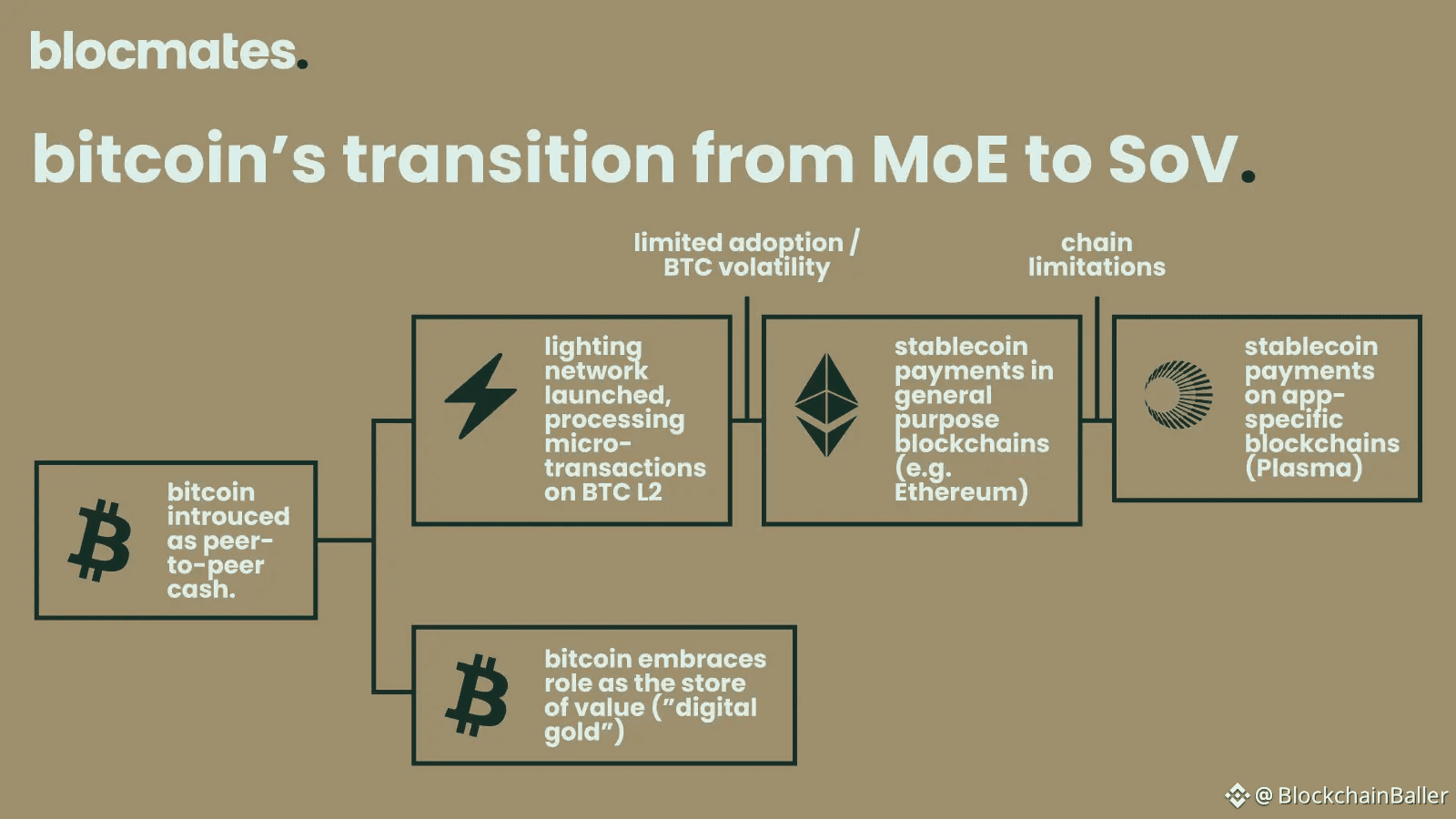

As decentralized technology moves beyond experimentation and into global digital infrastructure, execution performance has become one of the most critical differentiators between blockchain networks. Security and decentralization are expected. What now defines competitive advantage is how efficiently transactions are processed, how reliably applications function under pressure, and how stable fees remain during heavy usage. Plasma was created to address these demands directly by focusing on one primary mission: optimized, high-throughput execution.

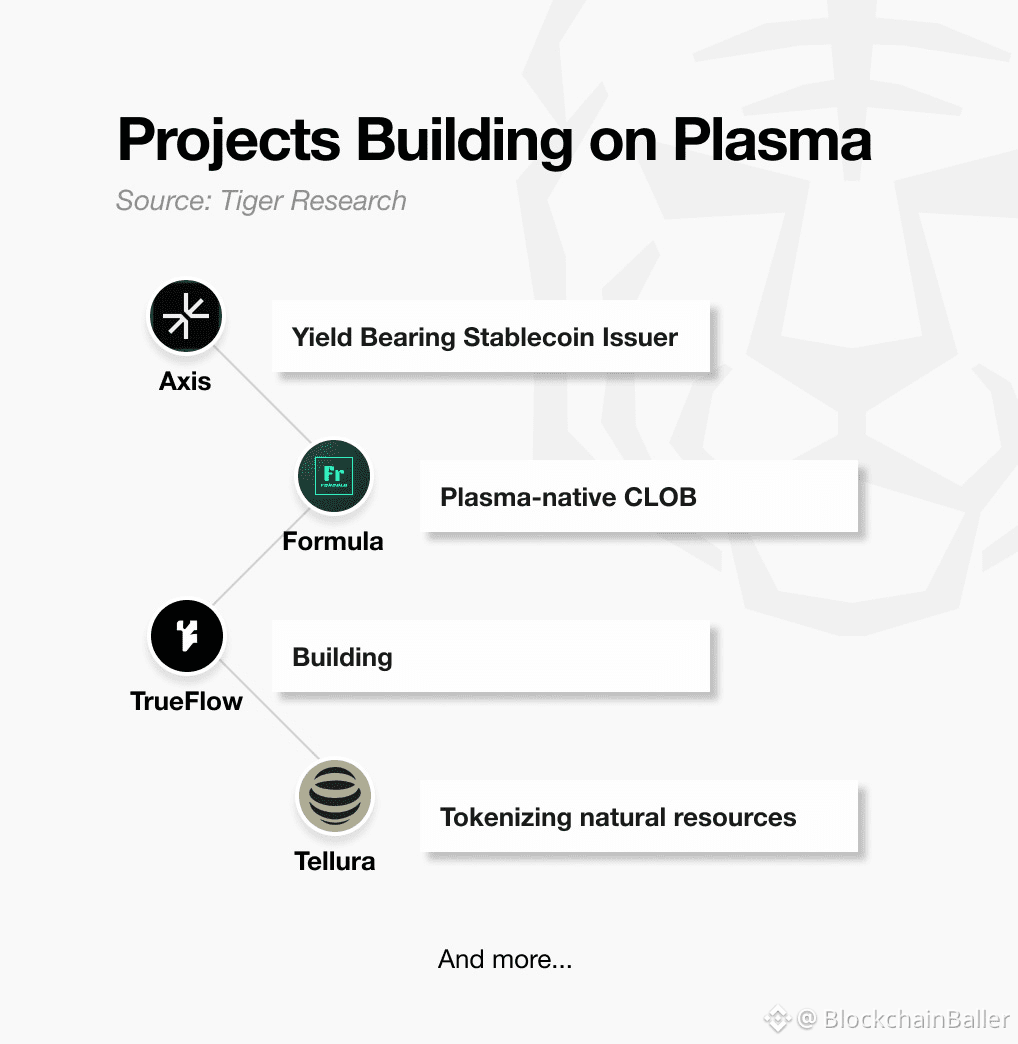

Plasma positions itself as an execution-first blockchain rather than a generalized network trying to handle every layer of Web3 at once. By concentrating on transaction processing and smart contract efficiency, Plasma is able to fine-tune its architecture for responsiveness and scalability. This specialization makes it particularly suitable for decentralized finance platforms, real-time gaming environments, AI-powered automation systems, digital marketplaces, and algorithmic trading protocols where latency and reliability are essential.

One of Plasma’s defining features is parallel transaction processing. Many traditional blockchains execute transactions sequentially, which creates congestion when network demand increases. Plasma analyzes transaction dependencies and executes multiple operations simultaneously whenever possible. This design significantly increases throughput while maintaining fast confirmation times and predictable costs. For users, it means smoother interactions and fewer delays. For developers, it provides a stable environment capable of supporting large-scale applications without constant redesigns to avoid bottlenecks.

Smart contract optimization is another cornerstone of Plasma’s architecture. The network reduces redundant computation and minimizes conflicts between transactions that interact with overlapping pieces of on-chain data. By improving how execution paths are scheduled and resolved, Plasma allows decentralized applications to operate continuously without compromising overall system performance. High-frequency systems such as automated trading strategies, liquidity management tools, and multiplayer game ecosystems benefit especially from this structure.

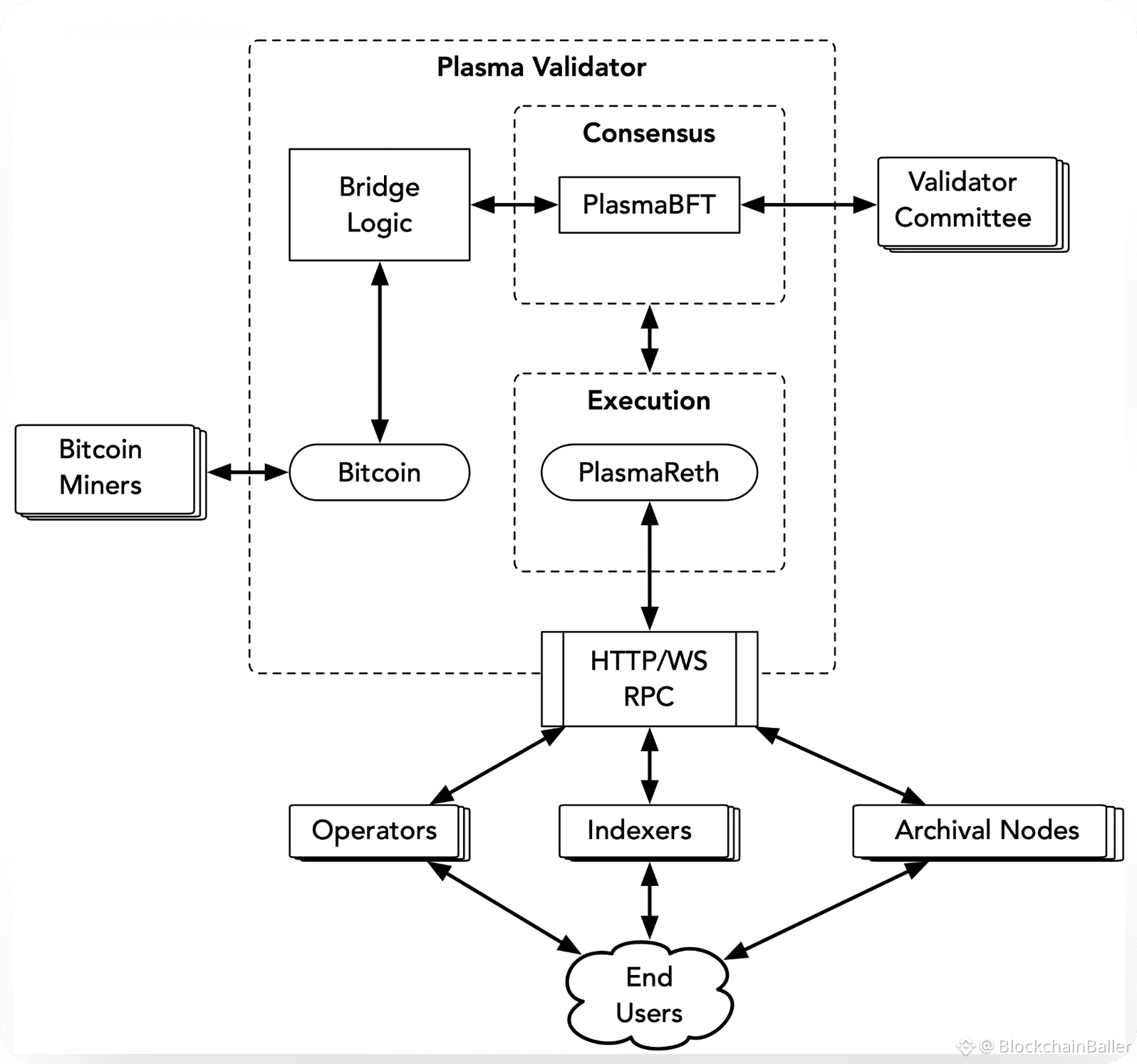

Plasma is also built to integrate within a modular blockchain ecosystem. Instead of operating as an isolated chain responsible for every function, Plasma can serve as the execution layer while other networks manage settlement, governance, or data availability. This composable structure allows each layer to specialize and improve independently. As assets and information move across networks, Plasma handles the heavy computational workload that requires rapid finality and consistent performance.

Security remains central to Plasma’s design. Its performance advantages are achieved through architectural efficiency rather than relaxed consensus standards. Transactions are validated rigorously, and execution remains deterministic, ensuring that scalability does not come at the expense of reliability. This balance between speed and trust is crucial for financial protocols and enterprise applications that depend on accurate and predictable system behavior.

From a development perspective, Plasma emphasizes accessibility and consistency. Support for established programming standards and familiar tooling lowers the barrier to entry for builders. Predictable fee models and stable execution environments allow teams to design sustainable products with clear cost expectations. This focus on developer experience helps foster an ecosystem capable of delivering consumer-grade decentralized services.

Plasma’s infrastructure is particularly well suited for future usage patterns. As Web3 shifts toward machine-driven activity, AI agents, and always-on services, blockchains must support continuous transaction streams rather than sporadic bursts of activity. Plasma is engineered for this machine-native reality, enabling decentralized applications to behave more like live digital platforms than static contracts triggered occasionally.

Economically, Plasma aims to support sustainable network growth rather than speculative congestion cycles. By minimizing bottlenecks and maintaining consistent fee structures, it creates a healthier environment for long-term participation. Stable infrastructure encourages builders and users to remain active across market cycles rather than being driven away by volatility and unpredictability.

Ultimately, Plasma’s identity is rooted in clarity of purpose. It is not designed to compete on hype