Bitcoin (BTC) price recovered slightly to $68,000 as it still failed to reclaim $70,000. However, if you zoom out, it should be noted that BTC has recovered from a weekly low of $60,000.

Plus, it looks like institutions are taking advantage of the dip to stock up on Bitcoin.

Binance Bets on Bitcoin

Binance has completed a 30-day transition to convert its SAFU (Secure Asset Fund for Users) reserve entirely into Bitcoin. Previously backed by a mix of assets including stablecoins, the fund is now fully denominated in BTC, with Binance committing to top it up if its value falls below $800 million due to market volatility.

The shift follows a late-January announcement that it would convert $1 billion in dollar-pegged tokens into bitcoin, reinforcing its stance that BTC is a long-term reserve asset.

The move reflects a broader trend of companies adopting bitcoin as a strategic treasury asset amid inflation concerns and low yields in traditional markets. Binance began the transition on February 2 with an onchain transfer of 1,315 BTC (around $100 million at the time) into SAFU.

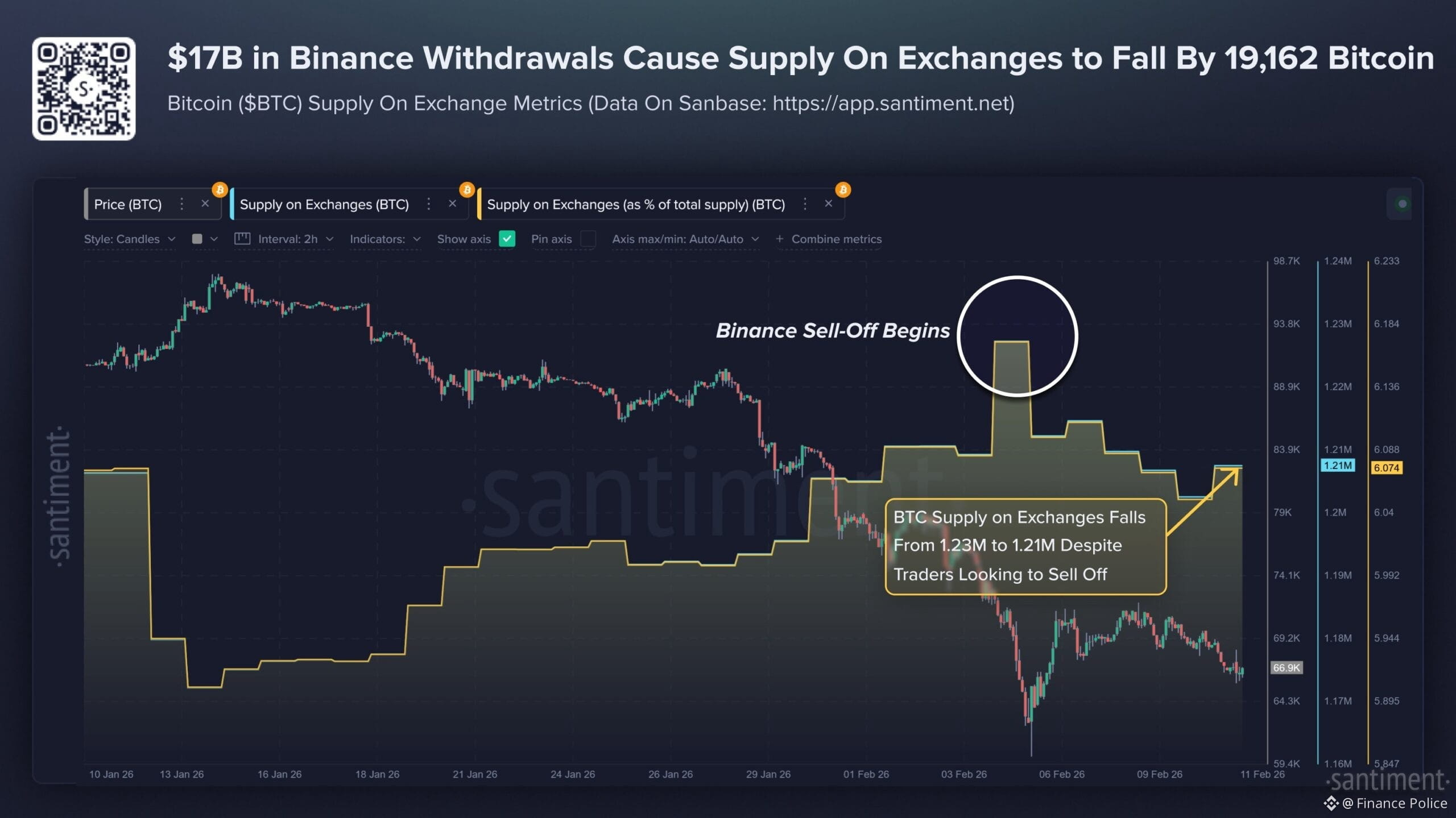

Speaking of Binance, here is an interesting chart from Santiment.

Santiment noted,

According to exchange flow numbers, there have been a net outflow of 19,162 $BTC from exchanges over the past week. Primarily due to the crowd’s distrust of Binance in relation to its involvement of the October 10, 2025 dump, we may continue to see coins moving back into cold wallets, or on to other exchanges where retail continues to look for opportunities to panic sell.

Bitcoin (BTC) Price Analysis

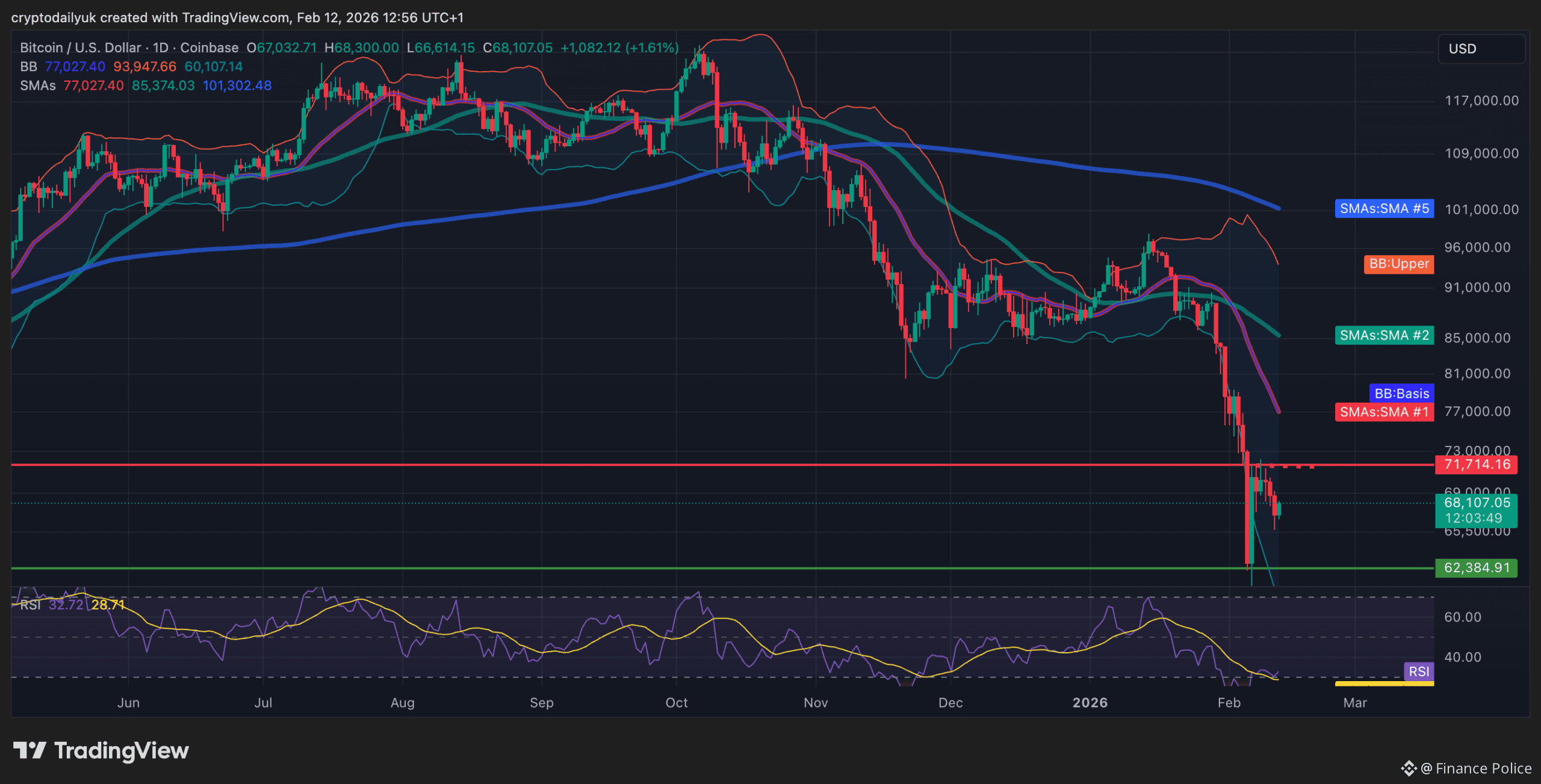

Bitcoin (BTC) went up slightly this Thursday as the price went up a bit from $67,000 to $68,000.

Source: TradingView

The relative strength index (RSI) is on the verge of being oversold, showing that the overall retail interest is still low. The price has trended inside the 20-day Bollinger Band, however the jaws are still wide open showing that Bitcoin(BTC) price volatility is still high.

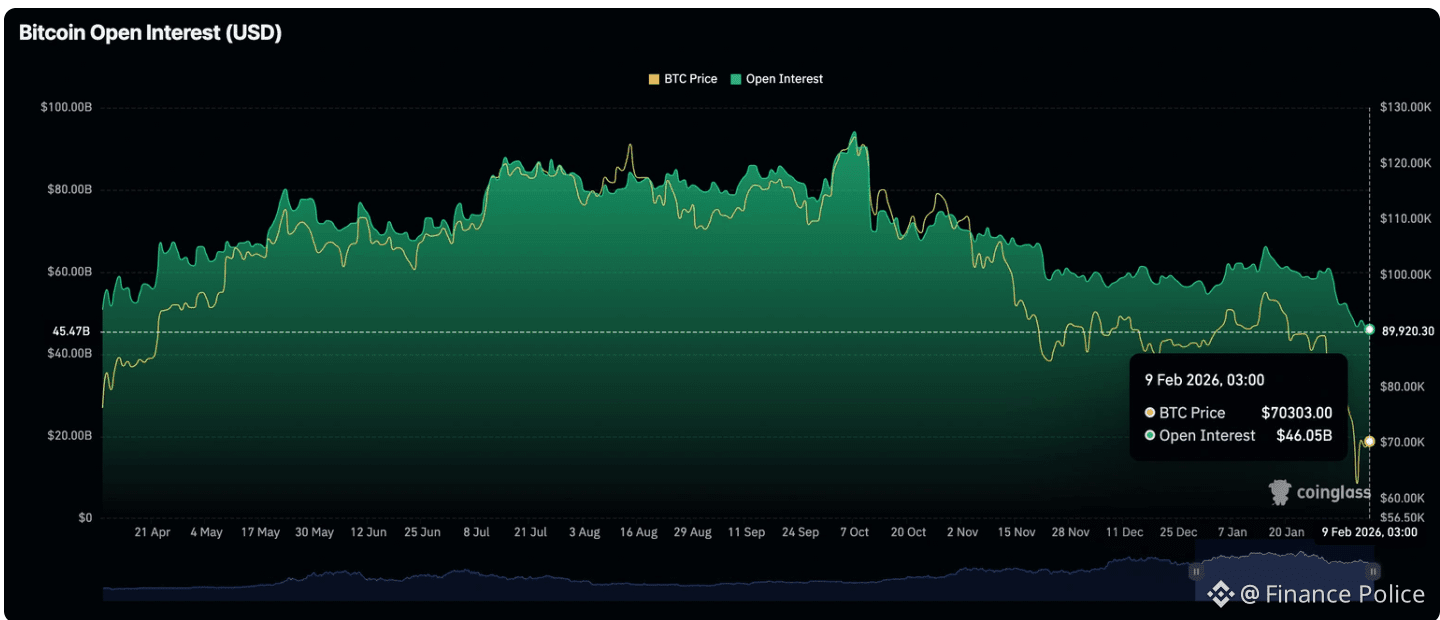

Bitcoin’s bounce from $60,000 looks more like a technical rebound from oversold levels than the start of a strong new uptrend. Retail participation remains muted, with futures open interest slipping to $46 billion from $46.7 billion a day earlier, according to CoinGlass, and continuing its decline from $48 billion on Saturday.

For the rally to have real momentum, open interest on Bitcoin price needs to trend higher. Without fresh positioning and stronger retail involvement, the chances of a sustained move toward $80,000 remain limited.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.