy consumption kaafi kam hoti hai compared to Proof-of-Work chains jaise Bitcoin. Scalability ke liye network high throughput architecture design karta hai jisse zyada transactions per second handle kiye ja sake. Faster finality aur low latency ka target rakha gaya hai, jo gaming aur AI based applications ke liye important hota hai. Eco-friendly point of view se dekhe to PoS model electricity usage ko reduce karta hai, lekin overall impact depend karta hai infrastructure kis energy source par chal raha hai.

3. VANRY Token ka Real Use Case

VANRY network ka native utility token hai. Iska main use transaction fees dena, staking karna aur governance voting me participate karna hai. Agar koi validator banna chahta hai ya kisi validator ko support karna chahta hai, to wo VANRY stake kar sakta hai. Staking rewards milte hain jo network activity aur total staked amount par depend karte hain. Ye guaranteed fixed return nahi hai. Reward rate time ke saath change ho sakta hai. Isliye sirf high APY dekhkar invest karna safe strategy nahi hoti.

4. Governance System aur Decision Making

VanarChain me governance token based hai. Jitne zyada tokens hold ya stake karte ho, utni voting power mil sakti hai. Governance proposals me network upgrades, fee structure changes, ecosystem grants jaise decisions include ho sakte hain. Theory me ye decentralized model hai jaha community vote karti hai. Lekin practical level par agar tokens kuch limited wallets me concentrated ho jaye, to decision making centralized ho sakti hai. Ye risk almost har PoS governance model me hota hai.

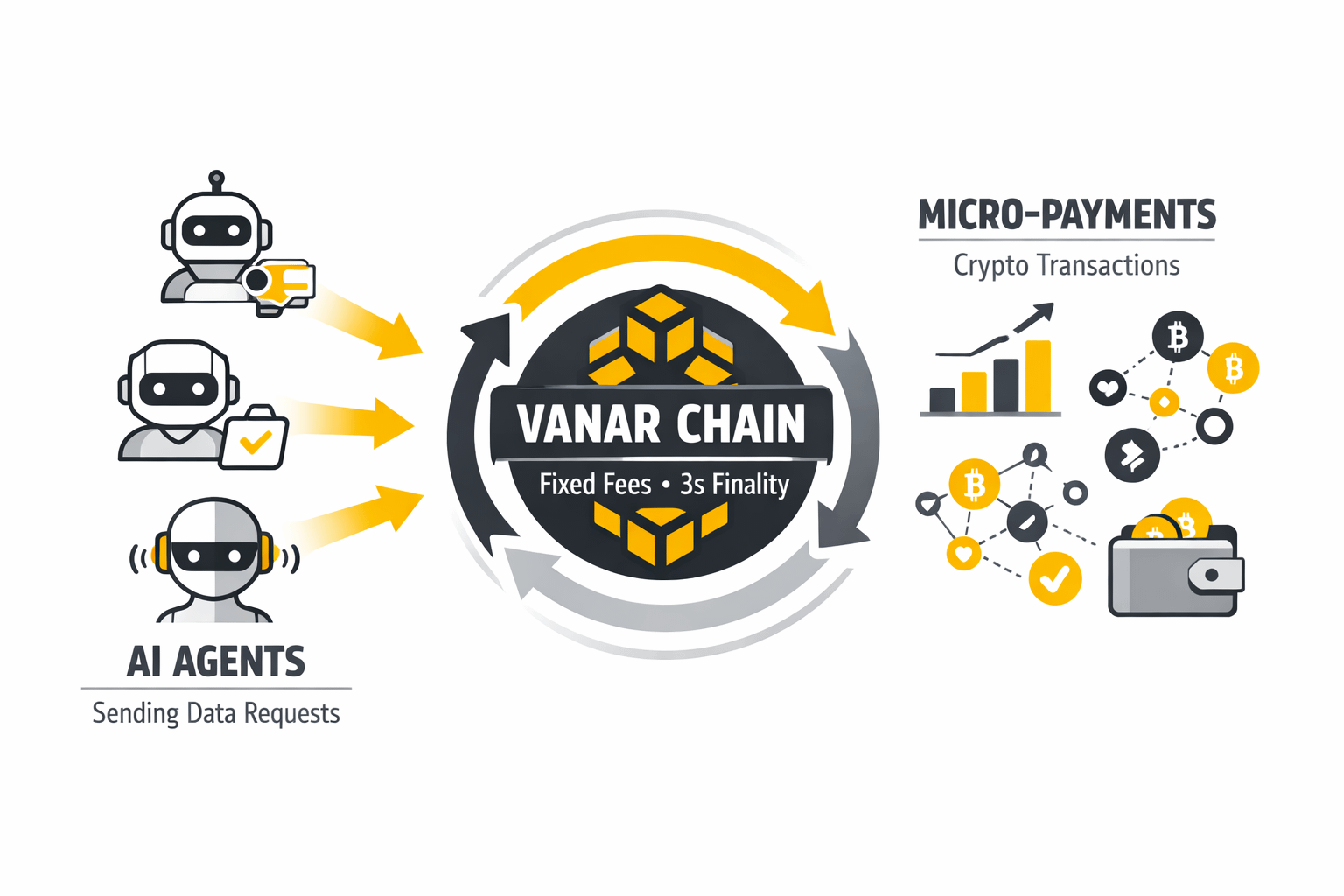

5. AI Integration aur AI Agents ka Role

VanarChain ka interesting part AI integration hai. AI agents ka use automated monitoring, fraud detection, data analysis, gaming logic aur personalized user experience me ho sakta hai. Example ke liye AI agent suspicious transactions detect kar sakta hai ya ecosystem data analyze karke optimization suggestions de sakta hai. AI + blockchain combination theoretically powerful hai kyunki smart contracts automation provide karte hain aur AI intelligence add karta hai. Lekin abhi AI integration early stage me hi mana jata hai aur real impact adoption par depend karega.

6. Smart Contracts aur Security Aspect

VanarChain EVM compatible hone ki wajah se Solidity based smart contracts support karta hai. Developers Ethereum tools jaise MetaMask, Remix ya Hardhat use kar sakte hain. Smart contracts automated agreements hote hain jo predefined conditions par execute hote hain. Gaming assets, NFTs, staking pools aur governance voting sab contracts ke through manage hote hain. Lekin smart contract bugs ka risk rehta hai. Agar contract audited na ho ya coding error ho, to funds ka loss ho sakta hai. Isliye security audits aur transparency important factor hai.

7. Risks, Research aur Official Sources

Har crypto project me risk hota hai aur VanarChain bhi exception nahi hai. Token price volatility, regulatory uncertainty, adoption challenges aur technical vulnerabilities sab possible risks hain. Staking me bhi slashing ya validator risk ho sakta hai. Isliye investment se pehle whitepaper khud padna zaroori hai. Authentic information ke liye official websites jaise vanarchain.com aur vanry.io check karna chahiye. Fake links aur unofficial sources se hamesha bachna chahiye. Overall project ka concept strong lag sakta hai, lekin long-term success depend karega adoption, transparency aur consistent development par.

Disclaimer:Ye post sirf educational purpose ke liye hai, financial advice nahi hai. Crypto investments high risk hote hain, apni research karo aur sirf utna invest karo jitna lose kar sakte ho.