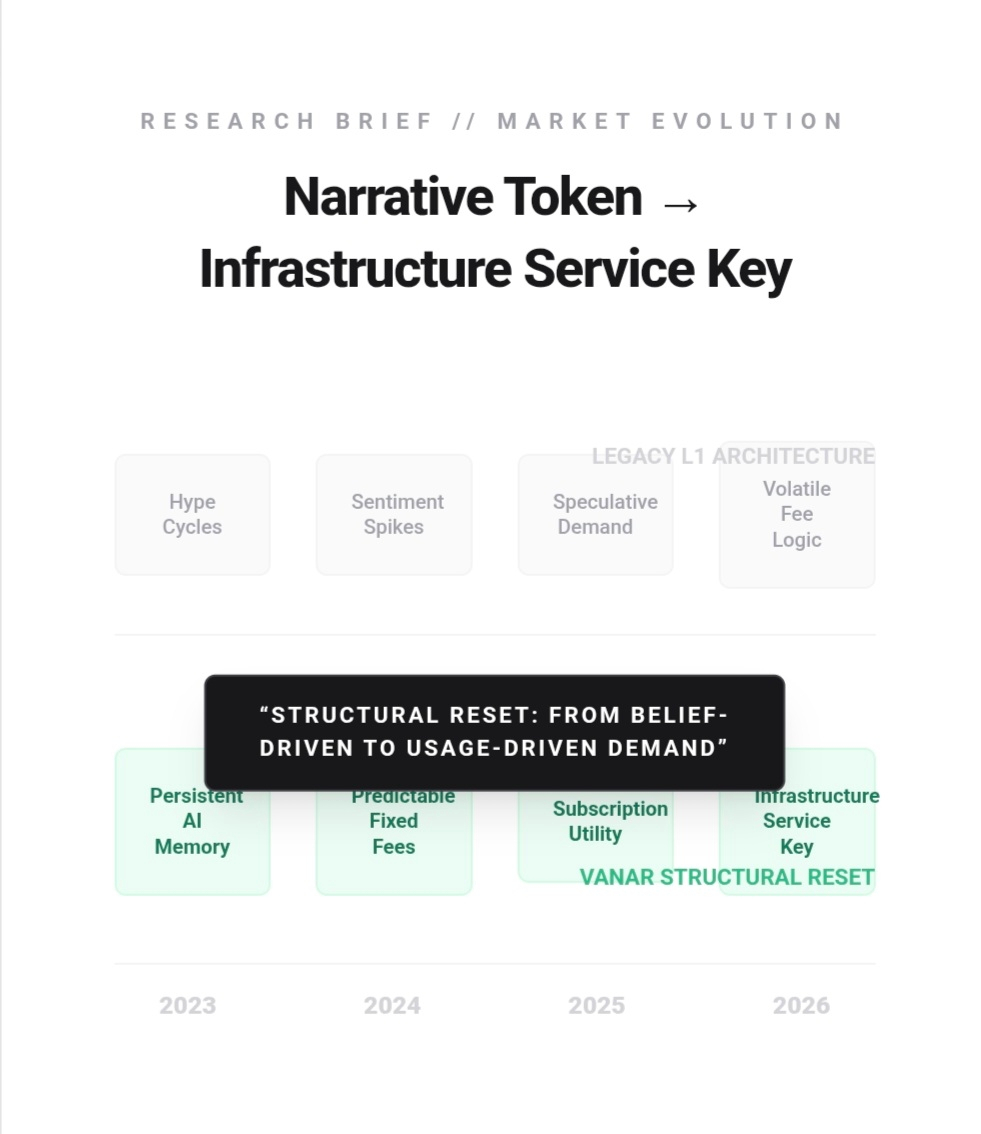

The current state of the Layer-1 landscape is undergoing a fundamental shift. While retail sentiment is often trapped in high-frequency noise and "ex$ETH clamation mark" marketing, professional observers are looking at a different metric: Operational Maturity.

As we navigate through February 2026, @Vanarchain is executing what I call a "Structural Reset." It is transitioning from a narrative-driven token to an Infrastructure Service Key.

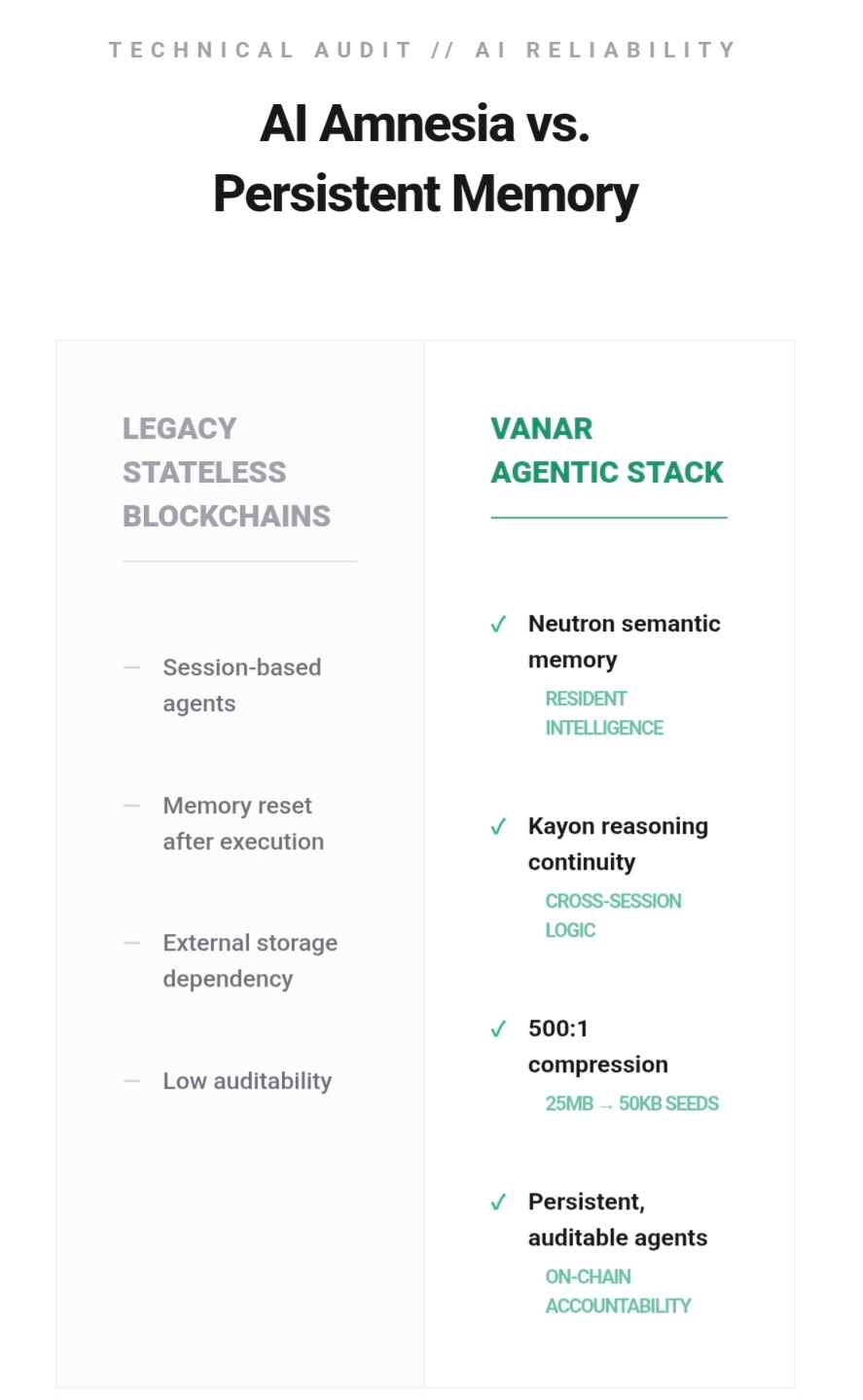

The Intelligence Gap: Curing "AI Amnesia"

The primary failure of legacy blockchains in the AI era is their stateless nature. AI agents on-chain today are effectively "temporary workers"; they reset after every session because the chain cannot provide persistent memory.

Vanar’s 5-layer stack solves this through Neutron (Semantic Memory) and Kayon (Reasoning Engine). By utilizing a compression ratio of 500:1, Vanar transforms 25MB files into queryable on-chain "Seeds" of just 50KB. This isn't just storage; it’s a "long-term residency permit" for AI agents, turning them into reliable, auditable executors for real-world business.

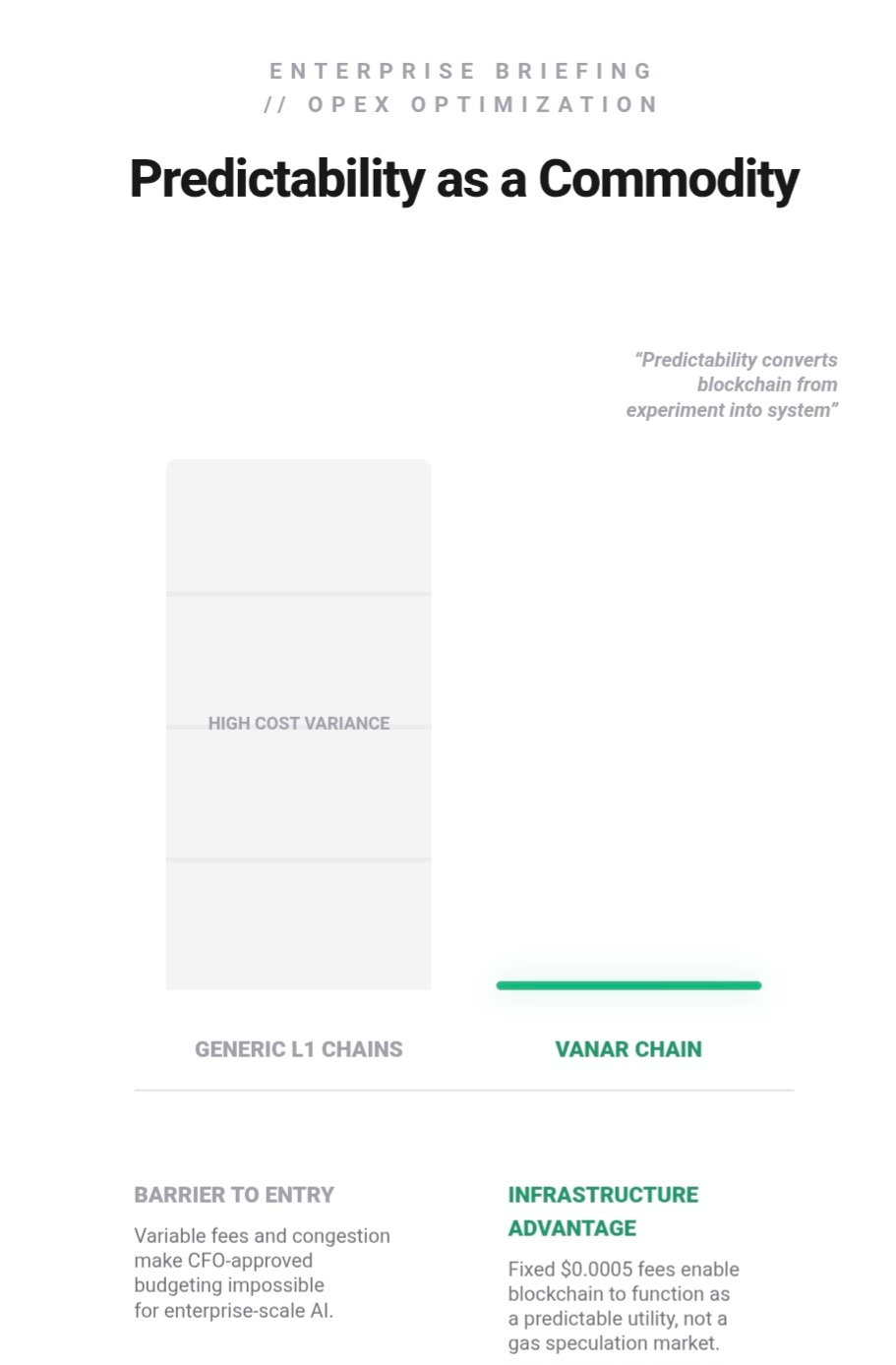

Institutional Logic: Predictability as a Commodity

At Consensus Hong Kong and AIBC Eurasia Dubai this week, the feedback from enterprise partners like Worldpay and Google Cloud has been clear: They don't want "flashy" blocks; they want "thinking" blocks with predictable costs.

Vanar’s fixed-fee model ($0.0005 per transaction) turns blockchain costs into an engineered system—a control loop that CFOs can actually budget for.

The Subscription Pivot: Beyond Speculation

The launch of the myNeutron and Kayon subscription models in early 2026 is the real catalyst. For the first time, $VANRY demand is being decoupled from pure speculation.

Utility Taxation: Access to advanced AI reasoning is now a paid service in VANRY.

Deflationary Pressure: A portion of these recurring fees is systematically burned, linking token value directly to platform usage.

Market Reality: The 0.00629 Accumulation Wall

While retail investors are exiting because the $0.006 price range feels "boring," the order books show a different story. We are seeing massive Smart Money accumulation near the 0.00629 level. This divergence suggests that sophisticated builders are positioning for 2026—the year AI moves from being a "toy" to becoming a "tool."

Verdict:

Adoption doesn't happen when people "believe" in Web3; it happens when the technology becomes invisible. Vanar is building that invisible, stable, and intelligent foundation. In this market, patience is the most expensive currency.