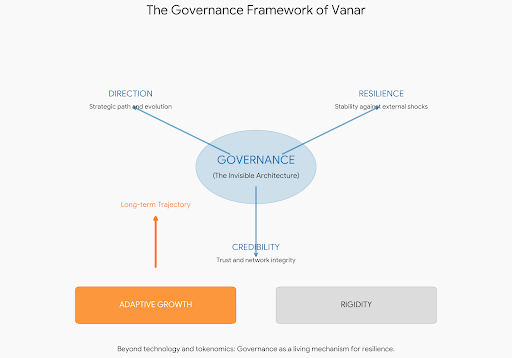

When I think about Vanar’s long-term trajectory, I don’t just focus on technology or token performance. I focus on governance. For me, governance is the invisible architecture that determines whether a blockchain remains adaptive or becomes rigid over time. In Vanar’s case, I see governance not as a symbolic feature, but as a living mechanism that can directly influence the network’s direction, resilience and credibility.

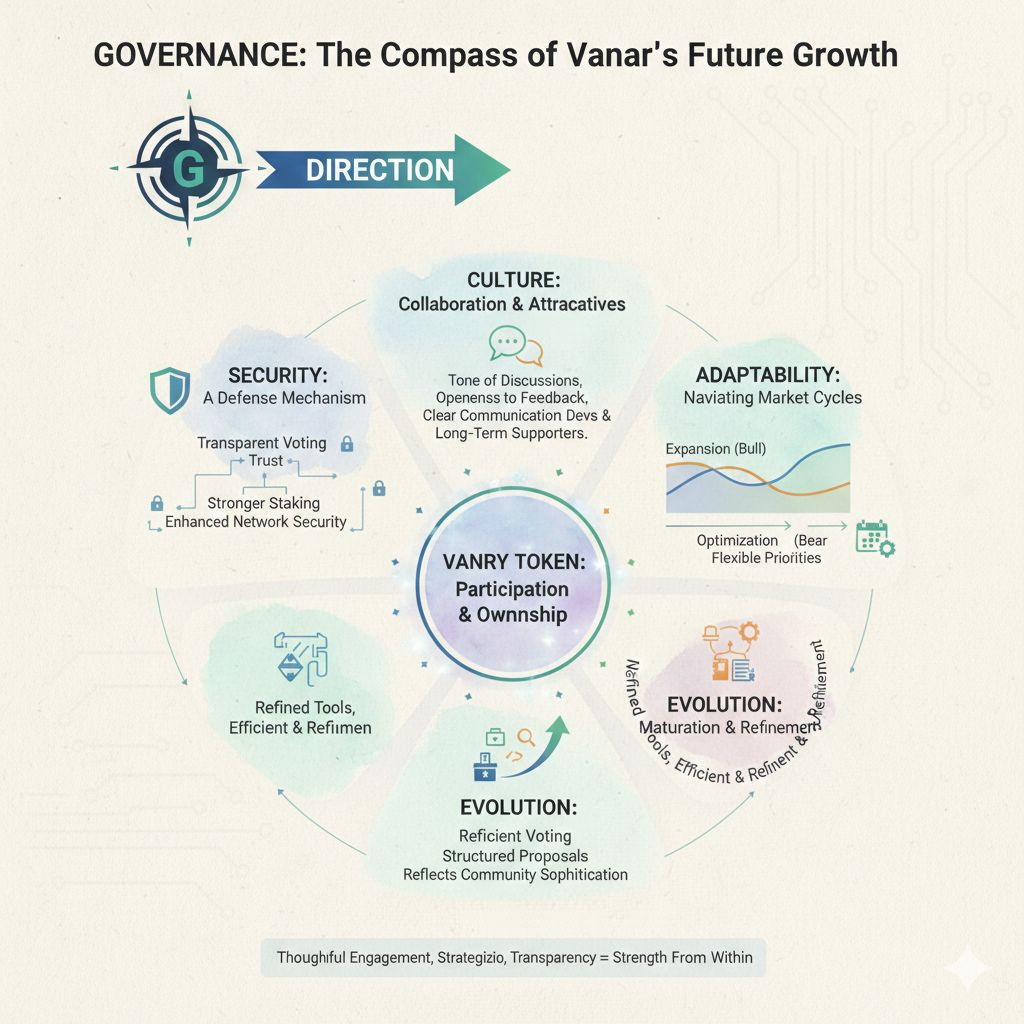

What stands out to me is how governance creates alignment. VANRY is not just a utility token circulating in markets; it represents participation. When token holders are given the ability to vote on proposals, upgrades, or ecosystem initiatives, the network shifts from being developer-led to community-shaped. That shift is powerful. It creates a sense of ownership that goes beyond speculation.

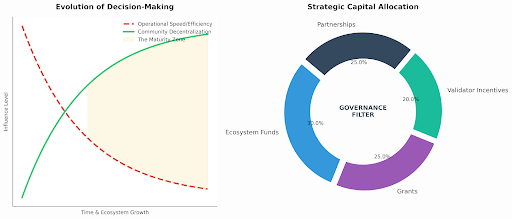

In many emerging ecosystems, decisions are often centralized in early stages for efficiency. I understand why that happens. Speed matters during growth. But over time, decentralization of decision-making becomes essential. If Vanar continues expanding its governance framework, it can distribute influence gradually while maintaining strategic clarity. That balance between coordination and decentralization is what I believe will define its maturity.

Governance also influences capital allocation. Ecosystem funds, grants, validator incentives, and strategic partnerships are not neutral decisions. They shape which sectors grow fastest within the network. If the governance process allows thoughtful evaluation of proposals, Vanar can channel resources into areas that strengthen its core identity rather than dilute it. In my view, smart governance is strategic capital management at scale.

Another dimension I consider is security. Governance is often seen as a growth tool, but I see it equally as a defense mechanism. Transparent voting systems, clear proposal structures, and accountable validators reduce uncertainty. When participants understand how decisions are made, trust increases. Trust strengthens staking participation, and stronger staking enhances network security. It becomes a reinforcing loop.

I also believe governance shapes culture. The tone of discussions, the openness to feedback, and the clarity of communication all influence how newcomers perceive the ecosystem. If Vanar fosters constructive governance participation, it can attract developers and long-term supporters who value collaboration over noise. Culture compounds just like technology does.

Market cycles will test every Layer-1, including Vanar. During bullish phases, governance might focus on expansion, partnerships, and scaling initiatives. During slower periods, it may shift toward optimization and sustainability. The flexibility to adapt priorities through community-driven mechanisms ensures that the network does not become trapped in outdated strategies. That adaptability is, to me, a key indicator of long-term viability.

What excites me most is the potential for governance to evolve. As participation grows, tools can become more refined, voting mechanisms more efficient, and proposal systems more structured. Governance does not need to remain static. It can mature alongside the ecosystem, reflecting the increasing sophistication of its community.

Ultimately, I see governance as the compass of Vanar’s future growth. Technology builds the roads, liquidity fuels movement, and applications attract users but governance decides the direction. When token holders engage thoughtfully, when proposals are evaluated strategically, and when transparency remains a priority, the ecosystem strengthens from within.

For me, Vanar’s future will not be determined solely by market conditions or external narratives. It will be shaped by how effectively its community uses governance to align incentives, allocate resources, and guide innovation. If that alignment continues to deepen, then growth will not just be rapid it will be sustainable.