Simple signs that can help you spot 2x–5x NFT movesMost people lose money in NFT flipping because they buy due to hype (FOMO) and sell in panic. Smart flippers don’t guess — they watch data, especially floor price and trading volume.Using the indicators below, you can often spot a strong NFT collection 2–4 weeks before a pump

Indicator 1: Floor Price Stays Strong When Market Falls

When the overall NFT market drops 20–30%, look for collections whose floor price does not fall much.

This shows:

Strong holders

Real demand

Confidence in the project

Example:

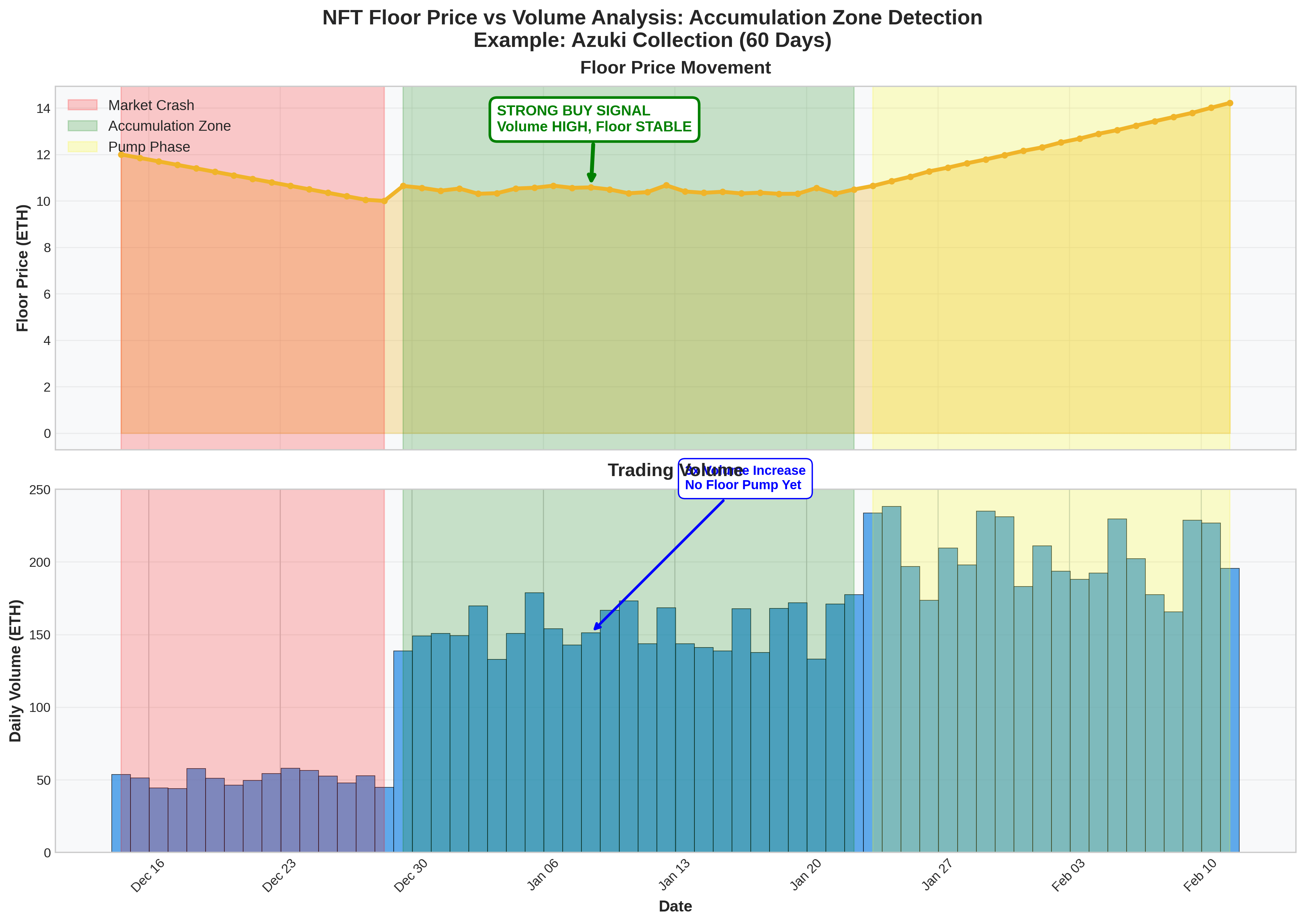

In January 2026, when the NFT market crashed, Azuki dropped only from 12 ETH to 10.5 ETH (about 12%). Other big projects fell 25–30%.

Azuki holders stayed calm and held their NFTs. After 3 weeks, Azuki went up to 15 ETH, giving a 42% gain from the bottom.

👉 Stable floor during bad market = strength.

Floor Price vs Volume Correlation

Indicator 2: High Volume but Flat Floor Price

If trading volume suddenly increases 3x–5x, but the floor price stays almost the same, this is a very important sign.

This usually means:

Big buyers (whales) are buying quietly

Accumulation is happening

A pump may come later

⚠️ If volume and price pump together instantly, that is often FOMO and does not last long.

The best setups are:

Volume increases first

Price moves 2–3 weeks later

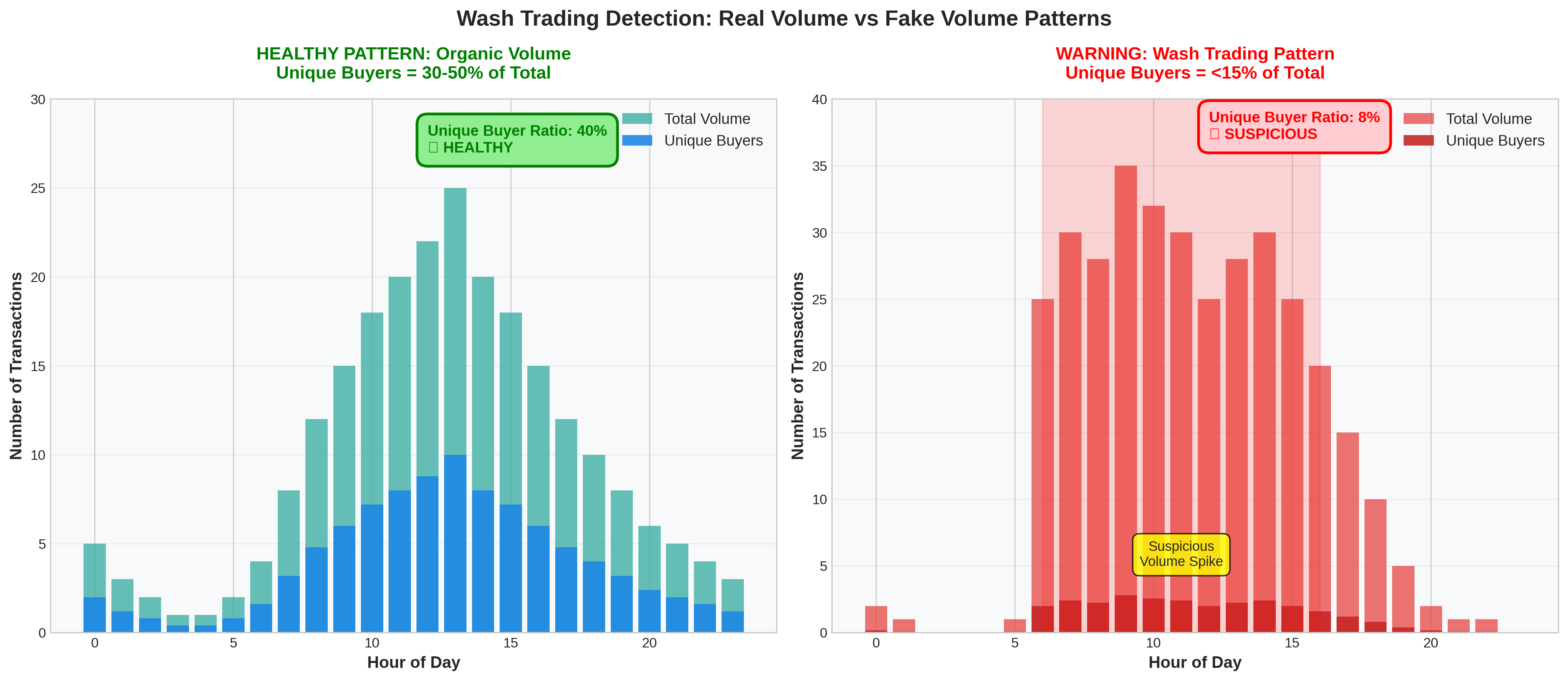

Wash Trading Detection Patterns

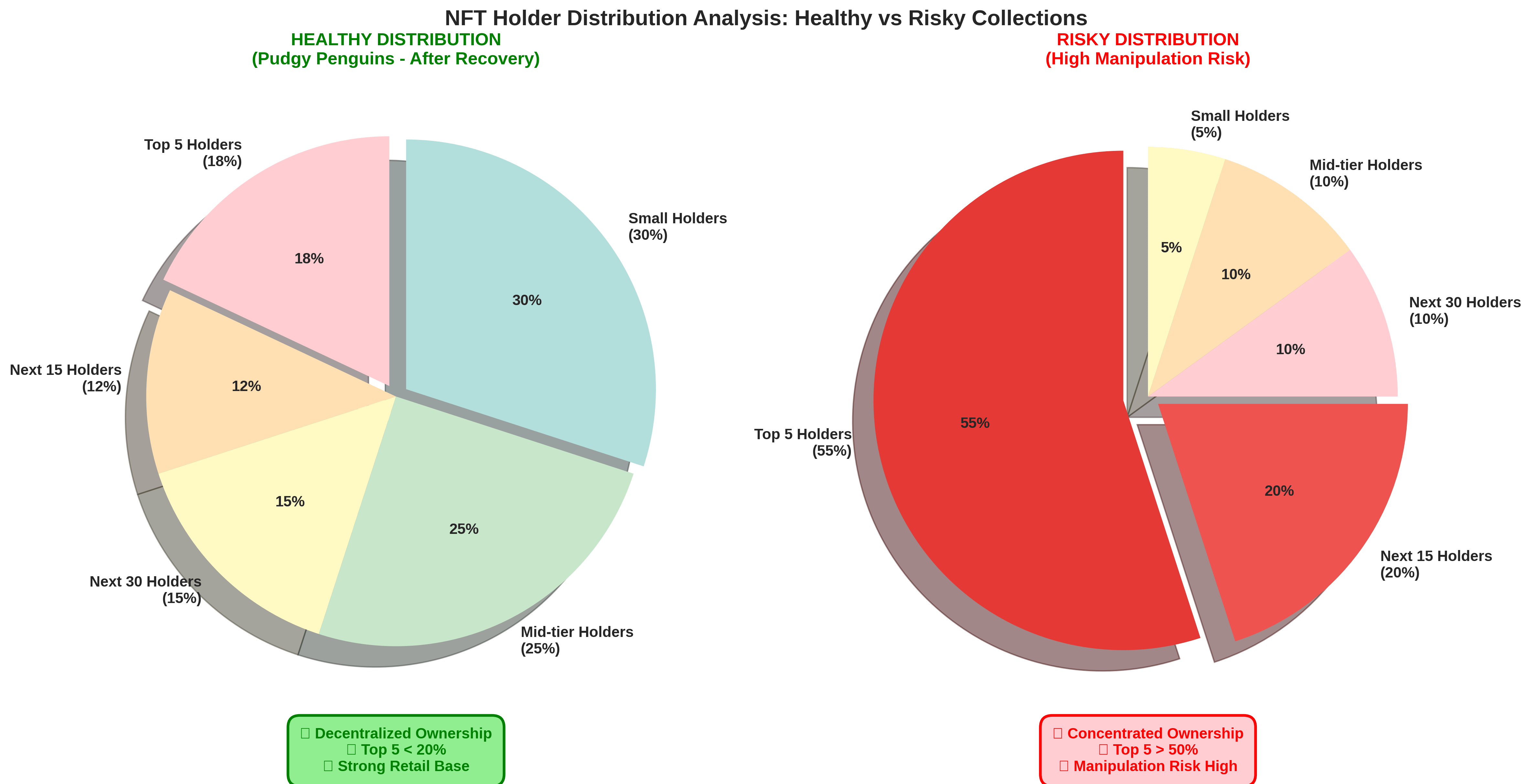

Indicator 3: Healthy Holder Distribution

Check how much supply the top 10 holders control.

Healthy: Top 10 holders own 20–30%

Risky: Top 10 holders own 50% or more

High concentration means price manipulation risk.

Example:

Pudgy Penguins recovered strongly when whale ownership reduced and more regular users started holding NFTs. This decentralization was a bullish1 sign.

Holder Distribution - Healthy vs Unhealthy

Indicator 4: Unique Buyers Matter More Than Volume

Volume alone can be fake.

100 ETH volume with only 5 buyers = likely wash trading

100 ETH volume with 40–50+ buyers = real demand

Use tools like NFTGo or Nansen to check unique buyers. Free versions are enough for basic analysis.

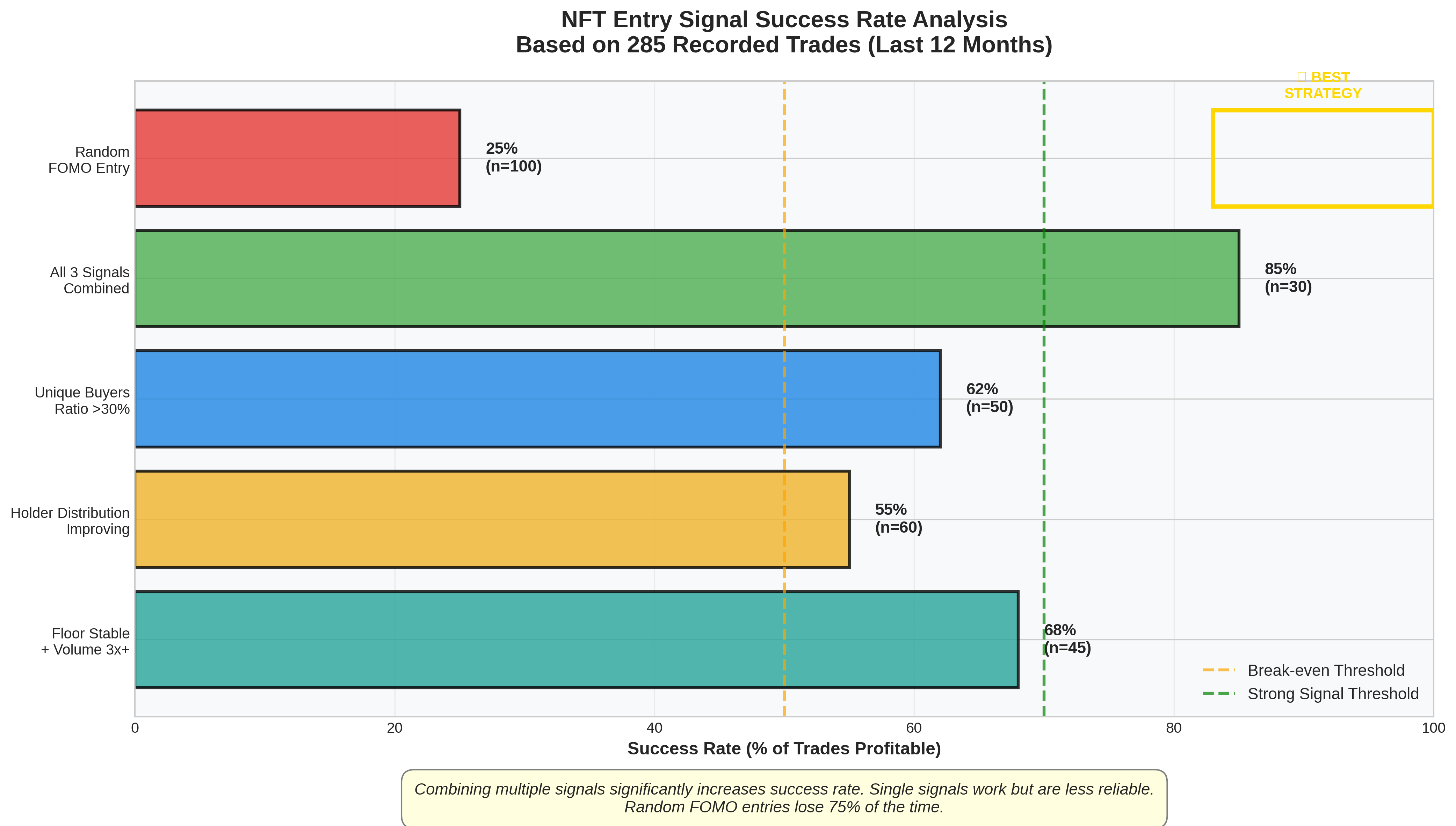

Entry Signal Success Rate Analysis

Case Study: Pudgy Penguins Recovery

December 2025

Floor price: 3 ETH

Daily volume: ~20 ETH (very low)

Early January

Volume jumps to 80–100 ETH daily

Floor stays around 3–3.2 ETH

Mid January

More unique buyers

Better holder distribution

Late January

Toy announcement

Floor moves to 5 ETH

February

Floor reaches 8 ETH

That’s 2.6x from the accumulation zone

If you bought around 3.2 ETH and sold at 8 ETH, you made 150% profit — just by following data, not hype.

Simple Action Plan You Can Follow This Week

Choose 5–10 well-known NFT collections you understand

Track floor price and volume daily (takes 5 minutes)

Check holder distribution once a week

If volume increases 3x+ and floor stays stable, add it to your watchlist

NFT flipping is not luck. It is about pattern recognition.

When most people buy due to hype, smart traders are already in profit.

Important Risk Reminder

NFTs are very illiquid

Never invest more than 10–20% of your crypto portfolio

Always plan your exit before buying

Indicators help, but nothing is guaranteed

#USTechFundFlows #WhaleDeRiskETH #BitcoinGoogleSearchesSurge #USNFPBlowout #BinanceSquare