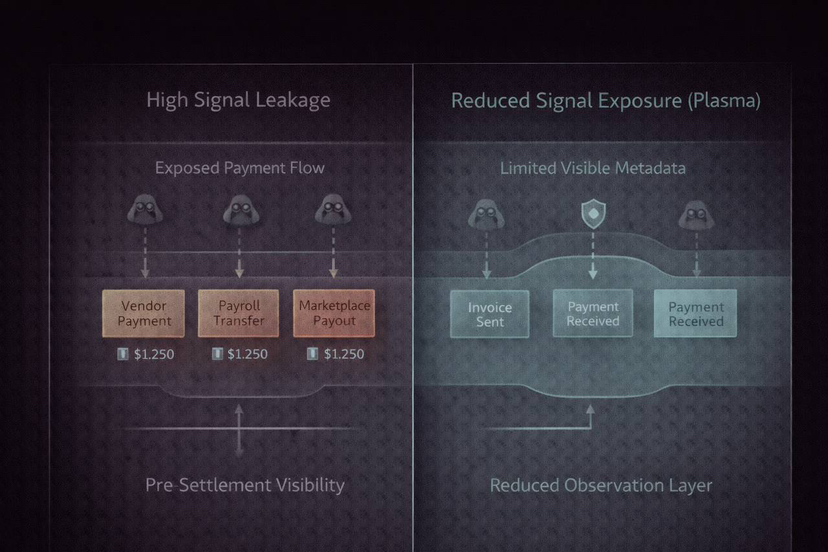

Stablecoins are already massive, yet massiveness does not translate to safe infrastructure. In the case of Plasma ($XPL), fees, speed, refunds, or UX are not the most neglected problems. It is a minor, expensive real world imperfection: order flow leakage. People can take advantage of a visible payment purpose prior to its settlement.

Those are risks in trading, payroll, treasury transactions, payouts and vendor payment. With crypto, transactions are left in an open state so long that bots, competitors or attackers will be able to see and respond. To the regular users, it may be sandwich attacks or copying. To the businesses, it may be foreseeable targets and time.

The opportunity of Plasma is to consider stablecoin payments as something secret and not something published.

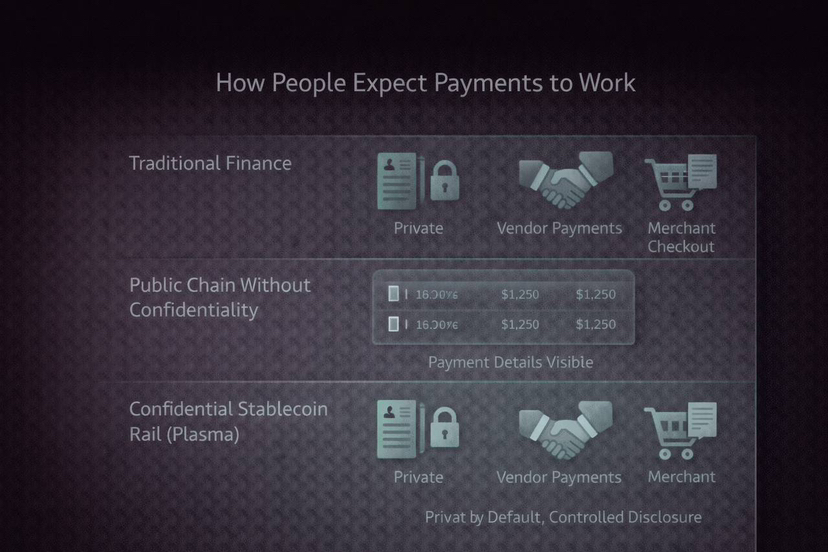

The thesis: stablecoin rails require confidentiality and not anonymity.

A lot of individuals believe that privacy is concealment whereas reputable systems of payment require more than that. Companies are not interested in shadow money but in regular money with regular controls, but without the broadcasting of sensitive information in the middle of a transfer.

A good stable coin rail must enable confidentiality in practice. It must enable sensitive payment information to be default-secured when necessary, but enable audits when necessary. That is what distinguishes between a rail serving real companies and the one serving crypto power users only.

Plasma is leading up to this mid ground. The main point it makes is simple, confidentiality may be a characteristic of compliant finance, but not its adversary.

Why pending visibility is a threat to reality.

Traditional finance In traditional finance, before your payroll file clears, it does not appear to strangers. The payments to the supplier are not displayed in an open waiting-room. Your balance of the treasury is not a live.

In most public chains it is that waiting room that is public. Before inclusion, transactions you do spill precise information about what you are going to do. This leakage can be used even without trading.

When you are operating a marketplace, a big chunk of payout is an indicator of business size and timing. Liquidity is indicated by huge transfers of stablecoins in the event that you are an exchange or fintech. When you pay contractors, the time of payment brings out operations. In the case of an aid organization, public transfer puts the recipients at risk.

This is why it is not an extravagance of confidentiality but rather working safety.

The MEV mentality is not just limited to trading.

MEV is frequently explained as a DeFi issue, although the fundamental concept is wider: once the action of one can be observed in advance, then it can be positioned around.

It turns into front-running and sandwich attacks in trading. In pay it is exploitative targeting. Hackers will be able to monitor big transfers, attack individual wallets, investigate poorly established security practices, or even a load on systems at their most opportune times. Volumes can be derived by competitors. Viewers are able to trace connections.

Although none of that may happen to you today, the risk increases with the proliferation of stablecoins. The larger the adoption, the greater the motivation of bad behavior.

A coin rail that does not take this into account incurs subsequent damage in attacks, churn, and loss of trust.

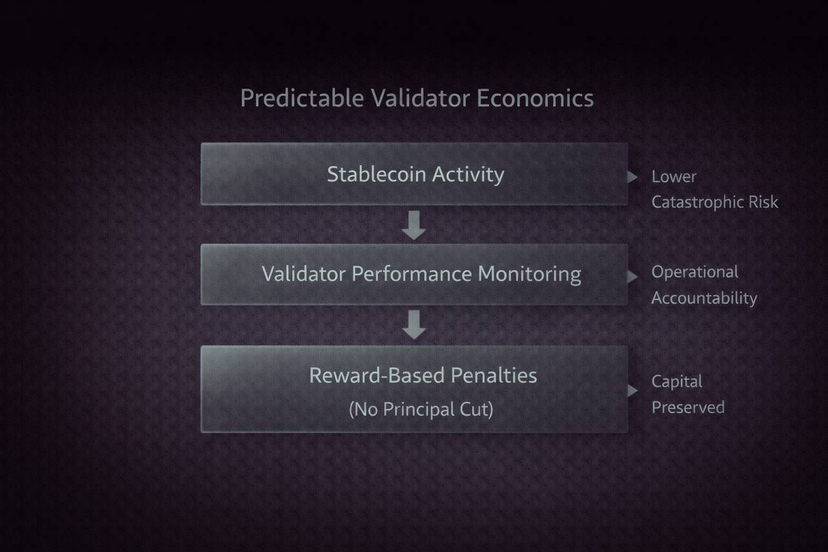

The strategy of plasma: make the rail composable, but shield that which requires shielding.

The most promising development path is the area of confidential by default and auditable when necessary design. This will allow safeguarding sensitive transfer information without making the chain a black box.

The confidential payments made by plasma are likely to conceal sensitive information and yet demonstrate correctness and permit proper oversight. Privacy is an optional feature, which maintains composability and auditability.

This is important to adopt since the market is not making a decision between an all-public and all- private. It selects usable on actual finance against unusable. Real finance requires selective disclosure and capability to expose the appropriate data to the appropriate parties at appropriate time.

When Plasma is branded as clean selective disclosure, it will appeal to the very people that the stablecoins are meant to cater to: operators, institutions, and serious builders.

The reason that stablecoin payments seem normal because of confidentiality.

Majority of individuals do not desire to share their history of payment, salaries on the streets, business suppliers mapped, and spending with strangers.

Once stablecoins become too public, they cease to experience money as they begin to experience a live stream, something not mainstream.

There is no need to sell confidentiality as privacy. It can be promoted as normalcy. Ordinary citizens believe that making payments is confidential by default and access is controlled. When the stablecoins have ambitions of becoming the money of every day, they should reflect that belief.

The placement of the plasma is to provide that normal feel, without sacrificing the values of not closing the set which make crypto useful.