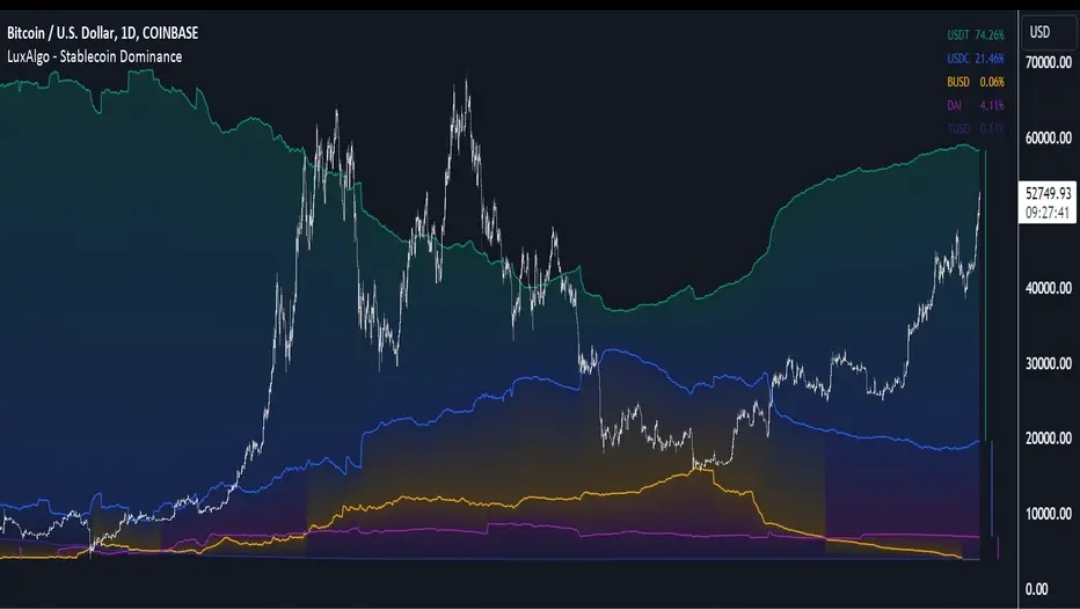

Most people focus on Bitcoin price.

Smart capital watches stablecoins.

Because stablecoins are not just “cash equivalents.”

They are liquidity weapons.

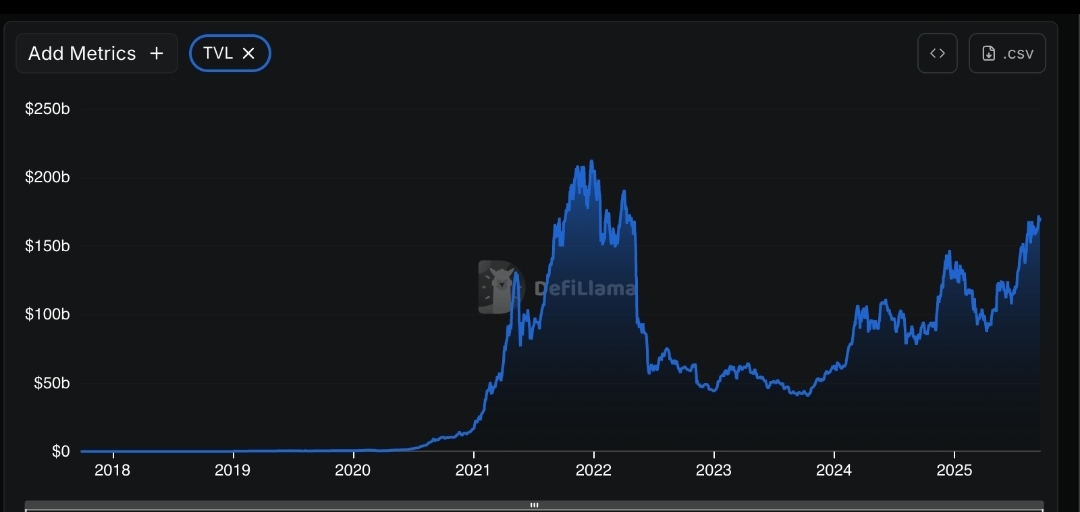

Every major cycle expansion in crypto has been preceded by one thing: stablecoin supply growth. Not narratives. Not ETF headlines. Not influencer hype.

Liquidity expansion.

When stablecoin market caps rise, it means dry powder is entering the ecosystem. Capital is preparing to deploy. It doesn’t always deploy immediately — but it’s sitting on the sidelines, inside crypto rails.

That matters.

There’s a quiet competition happening between major stablecoin issuers. It’s not loud, but it’s strategic.

More exchange integrations.

More DeFi incentives.

More chain expansions.

More institutional on-ramps.

Stablecoins determine where liquidity settles.

If a specific stablecoin dominates trading pairs on a chain, that chain attracts volume. If one stablecoin becomes the preferred collateral in derivatives markets, it shapes leverage structure.

This is not small.

In many cases, stablecoins are the actual base layer of crypto trading activity. Bitcoin is the asset. Stablecoins are the fuel.

Another important point most retail ignores: redemptions.

When stablecoin supply contracts significantly, it often signals capital leaving the ecosystem entirely — not rotating within it. That’s different from money moving from altcoins to Bitcoin. That’s money exiting crypto rails.

During bear markets, watch for contraction.

During early bull markets, watch for quiet expansion.

It usually starts small.

A few hundred million added. Then a few billion. Then acceleration.

By the time headlines talk about “liquidity returning,” positioning has already improved.

There’s also a deeper structural angle.

Stablecoins are becoming collateral.

Used in lending.

Used in perpetual markets.

Used in on-chain treasury management.

Used by funds to arbitrage spreads.

They’re no longer just trading chips. They’re infrastructure.

And infrastructure scales before price does.

If you understand stablecoin flows, you understand where risk appetite is building.

You’ll notice something interesting in early cycle phases. Stablecoin supply rises while volatility stays compressed. That means capital is entering cautiously. Not chasing. Preparing.

Later in cycles, stablecoins deploy aggressively into risk assets. Altcoin rallies accelerate. Leverage increases. Funding spikes.

That’s when liquidity shifts from defensive to speculative.

The stablecoin war isn’t about branding.

It’s about control of rails.

Whoever controls the rails influences where capital flows first.

And in crypto, being first matters.

Price doesn’t expand without liquidity.

And liquidity doesn’t expand without stablecoins.

So while most traders stare at candles, the real shift often begins underneath — in the plumbing.