@Plasma Last Tuesday, 8:15 a.m.—half-empty café, near the office. The espresso grinder rattled nonstop while I thumb-scrolled through on-chain metrics like it was urgent life news. This little stainless sugar tin kept skidding every time the table got bumped, and it was getting under my skin in a very specific way. That was the morning: annoyed, but still leaning in. I had a call later with a finance team that treats “settlement certainty” as a real cost center, not a slogan. It looked stable in a way crypto rarely does. When I saw Aave on Plasma still hovering around $6.5B in deposits, I felt that familiar itch to ask what, exactly, is being trusted here?

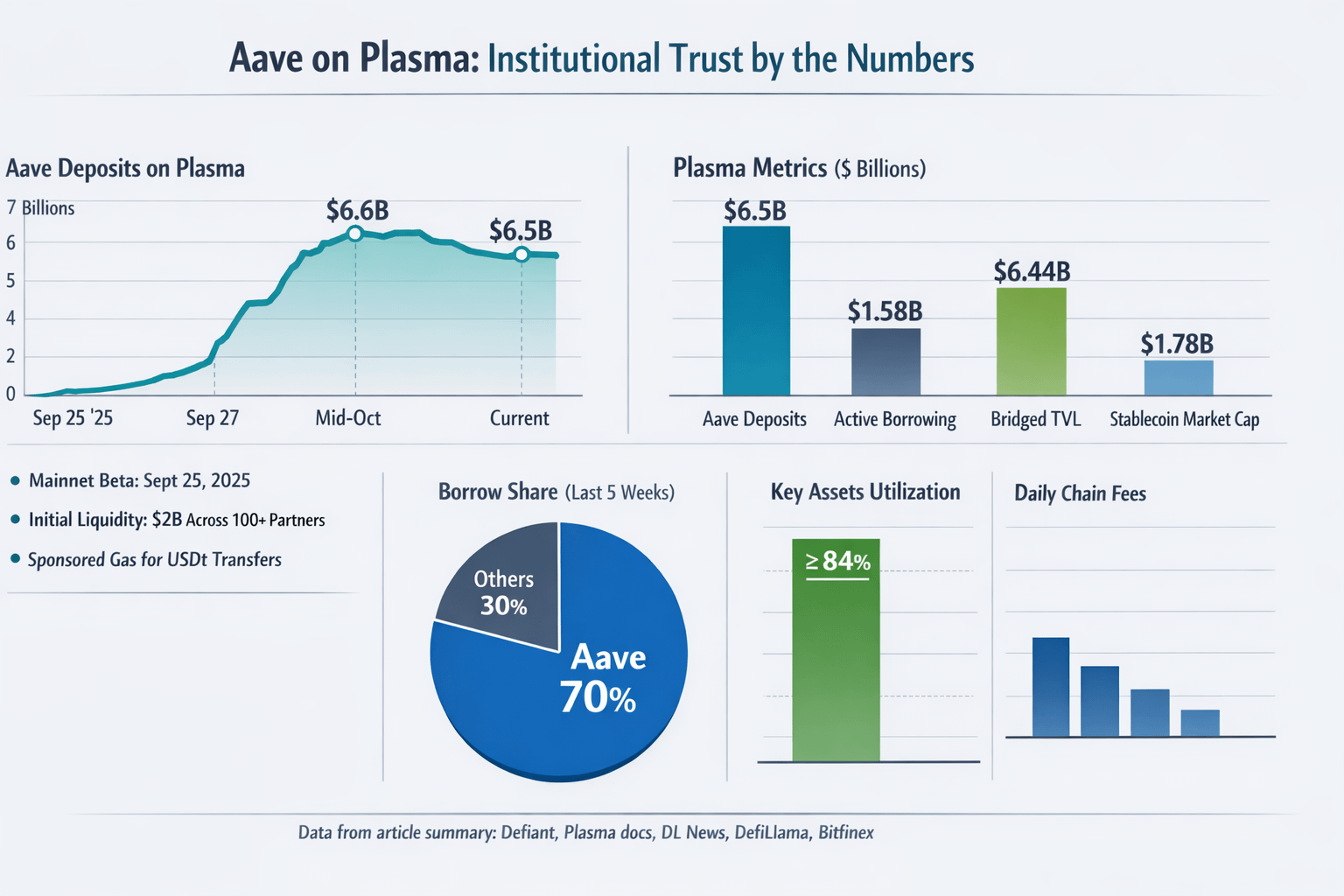

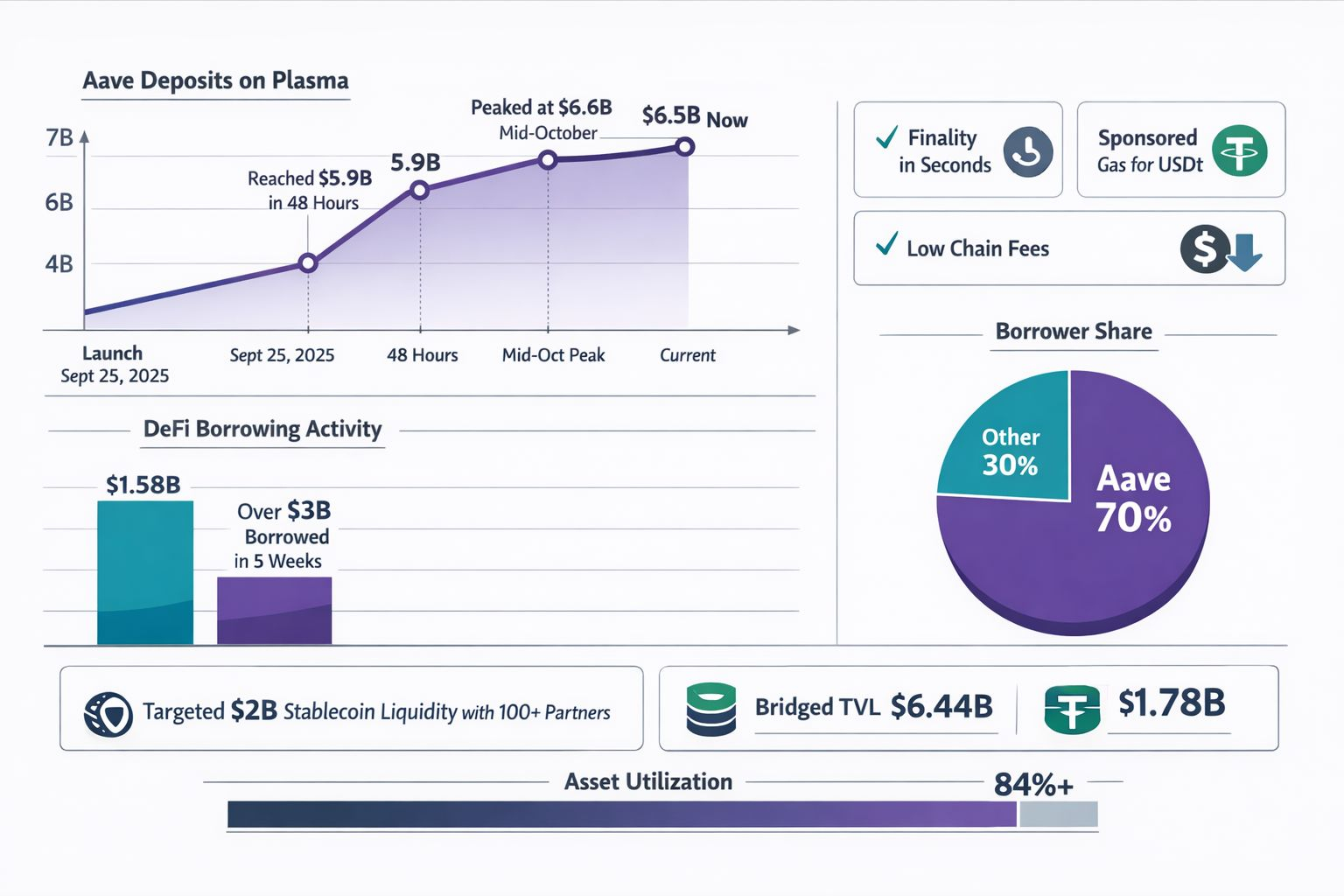

The timing matters here—and it’s why the idea keeps circling back. Plasma’s mainnet beta went live on September 25, 2025, and it framed itself from day one as a Layer 1 optimized for stablecoins. It didn’t wait for liquidity to arrive organically; it launched with it. The Defiant reported that the rollout targeted about $2 billion in stablecoin liquidity spread across more than 100 DeFi partners, including Aave, from day one.

I’ve learned to distrust simple stories about “institutions entering DeFi.” The label covers everyone from market makers to corporate treasuries, but the constraints rhyme: predictable execution, clean accounting, and low tolerance for edge cases. Plasma’s docs describe deterministic finality within seconds via PlasmaBFT, a pipelined Fast HotStuff variant. I read that as a scheduling promise: once a transaction commits, it’s final, and operations can reconcile without a stack of “maybe” states. For an allocator, that shrinks the window where mistakes can cascade.

Aave fits neatly into that mindset because it already behaves like a rules-driven credit venue. There are clear parameters, transparent positions, and familiar risk levers. Plasma’s own write-up says deposits into Aave on Plasma reached $5.9 billion within 48 hours of mainnet launch and peaked around $6.6 billion by mid-October. It also cites $1.58 billion in active borrowing and utilization above 84% for key assets, which suggests the liquidity wasn’t just parked for screenshots. They framed the launch as risk-ready, with oracles and parameters tuned before incentives began.

When I hear institutions described as buying “certainty,” I translate it into workflow relief. A payment that settles the same way every time reduces reconciliation headaches. Collateral that bridges in cleanly reduces the number of conditions a risk team has to document. The Bitfinex explainer points to sponsored gas for USDt transfers, so someone can send stablecoins without holding a native token just to pay fees. That’s consumer-friendly, but it’s also how you make payments behave like payments.

Retail tends to approach the same system from the opposite end. Certainty is nice, but incentives and yield are often the real magnets. A DL News report that tracked a 55% jump in DeFi lending described borrowers migrating to high-throughput environments where looped strategies and points incentives thrive. It noted more than $3 billion borrowed on Plasma over roughly five weeks, with Aave capturing nearly 70% of borrows. I take that as a reminder that “trust” can simply mean “this is where the rewards are today.”

The chain-level picture adds context. DefiLlama currently shows Plasma with about $6.44 billion in bridged TVL and roughly $1.78 billion in stablecoin market cap, alongside very low daily chain fees. Those metrics fit a network built for frequent stablecoin movement, which is exactly what treasury workflows want. They don’t prove the capital is sticky, but they help explain why Plasma keeps appearing in risk meetings.

I don’t walk away from this thinking retail is wrong or institutions are right. I just see two definitions of trust. Retail often trusts momentum and payouts; institutions trust processes that survive audits, reconciliations, and bad days. If Plasma can keep deterministic settlement and a deep credit market without leaning too heavily on incentives, that $6.5B figure will look less like a spike and more like infrastructure. I’m watching either way, because certainty is valuable, and it isn’t free.