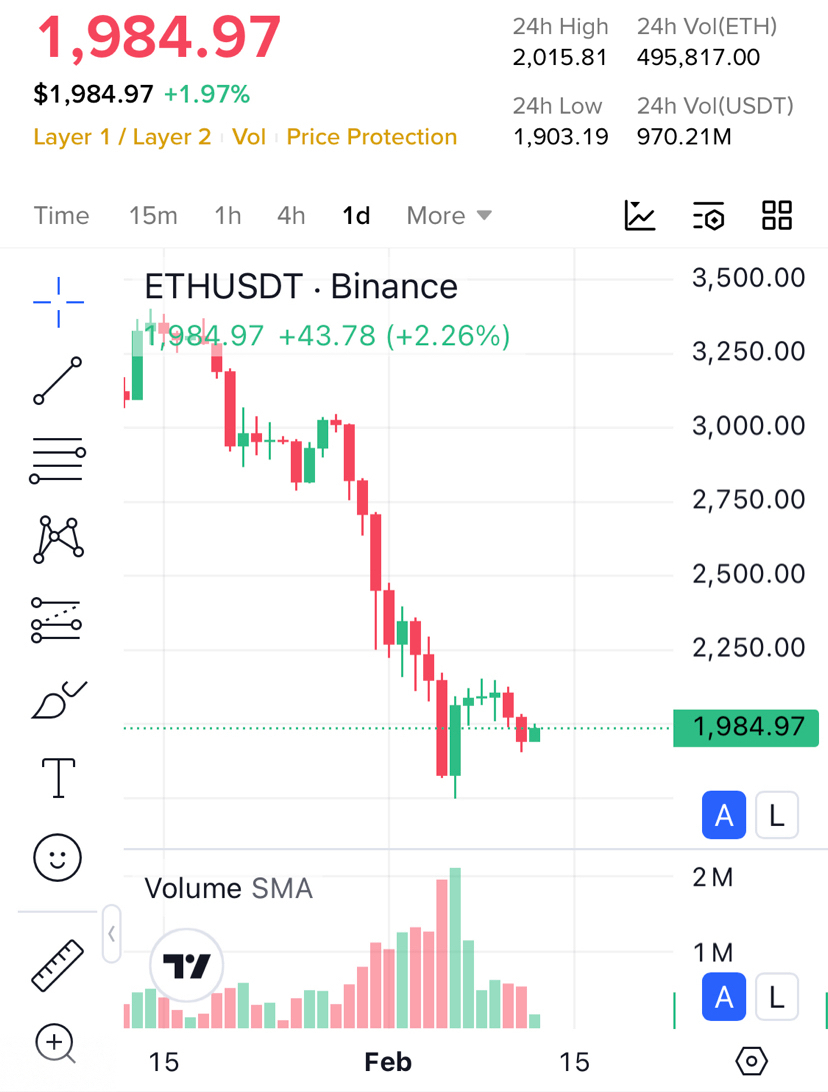

Ethereum hovering around the $1,900–$2,000 zone should feel like relief.

After the recent drop, stabilization is normally where confidence slowly returns.

Analysts begin talking about “bottoming.”

Dip-buyers start appearing on timelines.

And the phrase V-shaped recovery quietly enters the conversation again.

I’ve watched this cycle play out more than once.

And when too many people start expecting the same bounce…

the market rarely delivers it on schedule.

What the Crowd Sees

Right now, the bullish argument sounds clean:

ETH is holding near a psychological support zone.

Institutional buyers are reportedly accumulating weakness.

Long-term projections still point toward higher structural highs.

From a distance, it looks like a classic dip-buying opportunity.

I understand why people feel comfortable here.

Because I used to feel the same way at similar moments in past cycles.

What Experience Taught Me Instead

The hardest lesson crypto ever taught me is simple:

Real bottoms don’t feel safe.

They feel exhausting.

They form when:

People stop debating bullish scenarios.

Volume dries up instead of spikes.

Hope quietly disappears rather than trends on social media.

We’re not there yet.

What we have now is expectation, not capitulation.

And markets love disappointing expectations.

The Structural Question Nobody Wants to Ask

Here’s the uncomfortable thought I keep coming back to:

What if $ETH doesn’t rebound quickly this time?

Not collapse.

Not explode higher.

Just… drift.

Sideways markets don’t make headlines,

but they drain conviction faster than crashes.

Because crashes create urgency.

Sideways action creates doubt.

And doubt is where weak positioning slowly exits.

Reading the Current Range Differently

Most traders are watching two obvious zones:

Support near $1,800–$1,900

Reclaim level around $2,000+

But the more interesting signal to me isn’t price alone.

It’s time.

The longer ETH spends failing to reclaim strength,

the more the narrative shifts from dip → distribution.

That transition is subtle.

And by the time it’s obvious, price is usually already lower.

I’ve learned not to ignore that phase.

This Isn’t Bearish — It’s Defensive

Being contrarian doesn’t mean predicting doom.

It means asking:

What outcome would surprise the most people right now?

At this moment, the surprise wouldn’t be a bounce.

Everyone is waiting for that.

The real surprise would be slow, boring weakness

that keeps frustrating both bulls and bears.

Those are the markets that teach patience the hard way.

My Personal Take

I’m not rushing to call a bottom.

And I’m not rushing to call a collapse either.

Because the longer I stay in crypto,

the more I realize survival isn’t about perfect predictions.

It’s about avoiding emotional trades during uncertain structure.

And Ethereum right now feels exactly like that kind of structure.

Unclear.

Uncomfortable.

Unfinished.

Final Thought

If ETH suddenly rips higher,

the crowd will say the bottom was obvious.

But if it drifts sideways for months first…

most people won’t still be watching.

That’s the scenario I’m quietly preparing for.

What’s your take?

Fast rebound… or slow grind that tests patience?

I’m curious where you stand.

#ETH #CZAMAonBinanceSquare #USRetailSalesMissForecast $ETH