The cryptocurrency market is currently navigating a period of intense volatility, and Solana $SOL is sitting at the heart of the storm. As of today, February 12, 2026, the live price of Solana is approximately $80.67.

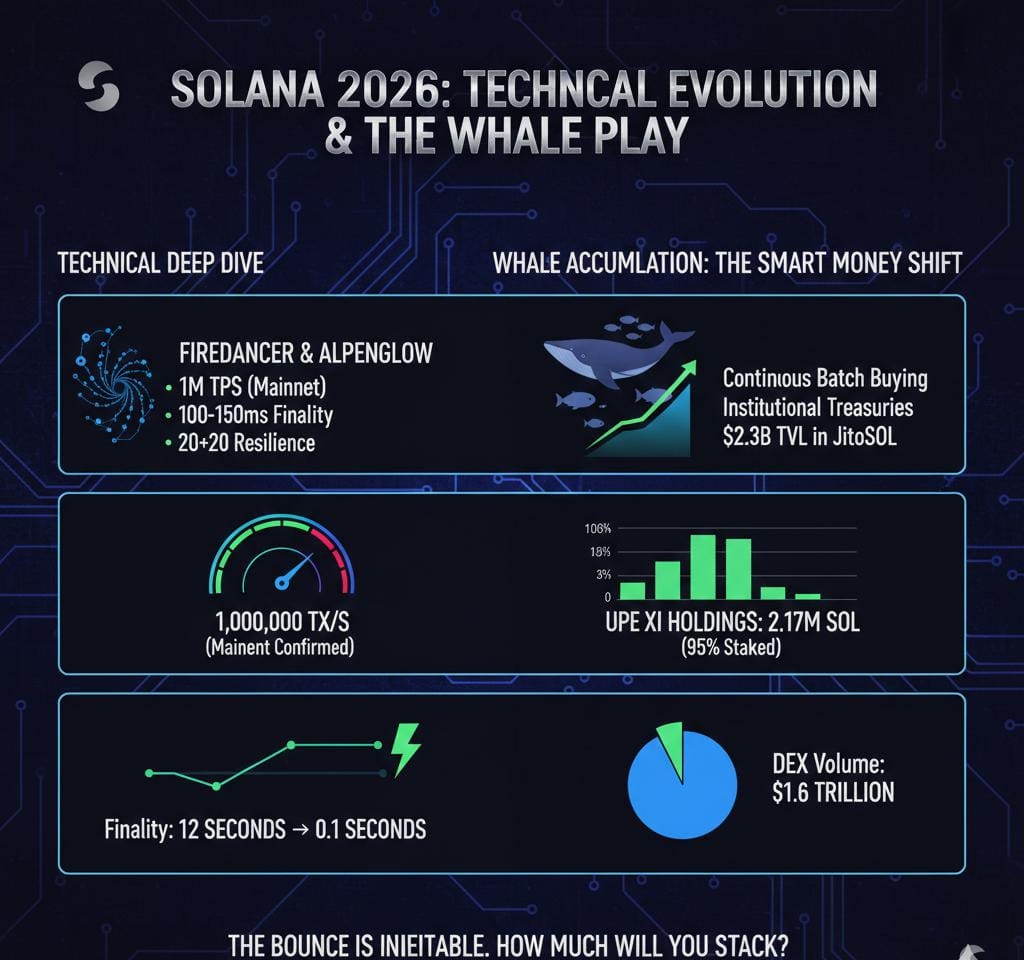

While the headline price shows a significant retracement from previous highs, the surface-level panic hides a much more powerful reality. You have Solana fundamentals soaring to all-time highs while low IQ market participants sell the bottom. Analysing the imminent completion of the Firedancer upgrade which processed 1 million transactions per second in testing to the upcoming Alpenglow consensus protocol, the network's technical infrastructure has never been more robust.

The Map to Recovery: $SOL Levels are Set

Technical analysis of the current market structure reveals a clear roadmap for the coming months. We are approaching "buy zones" that historically precede parabolic runs.

Support 1: $45.00 – $55.00 — Healthy Correction This range represents a standard retest of previous consolidation. A pullback to this level is considered a "healthy correction" in a macro bull cycle, allowing the market to shake out over-leveraged positions and build a stronger foundation for the next leg up.

Support 2: $10.00 – $20.00 — Maximum Pain / Maximum Opportunity This is the "capitulation" floor. While reaching these levels would cause maximum pain for short-term holders, it historically represents a generational entry point. For the long-term investor, this is the zone of maximum opportunity where life-changing wealth is often positioned. I do hope we do not reach here though, $BTC will will have to bleed more for this to happen.

What analysts are Saying

Market analysts remain divided on short-term "noise," but the long-term consensus is leaning heavily bullish:

— Institutional Infrastructure: Analysts at SwapSpace note that while current liquidity is rotating into safe-haven assets, the re-emergence of institutional capital in the second half of 2026 is expected to fuel a massive rebound.

— The "Oversold" Signal: Momentum indicators like the Money Flow Index (MFI) are approaching oversold areas below 20.0. Historically, whenever SOL has entered this zone, it has been followed by significant price stabilization and a strong bounce.

— Fundamental Divergence: Experts at The Motley Fool highlight that 2026 is a "game-changing" year for Solana. With transaction finality set to drop to 100-150 milliseconds via Alpenglow, the gap between the declining price and the increasing utility is creating a massive spring-load effect.

"The network is faster, more secure, and more institutionalized than it was at its peak. Selling now is trading based on fear rather than the math of 1 million transactions per second."

The bounce is inevitable. The only question is how much you’re willing to stack before the recovery begins.