Still, majority of stablecoin chains carry an old crypto assumption that nobody questions enough. They assume people must hold a separate gas asset. You want to use USDT, fine, but first go buy another token. Hold it. Manage it. Refill it. Monitor it.

The real problem is not only the fee. It is the mental overhead. A normal user understands I have USDT. That is simple. But when the system says you also need some chain token to move your USDT, that is where confusion begin. It stop feeling like money and start feeling like crypto machinery.

Plasma is one of the first projects that treats this as a product design flaw instead of blaming users for not understanding gas. That shift is important.

The Stablecoin-Native Thesis

The core idea behind Plasma is almost boring in its simplicity. If stablecoins are meant to behave like dollars, then the entire experience should remain in that same mental unit.

The moment a user must think about topping up gas, the illusion breaks. It becomes technical. It becomes abstract. It becomes risky in the mind of mainstream users.

Plasma tries to move gas into the background by allowing supported transactions to pay fees in tokens people already use, like USDT, instead of forcing everyone to hold XPL first. That might sound like a small UX tweak, but it opens something much larger.

Predictable charges.

Cleaner onboarding.

Simpler accounting.

New product models.

This is not just technical optimization. It is mental model engineering.

What Custom Gas Tokens Actually Mean

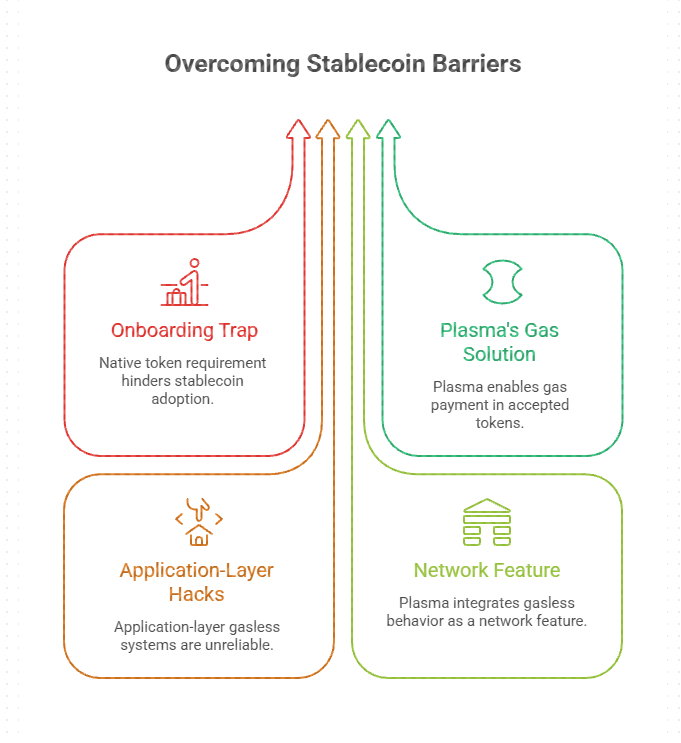

On most chains, if you do not own the native token, you cannot transact. That is the onboarding trap. You came to buy stablecoins, now you must buy something else.

Plasma’s approach allows gas payment in accepted tokens. In simple terms, a wallet or app can execute transactions without the user holding XPL. The protocol handles conversion and settlement behind the scenes.

This is important because many so called gasless systems today live at the application layer. Developers build clever paymasters or fee abstraction systems. They work until edge cases appear. They break. They become expensive to maintain.

Plasma tries to make this behavior a first-class network feature instead of a hack layered on top. That difference matters for reliability.

The Business Unlock Most People Ignore

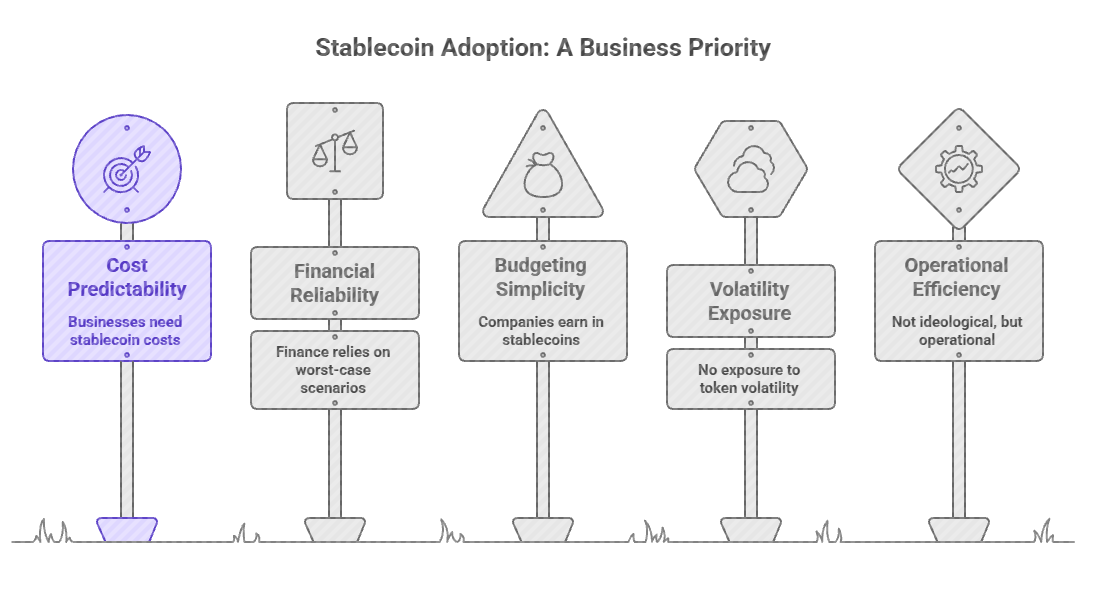

Here is what businesses care about more than users do. Predictability.

If a platform runs in stablecoins, it wants costs expressed in stablecoins. It wants to say this action costs one cent. Not this action costs some fluctuating fraction of a volatile asset.

Finance does not operate on averages. It operates on worst case scenarios and reliability.

When gas can be paid in USDT, companies can budget in the same currency they earn in. No separate treasury bucket for gas tokens. No exposure to token volatility. No late night surprises because price moved.

This is not ideological. It is operational.

Product Design Leverage

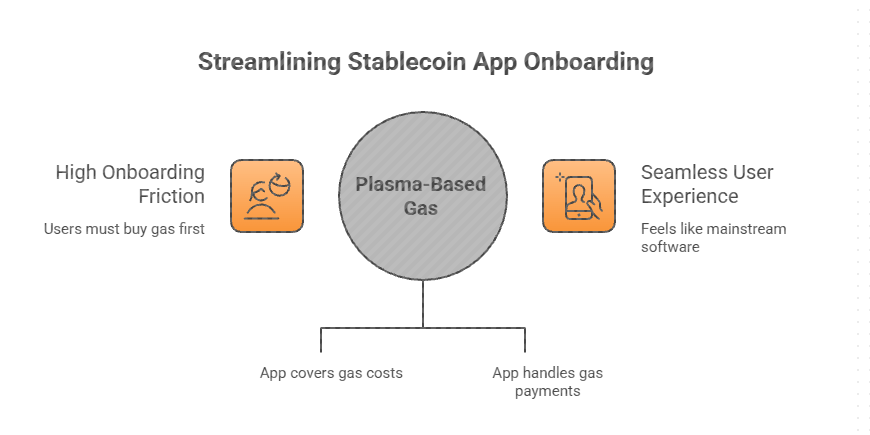

There is another unlock here that most people miss. Sponsoring fees becomes clean.

Modern software hides friction early. Freemium models. Trial flows. Subsidized onboarding. That is normal product strategy.

Stablecoin apps struggle because the first step requires buying gas. The onboarding flow becomes a tutorial about blockchain mechanics.

With stablecoin-based gas and paymaster execution, an app can say try this, no extra token needed. That changes growth dynamics. It turns stablecoin apps into something that feels like mainstream software.

Plasma is not just simplifying for users. It is giving builders tools to design smoother products.

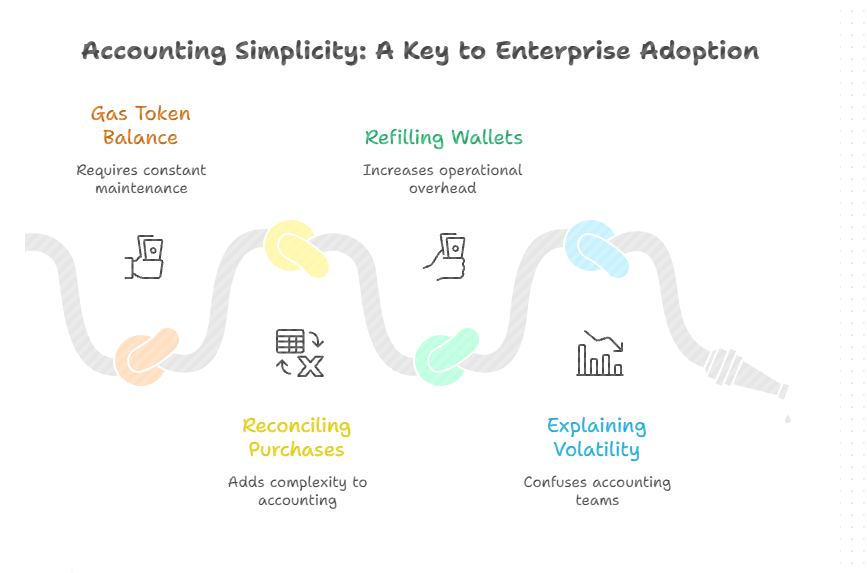

Accounting Simplicity Is Bigger Than It Sounds

Operational friction kills enterprise adoption quietly.

Every time a business must maintain a gas token balance, reconcile purchases, refill wallets, and explain token volatility to accounting teams, friction increases.

When fees are paid in USDT, everything stays in one ledger unit. Treasury, expenses, revenue, all denominated the same way.

It sounds minor. But large organizations die by a thousand small frictions. Plasma’s gas model aims to remove one of those cuts.

Emotional Simplicity for Users

For normal users, simplicity reduces mistakes.

If someone holds USDT, they understand it. When they must buy another token, errors happen. They buy wrong asset. They buy too little. It runs out mid transaction. They panic.

Keeping the experience in one unit reduces confusion. And confusion is where fraud, errors, and loss of trust begins.

If stablecoins are to become everyday money, they must feel boring and predictable.

The Real Risk

Of course, simplifying gas introduces network responsibility. If transactions become too easy, spam risk rises.

So the system must include guardrails. Token whitelisting. Flow restrictions. Rate limits. Monitoring. Payments-grade infrastructure must assume adversarial behavior.

Making things easy without making them sustainable is dangerous. Plasma’s design must balance friction removal with abuse prevention.

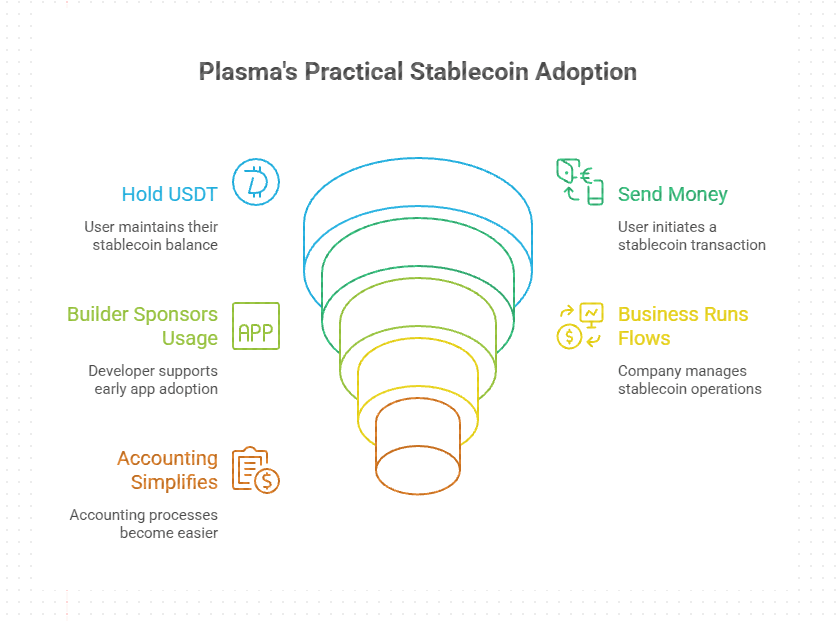

What Success Would Look Like

If Plasma’s custom gas model works long term, the outcome is not flashy.

A user installs a wallet, holds USDT, sends money. No extra token. No tutorial.

A builder launches an app and sponsors early usage like normal software.

A business runs stablecoin flows and budgets in its operating currency.

Accounting teams stop juggling gas token bookkeeping.

That is not hype driven adoption. It is practical adoption. And in the world of stablecoins, practicality is everything.