Hey, fellow crypto traveler, it's February 2026, and Ethereum is sitting uncomfortably around $1,940–$2,100 right now, dipping below that psychological $2,000 level again. If you're like me, you've probably stared at your portfolio, sighed, and wondered: "Is this the bottom, or are we heading to $1,500 pain town?" I've been there multiple cycles, actually and let me tell you, these moments feel brutal, but they're often the setups for the biggest rewards.

This daily chart screams "capitulation" — ETH sliding hard toward $2,000 support with red candles everywhere. Classic bearish pressure, but supports like this have held before.The short-term vibe is rough: liquidations, macro headwinds, some ETF outflows, and yes, a lot of holders underwater. But zoom out, and something quietly bullish is happening full-scale accumulation by long-term holders and whales. On-chain data shows accumulating addresses loading up aggressively while price bleeds. That's not panic selling; that's conviction buying at "discount" levels. I've seen this pattern before the 2021 run smart money doesn't chase highs; they stack during fear .

Look at this accumulation address realized price chart—price dipping below the average cost basis for these patient holders, yet inflows continue. This is textbook "smart money loading the truck" behavior.

Now, the big question: Where does ETH go by the end of 2026?Bull Case – $7,000–$9,000+ (My Personal Favorite Scenario)

Institutions like Standard Chartered are still calling 2026 "the year of Ethereum." They recently pegged $7,500 as a realistic end-of-year target (down from wilder earlier calls, but still massive upside from here roughly 280–300%). Why? Scaling upgrades (post-Pectra effects kicking in), real-world assets exploding on-chain, stablecoin dominance on Ethereum rails, and ETH finally acting like productive money with staking yields. Tom Lee from Fundstrat has thrown out $7K–$9K early 2026 vibes too. If ETF inflows flip positive again, macro softens, and we get that ETH/BTC ratio rebound... yeah, I can absolutely see us ripping past $7,500. I'm leaning bullish here Ethereum's fundamentals are too strong to stay suppressed forever.

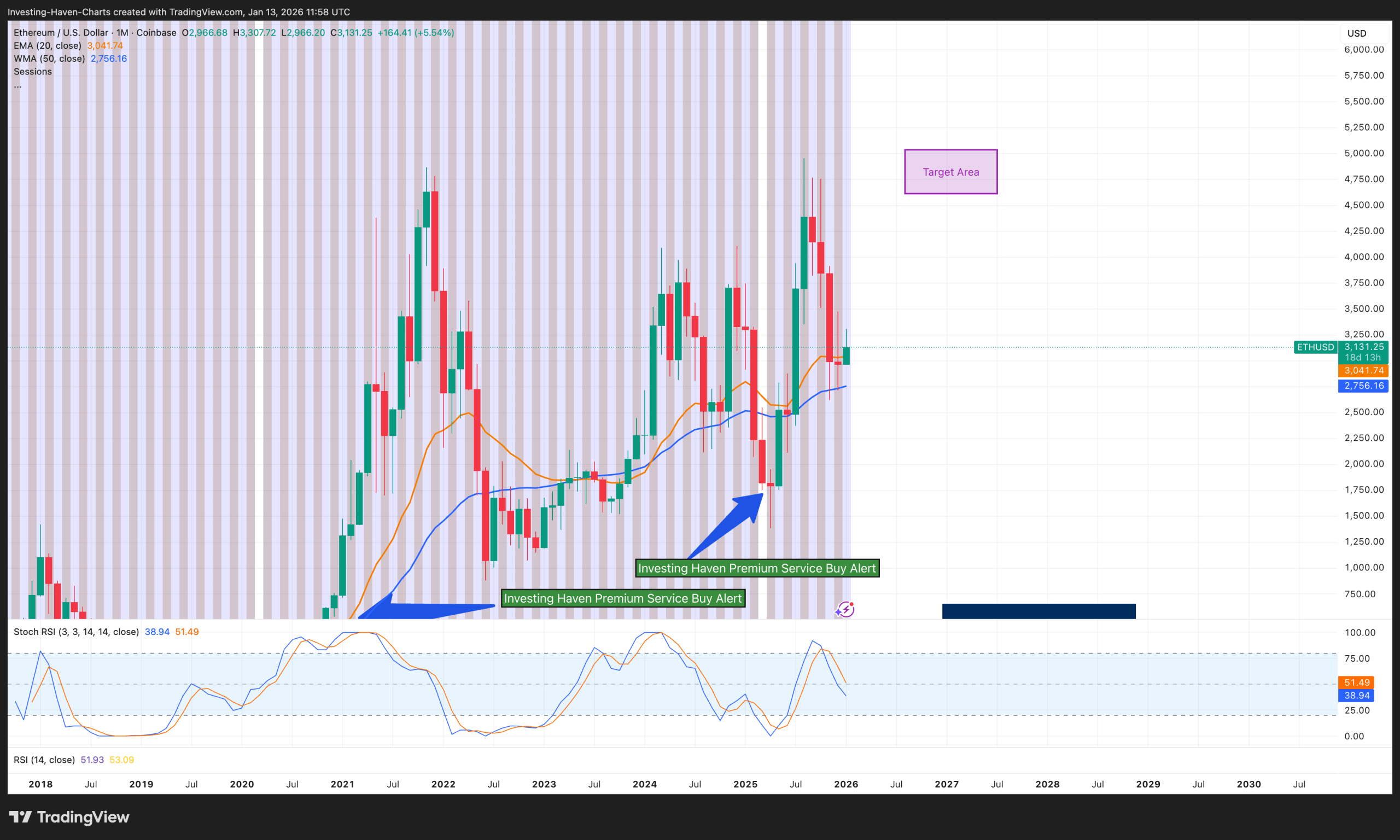

This long-term monthly chart from InvestingHaven shows the historical pattern clearly pointing to a "target area" well above current levels $5,000+ feels conservative in a full bull leg.

Base/Realistic Case – $4,000–$6,000.

Most balanced forecasts land here. Changelly around ~$4,700 average, some others pushing $5,500–$6,800 if momentum returns. This feels right to me enough upside to reward patience (100–200% from $2K), but not ignoring risks like L2 fee dilution or prolonged sideways chop. Ethereum needs catalysts (regulatory clarity on staking/ETFs, RWA milestones), but the network activity and whale behavior support a solid recovery.

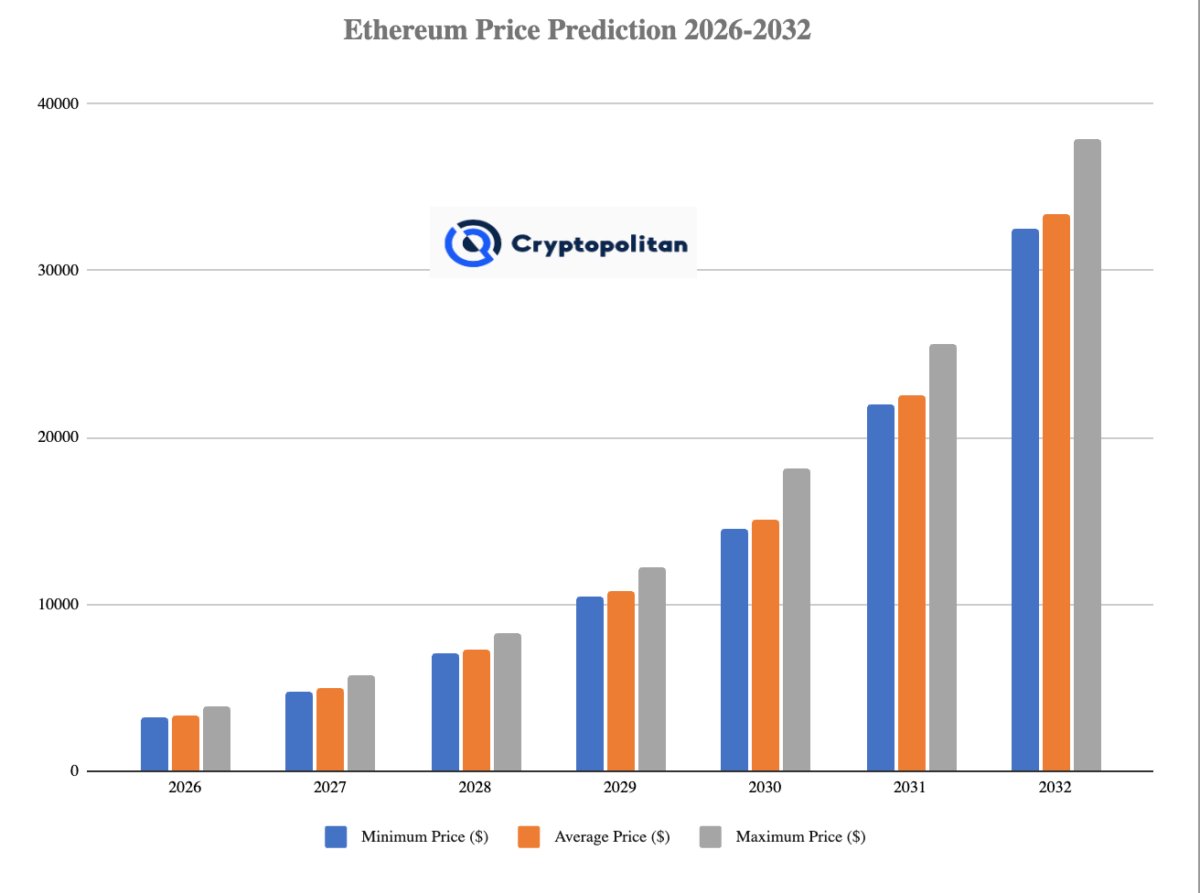

Bar projections like this one visualize the moderate-to-bullish path minimums in the low $4K range, averages climbing steadily, maxes teasing higher if adoption accelerates.

Bear Case – Sub-$3,000 or Flat

If macro stays ugly, competition eats more share, or we get another nasty deleveraging event, we could test $1,760–$1,000 in the worst scenarios. I don't love this outcome Ethereum's moat (DeFi TVL, developer mindshare, institutional preference) feels stronger than everbut crypto loves to humble us.

My Take: This Dip Feels Like Opportunity, Not the End.

Honestly? Sub-$2,000 ETH in 2026 looks like a generational entry to me. Whales are stacking, fundamentals are improving quietly, and the narrative around "productive crypto" + real adoption is gaining steam. Volatility will be wild expect more pain before gain but if you're in for the long haul, these levels could age like fine wine. Always do your own research, never invest more than you can afford to lose, and maybe keep some dry powder for if we wick lower. But personally? I'm optimistic. 2026 could be Ethereum's year to shine again.What do you thinkloading up or waiting for confirmation? Drop your thoughts below!